ABN Amro's Bonus System: Potential Penalties From The Dutch Central Bank

Table of Contents

The DNB's Concerns Regarding ABN Amro's Bonus System

The DNB has raised several concerns regarding ABN Amro's bonus system, suggesting a potential misalignment with responsible banking practices and regulatory guidelines. These concerns center around several key issues:

-

Excessive risk-taking incentivized by the bonus structure: The DNB may believe that the current bonus system encourages excessive risk-taking by employees, potentially jeopardizing the bank's financial stability. This could involve rewarding short-term gains over long-term sustainable growth.

-

Lack of alignment between bonuses and long-term sustainable performance: The DNB likely expects a stronger correlation between bonus payouts and long-term, sustainable performance indicators. A system that prioritizes short-term profits might incentivize actions detrimental to the bank's long-term health.

-

Insufficient consideration of ethical conduct and compliance in bonus calculations: The DNB's focus on responsible banking necessitates ethical considerations in compensation structures. The current system may lack sufficient weight given to ethical behavior and compliance with regulations.

-

Non-compliance with DNB's guidelines on responsible compensation: The DNB has specific guidelines on executive compensation and responsible banking practices. ABN Amro's bonus system may not fully comply with these established rules and regulations, triggering the current investigation.

The DNB has previously taken action against other Dutch banks for similar issues, highlighting the seriousness of these concerns and the potential for significant penalties. [Insert link to relevant DNB publication or news article here].

Potential Penalties ABN Amro Could Face

The potential penalties ABN Amro could face from the DNB range from significant financial fines to reputational damage and operational restrictions. The severity of the penalties will depend on the extent of the DNB’s concerns and the evidence of non-compliance:

-

Financial fines: Depending on the severity of the violations, the DNB could impose substantial financial penalties, potentially reaching millions or even tens of millions of euros.

-

Reputational damage: Negative publicity surrounding the investigation and potential penalties could severely damage ABN Amro's reputation, impacting customer trust and investor confidence.

-

Restrictions on future bonus payments: The DNB might impose restrictions on future bonus payments, potentially limiting the amount or altering the structure of the bonus system to align with regulatory requirements.

-

Supervisory actions: The DNB could implement increased scrutiny over ABN Amro's operations, including more frequent audits and investigations, alongside potential enforcement actions.

Precedents set by previous DNB actions against other financial institutions suggest that the penalties could be substantial, particularly given the potential systemic risks associated with irresponsible bonus structures.

ABN Amro's Response and Future Actions

In response to the DNB's concerns, ABN Amro has [insert ABN Amro's official statement or response here]. The bank has indicated its commitment to addressing the issues raised and has outlined plans to reform its bonus system. These changes might include: [Insert details of planned changes to the bonus system, if available].

The impact of these changes on employee morale and retention remains to be seen. A significant overhaul of the bonus system could potentially lead to decreased employee motivation, particularly if the new structure is perceived as less rewarding. However, a more responsible and ethical bonus system may also attract and retain talent who value long-term stability and ethical practices. The effectiveness of these changes in mitigating future penalties will be determined through ongoing monitoring by the DNB.

Impact on Shareholders and Investors

The potential penalties and changes in ABN Amro's bonus system could significantly impact investor confidence and share prices. Negative news surrounding regulatory scrutiny and potential fines can trigger a sell-off, leading to a decrease in the bank's share price. Furthermore, the restructuring of the bonus system could also affect investor perception of the bank's future profitability and long-term sustainability. This may influence future investment decisions, leading to reduced investment in ABN Amro.

Conclusion: Understanding the Implications of ABN Amro's Bonus System and Potential Penalties

The DNB's investigation into ABN Amro's bonus system highlights the crucial role of responsible corporate governance and ethical compensation structures within the banking sector. The concerns raised, the potential penalties, and ABN Amro's response all underscore the importance of aligning bonus systems with long-term sustainable performance and ethical conduct. The potential impact extends beyond ABN Amro, serving as a cautionary tale for other financial institutions about the necessity of complying with regulatory guidelines on executive compensation and responsible banking practices.

To stay informed about the ongoing developments concerning ABN Amro's bonus structure, the DNB's review of ABN Amro's compensation, and ABN Amro's response to regulatory scrutiny, it's crucial to follow reputable financial news sources and official statements from both ABN Amro and the DNB. Understanding the implications of this case is essential for investors, stakeholders, and anyone interested in the responsible governance of the financial industry. The future of ABN Amro, and indeed the wider financial landscape, hinges on the success of implementing truly responsible and ethical corporate governance.

Featured Posts

-

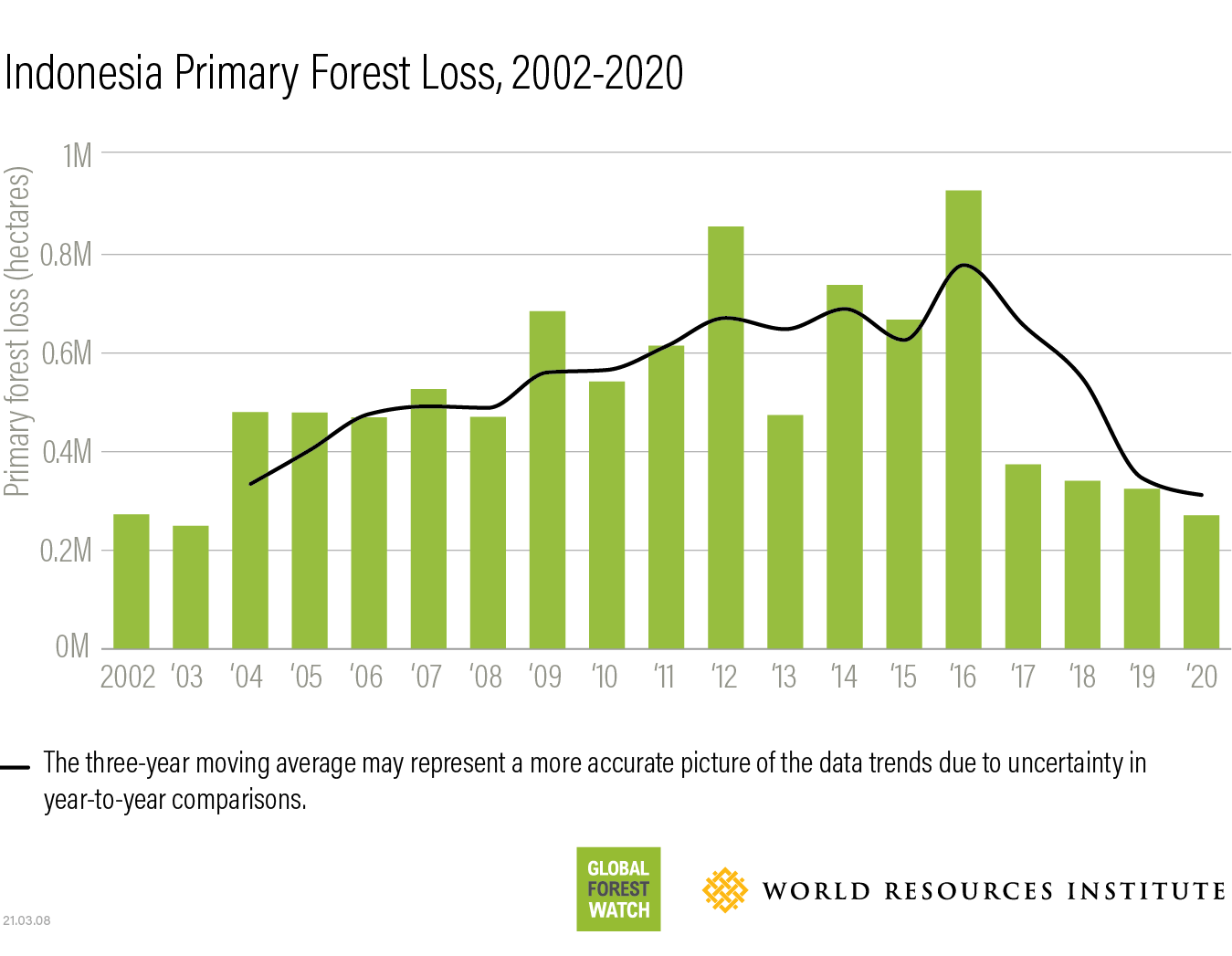

Record Breaking Global Forest Loss Wildfires And Deforestation

May 22, 2025

Record Breaking Global Forest Loss Wildfires And Deforestation

May 22, 2025 -

From Boardroom To Bedroom The Scandal Of Two Ceos

May 22, 2025

From Boardroom To Bedroom The Scandal Of Two Ceos

May 22, 2025 -

A Realistic Look At A Young Playwrights Watercolor Inspired Script

May 22, 2025

A Realistic Look At A Young Playwrights Watercolor Inspired Script

May 22, 2025 -

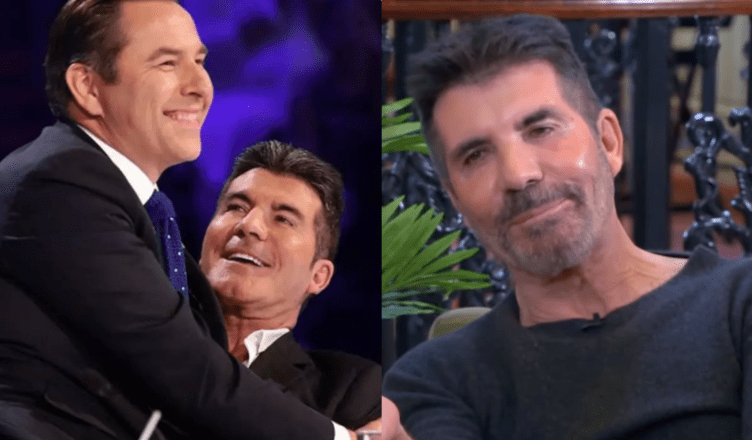

Celebrity News David Walliams Speaks Out Against Simon Cowell

May 22, 2025

Celebrity News David Walliams Speaks Out Against Simon Cowell

May 22, 2025 -

Abn Amro Bonus Scandal Potential Fine From Dutch Regulator

May 22, 2025

Abn Amro Bonus Scandal Potential Fine From Dutch Regulator

May 22, 2025

Latest Posts

-

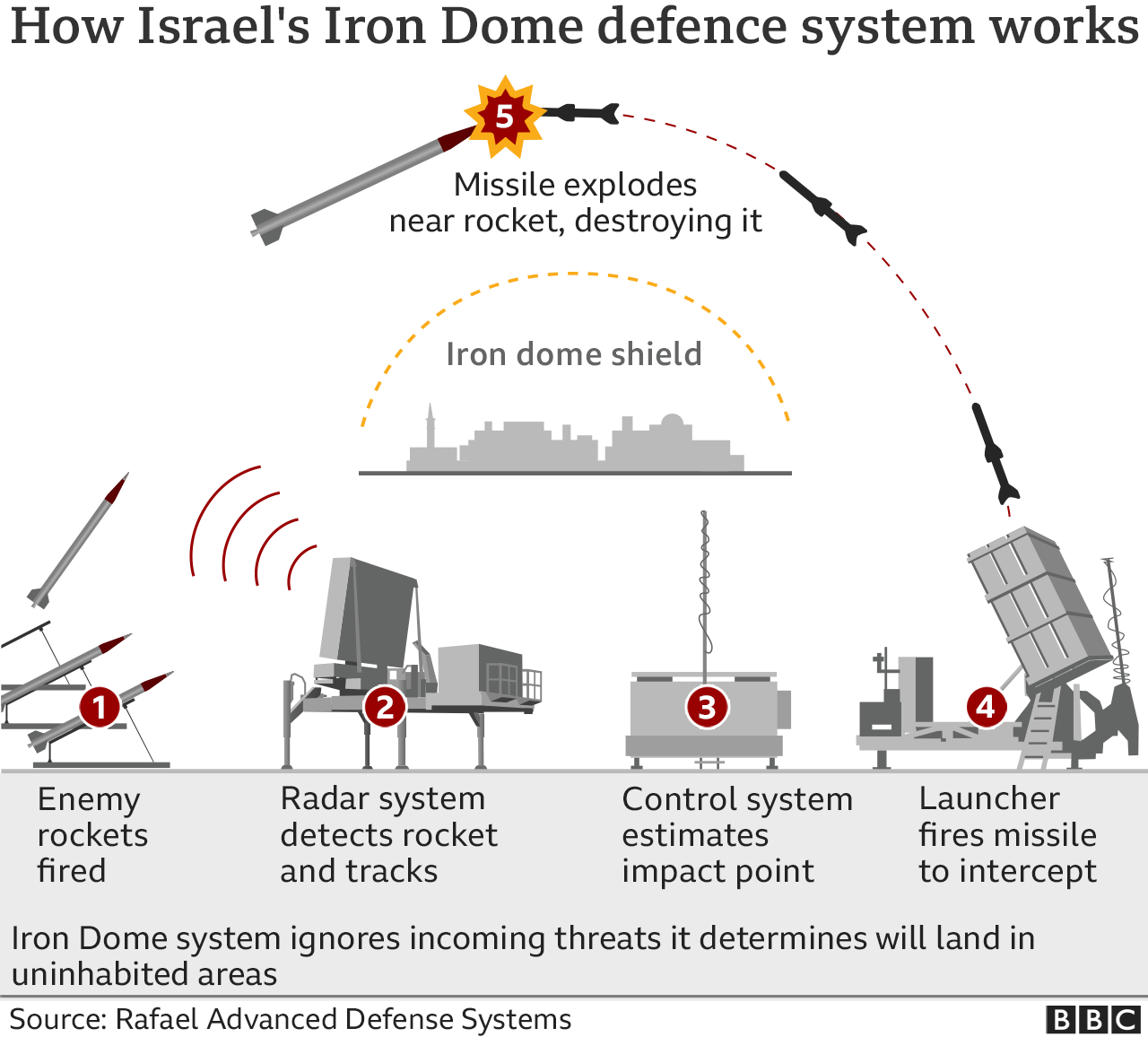

Is Trumps Golden Dome Missile Shield Realistic A Comprehensive Look

May 22, 2025

Is Trumps Golden Dome Missile Shield Realistic A Comprehensive Look

May 22, 2025 -

The Golden Dome Details Of Trumps Planned Missile Shield

May 22, 2025

The Golden Dome Details Of Trumps Planned Missile Shield

May 22, 2025 -

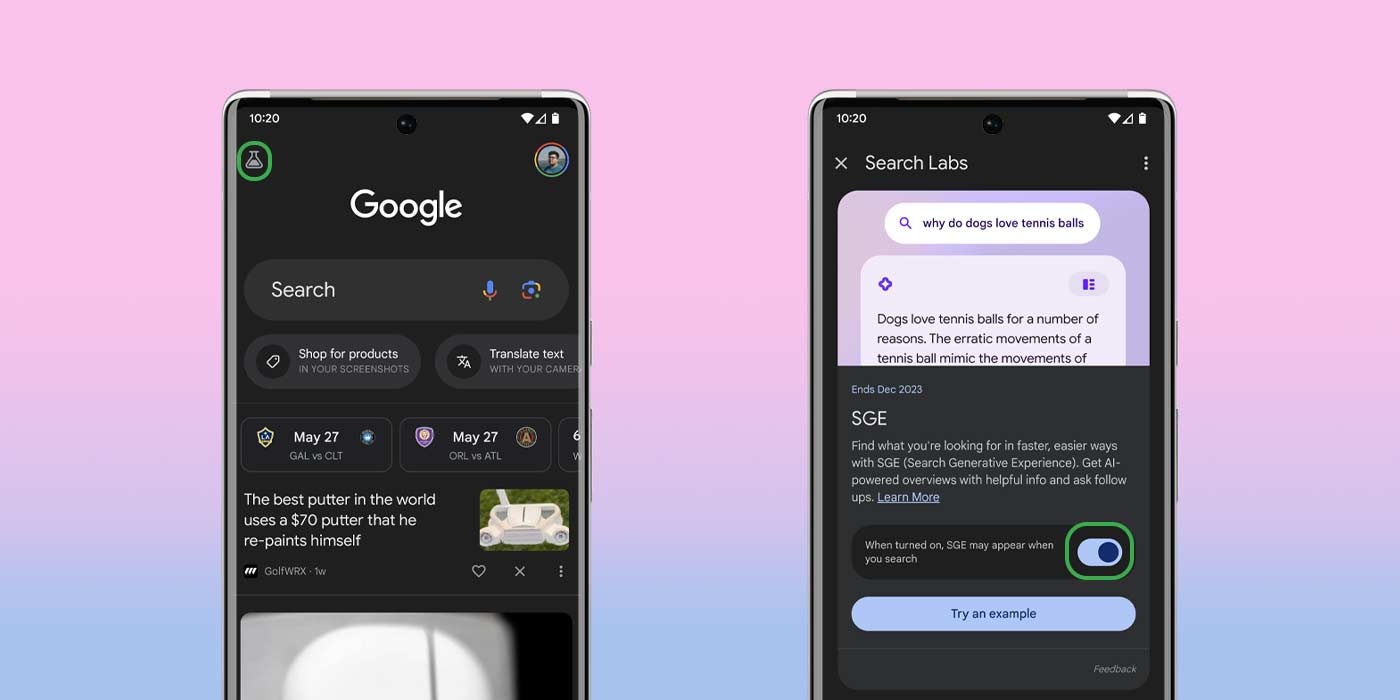

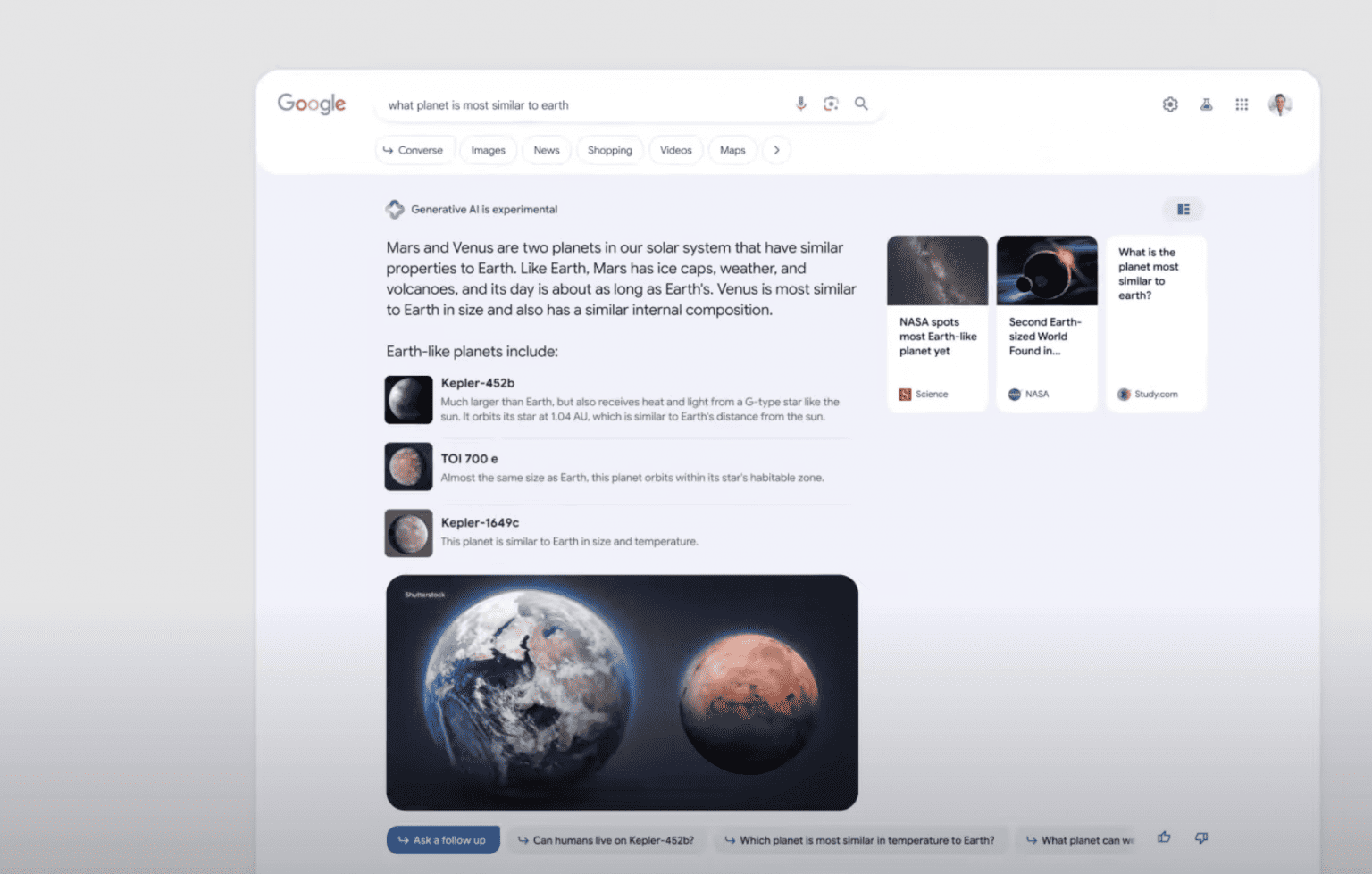

Ai And Google Search The Ai Mode Advantage

May 22, 2025

Ai And Google Search The Ai Mode Advantage

May 22, 2025 -

Golden Dome Missile Shield Trumps Plan And Its Feasibility

May 22, 2025

Golden Dome Missile Shield Trumps Plan And Its Feasibility

May 22, 2025 -

Exploring The Potential Of Ai Mode In Google Search

May 22, 2025

Exploring The Potential Of Ai Mode In Google Search

May 22, 2025