2025 Market Analysis: Understanding The BigBear.ai (BBAI) Stock Plunge

Table of Contents

Main Points: Dissecting the Factors Behind the BBAI Stock Decline

H2: Macroeconomic Factors Influencing BBAI Stock Performance

The BigBear.ai (BBAI) stock plunge wasn't solely a company-specific event; broader macroeconomic headwinds played a significant role. Understanding these factors is essential for a comprehensive market analysis.

H3: Impact of broader market corrections and economic downturns.

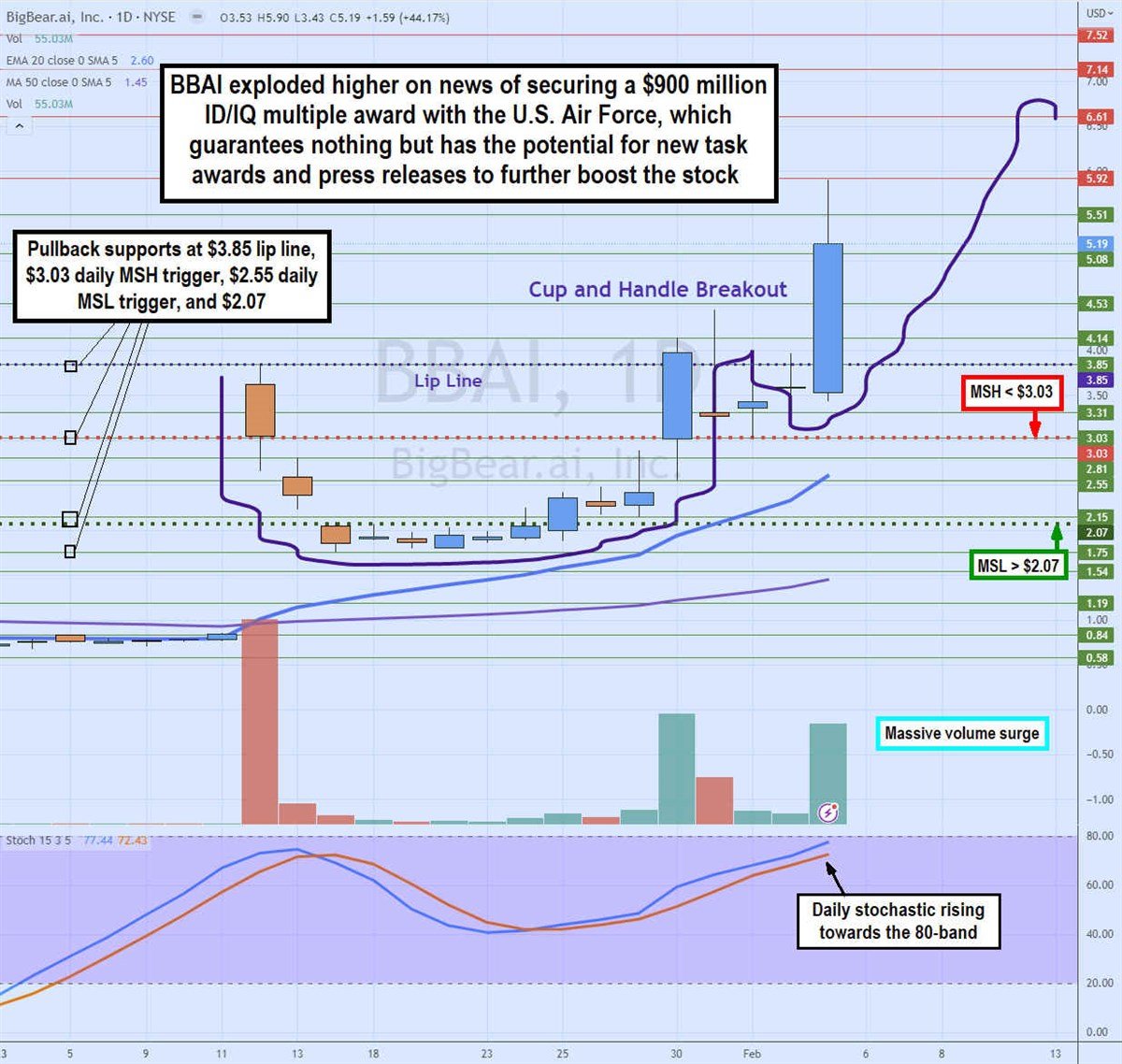

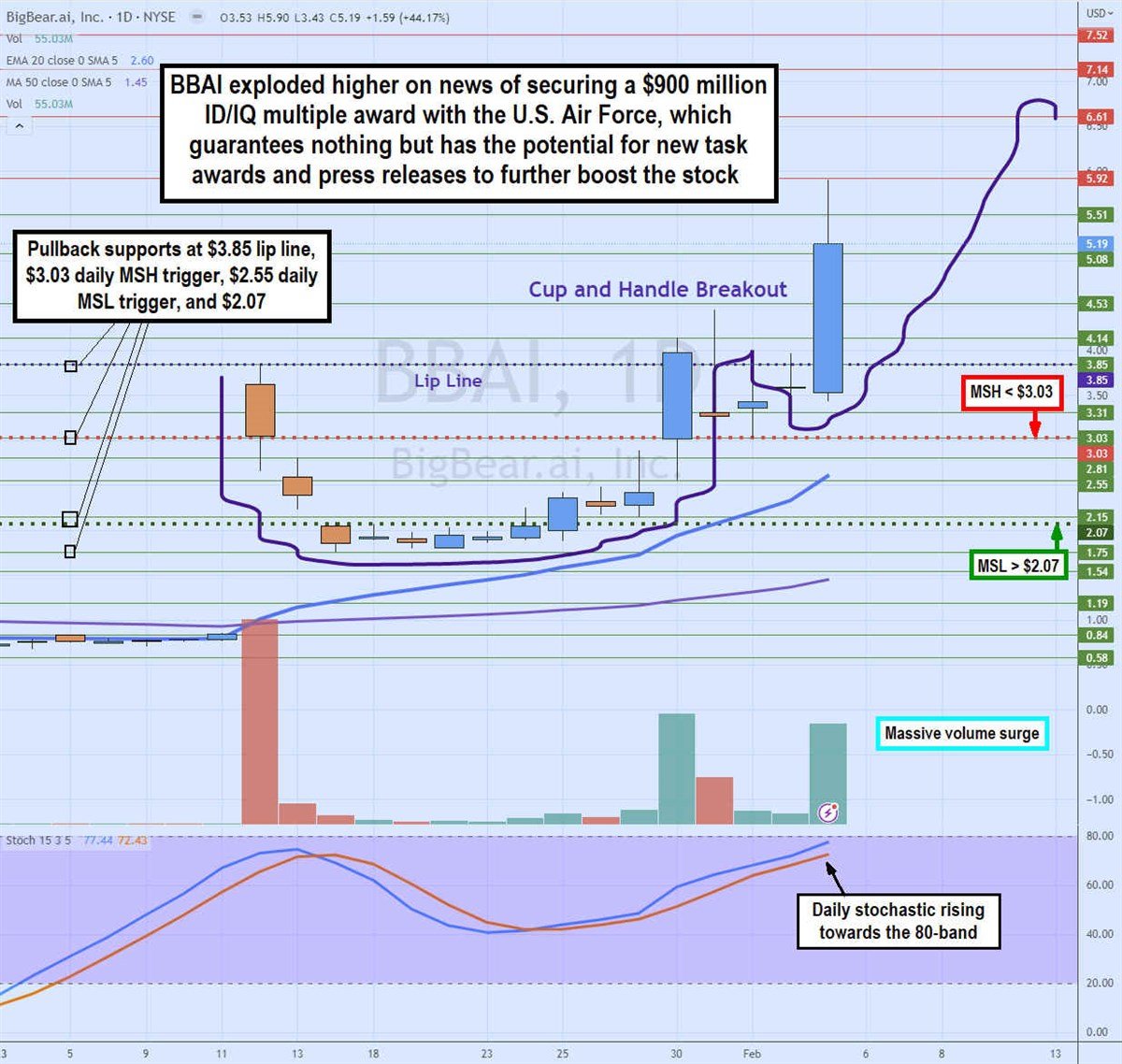

- Interest Rate Hikes: The aggressive interest rate hikes implemented by central banks in 2024 and 2025 to combat inflation significantly impacted investor sentiment. Higher interest rates increase borrowing costs for companies, reducing profitability and making growth stocks, like BBAI, less attractive. This correlation between interest rate increases and BBAI's stock price is clearly visible in historical data (insert chart/graph here if available, sourced from a reputable financial site).

- Inflationary Pressures: Persistent inflation eroded consumer confidence and reduced spending, affecting the demand for BigBear.ai's products and services. High inflation often leads to reduced investment in discretionary spending areas like AI solutions, directly impacting companies like BBAI.

- Recessionary Fears: Growing fears of a recession in 2025 dampened investor risk appetite. Investors shifted towards safer assets, leading to a sell-off in riskier growth stocks, including BBAI. News reports and analyst predictions at the time reflected widespread recessionary concerns (cite news sources here).

H3: Geopolitical instability and its effect on investor sentiment.

Geopolitical uncertainties further exacerbated the negative market sentiment.

- Global Conflicts: Ongoing geopolitical conflicts created uncertainty in the global economy, leading to increased volatility in financial markets. Investors often become risk-averse during periods of geopolitical instability, impacting the valuation of growth stocks like BigBear.ai (BBAI). (Cite specific geopolitical events and their impact with credible sources).

- Supply Chain Disruptions: Continued supply chain disruptions impacted the availability of critical components for technology companies, impacting production and potentially impacting BBAI's operational efficiency.

H2: Company-Specific Issues Contributing to the BBAI Stock Plunge

While macroeconomic factors played a significant role, internal challenges within BigBear.ai also contributed to the stock plunge.

H3: Analysis of BigBear.ai's financial performance and missed earnings expectations.

- Revenue Shortfalls: BigBear.ai failed to meet projected revenue targets for several quarters leading up to the stock plunge. This resulted in a loss of investor confidence, as demonstrated by declining revenue figures (insert relevant financial data and chart sourced from SEC filings or reputable financial news).

- Profit Margin Squeeze: Decreasing profit margins indicated challenges in controlling costs and maintaining competitive pricing, further impacting investor sentiment and contributing to the negative stock performance.

- Increased Debt: A high debt-to-equity ratio could have also triggered negative investor reaction, signaling financial vulnerability.

H3: Examination of BigBear.ai's strategic decisions and operational challenges.

- Failed Acquisitions: Any unsuccessful mergers or acquisitions undertaken by BigBear.ai could have diluted shareholder value and contributed to investor concerns. A thorough analysis of these strategic decisions is needed (refer to official company statements if available).

- Management Changes: Significant leadership changes within the company might have led to uncertainty and a disruption in strategic direction, negatively influencing investor perception. (cite relevant news sources if applicable).

- Product Development Delays: Delays or setbacks in product development could have hindered market penetration and negatively impacted revenue projections, contributing to the stock's decline.

H3: Competitive landscape and market saturation.

- Intense Competition: The AI and data analytics sector is highly competitive, with numerous established players and emerging startups vying for market share. This intense competition put pressure on BBAI's pricing and profitability. (Identify and discuss key competitors and their market share).

- Technological Advancements: Rapid technological advancements in the AI space meant that BBAI needed to continuously innovate to stay competitive. Failure to keep pace with the latest technological breakthroughs could have hurt their market position and led to declining investor confidence.

- Market Saturation: Market saturation in certain segments could have limited BigBear.ai's growth potential and contributed to the stock's decline.

Conclusion: Lessons Learned and Future Outlook for BBAI Stock

The BigBear.ai (BBAI) stock plunge in 2025 serves as a stark reminder of the interplay between macroeconomic conditions and company-specific factors affecting stock performance. The downturn highlights the vulnerability of growth stocks during economic downturns and the importance of strong financial performance and effective strategic decision-making.

Key Takeaways:

- Macroeconomic conditions significantly impact stock market performance.

- Strong financial performance and effective strategic management are crucial for success.

- Thorough due diligence is essential before investing in any stock, especially in volatile sectors.

Future Outlook: The future of BigBear.ai (BBAI) stock remains uncertain. While a recovery is possible, it depends on the company's ability to address its internal challenges and adapt to the evolving market landscape. Continued monitoring of its financial performance and strategic moves will be critical.

Call to Action: Understanding the intricacies of the BigBear.ai (BBAI) stock plunge is crucial for informed investment decisions. Conduct thorough research, analyze financial statements, and consult with financial advisors before investing in volatile markets like the AI and data analytics sectors. Remember to perform your own due diligence before making any investment decisions concerning BigBear.ai (BBAI) stock or any other security.

Featured Posts

-

Post Brexit Challenges For Uk Luxury Exports To The Eu

May 21, 2025

Post Brexit Challenges For Uk Luxury Exports To The Eu

May 21, 2025 -

Britains Got Talent Walliams And Cowells Public Feud Explodes

May 21, 2025

Britains Got Talent Walliams And Cowells Public Feud Explodes

May 21, 2025 -

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Dimokratiki Programma And Eisitiria

May 21, 2025

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Dimokratiki Programma And Eisitiria

May 21, 2025 -

Abn Amro Problemen Bij Het Online Betalen Van Opslagkosten

May 21, 2025

Abn Amro Problemen Bij Het Online Betalen Van Opslagkosten

May 21, 2025 -

Huuhkajien Avauskokoonpanossa Kolme Muutosta Kaellman Penkille

May 21, 2025

Huuhkajien Avauskokoonpanossa Kolme Muutosta Kaellman Penkille

May 21, 2025

Latest Posts

-

Conquering Lack Of Funds A Step By Step Guide

May 22, 2025

Conquering Lack Of Funds A Step By Step Guide

May 22, 2025 -

Arunas Unexpected Loss At Wtt Chennai Open

May 22, 2025

Arunas Unexpected Loss At Wtt Chennai Open

May 22, 2025 -

Wtt Star Contender Chennai 2025 Snehit Suravajjula Upsets Sharath Kamal In Farewell Match

May 22, 2025

Wtt Star Contender Chennai 2025 Snehit Suravajjula Upsets Sharath Kamal In Farewell Match

May 22, 2025 -

Lack Of Funds Strategies For Financial Success

May 22, 2025

Lack Of Funds Strategies For Financial Success

May 22, 2025 -

Oh Jun Sung Claims Wtt Star Contender Chennai Title

May 22, 2025

Oh Jun Sung Claims Wtt Star Contender Chennai Title

May 22, 2025