Addressing Investor Concerns: BofA's Analysis Of Elevated Stock Market Valuations

Table of Contents

BofA's Methodology: How They Assessed Market Valuations

BofA's analysis of elevated stock market valuations wasn't a simple snapshot. Their assessment involved a rigorous examination using a variety of established valuation metrics. Understanding their methodology is crucial to grasping the implications of their findings. The firm employed a multi-faceted approach, combining quantitative data with qualitative insights.

-

Price-to-Earnings Ratio (P/E): BofA likely utilized the widely used P/E ratio, comparing current earnings per share to the market price of a stock. However, they acknowledged the limitations of this metric, particularly its sensitivity to variations in reported earnings and its potential to be skewed in periods of low or negative earnings.

-

Discounted Cash Flow (DCF) Analysis: A more comprehensive approach, DCF analysis projects future cash flows and discounts them back to their present value. This method considers the time value of money and is less susceptible to short-term earnings fluctuations than P/E ratios. BofA's DCF models would have incorporated assumptions about future growth rates, discount rates (reflecting risk), and terminal value.

-

Other Valuation Methods: Beyond P/E and DCF, BofA likely incorporated other relevant metrics such as price-to-sales ratios, enterprise value-to-EBITDA, and potentially more industry-specific valuation ratios tailored to specific sectors under analysis. The combination of these methods provided a more robust and nuanced picture of market valuations.

Key Findings: BofA's Assessment of Elevated Stock Prices

BofA's analysis provides a crucial perspective on whether current stock prices are justified. Their conclusions are likely nuanced, acknowledging both the potential for continued growth and the risks associated with elevated valuations.

-

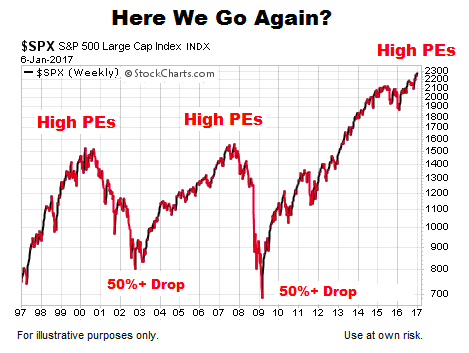

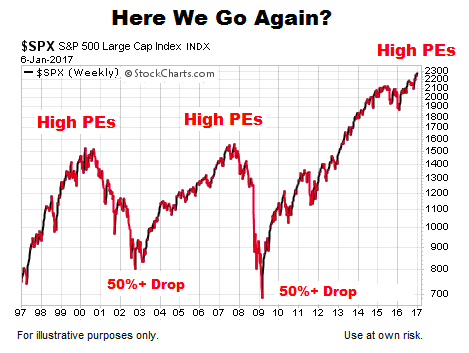

P/E Ratios Compared to Historical Averages: BofA’s research likely compared current P/E ratios to historical averages across various sectors and the market as a whole. This comparison helps determine whether current valuations are significantly above or below long-term trends.

-

Impact of Interest Rates and Inflation: The analysis undoubtedly factored in the significant influence of interest rate hikes and persistent inflationary pressures on stock valuations. Higher interest rates increase the discount rate used in DCF models, leading to lower valuations. Inflation also erodes purchasing power and can impact corporate earnings, influencing future growth projections.

-

Overvalued and Undervalued Sectors: BofA’s findings likely highlighted specific sectors or industries they identified as relatively overvalued or undervalued compared to their intrinsic value. This provides investors with sector-specific guidance for portfolio adjustments.

Addressing Investor Concerns: Mitigation Strategies Based on BofA's Analysis

Based on BofA's analysis, investors can employ several strategies to mitigate the risks associated with elevated valuations. These strategies focus on managing risk while still aiming for growth.

-

Portfolio Diversification: Diversification across various asset classes (stocks, bonds, real estate, etc.) is crucial to reduce overall portfolio risk. This helps to mitigate losses in one sector with gains in another.

-

Incorporating Defensive Stocks: Defensive stocks, representing companies in less volatile sectors (e.g., consumer staples, utilities), can provide stability during periods of market uncertainty. These stocks often perform relatively well even when growth sectors experience downturns.

-

Opportunities in Undervalued Sectors: BofA’s research may pinpoint specific undervalued sectors. Investing in these areas offers the potential for higher returns while potentially mitigating some of the overall market risk associated with higher valuations.

The Role of Future Growth Projections in Valuation

BofA's valuation models heavily rely on future growth projections. The accuracy of these projections significantly influences the final valuation. Overly optimistic growth estimates can lead to inflated valuations, while pessimistic forecasts can result in undervalued assessments. Investors should critically assess the underlying assumptions behind these growth projections. Sustainable, long-term growth is more valuable than short bursts of high growth that may not be repeatable.

The Impact of Macroeconomic Factors on Market Valuations

Macroeconomic conditions significantly impact market valuations. BofA's analysis would consider factors such as:

-

Interest Rate Hikes: Higher interest rates generally lead to lower valuations, making borrowing more expensive for businesses and increasing the attractiveness of fixed-income investments.

-

Inflationary Pressures: High inflation erodes corporate profitability and can lead to higher discount rates in valuation models.

-

Geopolitical Risks: Geopolitical uncertainties can also create volatility and negatively affect investor sentiment, thus influencing market valuations. BofA's analysis will factor in these risks to provide a complete picture.

Conclusion

BofA's analysis of elevated stock market valuations offers valuable insights for investors. Their multi-faceted approach, incorporating various valuation metrics and considering macroeconomic factors, provides a comprehensive assessment. The key takeaway is that while valuations may appear high, the future growth prospects of companies and the prevailing macroeconomic environment ultimately influence whether these valuations are justified. Investors need to carefully balance risk and reward by considering diversification across asset classes, including defensive stocks in their portfolio. Regularly reviewing your investment strategy in light of ongoing market analysis and expert opinions like those offered by BofA is crucial for navigating the complexities of elevated stock market valuations. By carefully analyzing BofA's findings and adapting your investment strategy accordingly, you can improve your chances of achieving your long-term financial goals.

Featured Posts

-

Bof A On Stock Market Valuations Why Investors Shouldnt Panic

Apr 23, 2025

Bof A On Stock Market Valuations Why Investors Shouldnt Panic

Apr 23, 2025 -

Trump Renews Assault On Jerome Powell Urges Termination Of Fed Chair

Apr 23, 2025

Trump Renews Assault On Jerome Powell Urges Termination Of Fed Chair

Apr 23, 2025 -

Ice Policy Separates Father From Newborn Mahmoud Khalils Plea

Apr 23, 2025

Ice Policy Separates Father From Newborn Mahmoud Khalils Plea

Apr 23, 2025 -

11th Inning Walk Off Bunt Gives Brewers Victory Over Royals

Apr 23, 2025

11th Inning Walk Off Bunt Gives Brewers Victory Over Royals

Apr 23, 2025 -

L Analyse De Je T Aime Moi Non Plus Par Amandine Gerard Perspectives Europeennes Et Marches

Apr 23, 2025

L Analyse De Je T Aime Moi Non Plus Par Amandine Gerard Perspectives Europeennes Et Marches

Apr 23, 2025