Belgium's 270MWh BESS: Navigating The Complexities Of Merchant Market Financing

Table of Contents

Understanding the Merchant Market Landscape for BESS in Belgium

The Belgian energy market, characterized by high renewable energy penetration, presents both opportunities and complexities for BESS investment. The intermittent nature of solar and wind power necessitates flexible energy solutions, creating a strong demand for BESS to enhance grid stability and reliability. However, this also introduces price volatility and competition among BESS providers, making revenue forecasting crucial.

Different revenue streams for merchant BESS projects in Belgium include:

- Frequency regulation: Providing ancillary services to balance grid frequency fluctuations.

- Peak shaving: Reducing peak demand charges by supplying energy during periods of high consumption.

- Energy arbitrage: Buying energy at low prices and selling it when prices are high.

Several factors shape the Belgian merchant market landscape:

- High renewable energy penetration: This influences grid stability and demand, creating opportunities for BESS to provide ancillary services.

- Competition among BESS providers: This can lead to price volatility and the need for competitive pricing strategies.

- Regulatory landscape: Government regulations and policies significantly impact BESS profitability and project viability. Understanding these regulations is paramount.

- Historical and projected energy price data: Analyzing historical price data and developing accurate future projections are critical for successful energy arbitrage strategies.

Key Financial Challenges and Risk Mitigation Strategies

Financing a large-scale BESS project like Belgium's 270MWh system presents significant financial challenges. High upfront capital costs, coupled with the inherent uncertainties of the merchant market, necessitate a robust risk mitigation strategy. Key challenges include:

- High initial capital expenditure (CAPEX) and long payback periods: Securing sufficient financing to cover the substantial initial investment is paramount.

- Credit risk assessment: Thorough credit risk assessments are crucial for securing favorable financing terms from lenders.

- Revenue uncertainty: Fluctuations in energy prices and ancillary service markets create revenue uncertainty.

Effective risk mitigation strategies are essential:

- Hedging against energy price fluctuations: Implementing hedging strategies, such as using derivative contracts, can help mitigate the risk of price volatility.

- Diversification of revenue streams: Participating in multiple revenue streams, such as frequency regulation and peak shaving, reduces reliance on a single source of income.

- Securing government subsidies or incentives: Exploring available government support programs can significantly reduce project costs and improve financial viability. Belgium's commitment to renewable energy may offer various incentives.

Structuring a Bankable BESS Project in Belgium

Structuring a bankable BESS project requires a meticulous approach focusing on several key aspects:

- Robust financial modeling: Developing a detailed financial model that accurately projects revenue, expenses, and profitability is critical for attracting investors.

- Comprehensive due diligence: Conducting thorough due diligence on technical aspects, permitting requirements, and regulatory compliance ensures a smooth project execution.

- Clear value proposition for investors: Articulating a clear and compelling value proposition, highlighting the project's potential returns and risk mitigation strategies, is essential for securing investment.

- Long-term power purchase agreements (PPAs) or other offtake arrangements: Securing long-term contracts for energy sales or ancillary services provides revenue predictability and reduces risk.

- Strong project development team: Assembling a team with proven experience in BESS development, construction, and merchant market financing is crucial for successful project execution.

The Role of Government Policies and Incentives

Government policies and incentives play a crucial role in shaping the financial landscape for BESS projects in Belgium. The availability of subsidies, tax breaks, or other support mechanisms can significantly influence project viability. Understanding these policies and leveraging available incentives are key to securing financing. Analyzing current Belgian legislation regarding renewable energy incentives and exploring potential future policy changes are critical steps in project planning.

Conclusion

Securing financing for Belgium's 270MWh BESS project within the merchant market demands a strategic approach. A well-structured project, incorporating robust risk mitigation strategies and a thorough understanding of the Belgian energy market, is essential for attracting investment. Successfully navigating the complexities of merchant market financing is crucial for realizing the full potential of large-scale energy storage projects. Learn more about optimizing your BESS financing strategy and unlocking the potential of large-scale energy storage deployments in Belgium. Explore the successful strategies for securing funding for your BESS project and contribute to Belgium's sustainable energy future.

Featured Posts

-

Ruth Buzzi Beloved Comedienne And Sesame Street Star Passes Away At 88

May 04, 2025

Ruth Buzzi Beloved Comedienne And Sesame Street Star Passes Away At 88

May 04, 2025 -

Maintaining Marvels Magic A Look At Creative Strategies And Challenges

May 04, 2025

Maintaining Marvels Magic A Look At Creative Strategies And Challenges

May 04, 2025 -

Eneco Innomotics And Johnson Controls Partner For Gigantic Heat Pump Project

May 04, 2025

Eneco Innomotics And Johnson Controls Partner For Gigantic Heat Pump Project

May 04, 2025 -

Zakharova Prokommentirovala Otnosheniya Makronov Podrobnosti Situatsii

May 04, 2025

Zakharova Prokommentirovala Otnosheniya Makronov Podrobnosti Situatsii

May 04, 2025 -

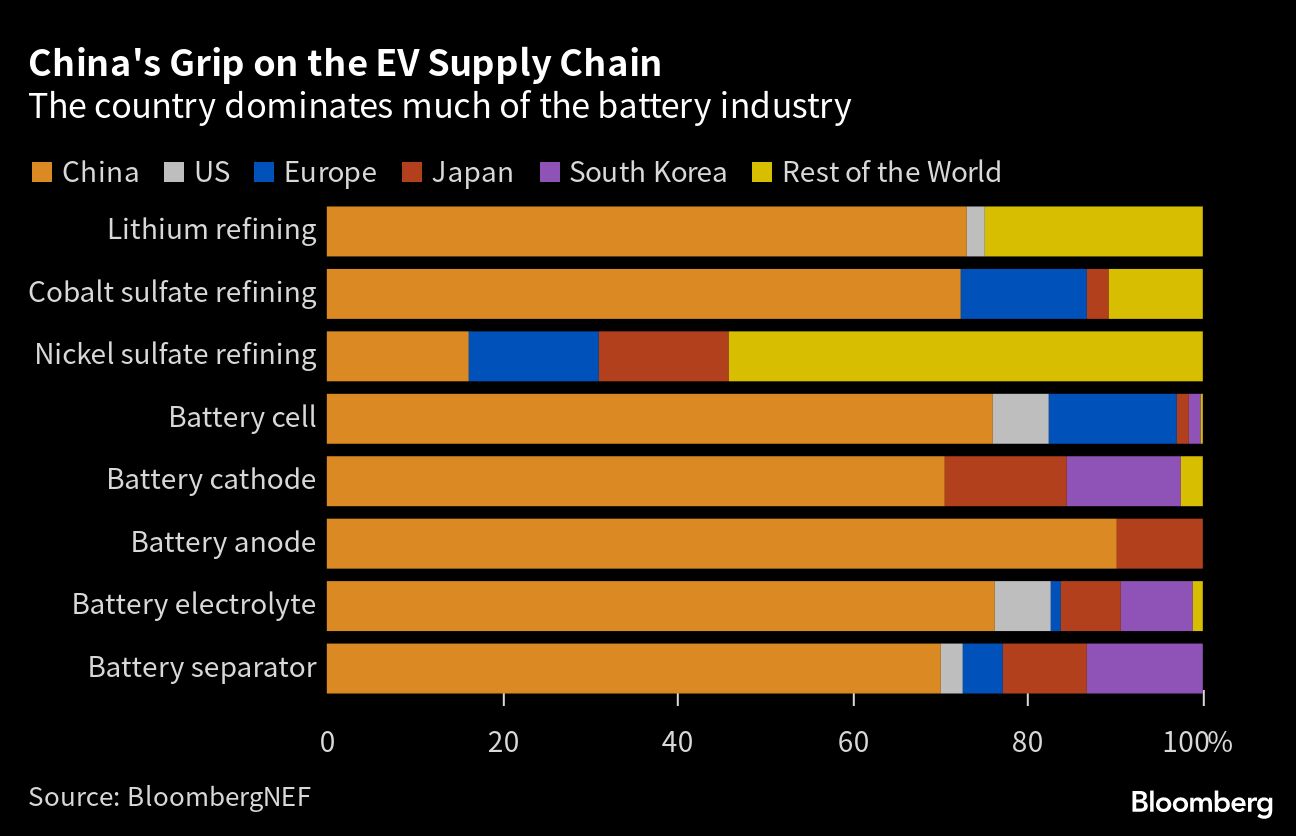

Electric Motor Independence Breaking Free From Chinas Grip

May 04, 2025

Electric Motor Independence Breaking Free From Chinas Grip

May 04, 2025

Latest Posts

-

The Cusma Negotiations Carneys Meeting With Trump And Whats At Stake

May 04, 2025

The Cusma Negotiations Carneys Meeting With Trump And Whats At Stake

May 04, 2025 -

Trump Carney Meeting Crucial For Cusmas Future

May 04, 2025

Trump Carney Meeting Crucial For Cusmas Future

May 04, 2025 -

Predicting The Stanley Cup Winner A Breakdown Of The Nhl Playoff Bracket

May 04, 2025

Predicting The Stanley Cup Winner A Breakdown Of The Nhl Playoff Bracket

May 04, 2025 -

Stanley Cup Playoffs Analyzing The Matchups And Top Contenders

May 04, 2025

Stanley Cup Playoffs Analyzing The Matchups And Top Contenders

May 04, 2025 -

Googles Advertising Business Under Threat Of U S Government Breakup

May 04, 2025

Googles Advertising Business Under Threat Of U S Government Breakup

May 04, 2025