7% Fall For Amsterdam Stocks As Trade War Fears Grip Markets

Table of Contents

Understanding the Trade War's Impact on Amsterdam's Stock Market

The interconnected nature of global markets means that trade disputes, even those seemingly far removed, can significantly impact seemingly distant economies like the Netherlands. The current trade war uncertainty creates a ripple effect, influencing investor confidence and affecting various aspects of the Amsterdam stock market.

- Increased import/export costs for Dutch businesses: Tariffs and trade barriers imposed as part of the trade war directly increase the cost of doing business for Dutch companies, impacting profitability and potentially slowing economic growth. This translates to lower stock valuations.

- Uncertainty affecting investor confidence and leading to sell-offs: The unpredictability surrounding trade policies creates a climate of fear and uncertainty, prompting investors to adopt a risk-averse approach and sell off their holdings to protect their capital. This contributes significantly to market volatility.

- Impact on specific sectors (e.g., technology, manufacturing, agriculture): Export-oriented industries like technology and manufacturing are particularly vulnerable, as trade restrictions limit their access to international markets. The agricultural sector is also significantly affected by trade disputes and resulting tariffs.

- Weakening of the Euro against the dollar: Currency fluctuations driven by trade war uncertainty further exacerbate the problem, making Dutch exports more expensive and impacting the profitability of businesses operating in international markets. Keywords: global trade, international markets, economic sanctions, investor sentiment, currency fluctuations.

Analyzing the Specific Sectors Hit Hardest

The technology and export-oriented manufacturing sectors experienced the most significant drops during today's market downturn. Preliminary data suggests a decline of over 10% in certain technology sub-sectors and around 8% in export-focused manufacturing companies.

- Sector-Specific Analysis: A deeper dive into company-specific data reveals that companies heavily reliant on exports to the US and China were hit the hardest, reflecting the direct impact of trade restrictions.

- Market Capitalization Impacts: The combined market capitalization of the most affected sectors saw a substantial decrease, highlighting the widespread nature of the decline.

- Company Performance: Several prominent Amsterdam-listed companies within these sectors reported significant share price drops. (Examples of specific companies and their performance should be inserted here – replace with real data when available).

- Vulnerability of Export-Dependent Industries: These sectors' heavy reliance on international trade makes them especially vulnerable to trade war escalations. Disruptions to supply chains and reduced market access directly translate to decreased revenue and lower stock prices. Keywords: sector-specific analysis, market capitalization, company performance, export-dependent industries, vulnerable sectors.

Investor Reactions and Future Market Outlook

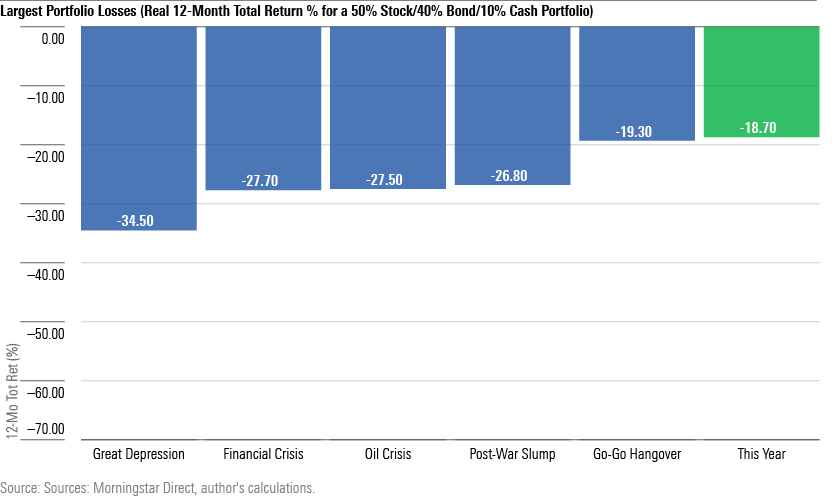

The immediate reaction to the 7% drop in Amsterdam stocks was a mix of panic selling and a cautious wait-and-see approach. Many investors opted to liquidate positions to minimize potential further losses, contributing to the overall market decline.

- Market Volatility: The current market volatility highlights the uncertainty surrounding future trade policies and their potential impact on the Dutch economy.

- Expert Opinions: Analysts offer a range of predictions, some predicting a further short-term decline while others anticipate a gradual recovery once trade uncertainties are resolved. (Include specific expert quotes and predictions here, citing sources).

- Government Interventions: The Dutch government might consider implementing strategies to mitigate the impact of the trade war, such as providing financial support to affected businesses or promoting domestic consumption.

- Future Market Trends: The long-term outlook depends largely on the resolution of trade disputes and the overall global economic climate. Keywords: market volatility, investor behavior, risk assessment, future market trends, government policies.

Strategies for Navigating Market Volatility

Given the current uncertainty, investors should adopt a cautious and strategic approach. This period demands disciplined financial planning and informed decision-making.

- Diversification: Spreading investments across different asset classes and sectors can help mitigate risk and reduce the impact of a downturn in any single sector.

- Risk Management: Implement robust risk management strategies to protect your portfolio from further losses. This includes setting stop-loss orders and regularly reviewing your investment strategy.

- Hedging Strategies: Consider using hedging techniques to protect against potential losses due to currency fluctuations or other market risks.

- Stay Informed: Stay updated on the latest market developments and economic news through reputable sources. Consult financial professionals for tailored advice. Keywords: diversification, risk management, hedging strategies, investment advice, financial planning.

7% Fall for Amsterdam Stocks – What Now?

The 7% drop in Amsterdam stocks underscores the significant impact of escalating trade war fears on global markets. The decline highlights the interconnectedness of the global economy and the vulnerability of export-dependent sectors. Investor reaction has been characterized by a mix of panic selling and cautious observation. Navigating this period of market volatility necessitates informed decision-making and the adoption of robust investment strategies. To mitigate potential losses, it’s crucial to diversify your portfolio, implement risk management measures, and stay updated on market trends. Consult with a financial advisor for personalized investment strategies tailored to your risk tolerance and financial goals in light of the recent downturn in Amsterdam stocks. Monitor Amsterdam stock market trends closely and adapt your investment strategies accordingly.

Featured Posts

-

Konchita Vurst O Favoritakh Evrovideniya 2025 Eksklyuziv Ot Unian

May 24, 2025

Konchita Vurst O Favoritakh Evrovideniya 2025 Eksklyuziv Ot Unian

May 24, 2025 -

Evrovidenie Pobediteli Poslednikh 10 Let Gde Oni Seychas

May 24, 2025

Evrovidenie Pobediteli Poslednikh 10 Let Gde Oni Seychas

May 24, 2025 -

Annie Kilner Addresses Allegations Public Statement And Social Media

May 24, 2025

Annie Kilner Addresses Allegations Public Statement And Social Media

May 24, 2025 -

Porsche Atidare Nauja Elektromobiliu Ikrovimo Stoti Europoje

May 24, 2025

Porsche Atidare Nauja Elektromobiliu Ikrovimo Stoti Europoje

May 24, 2025 -

U S Penny Phase Out No More Pennies In Circulation By 2026

May 24, 2025

U S Penny Phase Out No More Pennies In Circulation By 2026

May 24, 2025

Latest Posts

-

Bitcoins Record High Fueled By Us Regulatory Optimism

May 24, 2025

Bitcoins Record High Fueled By Us Regulatory Optimism

May 24, 2025 -

Canadian Auto Execs Demand Stronger Action Against Trumps Threats

May 24, 2025

Canadian Auto Execs Demand Stronger Action Against Trumps Threats

May 24, 2025 -

Is Posthaste Trouble Brewing In The Worlds Largest Bond Market

May 24, 2025

Is Posthaste Trouble Brewing In The Worlds Largest Bond Market

May 24, 2025 -

The Posthaste Effect How Bond Market Instability Impacts The Global Economy

May 24, 2025

The Posthaste Effect How Bond Market Instability Impacts The Global Economy

May 24, 2025 -

Extreme Price Increase Broadcoms V Mware Deal Sparks Outrage From At And T

May 24, 2025

Extreme Price Increase Broadcoms V Mware Deal Sparks Outrage From At And T

May 24, 2025