5 Essential Do's & Don'ts: Securing A Private Credit Role

Table of Contents

Do's: Boosting Your Private Credit Job Application

1. Highlight Relevant Skills & Experience

Focus on skills directly applicable to private credit analysis. This includes:

- Financial Modeling: Showcase your proficiency in building and analyzing complex financial models, including discounted cash flow (DCF) analysis and leveraged buyout (LBO) models.

- Credit Underwriting: Highlight your experience in assessing credit risk, analyzing financial statements, and making lending decisions. Mention specific methodologies used.

- Due Diligence: Detail your experience conducting thorough due diligence on potential investments, including financial statement analysis, legal reviews, and operational assessments.

- Portfolio Management: Showcase your understanding of portfolio construction, risk management, and performance monitoring. Quantify your contributions to portfolio performance whenever possible.

Quantify your achievements whenever possible. Instead of "Improved efficiency," use "Improved efficiency by 15% through process optimization." Showcase experience with relevant software (e.g., Bloomberg Terminal, Argus, Excel, Capital IQ). Emphasize experience in analyzing financial statements, cash flow projections, and key credit metrics like leverage ratios, interest coverage, and debt service coverage ratios.

2. Tailor Your Resume & Cover Letter

Don't send out generic applications. Customize your resume and cover letter for each specific private credit role.

- Company Research: Research the company's investment strategy, recent transactions, and the team you’re applying to join. Understanding their focus will help you tailor your application to highlight relevant experience.

- Keyword Optimization: Use keywords from the job description in your resume and cover letter. This helps Applicant Tracking Systems (ATS) identify your application as a strong match.

- Highlight Achievements: Instead of listing responsibilities, showcase accomplishments demonstrating your expertise in private credit, such as successfully underwriting a specific deal or improving portfolio performance.

- Targeted Approach: Address the specific needs and challenges mentioned in the job description, showing how your skills and experience directly address them.

3. Network Strategically

Networking is crucial in securing a private credit role.

- Industry Events: Attend industry events, conferences, and workshops focused on private credit, alternative investments, and private debt.

- LinkedIn: Actively engage on LinkedIn by joining relevant groups, participating in discussions, and connecting with professionals in the private credit space.

- Informational Interviews: Reach out to individuals working in private credit roles for informational interviews to learn about their experiences and gain valuable insights.

- Recruiters: Build relationships with recruiters specializing in finance and private credit placements. They often have exclusive access to unadvertised opportunities.

4. Master the Interview Process

Preparation is key to acing the interview.

- Behavioral Questions: Practice answering behavioral interview questions focusing on teamwork, problem-solving, conflict resolution, and handling pressure. Use the STAR method (Situation, Task, Action, Result) to structure your responses.

- Technical Questions: Prepare for technical questions related to credit analysis, financial modeling, valuation methodologies, and your understanding of credit risk.

- Market Knowledge: Demonstrate your understanding of the private credit market, including current trends, challenges, and regulatory changes. Be prepared to discuss your thoughts on specific market dynamics.

- Firm Research: Thoroughly research the firm’s investment strategy, portfolio companies, and recent transactions.

5. Showcase Your Passion for Private Credit

Demonstrate genuine enthusiasm for the industry.

- Market Awareness: Stay updated on market trends and news by reading industry publications like Private Debt Investor, Debtwire, and other relevant sources.

- Specific Interest: Express your interest in the firm's specific investment strategy and portfolio companies. This shows you've done your research and are genuinely interested in their work.

- Proactive Learning: Showcase initiative and a proactive approach to learning by mentioning continuous professional development activities, relevant certifications, or independent learning projects.

- Enthusiasm: Express your excitement about the challenges and rewards of working in private credit.

Don'ts: Common Mistakes to Avoid

1. Generic Applications

Avoid submitting generic resumes and cover letters. Each application should be tailored to the specific job and company. Failing to research the company thoroughly demonstrates a lack of interest and professionalism.

2. Lack of Specific Examples

Avoid vague statements about your skills and experience. Always back up your claims with concrete examples and quantifiable results. Instead of simply listing skills, show how you've successfully applied them in past roles.

3. Poor Communication

Avoid grammatical errors and typos in all your communication materials. Practice clear and concise communication during interviews, ensuring your points are well-structured and easy to understand. Your resume should also be easy to read and well-formatted.

4. Neglecting Networking

Don't underestimate the power of networking. Building relationships within the private credit industry is crucial for uncovering hidden opportunities and gaining valuable insights. Always follow up after networking events and interviews.

5. Lack of Preparation

Avoid going into interviews unprepared. Thoroughly research the firm, the role, and anticipate potential interview questions. A lack of preparation shows a lack of interest and commitment.

Conclusion

Securing a private credit role requires meticulous preparation and a strategic approach. By following these five essential dos and don'ts, you'll significantly improve your chances of landing your dream job in private debt. Remember to tailor your applications, network effectively, and showcase your passion for private credit. Don't delay – start refining your approach today and take control of your private credit career aspirations! Good luck in your search for the perfect private credit role!

Featured Posts

-

The Us Economy And Elon Musks Net Worth A Complex Relationship

May 10, 2025

The Us Economy And Elon Musks Net Worth A Complex Relationship

May 10, 2025 -

Unraveling The Truth Us Funding For Transgender Animal Research

May 10, 2025

Unraveling The Truth Us Funding For Transgender Animal Research

May 10, 2025 -

Dangotes Influence On Nigerias Petrol Market And Nnpc Pricing

May 10, 2025

Dangotes Influence On Nigerias Petrol Market And Nnpc Pricing

May 10, 2025 -

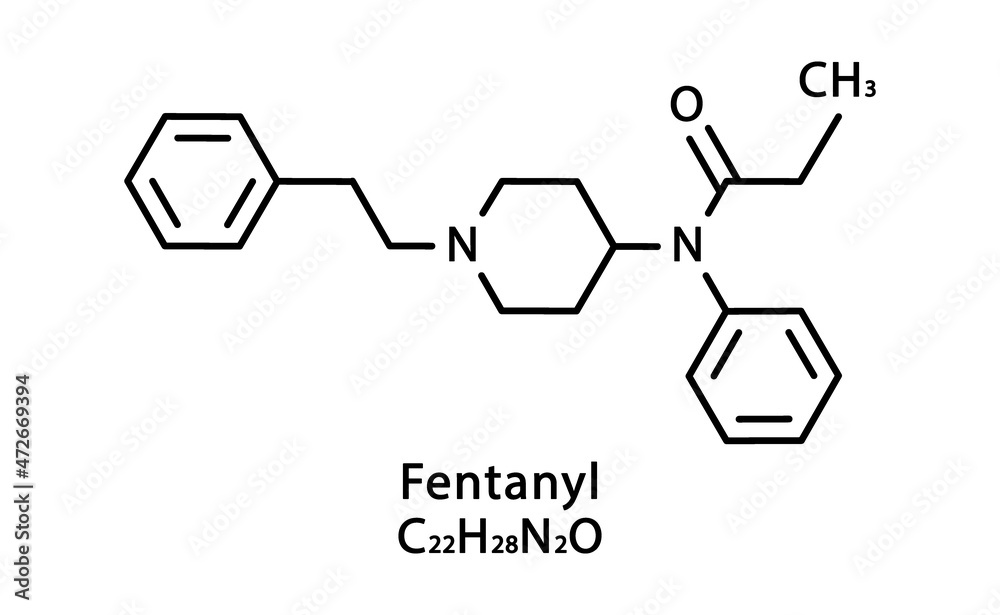

Fake Fentanyl Displayed By Attorney General Concerns And Implications

May 10, 2025

Fake Fentanyl Displayed By Attorney General Concerns And Implications

May 10, 2025 -

Easing Bond Forward Regulations A Key Demand From Indian Insurers

May 10, 2025

Easing Bond Forward Regulations A Key Demand From Indian Insurers

May 10, 2025