ABN Amro Facing Regulatory Action: Potential Fine For Bonus Practices

Table of Contents

Details of the Alleged Bonus Scheme Violations

The core of the regulatory action against ABN Amro centers around allegations of irregularities within its bonus scheme. While the specifics haven't been fully disclosed publicly, concerns revolve around several key areas:

- Excessive Bonuses: Reports suggest that bonuses awarded to certain employees were disproportionate to their performance and potentially encouraged excessive risk-taking. The size of these bonuses compared to the bank's overall profitability and the salaries of other employees is a major area of concern.

- Risk-Taking Incentives: The structure of the bonus scheme is alleged to have inadvertently incentivized employees to engage in riskier investment strategies, potentially jeopardizing the bank's financial stability. This contradicts the principles of sound risk management crucial for maintaining financial stability in the Dutch banking sector.

- Lack of Transparency: Allegations also point towards a lack of transparency surrounding the bonus calculation methodology. The criteria used to determine bonus payouts, and the rationale behind specific awards, have been called into question, raising concerns about fairness and compliance.

These alleged "ABN Amro bonus practices" violations represent serious compliance failures, potentially leading to significant financial penalties and reputational damage.

The Regulatory Body Involved and Their Concerns

The investigation into ABN Amro's bonus practices is being led by De Nederlandsche Bank (DNB), the central bank of the Netherlands. DNB's concerns are rooted in its mandate to ensure the stability and integrity of the Dutch financial system. The investigation is being conducted under the framework of Dutch banking regulations, which emphasize responsible risk management, fair compensation practices, and transparent corporate governance.

- DNB Investigation: The DNB investigation is thorough and aims to determine the extent of the alleged violations and their impact on the bank's operations and financial health.

- Regulatory Compliance: The core of DNB's concerns centers around ABN Amro's failure to adhere to regulatory guidelines concerning bonus structures and risk management. The potential financial sanctions reflect the seriousness of these breaches.

- Dutch Banking Regulations: The legal framework guiding the DNB's investigation emphasizes the importance of responsible banking practices and seeks to prevent future occurrences of such alleged misconduct.

The outcome of the DNB investigation will have significant implications for ABN Amro and the wider Dutch banking sector.

Potential Financial Penalties and Their Impact

The potential financial penalties ABN Amro could face are substantial, potentially reaching millions or even billions of euros. The severity of the fine will depend on the findings of the DNB investigation and the extent of the alleged violations. The impact of such a large financial penalty could be wide-ranging:

- Financial Penalties: A substantial fine would significantly impact ABN Amro's profitability and financial stability. It might require the bank to implement cost-cutting measures or reduce dividends to shareholders.

- Reputational Damage: Beyond the financial implications, a large fine would inflict significant reputational damage on ABN Amro. This could erode customer trust and potentially impact future business opportunities.

- Shareholder Impact: The news of the investigation and potential fines has already impacted ABN Amro's stock price. A substantial penalty could further negatively affect shareholder value and investor confidence.

The potential consequences underscore the significant cost of non-compliance with financial regulations.

ABN Amro's Response and Future Actions

ABN Amro has acknowledged the DNB investigation and stated its commitment to cooperating fully. The bank has also expressed its commitment to improving its internal control systems and ensuring full compliance with all relevant regulations.

- ABN Amro Response: The bank's official response emphasizes its dedication to responsible banking practices and its commitment to learning from any shortcomings.

- Remedial Actions: ABN Amro may be required to implement substantial changes to its bonus scheme and internal control systems to address the concerns raised by the DNB.

- Compliance Improvements: The bank is likely to invest heavily in compliance training and enhanced monitoring mechanisms to prevent future regulatory breaches. This is key to rebuilding trust and reputation.

The bank's actions in response to this investigation will be crucial in shaping its future and determining the long-term consequences of this case.

Conclusion: The Future of ABN Amro's Bonus Practices and Regulatory Oversight

The investigation into ABN Amro's bonus practices highlights the crucial role of regulatory oversight in maintaining the stability and integrity of the financial sector. The potential for a substantial fine underscores the severe consequences of non-compliance. The outcome of this case will have a significant impact on ABN Amro's future, impacting its financial health, reputation, and corporate governance. The case also reinforces the need for responsible bonus schemes that avoid incentivizing excessive risk-taking within the financial industry. Stay informed about the ongoing developments in the ABN Amro bonus practices case and how this impacts the future of financial regulation. Understanding the implications of these events is crucial for anyone invested in the Dutch banking sector and the broader financial landscape.

Featured Posts

-

Kamerbrief Verkoopprogramma Certificaten Abn Amro Een Complete Gids

May 21, 2025

Kamerbrief Verkoopprogramma Certificaten Abn Amro Een Complete Gids

May 21, 2025 -

India Achieves Record Participation At Wtt Star Contender Chennai With 19 Paddlers

May 21, 2025

India Achieves Record Participation At Wtt Star Contender Chennai With 19 Paddlers

May 21, 2025 -

Liverpool Juara Liga Inggris 2024 2025 Prediksi Dan Daftar Juara Premier League 10 Tahun Terakhir

May 21, 2025

Liverpool Juara Liga Inggris 2024 2025 Prediksi Dan Daftar Juara Premier League 10 Tahun Terakhir

May 21, 2025 -

Cest La Petite Italie De L Ouest Architecture Toscane Et Charme Inattendu

May 21, 2025

Cest La Petite Italie De L Ouest Architecture Toscane Et Charme Inattendu

May 21, 2025 -

Service De Navette Gratuit En Test Liaison La Haye Fouassiere Haute Goulaine

May 21, 2025

Service De Navette Gratuit En Test Liaison La Haye Fouassiere Haute Goulaine

May 21, 2025

Latest Posts

-

Analyzing The Potential Merger Of Canadian Tire And Hudsons Bay

May 21, 2025

Analyzing The Potential Merger Of Canadian Tire And Hudsons Bay

May 21, 2025 -

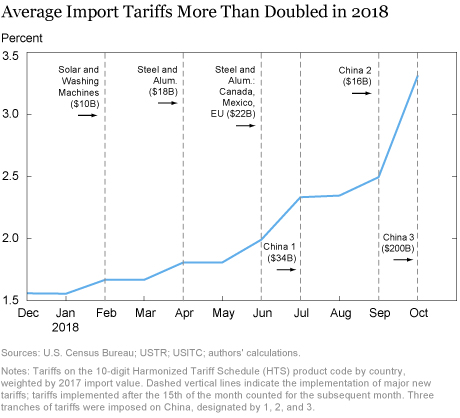

Canadian Government Rebuts Oxford Report On Us Tariffs

May 21, 2025

Canadian Government Rebuts Oxford Report On Us Tariffs

May 21, 2025 -

Canadas Response To Oxford Report Us Tariffs Largely Unchanged

May 21, 2025

Canadas Response To Oxford Report Us Tariffs Largely Unchanged

May 21, 2025 -

Ftc Vs Meta The Defense Begins

May 21, 2025

Ftc Vs Meta The Defense Begins

May 21, 2025 -

Home And Abroad Fp Videos Analysis Of Current Tariff Challenges

May 21, 2025

Home And Abroad Fp Videos Analysis Of Current Tariff Challenges

May 21, 2025