Land Your Dream Job: 5 Do's & Don'ts In Private Credit

Table of Contents

Do's: Maximize Your Chances of Landing a Private Credit Role

1. Develop In-Demand Skills

The private credit industry demands a specific skill set. Focus on developing expertise in areas highly valued by employers.

- Financial Modeling: Master building sophisticated financial models, including leveraged buyout (LBO) models, discounted cash flow (DCF) analyses, and valuation techniques specific to distressed debt and private equity investments.

- Credit Analysis: Develop a deep understanding of credit risk assessment, including covenant analysis, cash flow forecasting, and the ability to interpret financial statements effectively. Proficiency in analyzing collateral and understanding different types of debt structures (e.g., senior secured, subordinated debt) is crucial.

- Valuation Techniques: Learn to apply various valuation methodologies relevant to private credit, including asset-based valuations, discounted cash flow analysis, and comparable company analysis. Understanding the nuances of valuing illiquid assets is essential.

- Software Proficiency: Master essential software tools like Microsoft Excel (advanced functions are key), Bloomberg Terminal (for market data and research), and potentially specialized private credit platforms used by firms.

- Relevant Certifications: Obtaining certifications like the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst) demonstrates commitment and enhances credibility significantly. These certifications showcase your knowledge of financial markets and alternative investments.

2. Network Strategically

Networking is paramount in the private credit industry. Don't underestimate the power of building relationships.

- Industry Events: Attend conferences, seminars, and networking events focused on private credit, alternative investments, and private equity. These events provide invaluable opportunities to meet professionals and learn about industry trends.

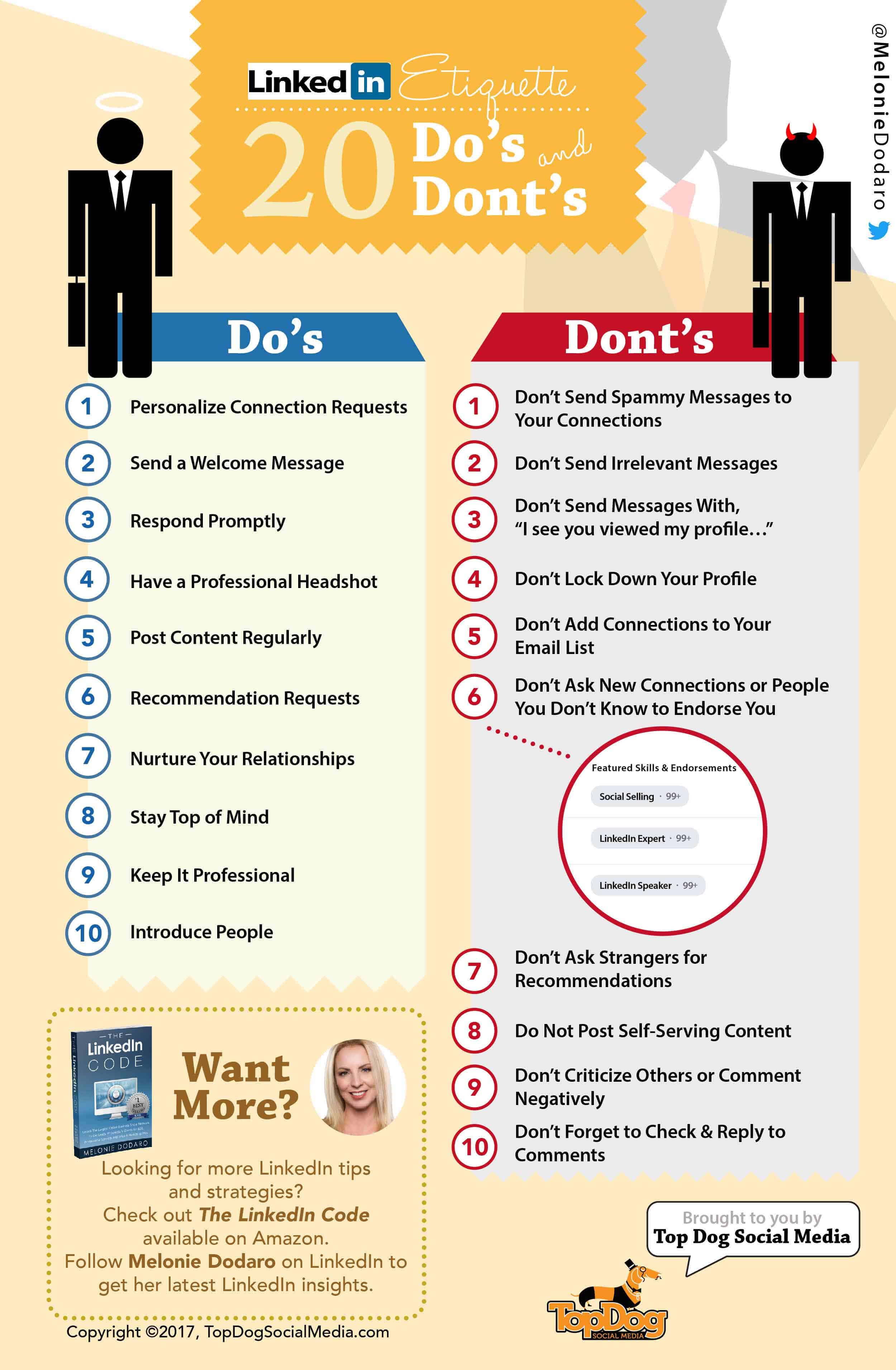

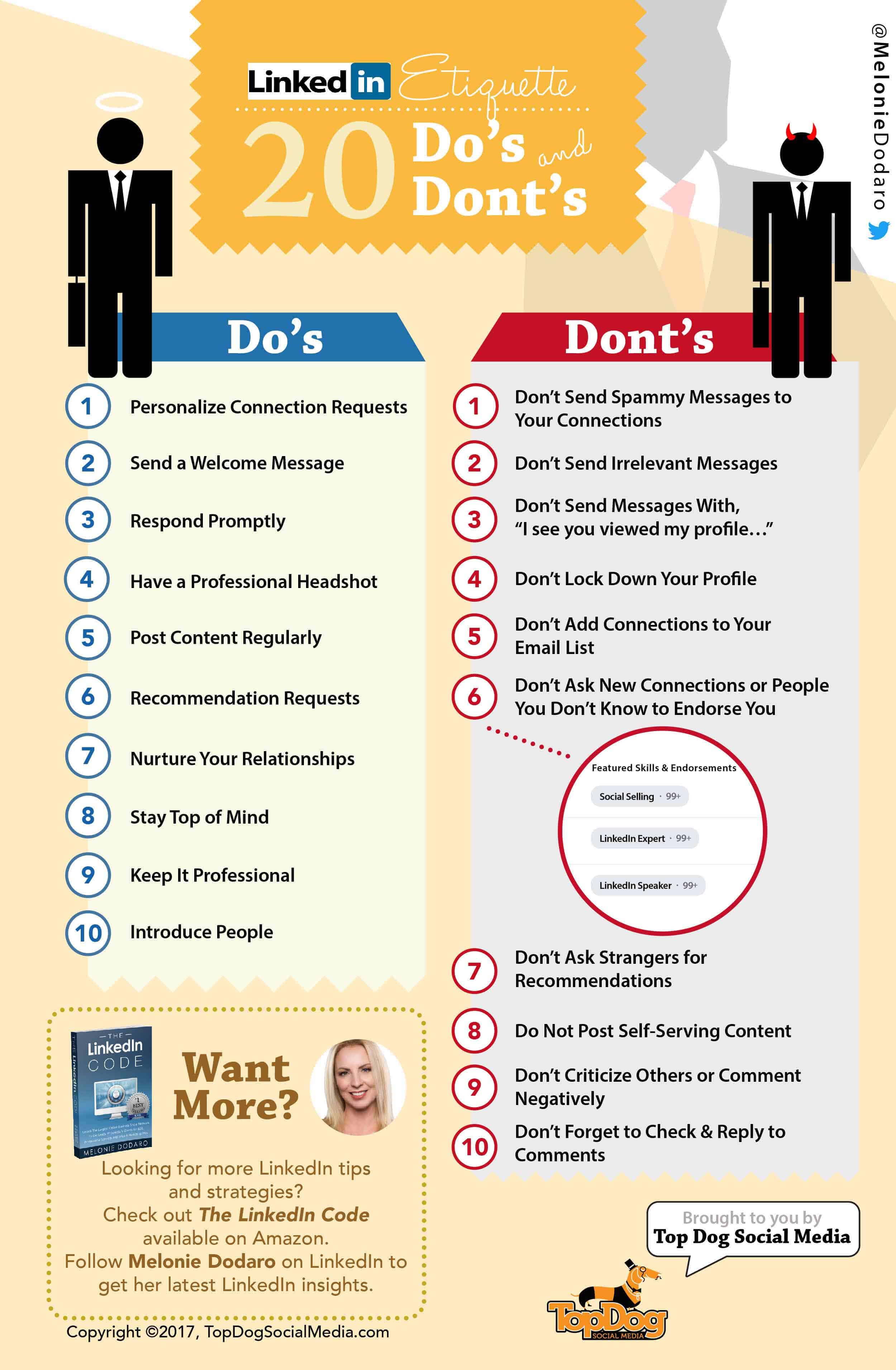

- Leverage LinkedIn: Utilize LinkedIn effectively. Connect with professionals working in private credit firms, engage with their content, and participate in relevant industry groups.

- Informational Interviews: Reach out to professionals for informational interviews. These conversations provide valuable insights into specific roles, firm cultures, and the overall industry landscape. Prepare thoughtful questions beforehand.

- Targeted Approach: Research specific private credit firms that align with your interests and career goals. Understand their investment strategies, recent transactions, and team structure. Tailor your networking efforts accordingly.

- Professional Organizations: Join relevant professional organizations like the Association for Financial Professionals (AFP) or industry-specific groups to expand your network and stay updated on industry news and trends.

3. Craft a Compelling Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count.

- Tailored Approach: Customize your resume and cover letter for each job application. Highlight experiences and skills directly relevant to the specific role and firm.

- Quantify Accomplishments: Use quantifiable metrics to demonstrate the impact of your contributions. Instead of simply stating responsibilities, quantify your achievements using numbers and data.

- Keyword Optimization: Incorporate keywords from the job description into your resume and cover letter to improve your chances of getting past Applicant Tracking Systems (ATS).

- Showcase Analytical Skills: Emphasize your analytical and problem-solving abilities, demonstrating your capacity to analyze complex financial data and make informed decisions.

- Highlight Relevant Experience: If you have experience in debt financing, restructuring, portfolio management, or related areas, prominently feature this in your resume and cover letter.

4. Ace the Interview

Interview preparation is crucial for success.

- Behavioral Questions: Practice answering common behavioral interview questions (e.g., "Tell me about a time you failed," "Describe a challenging situation you overcame"). Prepare examples showcasing your relevant skills and experiences.

- Firm Research: Thoroughly research the firm's investment strategy, recent deals, and team members. Demonstrate genuine interest in their work and investment philosophy during the interview.

- Thoughtful Questions: Prepare insightful questions to ask the interviewer, demonstrating your engagement and interest in the role and the firm.

- Communication Skills: Develop strong communication skills and practice confidently articulating your thoughts and ideas. Clearly and concisely express your understanding of private credit concepts.

- Market Awareness: Demonstrate your understanding of current market trends in private credit, including interest rate changes, economic conditions, and regulatory developments.

5. Follow Up Professionally

Following up after the interview is essential.

- Thank-You Note: Send a personalized thank-you note to each interviewer within 24 hours, expressing your gratitude and reiterating your interest in the position.

- Follow-Up Communication: If you haven't heard back within a reasonable timeframe (specified in the interview or company communication), a polite follow-up email is appropriate.

- Professionalism: Maintain professional communication throughout the entire process, from initial application to final stages of the interview process.

- Enthusiasm: Showcase your continued enthusiasm for the role and the firm. Express your eagerness to contribute to their team.

Don'ts: Avoid These Common Mistakes

- Neglecting Networking: Don't underestimate the importance of building relationships; it's a crucial aspect of landing a private credit job.

- Submitting Generic Applications: Avoid submitting generic resumes and cover letters; always tailor your application materials to each specific job description.

- Lack of Financial Modeling Skills: Private credit roles require strong financial modeling skills; dedicate time and effort to mastering these essential competencies.

- Poor Interview Preparation: Don't enter an interview unprepared; thorough research and practice are essential to demonstrate your knowledge and competence.

- Ignoring Follow-Up: A timely and professional follow-up demonstrates your persistence and interest, which can significantly enhance your chances of securing a job offer.

Conclusion

Securing your dream job in private credit requires a combination of hard work, strategic planning, and a proactive approach. By following these do's and don'ts, you can significantly improve your chances of landing your ideal role. Remember to focus on developing in-demand skills, networking strategically, crafting compelling application materials, acing the interview, and following up professionally. Don't delay – start honing your skills and networking today to land your dream job in private credit and private debt financing!

Featured Posts

-

Tonga Qualifies For Ofc U 19 Womens Championship 2025 A Historic Win

May 01, 2025

Tonga Qualifies For Ofc U 19 Womens Championship 2025 A Historic Win

May 01, 2025 -

Nigeria Railway Corporation Restarts Warri Itakpe Train Service

May 01, 2025

Nigeria Railway Corporation Restarts Warri Itakpe Train Service

May 01, 2025 -

Rocket Launch Abort Blue Origin Announces Subsystem Problem

May 01, 2025

Rocket Launch Abort Blue Origin Announces Subsystem Problem

May 01, 2025 -

Prince Williams Pensive Portrait A New Photo From Kensington Palace

May 01, 2025

Prince Williams Pensive Portrait A New Photo From Kensington Palace

May 01, 2025 -

Analyzing Xrp Ripple At Sub 3 Prices Buy Or Sell

May 01, 2025

Analyzing Xrp Ripple At Sub 3 Prices Buy Or Sell

May 01, 2025

Latest Posts

-

Global Defense Budgets Soar Amidst Growing Russian Threat

May 01, 2025

Global Defense Budgets Soar Amidst Growing Russian Threat

May 01, 2025 -

Cruise Ship Innovations Whats New For 2025

May 01, 2025

Cruise Ship Innovations Whats New For 2025

May 01, 2025 -

The Best New Cruises Departing From Southern Ports In 2025

May 01, 2025

The Best New Cruises Departing From Southern Ports In 2025

May 01, 2025 -

Nclh Stock Is It Worth The Investment According To Hedge Funds

May 01, 2025

Nclh Stock Is It Worth The Investment According To Hedge Funds

May 01, 2025 -

New Cruise Ships Of 2025 The Big Deal

May 01, 2025

New Cruise Ships Of 2025 The Big Deal

May 01, 2025