5 Essential Do's & Don'ts: Succeeding In The Private Credit Market

Table of Contents

Do: Thoroughly Undertake Due Diligence

Thorough due diligence is the cornerstone of success in the private credit market. This involves a meticulous examination of potential borrowers and investments to mitigate risk and ensure a sound investment strategy.

Assess Creditworthiness Rigorously:

Don't rely solely on superficial metrics. A deep dive into the borrower's financial health is crucial. This requires a comprehensive analysis of various factors.

- Verify financial information through independent sources: Don't solely trust the numbers provided by the borrower. Cross-reference data with industry reports and independent audits for accuracy.

- Analyze cash flow projections and stress test scenarios: Project future cash flows under various economic conditions (optimistic, pessimistic, and most likely) to understand the borrower's resilience.

- Conduct background checks on key personnel: Investigate the management team's experience, reputation, and track record to assess their competence and integrity. This includes credit history checks and background checks where appropriate.

Structure the Loan Securely:

Protecting your investment requires a carefully structured loan agreement. This involves securing appropriate collateral, including tangible assets and revenue streams, and implementing robust covenants to safeguard against default.

- Secure appropriate collateral to mitigate risk: Collateral acts as a safety net in case of default. Evaluate the value and liquidity of the proposed collateral carefully.

- Include detailed covenants to protect your interests: Covenants are contractual agreements outlining specific borrower obligations, such as maintaining certain financial ratios or restrictions on further borrowing.

- Negotiate clear and enforceable repayment schedules: Establish a realistic and well-defined repayment plan, including interest rates, payment frequency, and prepayment penalties (if applicable).

Don't: Neglect Regulatory Compliance

The private credit market, while offering high returns, operates under a complex regulatory framework. Non-compliance can lead to significant penalties and reputational damage.

Stay Updated on Regulations:

The regulatory landscape is constantly evolving. Staying informed about the latest regulations is critical for maintaining compliance.

- Regularly review and update your understanding of relevant laws and regulations: Subscribe to regulatory updates, attend industry seminars, and engage legal counsel.

- Seek legal counsel to ensure compliance with all applicable rules: Don't rely solely on self-interpretation; consult with legal experts to ensure your actions are legally sound.

- Maintain meticulous records of all transactions: Keep detailed and accurate records of all transactions to facilitate audits and demonstrate compliance.

Underestimate Reporting Requirements:

Transparency and accurate reporting are vital for maintaining investor confidence and building long-term relationships.

- Develop a robust reporting system: Implement a system to ensure timely and accurate reporting to investors and regulators.

- Provide regular updates to investors and stakeholders: Keep investors informed about portfolio performance, risk management strategies, and any significant developments.

- Adhere to industry best practices for reporting: Follow accepted industry standards for transparency and reporting.

Do: Diversify Your Portfolio

Diversification is crucial for mitigating risk in the private credit market. Spreading your investments across various borrowers, industries, and loan types helps to reduce the impact of any single investment defaulting.

Spread Your Risk:

Don't put all your eggs in one basket. Diversification is paramount.

- Invest in a variety of private credit opportunities: Explore different types of loans (e.g., senior secured, mezzanine, subordinated debt), industries, and borrower sizes.

- Consider geographic diversification: Don't concentrate your investments in a single geographic region. Diversify across different regions and countries to spread risk.

- Balance your portfolio across different risk profiles: Maintain a balance between higher-risk, higher-return investments and lower-risk, lower-return investments.

Manage Your Portfolio Actively:

Active portfolio management is essential for adapting to changing market conditions and optimizing returns.

- Implement a robust portfolio monitoring system: Regularly track the performance of your investments, including credit quality, cash flows, and market valuations.

- Conduct regular reviews of your investment strategy: Periodically review your investment strategy to assess its effectiveness and make necessary adjustments.

- Be prepared to adjust your strategy based on market conditions: Remain flexible and responsive to changes in the economic environment and the private credit market.

Don't: Underestimate the Importance of Relationships

Building and maintaining strong relationships is paramount for success in the private credit market. These connections facilitate deal sourcing, information sharing, and effective risk management.

Network Strategically:

Networking is crucial for accessing deal flow and staying ahead of market trends.

- Attend industry events and conferences: Networking events provide valuable opportunities to meet potential borrowers, investors, and intermediaries.

- Cultivate relationships with key players in the private credit market: Building strong relationships with key individuals can provide access to exclusive investment opportunities.

- Maintain a strong professional reputation: A strong reputation is critical for attracting investors and building trust with borrowers.

Neglect Communication:

Open and consistent communication is essential for managing expectations and building trust with all stakeholders.

- Establish clear communication protocols: Define how and when you will communicate with borrowers and investors.

- Provide regular updates to all stakeholders: Keep borrowers and investors informed about the status of their investments and any relevant developments.

- Be responsive to inquiries and concerns: Address questions and concerns promptly and professionally.

Do: Leverage Technology and Data Analytics

Technology and data analytics are transforming the private credit market, offering opportunities to enhance efficiency, improve risk assessment, and identify promising investments.

Utilize Data-Driven Decision Making:

Data analytics provides valuable insights to inform your investment decisions.

- Leverage data analytics platforms to screen potential borrowers: Use data analytics tools to assess the creditworthiness of potential borrowers and identify high-quality investment opportunities.

- Utilize predictive modeling to assess credit risk: Employ sophisticated models to predict the likelihood of default and inform your lending decisions.

- Track portfolio performance using data analytics: Monitor your portfolio's performance using data analytics to identify areas for improvement and optimization.

Embrace Automation:

Automation streamlines processes and reduces operational costs, allowing you to focus on strategic decision-making.

- Implement automated underwriting systems: Automate the loan underwriting process to improve efficiency and reduce processing time.

- Use technology to manage documentation and compliance: Utilize technology to manage loan documents, track compliance requirements, and ensure regulatory adherence.

- Automate reporting and communication processes: Automate reporting generation and communication to investors and borrowers, saving time and improving accuracy.

Conclusion:

Succeeding in the private credit market demands a combination of careful planning, diligent execution, and a keen understanding of the market dynamics. By following these essential "do's" and "don'ts," you can significantly enhance your chances of success. Remember to prioritize thorough due diligence, maintain regulatory compliance, diversify your portfolio, cultivate strong relationships, and leverage technology to optimize your strategy. Start building your success in the private credit market today!

Featured Posts

-

Switzerland Joins Eu In Broadening Sanctions Against Russian Media

Apr 23, 2025

Switzerland Joins Eu In Broadening Sanctions Against Russian Media

Apr 23, 2025 -

Sans Alcool Dry January Et Tournee Minerale Une Tendance Positive Pour Le Bien Etre

Apr 23, 2025

Sans Alcool Dry January Et Tournee Minerale Une Tendance Positive Pour Le Bien Etre

Apr 23, 2025 -

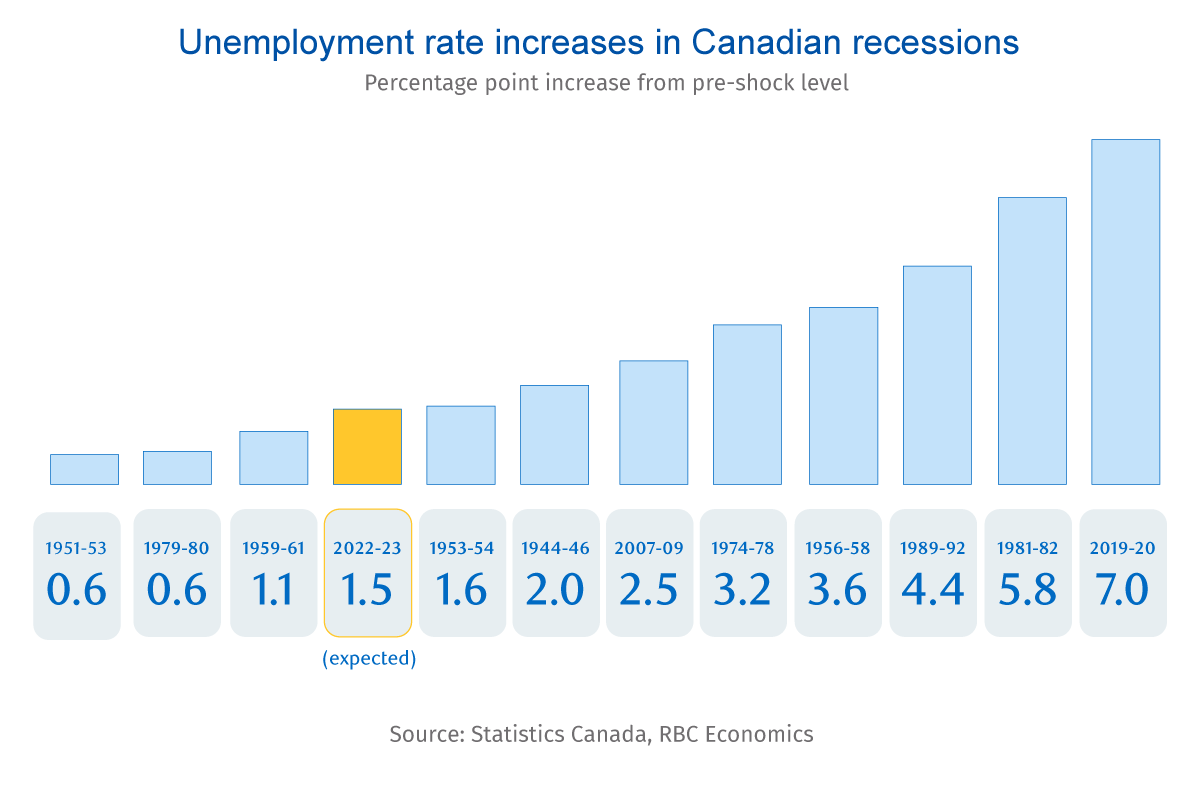

Canadas Economy Deeper Recession Predicted Despite Lower Tariffs

Apr 23, 2025

Canadas Economy Deeper Recession Predicted Despite Lower Tariffs

Apr 23, 2025 -

Chistiy Ponedelnik 3 Marta 2025 Goda Chto Mozhno I Nelzya Est Tserkovnye Sluzhby

Apr 23, 2025

Chistiy Ponedelnik 3 Marta 2025 Goda Chto Mozhno I Nelzya Est Tserkovnye Sluzhby

Apr 23, 2025 -

Woman And Child Escape Manhole Explosion Near Miss In City Location

Apr 23, 2025

Woman And Child Escape Manhole Explosion Near Miss In City Location

Apr 23, 2025