Addressing Investor Concerns: BofA's View On High Stock Market Valuations

Table of Contents

High stock market valuations are a significant concern for many investors. This article examines Bank of America's (BofA) perspective on this issue, providing insights into their analysis and offering a clearer understanding of the current market dynamics. We'll explore BofA's rationale behind their assessment and discuss the implications for investors navigating these potentially volatile times. We will delve into BofA's recommendations for managing risk and making informed investment decisions in this complex environment.

BofA's Assessment of Current Market Valuations

BofA generally adopts a cautious yet not overly pessimistic stance on current market valuations. While acknowledging the historically high levels of certain metrics, they recognize the influence of several mitigating factors. Their analysis isn't a blanket condemnation of the market but rather a call for careful consideration and strategic decision-making.

-

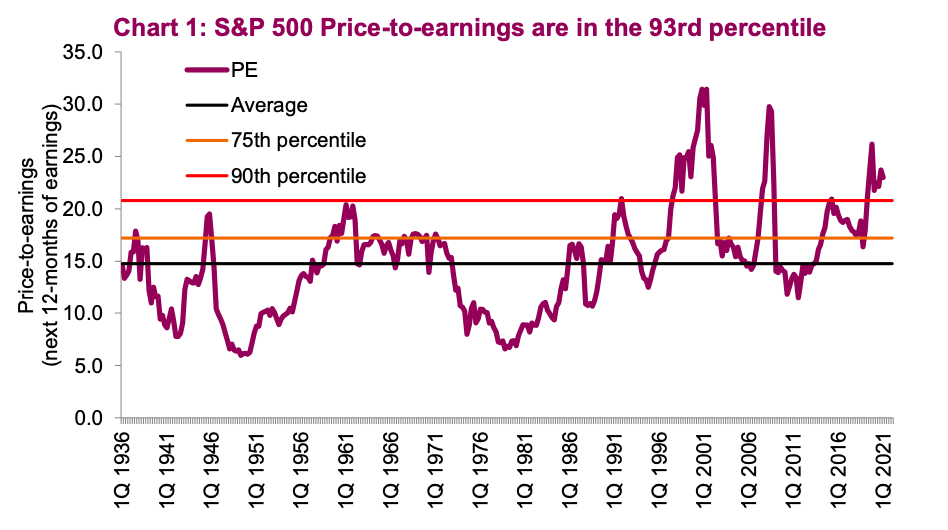

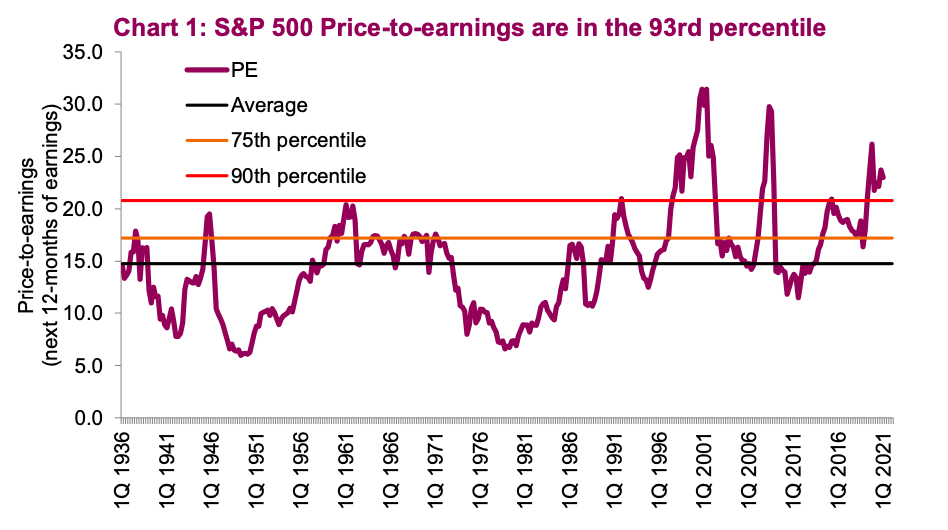

Valuation Metrics: BofA likely employs a range of valuation metrics in their assessment, including Price-to-Earnings ratios (P/E), Price-to-Sales ratios (P/S), Price-to-Book ratios (P/B), and other relevant measures specific to different sectors. They likely analyze these metrics across various indices and individual stocks.

-

Overvalued and Undervalued Sectors: While specific stock and sector recommendations are usually found in BofA's proprietary research reports (and often require a subscription), their public commentary might highlight sectors experiencing particularly rapid growth and therefore potentially higher valuations, versus those showing slower growth and potentially lower valuations. For example, technology stocks might be flagged as potentially overvalued in certain market cycles while undervalued sectors might be found in cyclical industries experiencing a resurgence.

-

Quantitative Data: BofA's reports often include quantitative data such as forward P/E ratios, comparing current valuations to historical averages and projections based on economic forecasts. This data provides context and helps to determine whether current valuations are significantly outside of historical norms.

Underlying Factors Contributing to High Valuations

BofA's analysis likely points to a confluence of factors contributing to the current high stock valuations. Understanding these factors is critical to interpreting their overall assessment.

-

Low Interest Rates: Prolonged periods of low interest rates encourage investors to seek higher returns in the stock market, driving up demand and prices. This reduces the attractiveness of traditional fixed-income investments.

-

Strong Corporate Earnings: Robust corporate earnings, especially in certain sectors, contribute positively to market sentiment, supporting higher stock valuations. However, BofA may caution investors about unsustainable growth spurts.

-

Technological Innovation: The rapid pace of technological innovation, particularly in sectors such as artificial intelligence, biotechnology, and renewable energy, fuels expectations for strong future growth, potentially justifying higher valuations for companies involved in these areas. However, this rapid innovation also brings inherent risks and uncertainties.

-

Geopolitical Factors: Geopolitical events, such as trade wars, international conflicts, and shifting global economic landscapes, significantly influence investor sentiment and consequently stock valuations. BofA's assessment incorporates these dynamics.

BofA's Recommendations for Investors

BofA likely advises investors to adopt a cautious yet opportunistic approach. This means focusing on selective investment rather than blanket market participation.

-

Diversification: BofA likely emphasizes the importance of portfolio diversification across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risks associated with high valuations in specific areas.

-

Recommended Sectors/Asset Classes: While specific recommendations are usually found in paid research reports, BofA's public statements might subtly highlight potentially less overvalued sectors or asset classes. Investors should follow BofA's official publications.

-

Hedging Strategies: Given the potential for market volatility, BofA likely suggests exploring hedging strategies, such as options trading or other risk mitigation techniques to protect against potential losses.

-

Long-Term Perspective: BofA would likely stress the importance of a long-term investment horizon over short-term gains, especially in a high-valuation environment where short-term fluctuations are more pronounced.

Managing Risk in a High-Valuation Environment

Navigating a market with high valuations requires a proactive risk management strategy.

-

Due Diligence: Thorough due diligence before investing is paramount. Investors must carefully analyze individual companies' financial statements, competitive landscape, and management quality before committing capital.

-

Identifying Overvalued Companies: BofA's research likely provides insights and tools to help investors identify potentially overvalued companies. This involves comparing valuation metrics against industry peers and historical trends.

-

Stop-Loss Orders: Utilizing stop-loss orders can limit potential losses by automatically selling a security when it reaches a predetermined price. This strategy helps to mitigate risks in a volatile market.

Conclusion

This article has explored BofA's perspective on high stock market valuations, examining the contributing factors and outlining their recommendations for investors. Understanding these insights is crucial for navigating the complexities of the current market. BofA's analysis highlights the need for a balanced approach, incorporating both risk management and strategic investment decisions. Remember that BofA's insights are part of a larger picture; individual circumstances and risk tolerance will always dictate investment decisions.

Call to Action: Stay informed on market trends and address your concerns about high stock market valuations by regularly reviewing BofA's research and seeking professional financial advice. Don't hesitate to contact your financial advisor to discuss your investment strategy in light of BofA's views on high stock market valuations.

Featured Posts

-

Benson Boones Sheer Lace Top At The 2025 I Heart Radio Music Awards Photo 5137824

Apr 26, 2025

Benson Boones Sheer Lace Top At The 2025 I Heart Radio Music Awards Photo 5137824

Apr 26, 2025 -

Santos Social Media Habits Under Fire From Justice Department Ahead Of Sentencing

Apr 26, 2025

Santos Social Media Habits Under Fire From Justice Department Ahead Of Sentencing

Apr 26, 2025 -

Mission Impossible The Final Reckoning Trailer Deep Dive

Apr 26, 2025

Mission Impossible The Final Reckoning Trailer Deep Dive

Apr 26, 2025 -

King Day Dutch Street Party Fun In Millcreek Common

Apr 26, 2025

King Day Dutch Street Party Fun In Millcreek Common

Apr 26, 2025 -

American Battleground Challenging The Worlds Richest

Apr 26, 2025

American Battleground Challenging The Worlds Richest

Apr 26, 2025