$800 Million XRP ETF Inflows: A Realistic Expectation Upon SEC Approval?

Table of Contents

The SEC's Stance on Crypto ETFs and its Potential Impact on XRP

The SEC's history with crypto ETFs is a rollercoaster of approvals and rejections. While Bitcoin and Ether futures ETFs have gained approval, the path for spot crypto ETFs, including those based on XRP, remains fraught with challenges. The SEC's decision-making process considers several crucial factors:

-

Regulatory hurdles for XRP: The SEC's classification of XRP as a security significantly impacts its eligibility for ETF listing. This classification stems from the SEC's lawsuit against Ripple Labs, alleging the unregistered sale of securities. A resolution to this lawsuit is critical for XRP's regulatory clarity.

-

Market manipulation concerns: The SEC scrutinizes crypto markets for evidence of price manipulation, a concern that has historically hindered ETF approvals. Robust surveillance mechanisms and market safeguards are essential to address these concerns.

-

Custodial solutions for XRP: Secure and regulated custodial solutions are crucial for ETF approval. Investors need assurance that their XRP holdings are safe and compliant with regulatory requirements.

-

Impact of Ripple's ongoing legal battle: The outcome of the Ripple lawsuit will significantly influence the SEC's stance on XRP ETFs. A favorable ruling for Ripple could pave the way for approval, while an unfavorable outcome could delay or prevent it.

Analyzing the $800 Million Figure: Market Demand and Investor Sentiment

The $800 million inflow estimate is likely based on a combination of market analysis and speculation. Several factors influence this projection:

-

XRP price predictions and their impact on inflow estimates: Optimistic XRP price predictions naturally inflate inflow estimates. However, these predictions are often highly speculative and subject to market volatility.

-

Existing XRP investment vehicles and their performance: The success of existing XRP investment vehicles (if any) can indicate potential demand for an ETF. Analyzing their performance and investor behavior provides valuable insights.

-

Potential for increased institutional investment in XRP: Institutional investors are often hesitant to enter unregulated markets. SEC approval could unlock significant institutional investment, bolstering the $800 million estimate.

-

Retail investor interest and its effect on market demand: Retail investor interest in XRP is a significant driver of market demand. High retail interest could contribute substantially to the inflow, even exceeding initial estimates.

Factors Influencing XRP ETF Inflows Beyond SEC Approval

Even with SEC approval, several factors could influence the actual inflows:

-

The overall crypto market sentiment and its influence on XRP: A bearish crypto market could dampen investor enthusiasm for XRP ETFs, regardless of SEC approval.

-

Competition from other crypto ETFs: The presence of competing crypto ETFs could dilute the inflows into an XRP ETF.

-

The availability and cost of XRP ETF products: The number of available XRP ETFs and their expense ratios will influence investor choices. Lower costs and wider availability increase attractiveness.

-

The role of marketing and media coverage in attracting investors: Effective marketing and positive media coverage can boost investor interest and drive inflows.

Alternative Scenarios: What if the SEC Delays or Rejects the XRP ETF?

A delay or rejection by the SEC would have significant consequences:

-

Impact on XRP price: Rejection would likely trigger a sharp decline in XRP's price, potentially causing significant market volatility.

-

Investor response and potential market volatility: Investors might shift their investments to other cryptocurrencies or assets, creating market instability.

-

Implications for Ripple and the broader XRP ecosystem: A rejection could severely damage Ripple's reputation and hinder the growth of the XRP ecosystem.

Conclusion: Assessing the Realism of $800 Million XRP ETF Inflows

The question of whether an $800 million inflow into XRP ETFs is realistic upon SEC approval remains complex. While the potential is undeniably significant, the factors discussed above, including the SEC's ongoing evaluation, market sentiment, and competitive landscape, introduce substantial uncertainty. The $800 million figure, while potentially achievable under ideal conditions, is arguably a high-end estimate. A more conservative approach would be prudent.

Stay updated on the latest developments concerning the potential approval of XRP ETFs and whether an $800 million inflow is a realistic expectation. Follow our blog for more analysis on XRP and other cryptocurrency investments.

Featured Posts

-

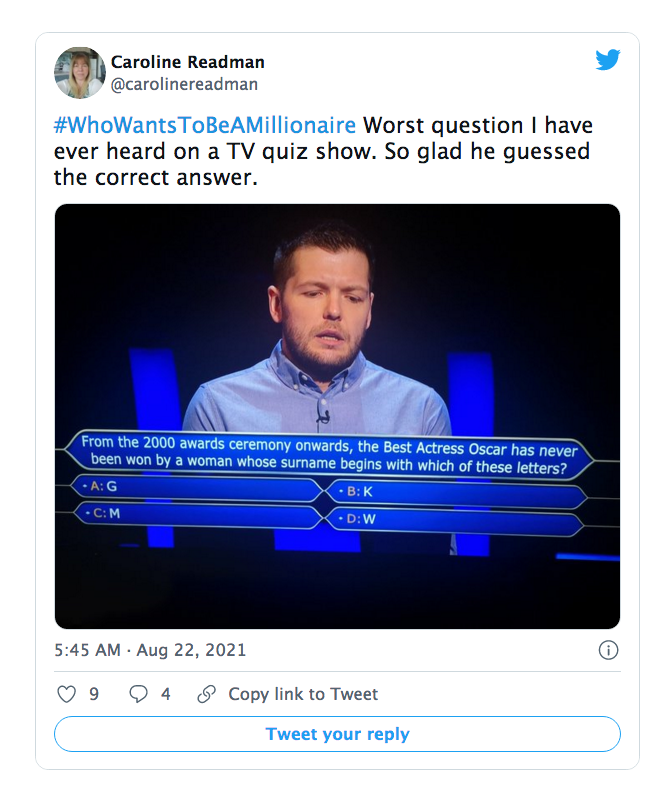

Millionaire Fans Outraged By Contestants Hesitation On Easy Question

May 07, 2025

Millionaire Fans Outraged By Contestants Hesitation On Easy Question

May 07, 2025 -

How Julius Randles Physicality Affects The Lakers Success

May 07, 2025

How Julius Randles Physicality Affects The Lakers Success

May 07, 2025 -

Investing In Xrp Ripple Potential Rewards And Risks

May 07, 2025

Investing In Xrp Ripple Potential Rewards And Risks

May 07, 2025 -

The Karate Kid Daniel La Russos Journey To Self Discovery And Martial Arts Mastery

May 07, 2025

The Karate Kid Daniel La Russos Journey To Self Discovery And Martial Arts Mastery

May 07, 2025 -

Kumingas Return Milestone Wins For Curry And Kerr Power Warriors Past Kings

May 07, 2025

Kumingas Return Milestone Wins For Curry And Kerr Power Warriors Past Kings

May 07, 2025

Latest Posts

-

Ethereum Price Analysis Is 2 700 The Next Target After Wyckoff Accumulation

May 08, 2025

Ethereum Price Analysis Is 2 700 The Next Target After Wyckoff Accumulation

May 08, 2025 -

Wyckoff Accumulation In Ethereum Could We See 2 700 Soon

May 08, 2025

Wyckoff Accumulation In Ethereum Could We See 2 700 Soon

May 08, 2025 -

Ethereum Price Prediction 2 700 On The Horizon As Wyckoff Accumulation Completes

May 08, 2025

Ethereum Price Prediction 2 700 On The Horizon As Wyckoff Accumulation Completes

May 08, 2025 -

Trump Medias Partnership With Crypto Com Etf Launch And Market Reaction

May 08, 2025

Trump Medias Partnership With Crypto Com Etf Launch And Market Reaction

May 08, 2025 -

Cro Jumps As Trump Media Announces Crypto Com Etf Partnership

May 08, 2025

Cro Jumps As Trump Media Announces Crypto Com Etf Partnership

May 08, 2025