The Future Of XRP: Analyzing The Impact Of ETF Decisions And SEC Actions

Table of Contents

The future of XRP, the native cryptocurrency of Ripple Labs, remains a topic of intense speculation. Its trajectory hinges significantly on the ongoing legal battle with the Securities and Exchange Commission (SEC) and the potential approval of XRP exchange-traded funds (ETFs). This article delves into the key factors influencing XRP's future, analyzing the implications of SEC actions and the potential impact of ETF approvals on its price and adoption.

The SEC vs. Ripple: A Defining Legal Battle

The SEC lawsuit against Ripple Labs is arguably the most significant factor shaping XRP's future. The outcome will profoundly impact its regulatory status and market perception.

The Core Arguments of the SEC Lawsuit

The SEC alleges that Ripple sold XRP as an unregistered security, violating federal securities laws. Their argument centers on the claim that XRP sales constituted an "investment contract," meaning investors purchased XRP with the expectation of profit based on Ripple's efforts.

- Key Points of Contention:

- Whether XRP sales were made to accredited and unaccredited investors.

- The level of Ripple's control over the XRP market.

- The distribution and utility of XRP within the RippleNet ecosystem.

- The degree of decentralization of the XRP Ledger.

Ripple counters that XRP is a decentralized digital asset, functioning as a currency rather than a security. They argue that the SEC's definition is overly broad and would stifle innovation in the cryptocurrency space. The potential implications of a ruling in favor of either party are vast, potentially setting precedents for how other cryptocurrencies are regulated.

- Links to Relevant Resources: [Insert links to relevant SEC filings, court documents, and news articles here]

Potential Outcomes and Their Impact on XRP

Several scenarios are possible following the conclusion of the lawsuit:

-

Ripple Wins: A victory for Ripple could lead to increased regulatory clarity, boosting investor confidence and potentially driving up XRP's price and trading volume. It would likely signal a more favorable regulatory environment for other cryptocurrencies.

-

SEC Wins: An SEC victory could severely damage XRP's market position, potentially leading to delisting from exchanges and decreased investor interest. It could also set a precedent for stricter regulation of other cryptocurrencies.

-

Settlement: A settlement between Ripple and the SEC would likely involve Ripple agreeing to certain conditions, potentially impacting future XRP sales and development. The impact on the price would depend on the specifics of the settlement.

Experts and market analysts offer differing perspectives on the likely outcome and its impact. [Insert links to expert opinions and market analyses here].

The Potential for XRP ETFs

The approval of XRP ETFs could be a significant catalyst for XRP's growth. However, several hurdles remain.

The Benefits and Drawbacks of XRP ETFs

XRP ETFs offer several potential benefits:

- Increased Liquidity: ETFs generally offer higher liquidity than directly holding XRP, making it easier to buy and sell.

- Accessibility: ETFs are accessible to a wider range of investors, including institutional investors, potentially driving demand.

- Institutional Investment: The approval of an XRP ETF could attract significant institutional investment, boosting its market capitalization.

However, potential downsides exist:

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains uncertain, impacting ETF approval.

- Market Manipulation: Concerns about market manipulation remain a potential challenge for any cryptocurrency ETF.

Comparing XRP ETF proposals to existing Bitcoin and Ethereum ETFs will help illuminate the potential trajectory. [Insert comparison data and analysis here]. The approval could significantly reduce price volatility, though the initial impact might be dramatic.

The Regulatory Hurdles to ETF Approval

Several factors could hinder XRP ETF approval:

- SEC Scrutiny: The SEC's scrutiny of cryptocurrencies, particularly following the Ripple lawsuit, creates uncertainty.

- Regulatory Clarity: Lack of clear regulatory guidelines on cryptocurrencies poses a challenge.

- Market Manipulation Concerns: Concerns about market manipulation remain a significant hurdle for ETF approval.

The regulatory process for ETF approval is complex and involves rigorous review. [Insert details about the regulatory processes involved here]. Examining previous ETF applications and their outcomes provides valuable insights. [Insert examples of previous ETF applications and their outcomes here].

Beyond the SEC and ETFs: Factors Shaping XRP's Future

The future of XRP isn't solely determined by legal battles and ETF approvals. Other factors play a crucial role.

Ripple's Technological Advancements

Ripple's continued development of its blockchain technology and its applications in cross-border payments is vital to XRP's long-term success.

- Technological Innovation: Continuous innovation is key to XRP's viability and competitiveness in the evolving cryptocurrency landscape.

- Partnerships and Collaborations: Partnerships and collaborations that demonstrate XRP adoption are crucial for its growth. [Mention specific partnerships and collaborations here].

The focus on technological advancement increases XRP's value proposition.

The Growing Adoption of XRP in Cross-Border Payments

XRP's use in cross-border payments is a significant factor in its future.

- Faster and Cheaper Transactions: XRP offers the potential to facilitate faster and cheaper cross-border transactions compared to traditional methods.

- Real-World Use Cases: Businesses are already using XRP for cross-border transactions. [Mention specific examples of businesses using XRP here].

- Impact on Price and Market Position: Increased adoption will positively influence XRP's price and market position.

Conclusion

The future of XRP is intrinsically linked to the outcome of the SEC lawsuit and the potential for ETF approval. While legal uncertainty remains, Ripple's technological advancements and the growing adoption of XRP in cross-border payments offer optimism. The interplay of regulatory developments, technological innovation, and market adoption will ultimately determine XRP's trajectory.

Call to Action: Stay informed about developments in the XRP ecosystem. Continue researching the potential of XRP and consider its role in your investment strategy carefully as you navigate the evolving landscape of digital asset regulations and the impact of potential XRP ETF approvals. Understanding the future of XRP requires constant monitoring of both legal and technological advancements.

Featured Posts

-

Accompagnement Numerique Pour Thes Dansants Reussis

May 01, 2025

Accompagnement Numerique Pour Thes Dansants Reussis

May 01, 2025 -

Experience The Merrie Monarch Festival Vibrant Performances And Cultural Displays

May 01, 2025

Experience The Merrie Monarch Festival Vibrant Performances And Cultural Displays

May 01, 2025 -

Classic Crab Stuffed Shrimp In Lobster Sauce Recipe

May 01, 2025

Classic Crab Stuffed Shrimp In Lobster Sauce Recipe

May 01, 2025 -

Port Talbot Neighbours Benefit From Michael Sheens 1 Million Debt Payment

May 01, 2025

Port Talbot Neighbours Benefit From Michael Sheens 1 Million Debt Payment

May 01, 2025 -

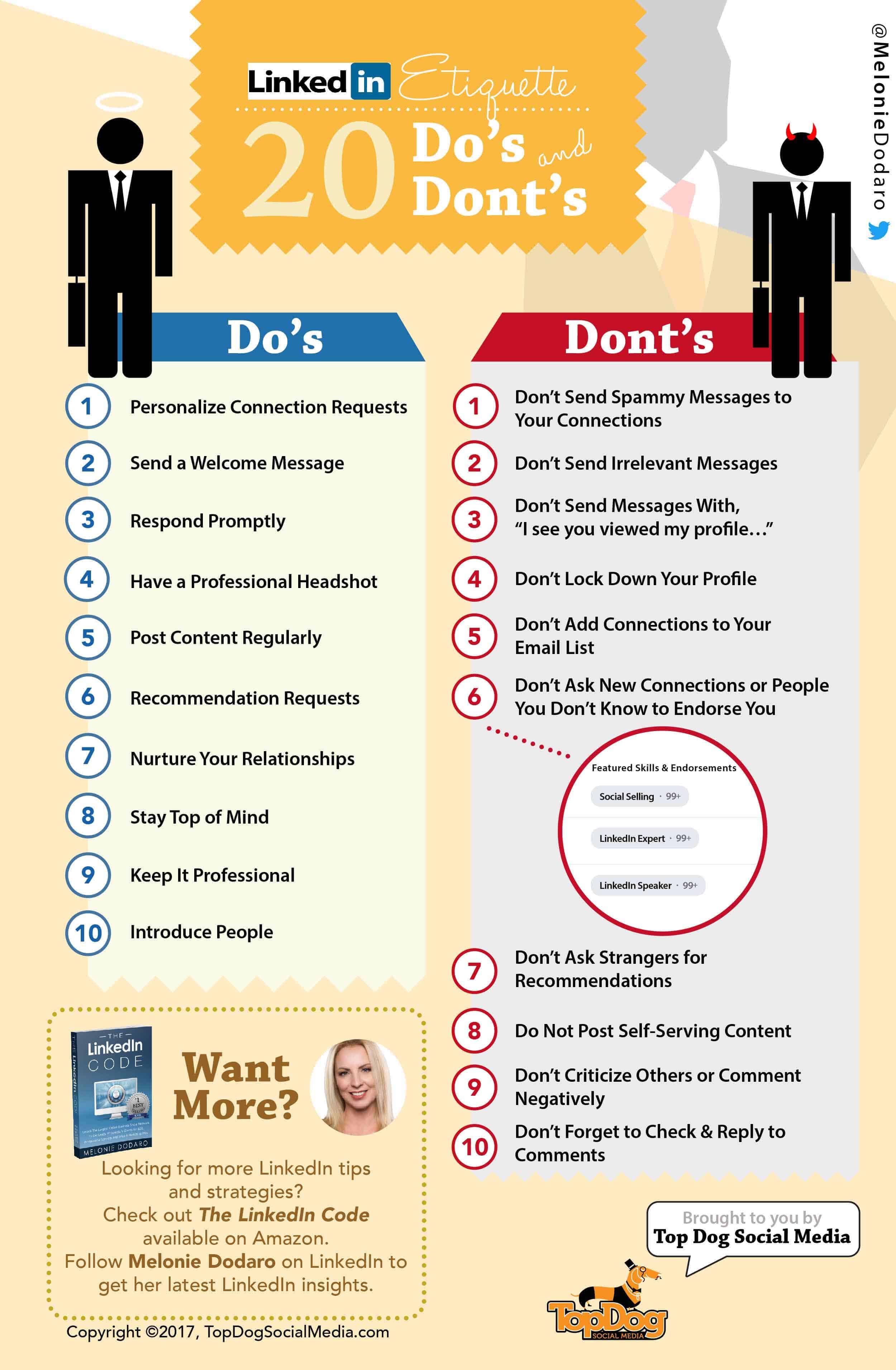

Land Your Dream Job 5 Dos And Don Ts In Private Credit

May 01, 2025

Land Your Dream Job 5 Dos And Don Ts In Private Credit

May 01, 2025

Latest Posts

-

Exclusive Deal Closed Wall Street Banks Complete Sale Of Elon Musks X Corp Debt

May 01, 2025

Exclusive Deal Closed Wall Street Banks Complete Sale Of Elon Musks X Corp Debt

May 01, 2025 -

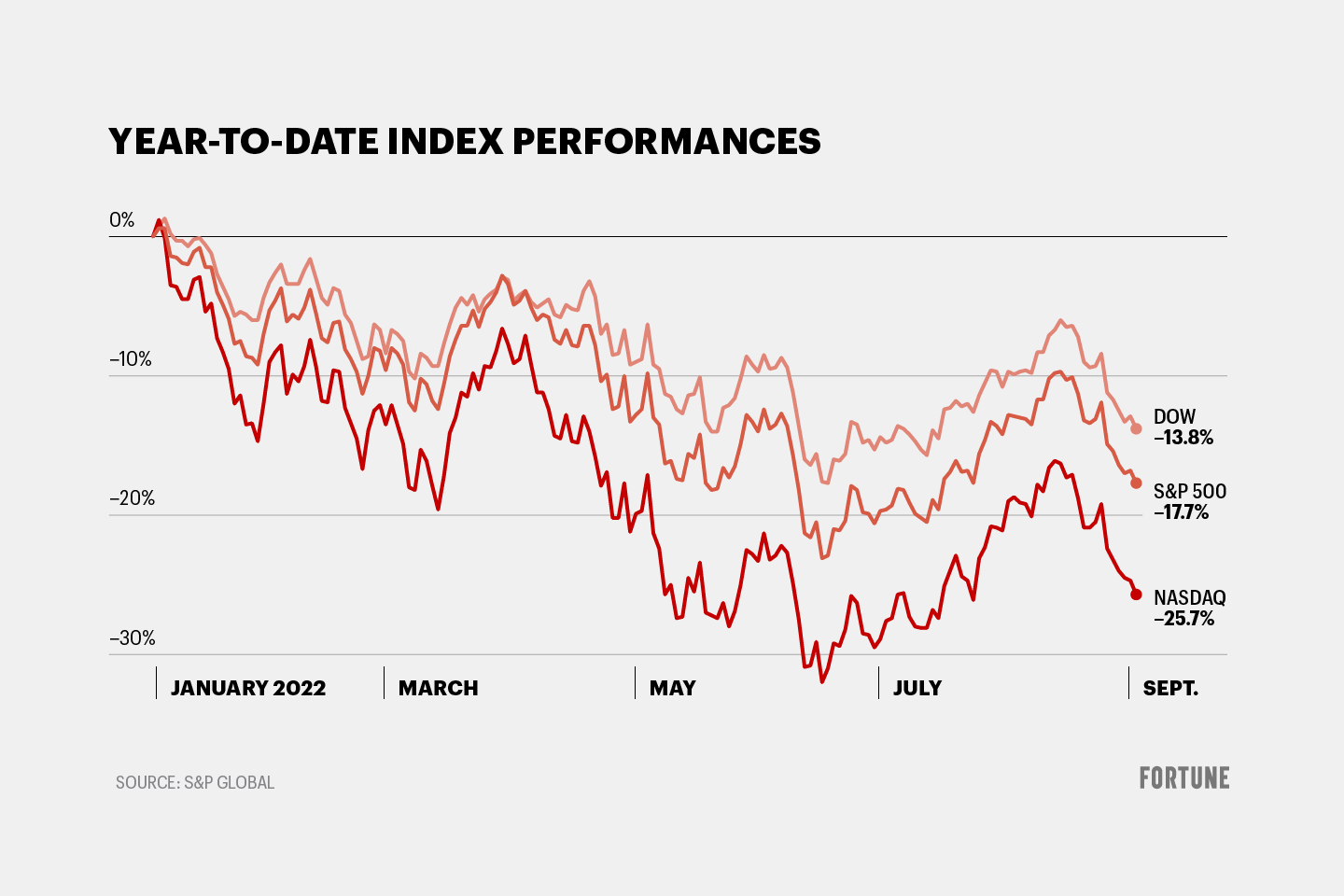

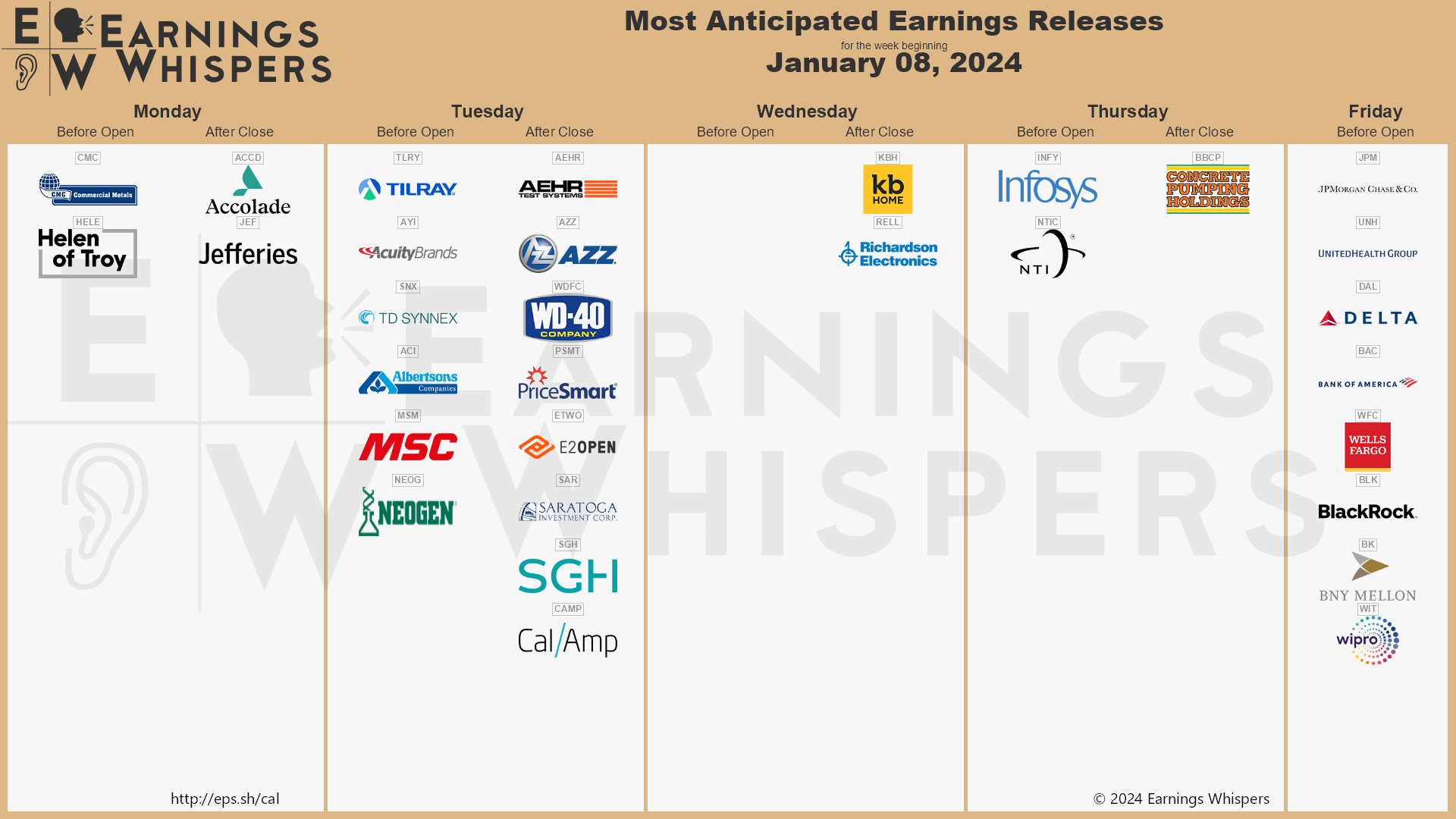

Analyzing Todays Stock Market Dow Futures Earnings And Market Trends

May 01, 2025

Analyzing Todays Stock Market Dow Futures Earnings And Market Trends

May 01, 2025 -

Exclusive Final Sale Of Elon Musks X Debt By Wall Street Banks

May 01, 2025

Exclusive Final Sale Of Elon Musks X Debt By Wall Street Banks

May 01, 2025 -

Stock Market Today Earnings Season Impact On Dow Futures And Market Indices

May 01, 2025

Stock Market Today Earnings Season Impact On Dow Futures And Market Indices

May 01, 2025 -

Palestinian Journalist Detained In West Bank Raid

May 01, 2025

Palestinian Journalist Detained In West Bank Raid

May 01, 2025