$50M Settlement Reached: Analyzing The Ripple-SEC Case And XRP's Trajectory

Table of Contents

Understanding the Ripple-SEC Lawsuit and its Core Arguments

The SEC's lawsuit against Ripple centered on the classification of XRP, Ripple's native cryptocurrency. The SEC alleged that Ripple conducted an unregistered securities offering, arguing that XRP sales constituted investment contracts under the Howey Test. This test, established in SEC v. W.J. Howey Co., defines an investment contract as an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others.

Ripple vehemently countered these claims, arguing that XRP is a decentralized digital asset functioning as a currency, not a security. They emphasized the distributed nature of XRP and the lack of centralized control, pointing to its use in various transactions and its presence on numerous exchanges. The core of the disagreement lay in the differing interpretations of the Howey Test, specifically concerning the role of Ripple's efforts in generating profits for XRP holders.

Key legal precedents, including previous SEC actions against other crypto projects, were cited by both sides, adding another layer of complexity to the case. The differing interpretations of existing legal frameworks highlighted the nascent nature of cryptocurrency regulation.

- SEC's claim: Unregistered securities offering of XRP.

- Ripple's argument: XRP is a currency, not a security; Programmatic sales were distinct from institutional sales.

- Howey Test application: A central point of contention, with different interpretations of "reasonable expectation of profits derived from the efforts of others."

- Impact of sales types: The distinction between programmatic sales (automated sales on exchanges) and direct sales to institutional investors played a significant role in the SEC's argument.

Deconstructing the $50 Million Settlement: What it Means for Ripple

The $50 million settlement marked a significant turning point, though it wasn't a complete victory for either side. Ripple agreed to pay the fine without admitting guilt. This lack of admission of wrongdoing is crucial, as it avoids a precedent-setting guilty verdict that could have severely impacted future cryptocurrency projects. However, the financial implications for Ripple are substantial, requiring them to allocate resources towards the settlement.

The settlement's impact on Ripple's operations and future projects remains to be seen. While it removes the immediate threat of further litigation from the SEC, it's unclear whether this settlement will impact investor confidence or hinder the development of new products and partnerships. The lingering uncertainty surrounding future regulatory actions could also affect Ripple's long-term strategy.

- No admission of guilt: A crucial element, avoiding a damaging legal precedent.

- Financial implications: Significant financial burden for Ripple.

- Reputation and investor confidence: Potential for both positive and negative impacts.

- Ongoing projects and development: Uncertainty regarding the impact on future initiatives.

XRP's Price Action and Market Sentiment Following the Settlement

XRP's price exhibited significant volatility in the period leading up to and following the settlement announcement. Before the announcement, anticipation fueled price fluctuations. The settlement itself initially caused a temporary price surge driven by relief amongst XRP holders. However, the long-term price prediction remains uncertain, dependent on market sentiment, regulatory developments, and broader cryptocurrency market trends. Trading volume and liquidity have also experienced fluctuations, reflecting investor uncertainty.

- Short-term price volatility: Significant price swings reflecting the market's reaction to the news.

- Long-term price prediction: Remains highly uncertain, influenced by numerous factors.

- Trading volume and liquidity: Fluctuations reflect shifting investor confidence.

- Adoption and use cases: The settlement's impact on XRP adoption remains to be determined.

The Ripple-SEC Case's Broader Implications for the Crypto Industry

The Ripple-SEC settlement sets a precedent, albeit a somewhat ambiguous one, for other cryptocurrency projects facing similar legal challenges. The SEC's continued scrutiny of the crypto market is undeniable. The case highlights the need for clearer regulatory frameworks specifically designed for the unique characteristics of digital assets. The lack of consistent regulatory clarity across jurisdictions continues to pose a significant challenge to innovation and widespread adoption within the crypto space.

- Implications for other cryptocurrencies: Other projects could face increased scrutiny.

- Increased regulatory scrutiny: The case underlines the SEC's active involvement in crypto regulation.

- Need for clearer regulatory frameworks: The lack of clear guidelines remains a major obstacle.

- Impact on innovation: Uncertainty may hinder innovation and development.

Conclusion: The Ripple-SEC Case: A Turning Point for XRP and Crypto Regulation?

The $50 million Ripple-SEC settlement represents a significant, albeit complex, development in the cryptocurrency landscape. While the immediate impact on Ripple and XRP's price is clear, the long-term consequences for the broader crypto industry remain to be seen. The case underscores the pressing need for clearer and more comprehensive regulatory frameworks that balance innovation with investor protection. This settlement will undoubtedly shape future discussions and legal battles surrounding cryptocurrencies.

Let's discuss! Share your thoughts on the Ripple-SEC case and its impact on XRP and the cryptocurrency market using #RippleSEC #XRP #CryptoRegulation. Follow for further updates on the Ripple-SEC case and XRP’s trajectory.

Featured Posts

-

Windstar Cruises A Foodies Voyage

May 01, 2025

Windstar Cruises A Foodies Voyage

May 01, 2025 -

Hasbros New Star Wars Shadow Of The Empire Dash Rendar Figure

May 01, 2025

Hasbros New Star Wars Shadow Of The Empire Dash Rendar Figure

May 01, 2025 -

Town Hall With Dr Victoria Watlington Moderated By Joe Bruno Channel 9

May 01, 2025

Town Hall With Dr Victoria Watlington Moderated By Joe Bruno Channel 9

May 01, 2025 -

The Future Of Xrp Analyzing The Impact Of Etf Decisions And Sec Actions

May 01, 2025

The Future Of Xrp Analyzing The Impact Of Etf Decisions And Sec Actions

May 01, 2025 -

Sheens Generosity 1 Million Debt Relief For 900

May 01, 2025

Sheens Generosity 1 Million Debt Relief For 900

May 01, 2025

Latest Posts

-

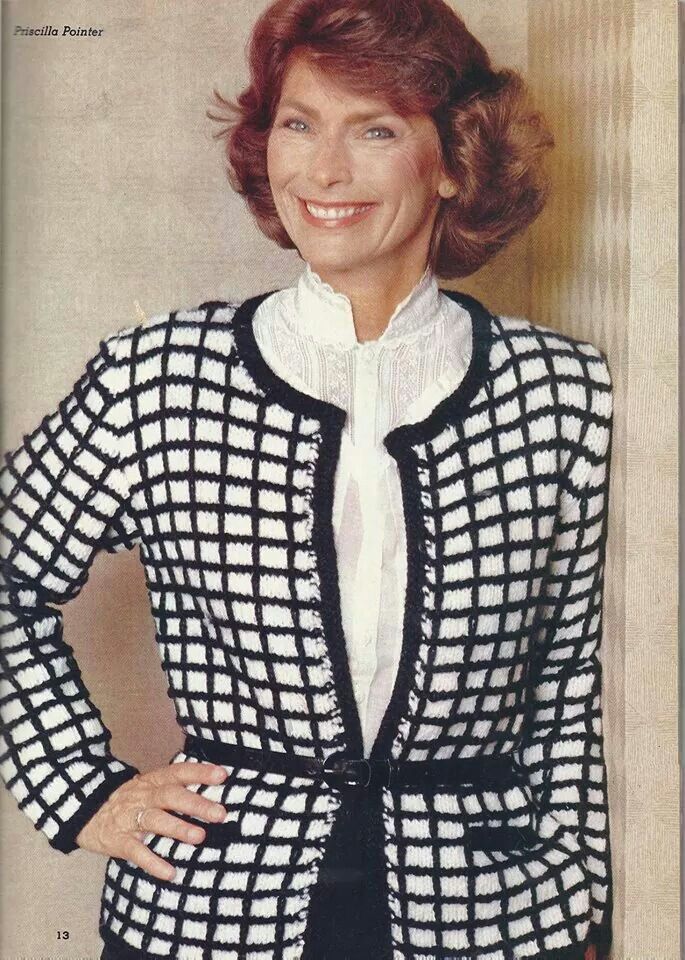

Veteran Actress Priscilla Pointer Amy Irvings Mother Dead At 100

May 01, 2025

Veteran Actress Priscilla Pointer Amy Irvings Mother Dead At 100

May 01, 2025 -

Priscilla Pointer Carrie Actress And Amy Irvings Mother Passes Away At 100

May 01, 2025

Priscilla Pointer Carrie Actress And Amy Irvings Mother Passes Away At 100

May 01, 2025 -

100 Year Old Actress Priscilla Pointer Known For Carrie Passes Away

May 01, 2025

100 Year Old Actress Priscilla Pointer Known For Carrie Passes Away

May 01, 2025 -

Death Of Priscilla Pointer Actress And Mother Of Amy Irving Aged 100

May 01, 2025

Death Of Priscilla Pointer Actress And Mother Of Amy Irving Aged 100

May 01, 2025 -

Actress Priscilla Pointer Star Of Carrie Dead At 100

May 01, 2025

Actress Priscilla Pointer Star Of Carrie Dead At 100

May 01, 2025