Addressing Investor Concerns: BofA's Perspective On Current Stock Market Valuations

Table of Contents

BofA's Overall Assessment of Current Stock Market Valuations

BofA's recent reports offer a nuanced perspective on current stock market valuations, avoiding simple "overvalued" or "undervalued" labels. Instead, they highlight a situation of varied valuations across different sectors. While some sectors show signs of being richly priced, others present more attractive opportunities. This nuanced approach reflects the complex interplay of macroeconomic factors affecting different parts of the market. BofA's assessment is data-driven, relying on a sophisticated analysis of various key metrics.

- Key Metrics: BofA utilizes a range of metrics to assess valuations, including Price-to-Earnings (P/E) ratios, Price-to-Sales (P/S) ratios, dividend yields, and discounted cash flow models. These provide a comprehensive picture, moving beyond a single valuation measure.

- Historical Comparisons: BofA's analysis often involves comparing current valuations to historical averages. This provides context, revealing whether current prices are significantly deviating from long-term trends. This historical perspective helps determine if current valuations represent genuine value or inflated prices.

- Sectoral Divergence: BofA's reports frequently highlight discrepancies in valuations across different sectors. For instance, while the technology sector might be considered overvalued by some metrics, the energy sector could appear comparatively undervalued due to factors like global supply and demand dynamics. This sectoral analysis provides crucial insights for strategic investment decisions.

Addressing Key Investor Concerns Regarding Valuation

Investor anxieties are understandable in the current climate. Inflation, interest rate hikes, and geopolitical risks all impact stock market valuations significantly. BofA addresses these concerns directly in its analyses.

- Inflation's Impact: BofA acknowledges inflation's role in eroding corporate profits and impacting future earnings estimates, which are central to stock valuations. They factor in inflation forecasts when assessing valuations and adjust their models accordingly.

- Interest Rate Hikes: Rising interest rates increase borrowing costs for companies, impacting profitability and potentially lowering future cash flows, thus affecting stock prices. BofA's analysis considers the impact of interest rate changes on different sectors' sensitivity to borrowing costs.

- Geopolitical Risks: Geopolitical uncertainty adds to market volatility and impacts investor sentiment. BofA incorporates geopolitical risks into its valuation models, accounting for potential disruptions to supply chains or global economic growth. They often highlight which sectors are most vulnerable and how this vulnerability impacts valuations.

- BofA's Mitigation Strategies: BofA suggests strategies like diversification across sectors and asset classes to mitigate these risks. They advocate for a balanced approach, focusing on value investing and avoiding speculative bubbles.

BofA's Predictions and Recommendations for Investors

BofA's predictions for stock market valuations are generally cautious, reflecting the current uncertain economic environment. Their recommendations often emphasize risk management and a long-term investment horizon.

- Investment Strategies: BofA suggests sector rotation, focusing on sectors less sensitive to interest rate hikes or inflation. Diversification across asset classes (stocks, bonds, real estate) remains a cornerstone of their recommendations.

- Risk Management: BofA stresses the importance of managing risk in the current environment, advocating for a thorough understanding of individual stock valuations and an appropriate risk tolerance for each investor.

- Specific Recommendations: While BofA avoids explicitly recommending specific stocks, their sector-specific analysis implicitly guides investors towards potentially undervalued sectors.

Analyzing BofA's Methodology and Potential Biases

It's crucial to critically examine BofA's methodology and acknowledge potential biases. While BofA is a reputable source, understanding their approach is essential for a comprehensive evaluation.

- Data Sources: BofA relies on a variety of data sources, including company filings, market data, and economic indicators. Understanding the quality and reliability of these sources is critical to interpreting their conclusions.

- Potential Conflicts of Interest: As a major financial institution, BofA engages in various investment banking activities that might create potential conflicts of interest. Transparency regarding these potential biases is vital when interpreting their analyses.

- Comparison with Other Analysts: Comparing BofA's views with those of other prominent analysts helps provide a balanced perspective on stock market valuations and identify potential areas of consensus or disagreement.

Conclusion: Navigating Stock Market Valuations with BofA's Insights

BofA's perspective on current stock market valuations offers a balanced, data-driven approach, highlighting both opportunities and risks. They emphasize the need for careful analysis, diversification, and risk management. Key takeaways include the importance of utilizing various valuation metrics, considering macroeconomic factors, and understanding the potential biases present in any analysis. To better understand current stock valuations and develop a well-informed investment strategy, further research into BofA's market analyses is strongly recommended. By thoroughly assessing stock market valuations, investors can make more informed decisions in this dynamic market environment. [Link to relevant BofA resources, if available].

Featured Posts

-

Shrwt Altsjyl Fy Msabqt Twzyf Bryd Aljzayr 2025

May 27, 2025

Shrwt Altsjyl Fy Msabqt Twzyf Bryd Aljzayr 2025

May 27, 2025 -

Stock Market News Dow S And P 500 And Nasdaq May 26 2024

May 27, 2025

Stock Market News Dow S And P 500 And Nasdaq May 26 2024

May 27, 2025 -

Cbss Tracker Season 3 Premiere Date And New Episode Details

May 27, 2025

Cbss Tracker Season 3 Premiere Date And New Episode Details

May 27, 2025 -

The Surprising Reason Behind Gwen Stefanis Lasting Marriage

May 27, 2025

The Surprising Reason Behind Gwen Stefanis Lasting Marriage

May 27, 2025 -

Wthayq Aghtyal Rwbrt Kynydy 1968 10 000 Sfht Tkshf Asrar Jdydt

May 27, 2025

Wthayq Aghtyal Rwbrt Kynydy 1968 10 000 Sfht Tkshf Asrar Jdydt

May 27, 2025

Latest Posts

-

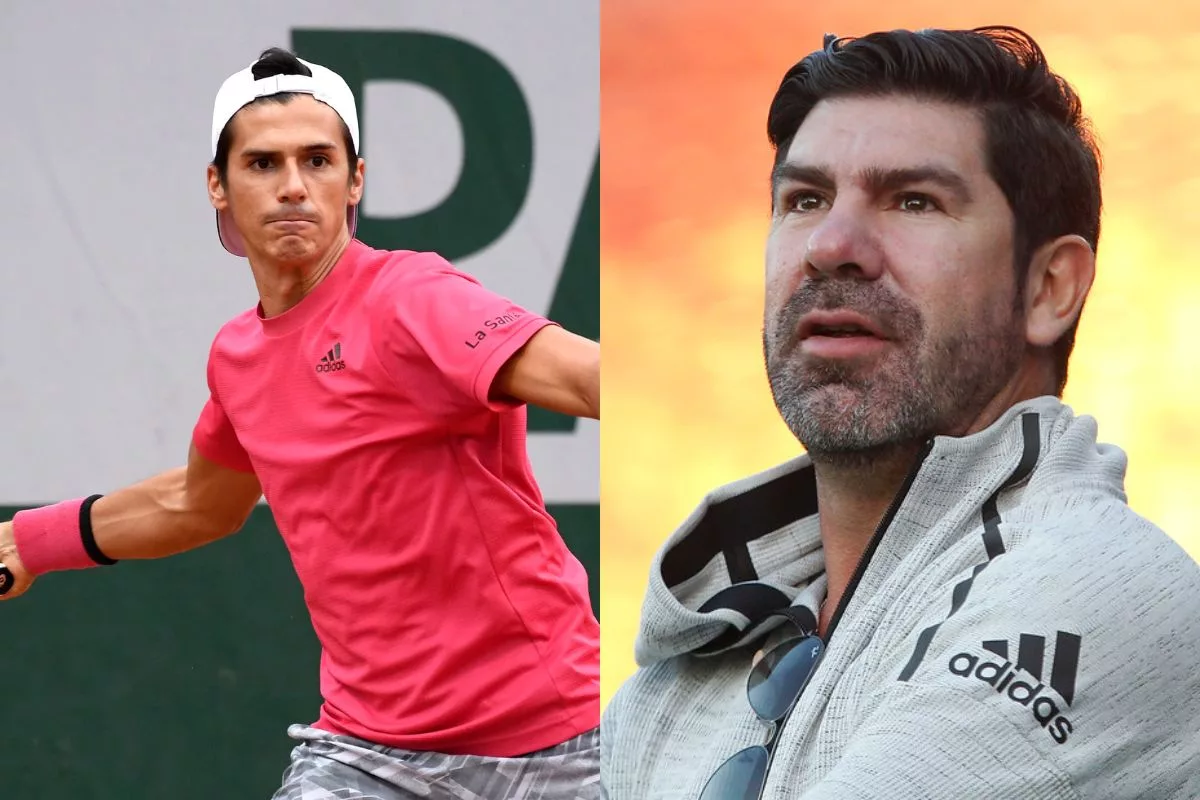

Un Tenista Argentino Revela Su Admiracion Por El Dios Del Tenis Marcelo Rios

May 30, 2025

Un Tenista Argentino Revela Su Admiracion Por El Dios Del Tenis Marcelo Rios

May 30, 2025 -

Marcelo Rios La Opinion De Un Tenista Argentino Que Lo Odiaba

May 30, 2025

Marcelo Rios La Opinion De Un Tenista Argentino Que Lo Odiaba

May 30, 2025 -

Confesion De Un Tenista Argentino Marcelo Rios Una Leyenda

May 30, 2025

Confesion De Un Tenista Argentino Marcelo Rios Una Leyenda

May 30, 2025 -

El Chino Rios Un Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025

El Chino Rios Un Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025 -

Odiado Tenista Argentino Su Impactante Confesion Sobre Marcelo Rios

May 30, 2025

Odiado Tenista Argentino Su Impactante Confesion Sobre Marcelo Rios

May 30, 2025