Key Republican Groups Threaten To Block Trump's Tax Bill

Table of Contents

The Conservative Caucus's Concerns

The Conservative Caucus, a powerful bloc within the Republican party, has emerged as a significant obstacle to the passage of Trump's tax bill. Their opposition stems from two primary concerns: increased spending and perceived unfair tax cuts for the wealthy.

Opposition to Spending Increases

This group fiercely opposes the increased government spending embedded within the proposed tax cuts. They argue that this contradicts the Republican party's long-standing commitment to fiscal conservatism and balanced budgets.

- Specific spending provisions opposed: The bill includes significant increases in military spending and certain social programs, which the Conservative Caucus considers fiscally irresponsible. They point to the lack of corresponding spending cuts elsewhere as a major point of contention.

- Leading figures and their statements: Prominent members of the Conservative Caucus, such as Senator [Insert Senator's Name] and Representative [Insert Representative's Name], have publicly denounced the bill's spending provisions, calling them "reckless" and a betrayal of core Republican principles. They've released statements emphasizing the need for fiscal restraint.

- Projected spending increase: Independent analyses estimate that the bill will increase the national debt by [Insert estimated amount] over the next decade. This substantial increase in spending fuels the Conservative Caucus's opposition.

Tax Cuts for the Wealthy

A central argument against Trump's tax bill within the Conservative Caucus is that the proposed tax cuts disproportionately benefit the wealthiest Americans, exacerbating income inequality.

- Specific tax provisions benefiting high-income earners: The bill includes provisions such as significantly lower corporate tax rates and reductions in capital gains taxes, which primarily benefit high-income individuals and corporations.

- Alternative proposals for fairer tax cuts: The Conservative Caucus has suggested alternative approaches, such as targeted tax cuts for middle- and lower-income families or a broader-based tax reform that focuses on simplification rather than significant cuts for the wealthy.

- Income distribution impact: Data suggests that the proposed tax cuts would lead to a widening gap between the rich and the poor, further concentrating wealth at the top. This widening disparity is a key concern for the Conservative Caucus.

Moderate Republicans' Reservations

Beyond the Conservative Caucus, moderate Republicans also harbor significant reservations about Trump's tax bill. Their concerns center on the lack of bipartisan support and the potential negative impacts on the national deficit.

Lack of Bipartisan Support

Moderate Republicans express deep concern about the bill's lack of Democratic support. They worry that passing such a significant piece of legislation along purely partisan lines will deepen political divisions and cause lasting damage to the legislative process.

- Specific moderate Republicans and their concerns: [Insert names of moderate Republicans] have voiced concerns about the long-term political ramifications of a partisan tax bill, arguing it will further polarize the country.

- Potential consequences of a purely partisan bill: Passing the bill without bipartisan support risks creating a political backlash and undermining future efforts at compromise on crucial issues.

- Public opinion on the bill: Recent polls suggest that a significant portion of the American public is opposed to the tax bill, further bolstering moderate Republicans' concerns about its political viability.

Impact on the Deficit

The projected impact of Trump's tax bill on the national debt is another major source of concern for moderate Republicans. They fear that the bill's substantial tax cuts, combined with increased spending, could lead to a spiraling national debt with potentially devastating long-term economic consequences.

- Economic forecasts and analyses: Several independent economic forecasts predict that the tax bill will significantly increase the national debt over the next decade, potentially triggering negative economic consequences.

- Alternative approaches to fiscal responsibility: Moderate Republicans are advocating for alternative approaches that prioritize fiscal responsibility, such as finding ways to reduce spending or identifying revenue-generating measures to offset the cost of the tax cuts.

- Projected deficit increase: The Congressional Budget Office (CBO) projects that the tax bill will add [insert estimated amount] to the national debt over the next ten years.

The Potential Fallout of Blocked Legislation

The potential failure of Trump's tax bill carries significant consequences, impacting both the political standing of the Trump administration and the US economy.

Political Ramifications for the Trump Administration

If the bill fails to pass, it would represent a major setback for President Trump and his legislative agenda. This failure could significantly damage his credibility and weaken his negotiating power in future legislative battles.

- Impact on midterm elections: The failure of this key legislative initiative could negatively affect Republican prospects in the upcoming midterm elections.

- Potential consequences for future legislative initiatives: A failure to pass the tax bill could severely hamper the President’s ability to pass other key legislation in the future.

Economic Uncertainty

The blocking of Trump's tax bill could also create significant economic uncertainty. The lack of clarity about the future tax policy could negatively impact investor confidence and potentially trigger a market downturn.

- Potential market reactions: Financial markets could react negatively to the failure of the bill, leading to increased volatility and potentially lower stock prices.

- Impact on investor confidence: Uncertainty surrounding tax policy could discourage investment and slow economic growth.

- Expert opinions on the economic outlook: Economists have expressed differing opinions on the potential economic impact, but many warn of potential negative consequences from the uncertainty surrounding the bill's fate.

Conclusion

Republican opposition to Trump's tax bill, fueled by internal divisions within the party, presents significant challenges to its passage. The Conservative Caucus's concerns about spending and tax cuts for the wealthy, coupled with moderate Republicans' reservations about the lack of bipartisan support and its impact on the deficit, paint a bleak picture for the bill's future. The potential fallout, encompassing both political damage to the Trump administration and economic uncertainty, underscores the gravity of the situation. The ongoing struggle to pass this legislation will significantly impact the US economy and political landscape. Stay informed on the developments surrounding Trump's tax bill and its potential effects. Follow our coverage for the latest updates on this crucial piece of legislation and the ongoing debate surrounding Trump's tax bill.

Featured Posts

-

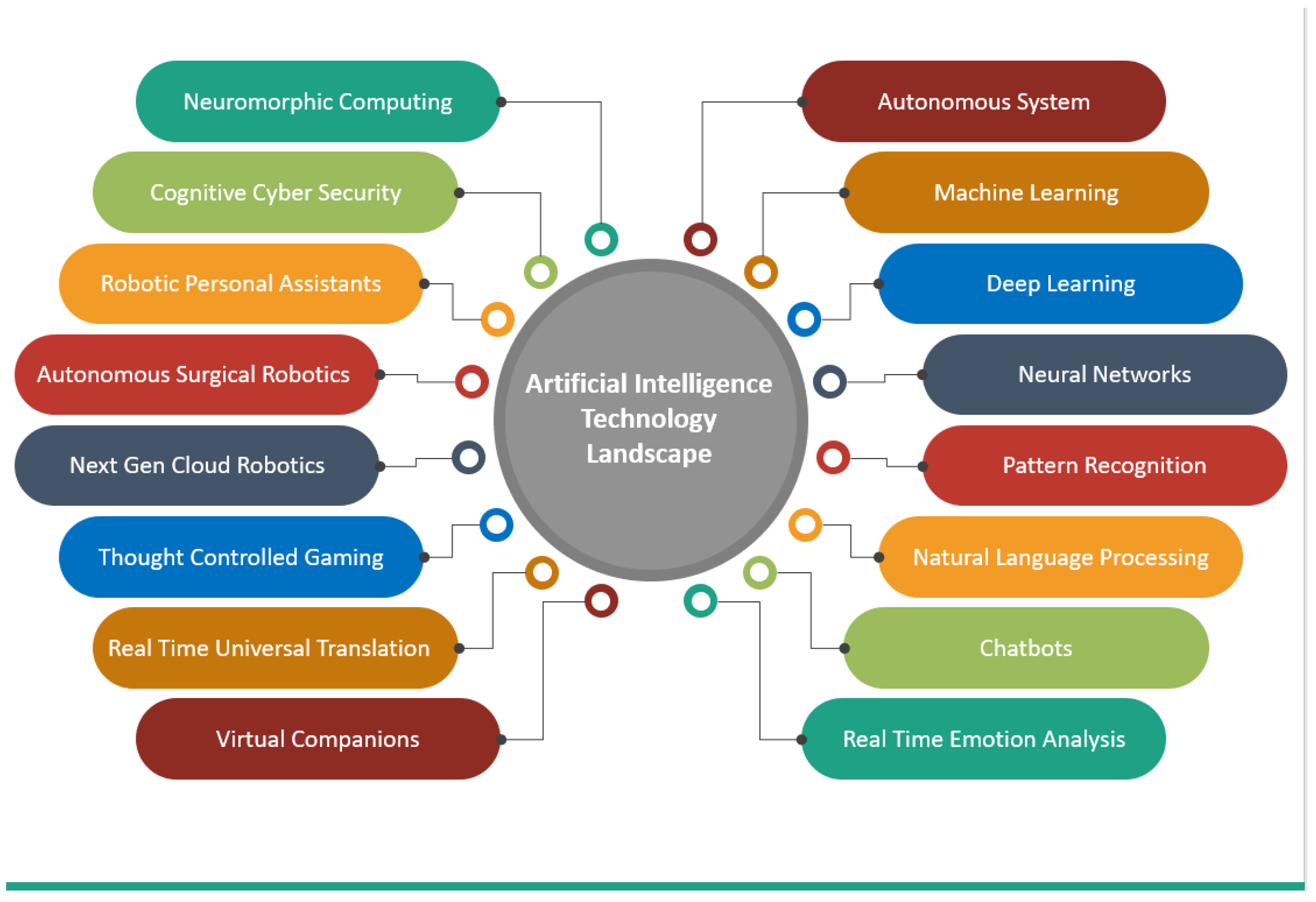

Is Ai Truly Thinking Examining The Cognitive Processes Of Artificial Intelligence

Apr 29, 2025

Is Ai Truly Thinking Examining The Cognitive Processes Of Artificial Intelligence

Apr 29, 2025 -

China Greenlights 10 New Nuclear Reactors Accelerating Energy Production

Apr 29, 2025

China Greenlights 10 New Nuclear Reactors Accelerating Energy Production

Apr 29, 2025 -

Selling Sunset Star Exposes La Landlord Price Gouging After Fires

Apr 29, 2025

Selling Sunset Star Exposes La Landlord Price Gouging After Fires

Apr 29, 2025 -

Fn Abwzby Antlaq Fealyath Fy 19 Nwfmbr

Apr 29, 2025

Fn Abwzby Antlaq Fealyath Fy 19 Nwfmbr

Apr 29, 2025 -

Debunking Ai Intelligence Exploring The Gaps In Current Ai Capabilities

Apr 29, 2025

Debunking Ai Intelligence Exploring The Gaps In Current Ai Capabilities

Apr 29, 2025

Latest Posts

-

Navigating The Difficulties Of All American Production

Apr 29, 2025

Navigating The Difficulties Of All American Production

Apr 29, 2025 -

Why Domestic Manufacturing In The Us Remains A Challenge

Apr 29, 2025

Why Domestic Manufacturing In The Us Remains A Challenge

Apr 29, 2025 -

The Struggle To Create All American Products A Realistic Look

Apr 29, 2025

The Struggle To Create All American Products A Realistic Look

Apr 29, 2025 -

The Challenges Of Producing All American Goods

Apr 29, 2025

The Challenges Of Producing All American Goods

Apr 29, 2025 -

Why Making An All American Product Is So Difficult

Apr 29, 2025

Why Making An All American Product Is So Difficult

Apr 29, 2025