5 Do's And Don'ts For Landing A Private Credit Job

Table of Contents

Do's for Securing a Private Credit Position

Do: Network Strategically within the Private Credit Industry

The private credit industry thrives on relationships. Networking isn't just about collecting business cards; it's about building genuine connections.

- Attend industry conferences and events: Events like those hosted by the CFA Institute or industry-specific conferences offer unparalleled networking opportunities. Engage actively, ask thoughtful questions, and follow up with new contacts.

- Leverage LinkedIn to connect with professionals in private credit: Optimize your LinkedIn profile, highlighting your skills and experience in private debt, alternative lending, and private equity. Engage with relevant posts and actively seek connections within the industry.

- Informational interviews are key to understanding the field: Reaching out for informational interviews allows you to learn about different roles, firms, and career paths within private credit, gaining valuable insight and building your network simultaneously.

- Join relevant professional organizations (e.g., CFA Institute): Membership in organizations like the CFA Institute provides access to networking events, educational resources, and a community of like-minded professionals in finance.

Do: Showcase Relevant Skills and Experience

Your resume and cover letter are your first impression. Make them count.

- Highlight experience in financial modeling, valuation, and credit analysis: Quantify your accomplishments. Instead of simply stating "Performed financial modeling," say "Developed financial models that improved investment decisions, resulting in a 10% increase in portfolio returns."

- Tailor your resume and cover letter to each specific job description: Generic applications get lost. Each application should directly address the specific requirements and keywords of the target role.

- Quantify your accomplishments whenever possible: Use metrics to demonstrate your impact (e.g., "Increased portfolio ROI by 15%," "Reduced loan defaults by 8%").

- Demonstrate strong analytical and problem-solving abilities: Highlight projects where you tackled complex problems and delivered effective solutions.

Do: Master the Art of the Private Credit Interview

Interviewing for a private credit role requires preparation and finesse.

- Practice behavioral interview questions (STAR method): The STAR method (Situation, Task, Action, Result) is crucial for structuring your responses and showcasing your accomplishments effectively.

- Research the firm and interviewers thoroughly: Understanding the firm's investment strategy, portfolio, and recent transactions demonstrates your genuine interest and initiative.

- Prepare insightful questions to ask the interviewer: Asking thoughtful questions shows your engagement and genuine curiosity about the role and the firm's culture.

- Demonstrate your understanding of private credit markets and investment strategies: Stay informed on current market trends and be prepared to discuss different investment strategies, including direct lending and fund investing.

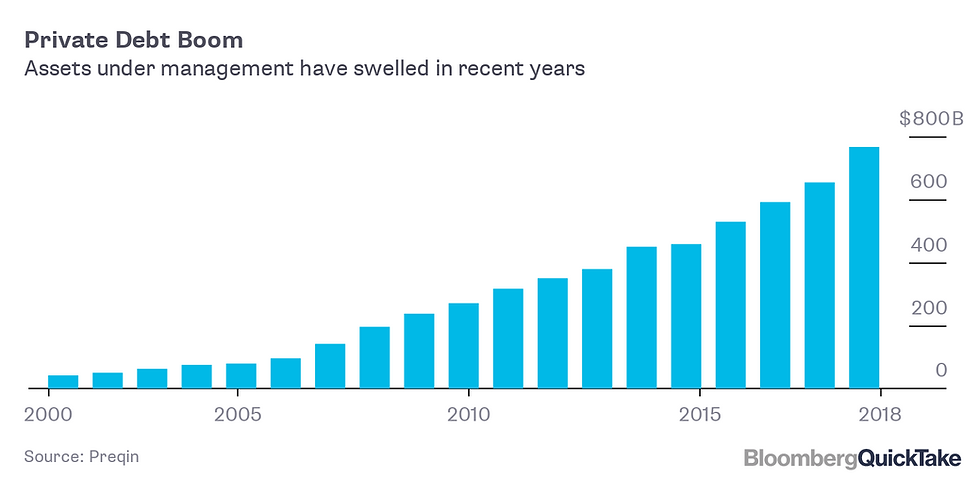

Do: Develop a Strong Understanding of Private Credit Markets

Private credit is a dynamic field. Continuous learning is essential.

- Stay up-to-date on market trends and economic indicators: Follow reputable financial news sources and publications to stay informed on market fluctuations and their impact on private credit.

- Read industry publications and follow key players in the private credit space: Publications such as Private Equity International and AltCredit Intelligence offer valuable insights into the industry.

- Develop a solid understanding of different private credit strategies (e.g., direct lending, fund investing): Familiarize yourself with the nuances of various private credit strategies and their risk profiles.

- Understand risk management in private credit investments: Demonstrate a comprehensive understanding of the various risks involved in private credit and the strategies employed to mitigate them.

Do: Highlight Your Passion for Private Credit

Enthusiasm is contagious.

- Demonstrate genuine interest in the field during interviews: Let your passion for private credit shine through your responses and questions.

- Show your initiative by pursuing further education or certifications: Consider pursuing relevant certifications like the CFA charter or other specialized finance qualifications to enhance your expertise.

- Network with professionals to express your enthusiasm: Use networking events to express your genuine interest and learn more about the field.

Don'ts That Can Hurt Your Private Credit Job Application

Don't: Neglect the Fundamentals of Finance

A strong foundation is critical.

- Ensure your understanding of accounting, finance, and economics is solid: Brush up on fundamental concepts in accounting, corporate finance, and financial economics.

- Brush up on core financial statements (balance sheet, income statement, cash flow statement): A deep understanding of financial statements is crucial for analyzing financial data and making informed investment decisions.

Don't: Submit a Generic Resume and Cover Letter

Each application should be tailored to the specific role and firm.

- Tailor your application materials to each specific job posting: Highlight the skills and experiences that are most relevant to the particular job description.

- Highlight relevant skills and experience for the target role: Use keywords from the job description throughout your resume and cover letter.

Don't: Underestimate the Importance of Networking

Networking opens doors that online applications can't.

- Building relationships is crucial for landing a private credit job: Attend industry events, connect with professionals on LinkedIn, and actively seek out informational interviews.

Don't: Lack Thorough Research on the Firm and Role

Preparation demonstrates your seriousness and interest.

- Show you understand the firm's investment strategy and culture: Research the firm's history, investment focus, and recent transactions.

- Demonstrate knowledge of the specific role's responsibilities: Carefully review the job description and understand the key responsibilities and expectations.

Don't: Forget to Follow Up

A simple thank-you note can make a difference.

- Send a thank-you note after each interview: Express your gratitude for the interviewer's time and reiterate your interest in the position.

- Maintain contact with recruiters and hiring managers: Follow up periodically to demonstrate your continued interest.

Conclusion

Securing a private credit job requires a multifaceted approach. By diligently following these dos and don'ts—networking effectively, showcasing your skills, mastering the interview process, and demonstrating a strong understanding of the private credit market—you significantly increase your chances of success. Start your journey toward a successful private credit career today! Implement these tips to secure your ideal private credit job and don't delay, take control of your private credit job search now!

Featured Posts

-

Us And South Sudan Partner To Manage Deportees Return

Apr 22, 2025

Us And South Sudan Partner To Manage Deportees Return

Apr 22, 2025 -

5 Dos And Don Ts For Landing A Private Credit Job

Apr 22, 2025

5 Dos And Don Ts For Landing A Private Credit Job

Apr 22, 2025 -

A Pan Nordic Defense Strategy Integrating Swedish Armor And Finnish Infantry

Apr 22, 2025

A Pan Nordic Defense Strategy Integrating Swedish Armor And Finnish Infantry

Apr 22, 2025 -

Following The Karen Read Murder Case A Comprehensive Timeline

Apr 22, 2025

Following The Karen Read Murder Case A Comprehensive Timeline

Apr 22, 2025 -

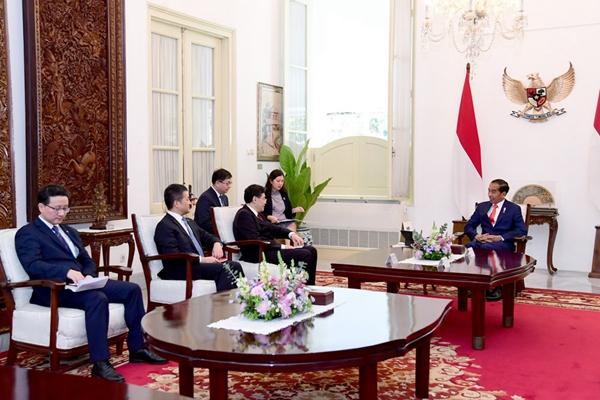

China And Indonesia Deepen Security Cooperation

Apr 22, 2025

China And Indonesia Deepen Security Cooperation

Apr 22, 2025