A Billionaire's Path: The Canadian Contender For Buffett's Legacy

Table of Contents

Identifying Potential Canadian Billionaire Successors

The search for the next Warren Buffett requires identifying individuals who embody his key characteristics: a similar investment philosophy, a proven track record, and strong ethical standing. Several criteria help us pinpoint potential Canadian successors:

- Exceptional long-term investment strategies: These individuals must demonstrate a commitment to long-term value creation, not short-term gains. This requires patience, discipline, and a deep understanding of market cycles.

- Focus on value investing principles: A core tenet of Buffett's success is value investing – identifying undervalued assets and holding them for significant periods. Potential successors must share this philosophy.

- Demonstrated success in diverse market conditions: True investing prowess lies in navigating both bull and bear markets successfully. A consistent track record through various economic climates is crucial.

- Strong reputation and ethical business practices: Buffett's reputation for integrity is as significant as his investment acumen. Ethical conduct and a commitment to corporate social responsibility are essential for potential successors.

Several Canadian billionaires and prominent investors fit this profile. While pinpointing the exact successor is impossible, consider the strategic approaches of individuals like Prem Watsa (Fairfax Financial Holdings) known for his long-term value investing and insurance-focused approach, and Galen Weston (George Weston Limited), whose family's business empire demonstrates generations of astute investments in diverse sectors. Researching their individual investment strategies provides further insights into the potential for future Canadian investment giants.

Analyzing Their Investment Strategies: A Comparison to Buffett's Approach

Comparing the strategies of potential Canadian billionaire successors to Warren Buffett's reveals both similarities and differences. While pinpointing exact parallels is challenging due to information asymmetry, some common threads emerge:

- Focus on undervalued companies: Like Buffett, many successful Canadian investors seek out companies trading below their intrinsic value, leveraging fundamental analysis to identify opportunities.

- Long-term holding periods: Patience is a virtue in investing, and many Canadian investors, mirroring Buffett's approach, hold onto their investments for extended periods, allowing for substantial growth.

- Emphasis on fundamental analysis: Instead of relying on short-term market trends, successful investors meticulously examine a company's financial health, management team, and competitive landscape.

- Diversification strategies: While focusing on core strengths, successful Canadian billionaires likely spread their investments across different sectors and asset classes to mitigate risk.

- Differences in industry focus or geographical diversification: Unlike Buffett's focus on certain sectors (insurance, consumer goods), some Canadian investors might exhibit greater diversification across industries or have a stronger focus on Canadian or North American markets initially.

Challenges and Opportunities for Canadian Investors on the Global Stage

Canadian investors, while possessing significant advantages, also face unique challenges in competing globally:

- Competition from established global players: The global investment landscape is fiercely competitive, with established firms from the US, Europe, and Asia vying for the same opportunities.

- Navigating different regulatory environments: International investment requires navigating complex legal and regulatory frameworks across various jurisdictions.

- Access to global markets and capital: Securing access to international markets and attracting global capital is crucial for expansion.

- Leveraging Canada's unique economic strengths: Canada's resource-rich economy, stable political environment, and skilled workforce present unique investment opportunities.

- Impact of geopolitical events: Global events, such as trade wars and political instability, can significantly impact investment strategies and returns.

The Canadian Market Advantage

Canada offers several advantages for building a global investment empire: a stable political and economic environment, abundant natural resources, a skilled workforce, and a reputation for sound corporate governance. These factors contribute to a lower-risk investment environment compared to some emerging markets, potentially enabling long-term value creation.

The Future of Canadian Billionaires in Global Finance

The future holds immense potential for Canadian billionaires in global finance. Their influence will likely extend beyond their individual investment portfolios:

- Potential for future growth and expansion: Continued expansion into global markets and strategic acquisitions are likely.

- Influence on investment trends: Their investment decisions will continue to shape global investment trends.

- Role in philanthropic endeavors: Many successful Canadian billionaires are likely to engage in significant philanthropic initiatives.

- Potential for succession planning within their companies: Succession planning will become increasingly important to ensure the longevity of their investment empires.

Conclusion:

This exploration of potential Canadian billionaire successors to Warren Buffett reveals a landscape of ambitious investors with unique strategies and opportunities. While they face significant global competition, their proven track records and focus on long-term value investing offer a compelling narrative. The future of global finance may well include a prominent Canadian figure continuing the legacy of legendary investors. Further research into Canadian billionaires and their investment approaches is encouraged to gain a deeper understanding of their potential to shape the future of investing. Learn more about the exciting world of Canadian billionaire investment strategies – discover the next generation of financial giants!

Featured Posts

-

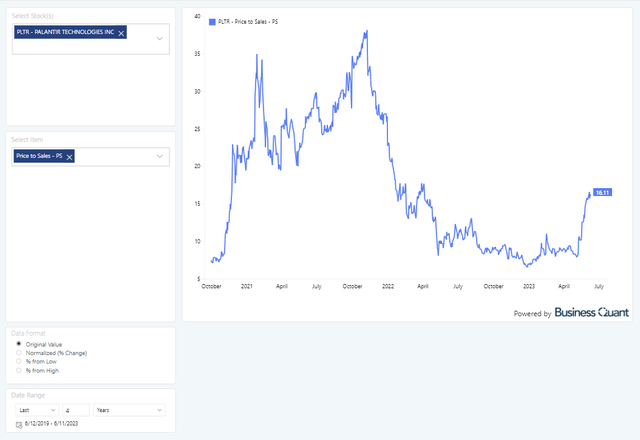

Should You Buy Palantir Stock Analyzing The Pre May 5th Outlook

May 10, 2025

Should You Buy Palantir Stock Analyzing The Pre May 5th Outlook

May 10, 2025 -

Blue Origins New Shepard Launch Delayed Subsystem Malfunction

May 10, 2025

Blue Origins New Shepard Launch Delayed Subsystem Malfunction

May 10, 2025 -

Rejected By Wolves Now A European Heartbeat

May 10, 2025

Rejected By Wolves Now A European Heartbeat

May 10, 2025 -

30 Drop In Palantir Stock Time To Invest

May 10, 2025

30 Drop In Palantir Stock Time To Invest

May 10, 2025 -

Reflecting On The Life And Death Of Americas First Non Binary Person

May 10, 2025

Reflecting On The Life And Death Of Americas First Non Binary Person

May 10, 2025