2025 Palantir Stock Outlook: Is A 40% Increase Realistic? Should You Invest?

Table of Contents

Analyzing Palantir's Current Financial Performance and Future Projections

Revenue Growth and Profitability

Palantir's recent financial reports paint a picture of a company experiencing significant revenue growth, although profitability remains a key area of focus. Analyzing key financial metrics is crucial for any Palantir stock prediction.

-

Key Financial Metrics (Year-over-Year Growth): Examine the year-over-year growth in revenue, net income, and operating income. Compare these figures to previous years and industry averages to gauge Palantir's performance relative to its competitors. (Note: Specific figures require accessing recent financial statements; this section would ideally include charts and graphs visualizing this data).

-

Comparison to Industry Competitors: Benchmarks against similar data analytics companies are vital. Consider factors like revenue scale, profit margins, and growth trajectories of competitors to assess Palantir's relative strength and positioning within the market.

-

Factors Impacting Revenue Growth: Palantir's revenue stream depends heavily on government contracts and commercial partnerships. Analyzing the success of new product launches and the expansion into new market segments is critical in evaluating future revenue potential. The increasing adoption of AI and data analytics solutions also plays a significant role.

Key Partnerships and Government Contracts

Palantir's reliance on large government contracts presents both opportunities and risks. A diverse portfolio of contracts is crucial for mitigating risks associated with any single contract's performance.

-

Significant Contracts: Identify and analyze the value and duration of major contracts, assessing their contribution to current and future revenue streams. (Note: Publicly available information on specific contracts will need to be incorporated here).

-

Potential for New Contracts: The ongoing geopolitical landscape and increasing demand for data analytics solutions by governmental organizations significantly influences the potential for securing new, high-value contracts.

-

Risk Associated with Government Reliance: Over-dependence on government contracts poses a risk. Diversification into the commercial sector is crucial for reducing this vulnerability and ensuring sustained growth.

Competition and Market Share

The data analytics market is fiercely competitive. Understanding Palantir's competitive position is crucial for a realistic Palantir stock forecast 2025.

-

Key Competitors: Identify major competitors (e.g., other big data analytics firms) and assess their strengths and weaknesses.

-

Competitive Advantages: Analyze Palantir's unique selling propositions, such as its proprietary technology, strong government relationships, and specialized expertise in complex data analysis.

-

Market Trends: Evaluate emerging market trends and their potential impact on Palantir's growth prospects. The increasing demand for AI-driven solutions and the growth of cloud computing are crucial considerations.

Factors That Could Influence Palantir's Stock Price by 2025

Technological Advancements and Innovation

Palantir's investment in research and development (R&D) is key to its long-term success. Continuous innovation and adaptation to evolving market demands are crucial for maintaining a competitive edge.

-

New Products and Features: Analyze the market potential of new product launches and assess their potential contribution to future revenue growth.

-

Innovation Capability: Evaluate Palantir's ability to adapt to technological advancements and innovate new solutions. A strong R&D pipeline is a positive indicator.

Macroeconomic Factors and Geopolitical Risks

Global economic conditions and geopolitical instability can significantly impact Palantir's stock price. Understanding these risks is essential for a comprehensive Palantir stock prediction.

-

Potential Risks: Assess the potential impact of factors like recession, inflation, and geopolitical instability on Palantir's business operations and revenue streams.

-

Mitigation Strategies: Evaluate Palantir's strategies for mitigating these risks, such as diversifying its customer base and geographical reach.

Investor Sentiment and Market Volatility

Investor sentiment and overall market volatility significantly influence stock prices. Understanding these dynamics is crucial for a realistic Palantir stock forecast 2025.

-

Analyst Ratings and News Sentiment: Analyze recent analyst ratings, news articles, and social media sentiment to gauge investor confidence in Palantir.

-

Market Conditions: Understand how overall market conditions, including economic growth, interest rates, and investor risk appetite, can affect stock prices independent of a company's performance.

Conclusion: Should You Invest in Palantir Stock for a 40% Increase by 2025?

Our analysis of Palantir's financial performance, future prospects, and potential risks suggests that a 40% increase in its stock price by 2025 is possible but not guaranteed. While Palantir exhibits significant revenue growth potential fueled by government contracts and expanding commercial partnerships, it also faces challenges including competition and reliance on specific sectors. Macroeconomic conditions and geopolitical events could further impact its performance.

Therefore, while the potential for substantial returns on a Palantir investment exists, it’s crucial to approach this opportunity with caution. A 40% increase is not a certainty. Conduct your own thorough research before investing in Palantir stock (PLTR). Consider your risk tolerance and investment goals before making any decisions regarding Palantir investment. Consult with a qualified financial advisor to discuss whether Palantir aligns with your overall investment strategy. Remember to review relevant resources such as financial news sites and SEC filings for the most up-to-date information.

Featured Posts

-

Chief Justice Roberts Account Of Being Mistaken For Gop Leader

May 10, 2025

Chief Justice Roberts Account Of Being Mistaken For Gop Leader

May 10, 2025 -

Podcast Production Revolution Ai Simplifies The Processing Of Repetitive Scatological Documents

May 10, 2025

Podcast Production Revolution Ai Simplifies The Processing Of Repetitive Scatological Documents

May 10, 2025 -

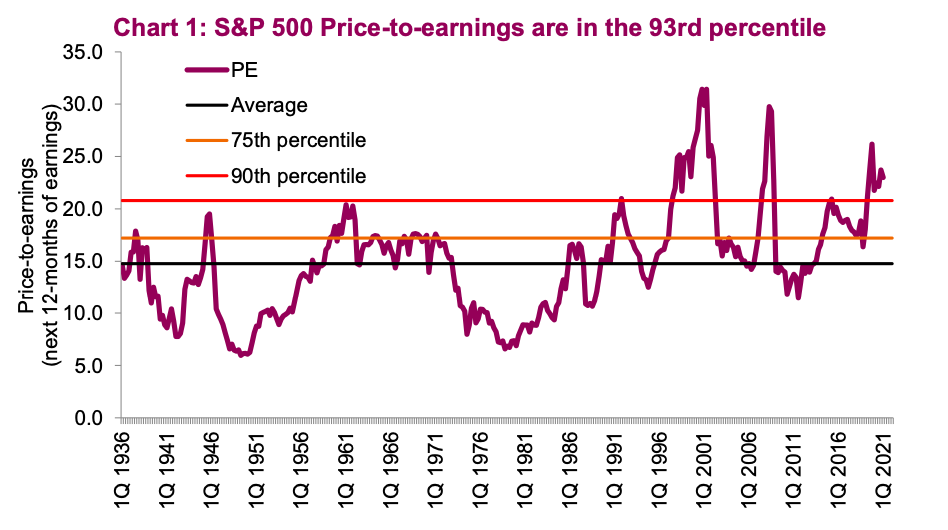

High Stock Market Valuations Bof As Take And Why Investors Shouldnt Panic

May 10, 2025

High Stock Market Valuations Bof As Take And Why Investors Shouldnt Panic

May 10, 2025 -

Proposed Uk Student Visa Changes Concerns For Pakistani Students And Asylum

May 10, 2025

Proposed Uk Student Visa Changes Concerns For Pakistani Students And Asylum

May 10, 2025 -

Knights Edge Wild In Ot Barbashev The Hero Series Tied

May 10, 2025

Knights Edge Wild In Ot Barbashev The Hero Series Tied

May 10, 2025