Addressing High Stock Market Valuations: BofA's View For Investors

Table of Contents

BofA's Assessment of Current Market Conditions

BofA generally holds a cautiously optimistic stance on current market valuations. While acknowledging the elevated levels compared to historical averages, their analysts point to several factors that could support continued, albeit potentially slower, growth. Their assessment is not a blanket statement of overvaluation but rather a nuanced view considering various economic indicators.

-

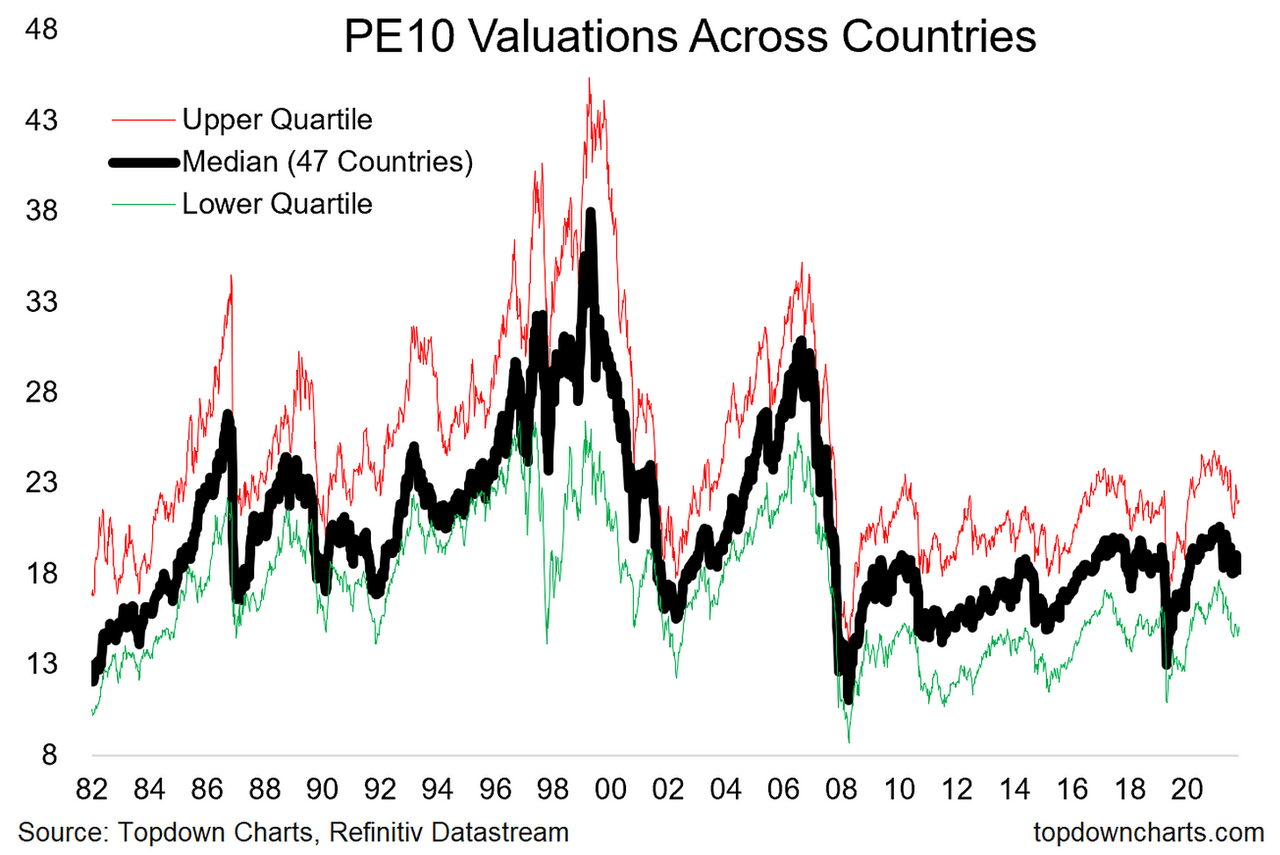

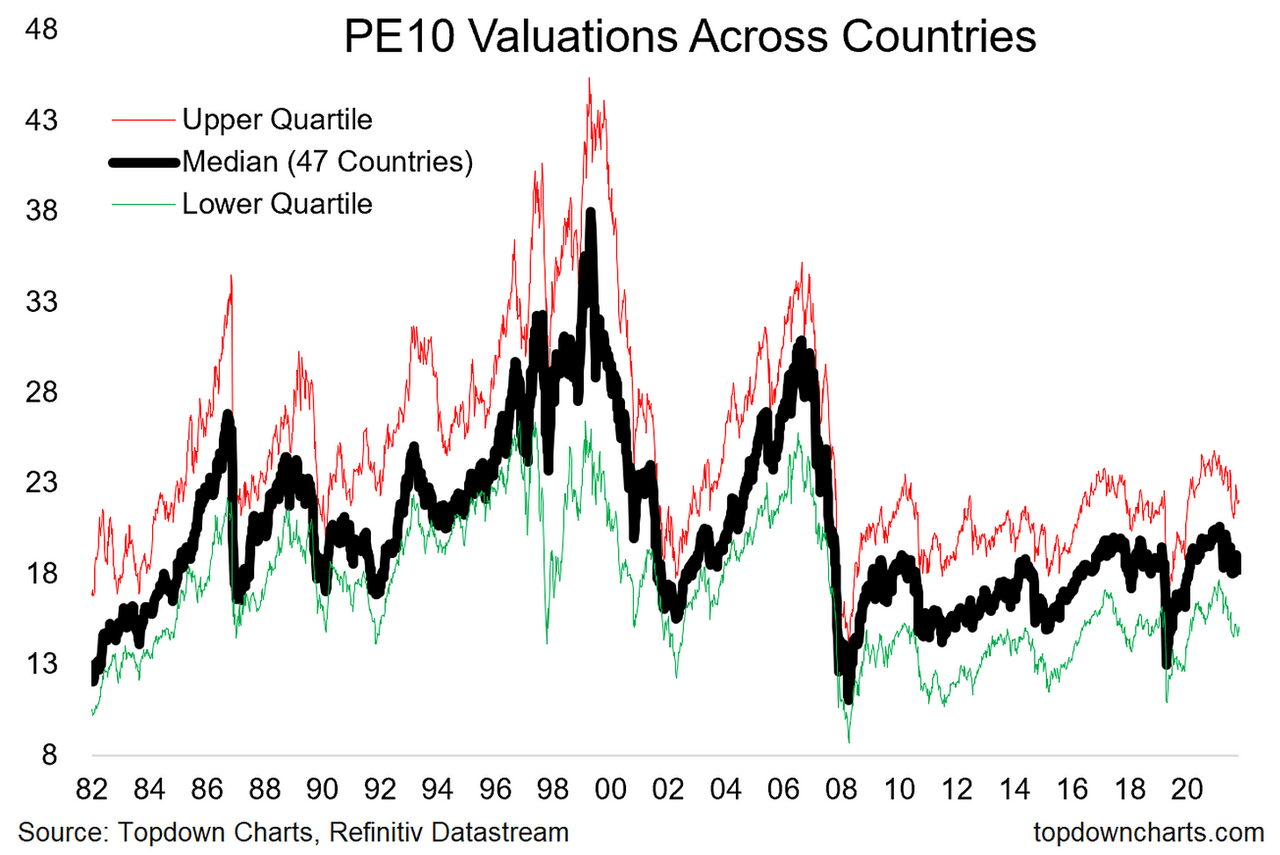

Price-to-Earnings (P/E) Ratios: BofA's research frequently cites P/E ratios as a key metric. While current P/E ratios might exceed historical averages by a certain percentage (the exact figure varies depending on the specific report and timeframe), BofA acknowledges that factors like low interest rates and strong corporate earnings can justify, to some extent, these higher valuations. However, they caution that these justifications are not indefinite.

-

Sector-Specific Analysis: BofA's analysts consistently delve into sector-specific assessments. For instance, they might flag technology stocks as potentially overvalued due to rapid growth already reflected in prices, while simultaneously expressing more positive sentiment towards sectors like energy, which may offer better value propositions given current market conditions and future projections. This granular approach highlights the importance of diversified investment strategies.

Factors Contributing to High Stock Market Valuations According to BofA

BofA identifies several key factors contributing to the current high stock valuations:

-

Low Interest Rates: Historically low interest rates make borrowing cheaper for corporations and encourage investment, driving up stock prices. This factor significantly impacts valuations across various sectors.

-

Strong Corporate Earnings (or Projected Earnings): Robust corporate earnings, or the anticipation of strong future earnings, fuels investor confidence and supports higher stock prices. BofA's analysts closely monitor earnings reports and forecasts to inform their valuations.

-

Inflationary Pressures: While inflation can be a negative factor, in certain instances, it can also contribute to higher stock valuations if companies can successfully pass on increased costs to consumers, maintaining profit margins. BofA carefully analyzes the interplay between inflation and corporate profitability.

-

Government Stimulus Measures: Government interventions, such as economic stimulus packages, can inject liquidity into the market, boosting investor confidence and potentially driving up stock prices. BofA assesses the impact of these measures on various sectors and market segments.

-

Increased Investor Risk Appetite: A general increase in investor willingness to take on risk can lead to higher valuations, as investors are more likely to bid up prices in anticipation of future growth. BofA analyzes investor sentiment through various market indicators to gauge risk appetite.

BofA's Recommendations for Investors Facing High Valuations

BofA offers several recommendations for investors navigating the current market environment characterized by high stock valuations:

-

Diversification Strategies: BofA strongly advises diversification across various asset classes, including stocks, bonds, and potentially real estate or alternative investments, to mitigate risk. They might suggest specific asset allocation models based on individual risk profiles.

-

Risk Management Techniques: Employing risk management techniques, such as hedging strategies, becomes crucial in a high-valuation environment. BofA may advise on options or other derivative instruments to protect against potential market downturns.

-

Sector-Specific Recommendations: Investors should carefully consider BofA's sector-specific assessments. Favoring undervalued sectors while carefully evaluating exposure to potentially overvalued sectors is key to managing risk and optimizing returns.

-

Time Horizon Considerations: BofA emphasizes the importance of a long-term investment strategy. Short-term market fluctuations should not dictate long-term investment decisions.

-

Due Diligence and Risk Tolerance: Thorough due diligence and an honest assessment of individual risk tolerance remain crucial in making sound investment choices, regardless of market conditions.

Alternative Investment Strategies in a High Valuation Environment

BofA frequently explores alternative investment strategies in periods of high stock valuations. While stocks remain a core component of many portfolios, BofA may advise looking towards:

-

Bonds: High-quality bonds can offer a more stable return compared to equities, especially in periods of market uncertainty. BofA analyzes the current bond market to identify potentially attractive opportunities.

-

Real Estate: Real estate can act as a hedge against inflation and provide diversification benefits. BofA might recommend certain real estate investment trusts (REITs) or direct property investments, depending on investor preferences and risk tolerance.

-

Other Asset Classes: Depending on specific market conditions, BofA might also suggest exploring other alternative asset classes such as commodities or private equity, which often demonstrate lower correlation with traditional stock markets.

Conclusion: Making Informed Decisions About High Stock Market Valuations

BofA's analysis highlights the complexities of navigating high stock market valuations. Their cautiously optimistic stance underscores the need for careful consideration of various factors, including sector-specific analysis, risk management, and diversification. By understanding the contributing factors to high valuations and following BofA's recommendations, investors can make more informed decisions. Remember to consider BofA's insights alongside your own due diligence and risk tolerance. Visit BofA's website for in-depth analysis on high stock market valuations and consult with a financial advisor to discuss your investment strategy in light of these high valuations. Staying informed about market trends is crucial to effectively manage your portfolio during periods of high stock valuations.

Featured Posts

-

Tylor Megill And The Mets Analyzing His Effective Pitching Techniques

Apr 29, 2025

Tylor Megill And The Mets Analyzing His Effective Pitching Techniques

Apr 29, 2025 -

Merd Fn Abwzby 2024 Kl Ma Thtaj Merfth

Apr 29, 2025

Merd Fn Abwzby 2024 Kl Ma Thtaj Merfth

Apr 29, 2025 -

Vehicle Subsystem Problem Grounds Blue Origin Rocket

Apr 29, 2025

Vehicle Subsystem Problem Grounds Blue Origin Rocket

Apr 29, 2025 -

Nba Fines Anthony Edwards 50 000 For Vulgar Response To Fan

Apr 29, 2025

Nba Fines Anthony Edwards 50 000 For Vulgar Response To Fan

Apr 29, 2025 -

Dlyl Shaml Lmerd Fn Abwzby 2024

Apr 29, 2025

Dlyl Shaml Lmerd Fn Abwzby 2024

Apr 29, 2025

Latest Posts

-

The Impact Of Zombie Office Buildings On Chicagos Real Estate Market

Apr 29, 2025

The Impact Of Zombie Office Buildings On Chicagos Real Estate Market

Apr 29, 2025 -

Key Republican Groups Threaten To Block Trumps Tax Bill

Apr 29, 2025

Key Republican Groups Threaten To Block Trumps Tax Bill

Apr 29, 2025 -

Zombie Buildings In Chicago Understanding The Office Real Estate Collapse

Apr 29, 2025

Zombie Buildings In Chicago Understanding The Office Real Estate Collapse

Apr 29, 2025 -

Can Trumps Tax Cuts Survive Internal Republican Opposition

Apr 29, 2025

Can Trumps Tax Cuts Survive Internal Republican Opposition

Apr 29, 2025 -

Chicagos Office Market Meltdown The Rise Of Zombie Buildings

Apr 29, 2025

Chicagos Office Market Meltdown The Rise Of Zombie Buildings

Apr 29, 2025