7% Fall In Amsterdam Stock Market: Trade War Uncertainty Deepens

Table of Contents

Trade War Uncertainty: The Primary Driver

The recent plunge in the Amsterdam stock market is primarily attributed to the intensifying global trade war. Several key developments have fueled this market downturn:

-

Escalating Tariffs: The imposition of new tariffs on various goods, particularly between major economic powers, has created a climate of uncertainty. This uncertainty directly impacts businesses involved in international trade, many of which are based in the Netherlands and listed on the Amsterdam stock exchange (AEX).

-

Breakdown of Negotiations: The failure of recent trade negotiations to achieve a resolution has further exacerbated investor anxieties. The lack of a clear path towards de-escalation has contributed to a sense of instability, prompting investors to seek safer havens for their investments.

-

Direct Impact on Dutch Businesses: The Netherlands, with its highly export-oriented economy, is particularly vulnerable to trade tensions. Many Dutch companies rely heavily on international trade, and the imposition of tariffs disrupts supply chains and reduces market access, directly impacting their profitability and share prices.

-

Expert Analysis: Financial analysts have widely attributed the Amsterdam stock market fall to the trade war. Reports from leading financial institutions highlight the increased risk aversion amongst investors and predict further market volatility until a resolution is reached in trade negotiations. Data shows a significant decline in export and import volumes related to affected sectors, further confirming the trade war's damaging effect.

Impact on Key Sectors of the Amsterdam Stock Market

The 7% fall in the Amsterdam stock market hasn't impacted all sectors equally. Several key industries have been particularly hard-hit:

-

Technology: The technology sector, heavily reliant on global supply chains and international collaboration, has experienced significant losses. Companies involved in the production and export of technology goods have seen substantial drops in their share prices.

-

Manufacturing: Dutch manufacturing companies, many of which export a large portion of their output, are facing reduced demand and increased costs due to tariffs. This has led to a sharp decline in their stock values.

-

Export-Oriented Industries: Any sector heavily reliant on exports has suffered. Companies whose products are subject to new tariffs or face reduced demand in foreign markets are experiencing considerable pressure.

-

Specific Examples: While individual company performance varies, notable declines have been observed in companies operating within the aforementioned sectors. Analyzing their stock performance provides a clear indication of the trade war's localized impact on the Amsterdam stock market. Charts illustrating these declines clearly demonstrate the disproportionate effect on export-heavy sectors.

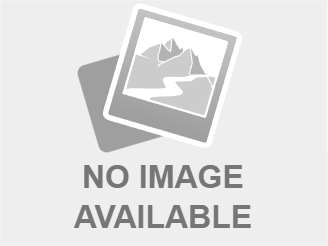

Investor Sentiment and Market Volatility

The recent market downturn reflects a clear shift in investor sentiment. Risk aversion has significantly increased, with investors becoming more cautious and less willing to invest in potentially volatile assets.

-

Decreased Confidence: The uncertainty surrounding future trade policies has eroded investor confidence, leading to reduced investment and capital flight.

-

Increased Market Volatility: The Amsterdam stock market has experienced heightened volatility, characterized by significant price fluctuations and increased trading volume, reflecting investor uncertainty and rapid reactions to trade news.

-

Future Predictions: Further market fluctuations are highly likely until the trade war uncertainty is resolved. Depending on the outcome of ongoing negotiations and any subsequent policy changes, the market could experience further declines or a potential rebound.

-

Investor Strategies: Investors are adopting various risk mitigation strategies, including diversification, hedging, and increased allocation to safer assets.

Government Response and Potential Mitigation Strategies

The Dutch government is actively monitoring the situation and considering various measures to mitigate the impact of the trade war on the Dutch economy and the Amsterdam stock market.

-

Official Responses: The government has issued statements acknowledging the challenges posed by the trade war and expressing its commitment to supporting businesses and maintaining economic stability.

-

Potential Policies: Various policy options are being explored, including financial support for affected industries, measures to stimulate domestic demand, and initiatives aimed at diversifying export markets.

-

Effectiveness of Strategies: The effectiveness of these strategies remains to be seen, as their success depends on both domestic implementation and the broader resolution of international trade tensions.

-

International Collaboration: The Netherlands is also engaged in international discussions and collaborations to address the broader trade war issues, hoping for multilateral solutions to reduce global uncertainty.

Conclusion

The 7% fall in the Amsterdam stock market underscores the severe impact of escalating trade war uncertainty. The downturn reflects a decline in investor confidence, directly impacting key sectors like technology, manufacturing, and export-oriented industries. While the Dutch government is exploring mitigation strategies, the ongoing uncertainty necessitates vigilance. To navigate this volatile market, it's crucial to monitor the Amsterdam stock market closely, understand the impact of the trade war on specific sectors, and consult with financial advisors to make informed investment decisions. Stay informed about evolving trade developments to effectively navigate the Amsterdam stock market volatility and protect your investments.

Featured Posts

-

2026 Porsche Cayenne Ev Spy Photos Reveal First Glimpses

May 25, 2025

2026 Porsche Cayenne Ev Spy Photos Reveal First Glimpses

May 25, 2025 -

Porsche Naujas Zingsnis Link Tvarios Ateities Naujas Ikrovimo Centras

May 25, 2025

Porsche Naujas Zingsnis Link Tvarios Ateities Naujas Ikrovimo Centras

May 25, 2025 -

Demnas Appointment At Gucci Expectations And Analysis

May 25, 2025

Demnas Appointment At Gucci Expectations And Analysis

May 25, 2025 -

Pair Refuels At 90mph During High Speed Police Chase

May 25, 2025

Pair Refuels At 90mph During High Speed Police Chase

May 25, 2025 -

M6 Southbound Traffic 60 Minute Delays After Accident

May 25, 2025

M6 Southbound Traffic 60 Minute Delays After Accident

May 25, 2025

Latest Posts

-

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Automakers

May 25, 2025

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Automakers

May 25, 2025 -

Exploring The Countrys Emerging Business Ecosystems

May 25, 2025

Exploring The Countrys Emerging Business Ecosystems

May 25, 2025 -

Are Bmw And Porsche Losing Ground In China Market Analysis And Future Outlook

May 25, 2025

Are Bmw And Porsche Losing Ground In China Market Analysis And Future Outlook

May 25, 2025 -

New Business Hubs A National Map And Economic Outlook

May 25, 2025

New Business Hubs A National Map And Economic Outlook

May 25, 2025 -

The Countrys New Business Hot Spots Investment Opportunities And Trends

May 25, 2025

The Countrys New Business Hot Spots Investment Opportunities And Trends

May 25, 2025