A Simple Strategy For Superior Dividend Income

Table of Contents

Understanding Dividend Investing Fundamentals

Defining Dividend Stocks

Dividend stocks are shares of companies that distribute a portion of their profits to shareholders as cash payments, known as dividends. Unlike other investment types, like growth stocks that primarily focus on capital appreciation, dividend stocks offer a regular income stream alongside potential price growth. This makes them attractive for investors seeking both income and long-term wealth building. Several types of dividend stocks exist, including high-yield dividend stocks (offering high dividend payouts), dividend growth stocks (consistently increasing dividends over time), and dividend aristocrat stocks (companies with a long history of consecutively increasing dividends).

- Dividend Yield vs. Payout Ratio: Dividend yield represents the annual dividend per share relative to the stock price, showing the percentage return from dividends. The payout ratio, on the other hand, indicates the percentage of a company's earnings paid out as dividends. Understanding both is crucial for assessing dividend sustainability.

- Dividend Reinvestment Plans (DRIPs): DRIPs allow you to automatically reinvest your dividends to buy more shares, accelerating the power of compounding. This strategy can significantly boost your long-term returns.

- Tax Implications: Dividend income is generally taxed as ordinary income, although qualified dividends may receive a lower tax rate. It's important to understand the tax implications in your specific jurisdiction.

Selecting High-Quality Dividend Stocks

Analyzing Financial Health

Before investing in any dividend stock, it's crucial to thoroughly analyze the company's financial health to ensure the dividend is sustainable. This involves scrutinizing financial statements and calculating key financial ratios to determine the company's dividend sustainability. A key ratio to examine is the debt-to-equity ratio, which indicates the company's financial leverage. High debt levels can threaten dividend payments.

- Key Financial Metrics: Analyze the dividend payout ratio (proportion of earnings paid as dividends), return on equity (ROE, measuring profitability), and debt levels to gauge the company's ability to maintain its dividend payments.

- Utilizing Resources: Use reputable financial websites and access SEC filings (in the US) for comprehensive financial information.

- Long-Term Growth Potential: Don't solely focus on the current dividend yield. Consider the company's long-term growth prospects, as this will impact future dividend increases and overall return.

Diversification for Reduced Risk

Building a Diversified Portfolio

Diversification is key to mitigating risk in any investment portfolio, including one focused on superior dividend income. Spreading your investments across different sectors and companies reduces the impact of any single company's underperformance. This is often referred to as portfolio diversification and sector diversification.

- Sector Diversification: Invest in dividend stocks from various sectors (e.g., technology, healthcare, consumer staples, utilities) to reduce your overall risk. Different sectors react differently to economic fluctuations.

- Investment Vehicles: Use diversified investment vehicles like Exchange Traded Funds (ETFs) or mutual funds, which hold a basket of dividend-paying stocks, to easily achieve diversification.

- Systematic Dividend Reinvestment: Automatically reinvesting dividends through DRIPs helps diversify your holdings over time, buying more shares in various companies within your portfolio.

Long-Term Investment Strategy

The Power of Compounding

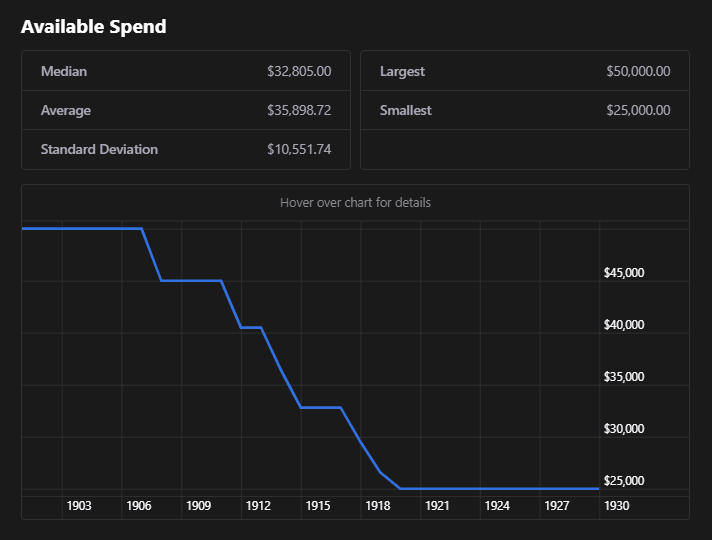

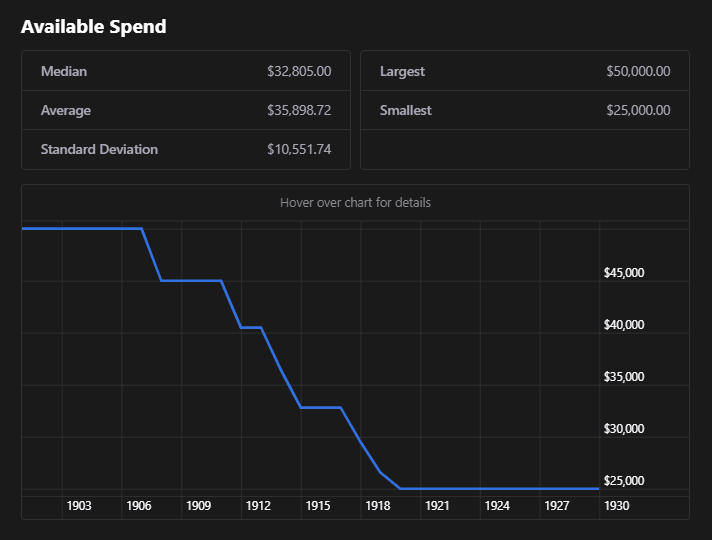

Reinvesting your dividends over time allows you to leverage the power of compound interest. This means earning returns not just on your initial investment but also on the accumulated dividends. This significantly accelerates wealth growth over the long term.

- Illustrative Example: Imagine investing $10,000 and receiving a 5% dividend yield annually. Reinvesting those dividends year after year will lead to significantly larger returns compared to simply receiving the dividends as cash.

- Patience and Long-Term Perspective: Building superior dividend income requires patience. Don't be swayed by short-term market fluctuations. Focus on the long-term growth potential of your investments.

- Superior Dividend Income Over Time: A long-term, disciplined approach to dividend investing can generate substantially higher returns over time compared to other investment strategies.

Monitoring and Adjusting Your Portfolio

Regular Review and Rebalancing

Regularly reviewing your portfolio's performance and making necessary adjustments is crucial for maintaining optimal performance. This includes portfolio management, rebalancing, and performance tracking.

- Review Schedule: Aim for quarterly or annual reviews of your portfolio's performance, comparing it to your investment goals and risk tolerance.

- Rebalancing: Periodically rebalance your portfolio to maintain your desired asset allocation. This involves selling some assets that have outperformed and buying others that have underperformed to bring your portfolio back to its target allocation.

- Reacting to Market Changes: Stay informed about market conditions and company-specific news to make informed decisions about your investments. Adjust your strategy as needed.

Conclusion

This article outlined a straightforward strategy for achieving superior dividend income. By understanding dividend investing fundamentals, selecting high-quality stocks, diversifying your portfolio, and employing a long-term investment approach, you can build a robust and reliable income stream. Remember that regular monitoring and adjustments are crucial for maintaining optimal performance.

Call to Action: Start building your path to superior dividend income today! Begin researching high-yield dividend stocks and crafting your personalized portfolio. Remember that consistent effort and smart decision-making are essential for achieving your financial goals with superior dividend income.

Featured Posts

-

From Cabin Crew To Cockpit One Womans Transition From Flight Attendant To Pilot

May 11, 2025

From Cabin Crew To Cockpit One Womans Transition From Flight Attendant To Pilot

May 11, 2025 -

Afstemning Aben Dansk Melodi Grand Prix 2025

May 11, 2025

Afstemning Aben Dansk Melodi Grand Prix 2025

May 11, 2025 -

Addressing Challenges In Automated Visual Inspection Of Lyophilized Vials

May 11, 2025

Addressing Challenges In Automated Visual Inspection Of Lyophilized Vials

May 11, 2025 -

Exposition D Art La Visite Surprise De Sylvester Stallone A Mon Atelier

May 11, 2025

Exposition D Art La Visite Surprise De Sylvester Stallone A Mon Atelier

May 11, 2025 -

Bayern Inter Milan L Analyse Du Quart De Finale De Ligue Des Champions

May 11, 2025

Bayern Inter Milan L Analyse Du Quart De Finale De Ligue Des Champions

May 11, 2025