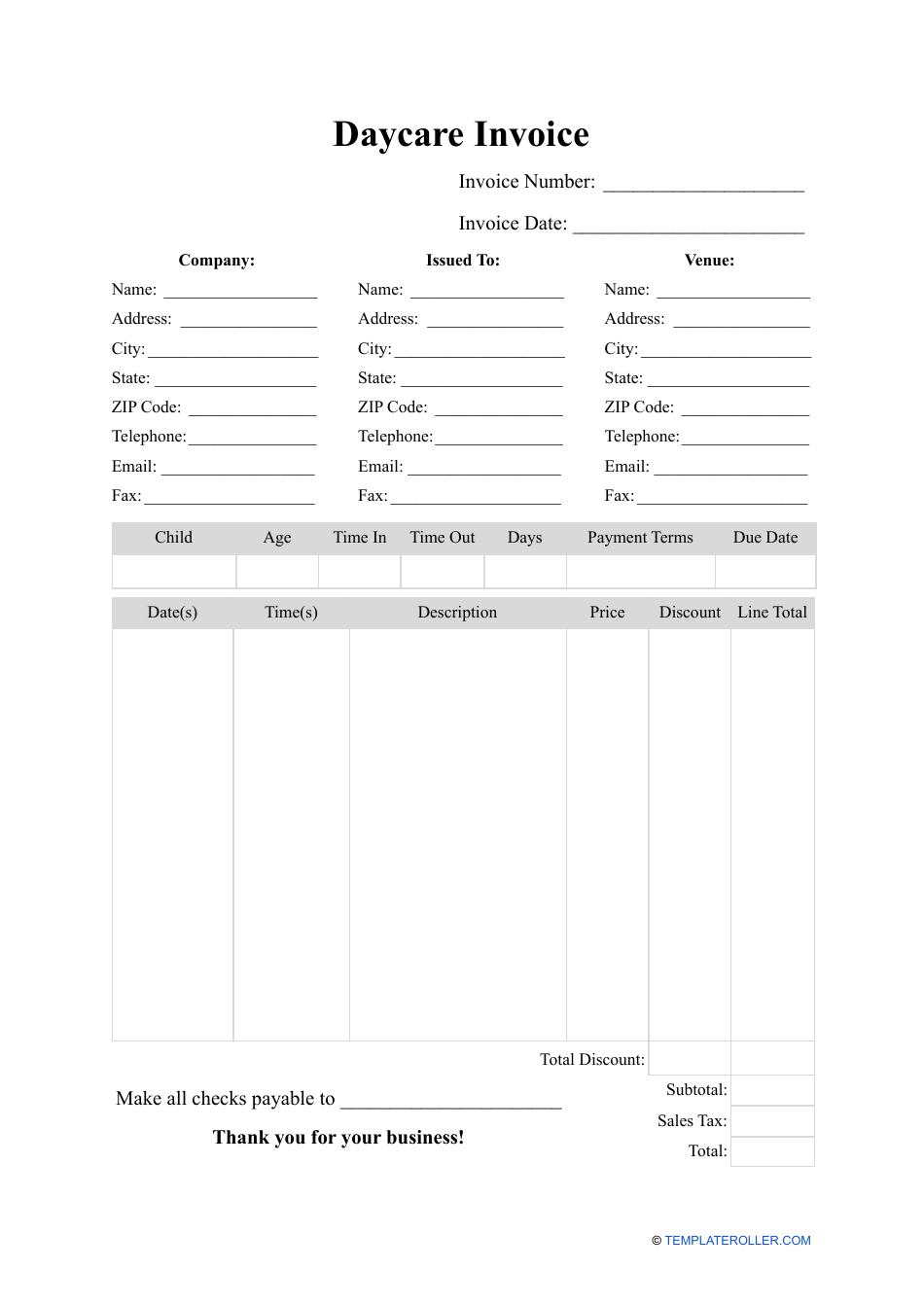

$3,000 Babysitting Bill Turns Into $3,600 Daycare Bill: A Financial Nightmare

Table of Contents

The soaring cost of childcare is a significant concern for many families. What starts as a manageable babysitting arrangement can quickly escalate into a financial burden, leaving parents scrambling to make ends meet. This article explores a real-life example of how a $3,000 monthly babysitting bill unexpectedly transformed into a $3,600 monthly daycare bill, highlighting the financial pitfalls and offering solutions to help you navigate this common problem. We'll examine the hidden costs, budgeting strategies, and alternative childcare options to avoid this financial nightmare.

The Unexpected Shift from Babysitting to Daycare

Initially, Sarah and Mark, a young professional couple, found a reliable babysitter who charged $3,000 per month for after-school care and occasional weekend evenings. This seemed manageable, fitting comfortably within their budget. However, their carefully constructed financial plan crumbled when their babysitter unexpectedly announced her move out of state. The sudden need for alternative childcare thrust them into a frantic search, ultimately leading them to a daycare center. The price jump from $3,000 to $3,600 per month was jarring.

- Increased hourly rate due to daycare's overhead costs: Daycare centers have substantial overhead – rent, utilities, staff salaries, licensing fees – all factored into their higher rates.

- Additional fees (e.g., registration, materials, etc.): Hidden fees like registration fees, supply costs for art projects, and extra charges for special events quickly add up.

- Unexpected expenses not covered by the initial babysitting agreement: The babysitter's arrangement was simple and straightforward. Daycare often involves unexpected expenses like sick days and additional fees for early pick-ups or late drop-offs.

- Lack of flexibility compared to the initial arrangement: The rigid schedule of a daycare center may not accommodate unexpected changes in work schedules or family emergencies.

Unforeseen Costs Associated with Daycare

Beyond the steep tuition fees, daycare expenses often extend far beyond the initial quoted price. Many parents underestimate these additional costs, leading to financial strain.

Beyond Tuition: The True Cost of Daycare

- Transportation costs (gas, public transport): The daily commute to and from daycare can significantly impact your budget, especially if you're relying on gas-guzzling vehicles or expensive public transportation.

- Additional fees for activities, supplies, or special events: Daycares often charge extra for field trips, special holiday events, and necessary supplies beyond basic materials.

- Potential for unexpected illnesses and related costs (missed work, doctor visits): Children in daycare are more prone to illnesses, potentially resulting in missed workdays, doctor visits, and medication costs.

- Clothing and personal items needed for daycare: Ensure you budget for extra clothing, shoes, and personal items that may get lost or damaged at daycare.

Budgeting Strategies for Childcare Expenses

Creating a realistic childcare budget is paramount. Failing to accurately account for all potential costs can lead to significant financial difficulties.

Effective Budgeting Techniques

- Track all childcare-related expenses meticulously: Keep detailed records of every expense related to childcare, including tuition, transportation, supplies, and other incidental costs.

- Explore various childcare options and compare costs: Before committing to a specific childcare provider, thoroughly research different options, compare their pricing structures, and look for any hidden fees.

- Factor in unexpected costs and build a contingency fund: Create a financial cushion for unforeseen events like illnesses, unexpected closures, or additional fees.

- Consider adjusting lifestyle choices to accommodate daycare expenses: To manage high daycare costs, you might need to adjust spending in other areas of your budget.

- Seek financial assistance or subsidies if eligible: Many government programs and private organizations offer financial assistance for childcare expenses. Explore these options to lessen your burden.

Alternative and Affordable Childcare Solutions

Fortunately, there are various alternatives to traditional daycare centers that can be more cost-effective.

Cost-Effective Childcare Options

- In-home daycare (potentially cheaper than centers): In-home daycares often have lower overhead than larger centers and may offer more personalized care at a reduced cost.

- Nanny shares (splitting costs with other families): Sharing a nanny with another family can significantly reduce your individual childcare expenses.

- Family or friend assistance (if reliable and feasible): If you have reliable family or friends who can provide childcare, this can be a cost-effective option.

- Utilizing flexible work arrangements to reduce daycare needs: Consider working from home or adjusting your work schedule to minimize the time your child needs formal daycare.

Conclusion

Transitioning from babysitting to daycare can lead to significant unexpected expenses, as demonstrated by the jump from a $3,000 babysitting bill to a $3,600 daycare bill. Careful budgeting, exploring alternative childcare solutions, and understanding the true cost of daycare are crucial to avoiding a similar financial nightmare. The true cost of childcare goes far beyond the initial quoted price. Hidden fees, transportation, and unexpected events can quickly derail your finances.

Call to Action: Don't let unexpected childcare costs derail your finances. Plan ahead, create a realistic budget, and explore affordable childcare options to avoid a costly $3,000 babysitting bill (or more) turning into an even pricier daycare bill. Start planning your childcare budget today!

Featured Posts

-

The Elizabeth Line A Review Of Wheelchair User Experiences

May 09, 2025

The Elizabeth Line A Review Of Wheelchair User Experiences

May 09, 2025 -

Hurun Global Rich List 2025 Elon Musks Net Worth Drops By 100 Billion But He Remains Richest

May 09, 2025

Hurun Global Rich List 2025 Elon Musks Net Worth Drops By 100 Billion But He Remains Richest

May 09, 2025 -

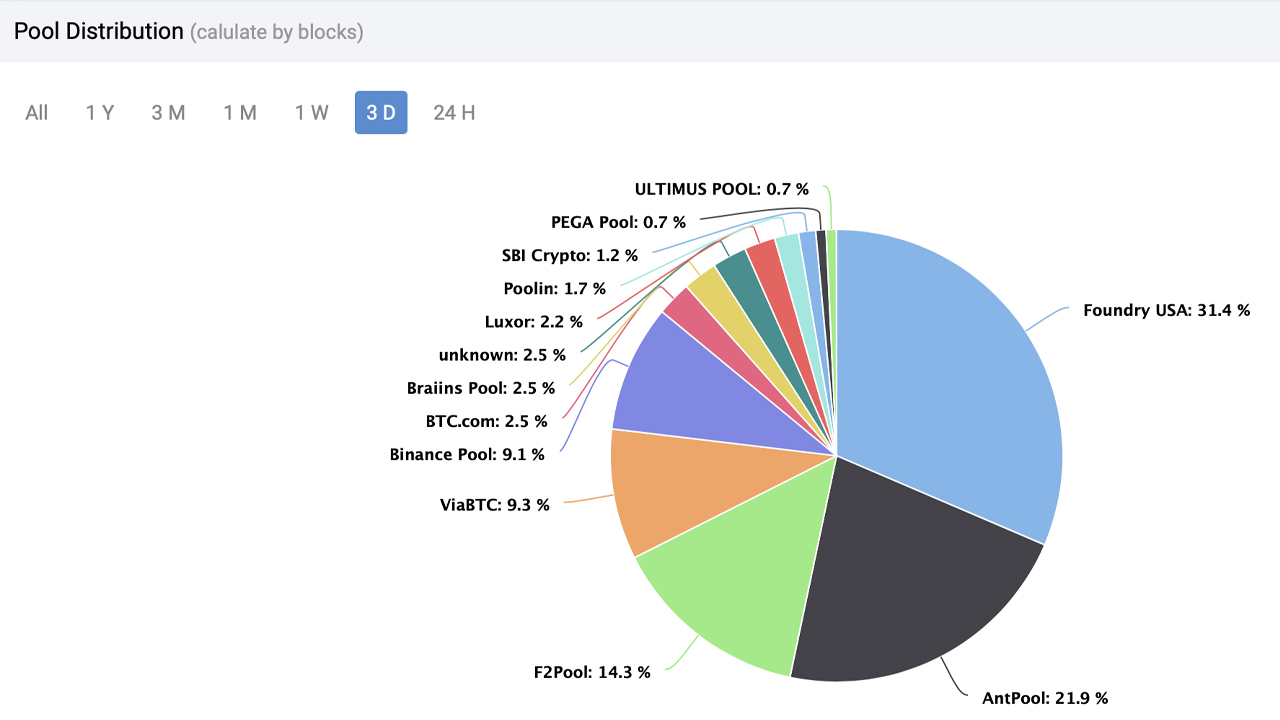

Bitcoin Mining Hashrate Explaining The Recent Increase

May 09, 2025

Bitcoin Mining Hashrate Explaining The Recent Increase

May 09, 2025 -

Colapinto For Doohan At Imola Analyzing The Rumors

May 09, 2025

Colapinto For Doohan At Imola Analyzing The Rumors

May 09, 2025 -

Daycare Debate Expert Opinion Vs Working Parent Reality

May 09, 2025

Daycare Debate Expert Opinion Vs Working Parent Reality

May 09, 2025