2025 Market Analysis: Factors Contributing To D-Wave Quantum (QBTS) Stock Decrease

Table of Contents

The year is 2025. D-Wave Quantum (QBTS), a pioneering company in the burgeoning field of quantum computing, has experienced a notable decrease in its stock price. This analysis dissects the key factors contributing to this downturn, examining macroeconomic influences, internal company challenges, and investor sentiment impacting QBTS's market performance. Understanding these interwoven factors is critical for investors considering navigating the intricate world of quantum computing investments.

Macroeconomic Factors Impacting QBTS Stock Performance

Broad Market Downturn

The overall economic climate profoundly impacts technology stocks, and high-growth sectors like quantum computing are particularly vulnerable. A general market correction or recession can significantly curtail investment in riskier ventures.

- Increased interest rates: Higher borrowing costs make it more expensive for companies like D-Wave Quantum to fund research and development, impacting growth and potentially reducing profitability.

- Inflation concerns: High inflation erodes purchasing power and can lead to reduced consumer and business spending, negatively impacting the demand for technologically advanced solutions.

- Reduced investor risk tolerance: In uncertain economic times, investors often shift their portfolios towards safer, more established investments, reducing capital available for high-risk, high-reward ventures like quantum computing.

- Decreased overall market liquidity: A less liquid market makes it harder for investors to buy or sell stocks quickly, exacerbating price volatility and potentially accelerating downward trends.

Competition and Investor Sentiment

The quantum computing sector is increasingly competitive. Negative news regarding competitors or advancements in alternative technologies can significantly impact investor confidence in QBTS.

- Emergence of new quantum computing companies: The influx of new players intensifies competition, creating a more crowded market and potentially reducing QBTS's market share.

- Advancements in rival technologies (e.g., superconducting qubits, trapped ions): Breakthroughs by competitors using different qubit technologies can shift investor perception of D-Wave's technology, potentially making it seem less attractive.

- Negative media coverage affecting sector sentiment: Negative news stories about the quantum computing sector as a whole can create a domino effect, leading to decreased investment across the board, including in QBTS.

D-Wave Quantum's Specific Challenges

Technological Hurdles and Development Costs

Quantum computing is inherently capital-intensive. Delays in achieving crucial technological milestones or unexpectedly high R&D costs can severely disappoint investors.

- Challenges in scaling qubit numbers: Increasing the number of qubits while maintaining coherence is a major technological challenge, impacting the power and potential applications of D-Wave's quantum annealers.

- Limitations in error correction: Current quantum computers are prone to errors, and improvements in error correction are essential for widespread adoption. Slow progress in this area may impact investor confidence.

- Difficulties in developing commercially viable applications: Finding practical, profitable applications for quantum computers is a critical hurdle. A lack of compelling commercial applications can stifle growth and investment.

- High operational costs: The cost of maintaining and operating quantum computers is substantial, impacting profitability and potentially reducing investor appeal.

Revenue Generation and Market Adoption

The path to profitability for quantum computing companies remains challenging. Slow adoption of quantum computing solutions by businesses directly impacts QBTS's financial performance and stock price.

- Limited commercial applications currently available: The number of commercially viable applications for quantum computing remains limited, hindering revenue generation and investor confidence.

- High barriers to entry for potential clients: The complexity of quantum computing technology creates high barriers to entry for potential clients, restricting market adoption.

- Dependence on government funding or strategic partnerships: QBTS's reliance on government grants or partnerships can create vulnerabilities, impacting long-term financial stability and investor confidence.

Analyst Ratings and Investor Behavior

Negative Analyst Reports

Downward revisions of earnings estimates or negative analyst reports can trigger significant sell-offs in QBTS stock.

- Impact of sell-side downgrades: Negative ratings from prominent financial analysts can influence investor sentiment and trigger widespread selling.

- Influence of influential financial analysts on investor sentiment: The opinions of key analysts carry significant weight, impacting the overall perception and valuation of QBTS.

- Spread of negative predictions through financial media: Negative news and predictions spread quickly through financial media, further exacerbating sell-offs.

Short-Selling and Market Volatility

High short interest in QBTS stock can amplify price declines during periods of market uncertainty.

- Increased short-selling activity: A high level of short selling indicates a negative outlook on the stock's future performance, potentially driving the price down further.

- Amplified price swings due to leverage: Short-selling involves leverage, amplifying price swings and potentially leading to more dramatic declines.

- Impact of short squeezes or covering positions: Short squeezes, where short sellers rush to buy back the stock to limit losses, can temporarily reverse downward trends, but this is often followed by further volatility.

Conclusion

The decline in D-Wave Quantum (QBTS) stock in 2025 is a complex issue stemming from macroeconomic headwinds, internal company challenges inherent in the nascent quantum computing sector, and fluctuating investor sentiment. While the long-term potential of quantum computing remains significant, investors must carefully assess the considerable risks involved. Further in-depth research into QBTS's strategic direction, technological advancements, and financial performance is crucial before making any investment decisions. Understanding these factors is key to navigating the volatile world of D-Wave Quantum (QBTS) stock and other quantum computing investments. Thorough due diligence is paramount before investing in D-Wave Quantum (QBTS) or any quantum computing stock.

Featured Posts

-

Maltraitance Et Abus Sexuels Presumes A La Fieldview Care Home Informations Et Reactions

May 20, 2025

Maltraitance Et Abus Sexuels Presumes A La Fieldview Care Home Informations Et Reactions

May 20, 2025 -

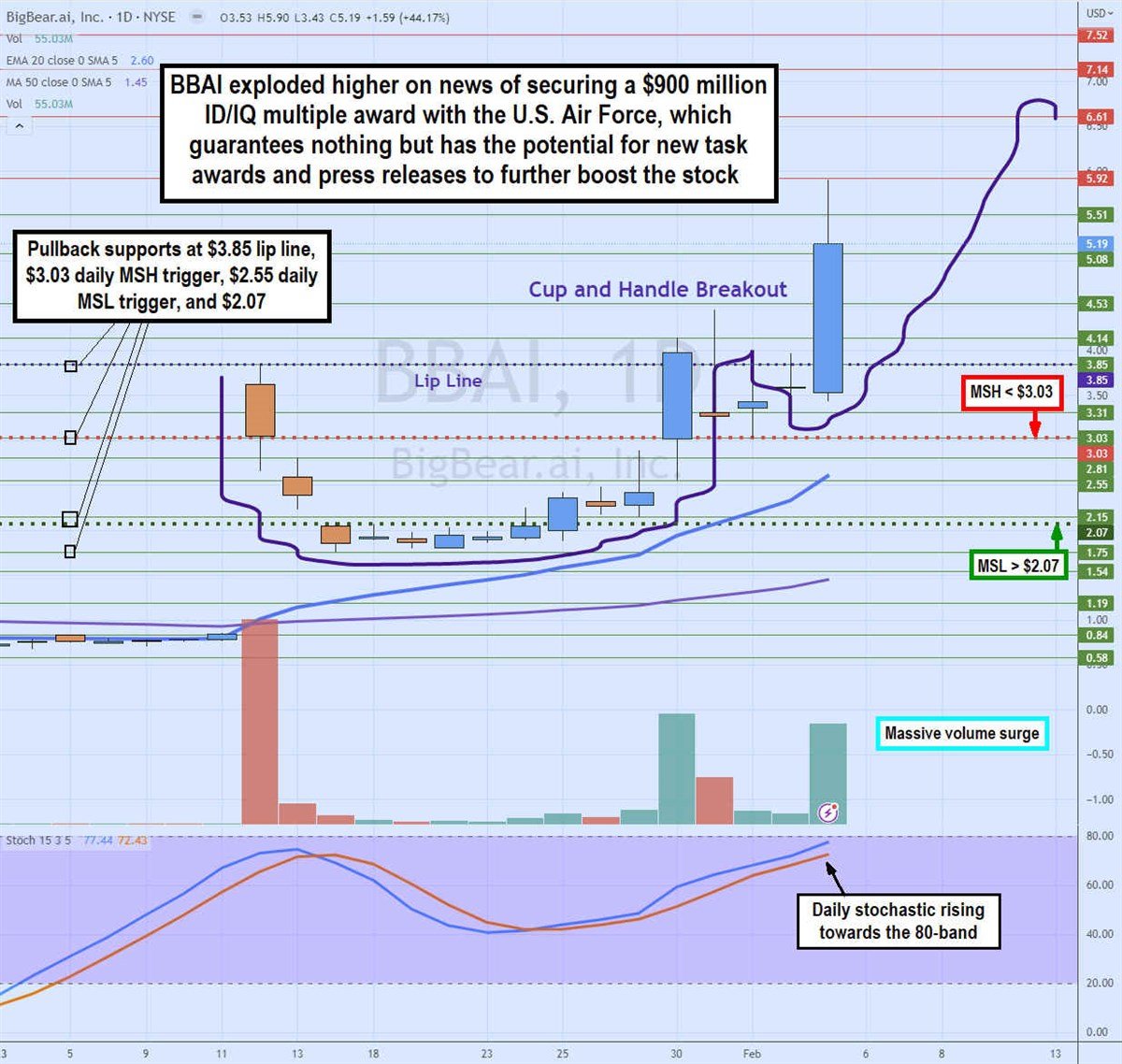

Big Bear Ai Stock Is It A Smart Investment Right Now

May 20, 2025

Big Bear Ai Stock Is It A Smart Investment Right Now

May 20, 2025 -

Savvatokyriako Stin Patra Breite Ton Efimereyonta Iatro Sas

May 20, 2025

Savvatokyriako Stin Patra Breite Ton Efimereyonta Iatro Sas

May 20, 2025 -

Expect Mild Temperatures And Low Rain Chances This Week

May 20, 2025

Expect Mild Temperatures And Low Rain Chances This Week

May 20, 2025 -

Hercule Poirot Su Play Station 5 Offerta Amazon A Meno Di 10 Euro

May 20, 2025

Hercule Poirot Su Play Station 5 Offerta Amazon A Meno Di 10 Euro

May 20, 2025