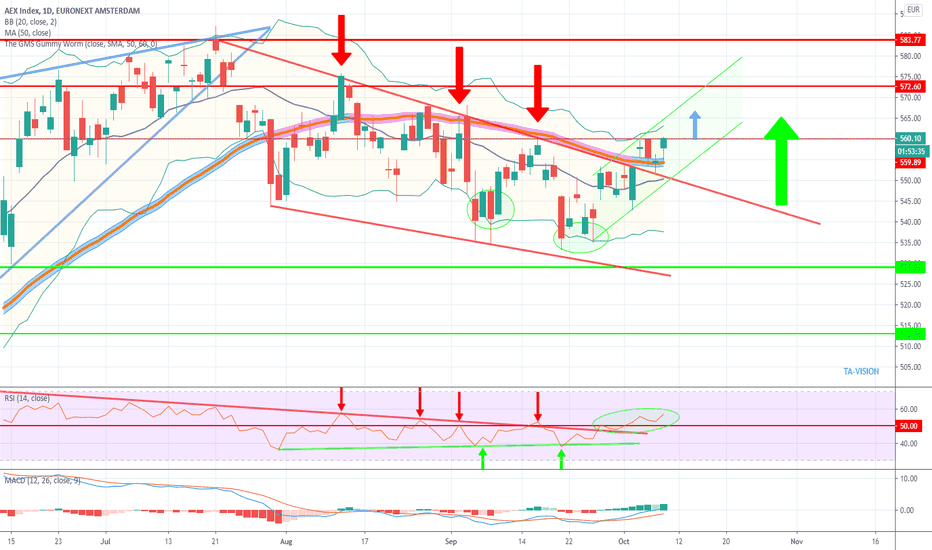

AEX Index Falls Below Key Support Level: Over 4% Drop

Table of Contents

Causes of the AEX Index Decline

Several intertwined factors contributed to the AEX Index's sharp decline. Understanding these contributing elements is crucial for assessing the market's current state and predicting its future movements.

Impact of Global Market Volatility

The AEX Index, like many global indices, is susceptible to broader market trends. Current global volatility, driven by several factors, significantly impacted today's drop.

- Rising Interest Rates: Aggressive interest rate hikes by central banks worldwide aim to curb inflation. However, this impacts borrowing costs for businesses and can slow economic growth, negatively impacting stock valuations, including those within the AEX. The correlation between rising interest rates and decreasing stock prices is clearly visible in recent global market performance.

- Inflationary Pressures: Persistent inflation erodes purchasing power and increases uncertainty about future economic growth. This uncertainty leads investors to seek safer investments, often resulting in a sell-off in riskier assets like stocks. The Eurozone's inflation rate, for example, directly impacts the AEX's performance.

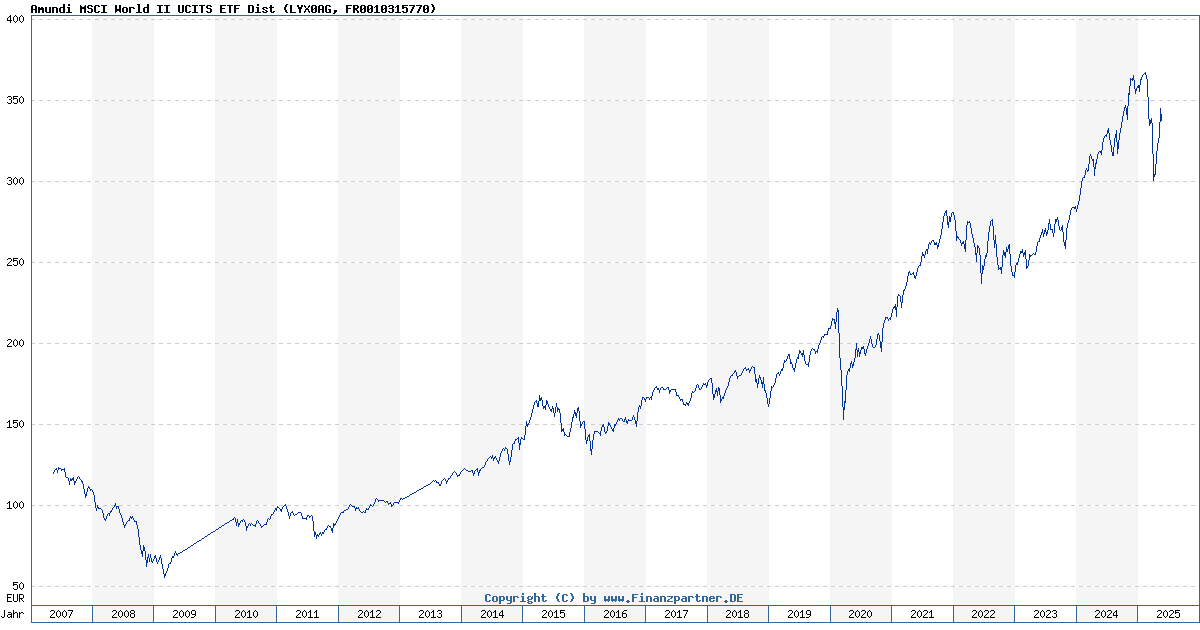

- Geopolitical Instability: Ongoing geopolitical tensions, such as the war in Ukraine, contribute to global uncertainty and risk aversion. These factors influence investor sentiment and can trigger significant market fluctuations, including those seen in the AEX today. For instance, the energy sector's sensitivity to geopolitical events has a direct impact on the AEX's overall performance. The percentage change in the MSCI World Index, often used as a benchmark, reflects this global correlation.

Sector-Specific Weakness within the AEX

The decline wasn't uniform across all sectors. Specific sectors within the AEX experienced particularly sharp drops, highlighting individual vulnerabilities.

- Financials: The financial sector often suffers during periods of rising interest rates, as higher borrowing costs can reduce lending activity and profitability. Several major Dutch banks saw significant share price declines today.

- Technology: The technology sector is vulnerable to shifts in investor sentiment and economic uncertainty. Growth stocks, often found in the technology sector, tend to be more sensitive to interest rate hikes. A few leading technology companies within the AEX significantly impacted the overall index's performance.

- Energy: While energy prices have been volatile, recent price corrections, coupled with global economic slowdown concerns, could have weighed on energy stocks within the AEX.

Impact of Company-Specific News

In addition to broader market trends, company-specific news also contributed to the AEX's decline.

- Disappointing Earnings Reports: Several AEX-listed companies released disappointing earnings reports this week, leading to immediate sell-offs in their shares. [Link to relevant news source]

- Management Changes: Unexpected changes in senior management at some prominent AEX companies may have also fueled investor uncertainty and contributed to the downward pressure. [Link to relevant news source]

- Regulatory Issues: Potential regulatory hurdles faced by certain companies within the AEX could also have influenced investor confidence and contributed to share price declines. [Link to relevant news source]

Analysis of the Broken Support Level

The AEX Index's breach of a key support level is a significant technical indicator with important implications.

Technical Analysis of the AEX Chart

The broken support level represents a psychological barrier and a crucial indicator of market sentiment. This level, often identified through technical analysis tools like moving averages and support/resistance lines, had previously held steady. Its breach suggests a potential for further declines in the short term. [Include a chart illustrating the broken support level if possible].

- Moving Averages: A clear break below the 200-day moving average is a bearish signal, suggesting a sustained downward trend.

- Support/Resistance: The failure to bounce back from this established support level indicates a weakening of bullish sentiment.

Implications for Investors

The decline raises concerns for investors in AEX-related assets.

- Long-Term Investors: Long-term investors should consider the broader economic outlook and the long-term fundamentals of their holdings. Diversification across different asset classes is crucial.

- Short-Term Traders: Short-term traders should exercise caution and employ risk management strategies such as stop-loss orders to limit potential losses.

Potential Future Outlook for the AEX Index

Predicting market movements is inherently challenging, but analyzing current conditions offers some insights.

Short-Term Predictions

The short-term outlook for the AEX remains uncertain. A rebound is possible, particularly if global market sentiment improves. However, further declines are also possible if negative news continues to emerge. Potential catalysts for a rebound include positive economic data or a resolution to current geopolitical concerns. [Cite sources for predictions and include disclaimers about the uncertainty of market predictions].

Long-Term Prospects

The long-term prospects of the AEX are tied to the health and resilience of the Dutch economy. While challenges exist, the Netherlands' strong fundamentals – including a diversified economy, skilled workforce, and robust infrastructure – suggest a potential for long-term growth.

Conclusion:

The AEX Index's fall below a key support level reflects a confluence of global and local factors. Understanding these factors, including global market volatility, sector-specific weaknesses, and company-specific news, is crucial for investors. Careful analysis, appropriate risk management, and staying informed about AEX Index developments are vital for navigating this period of uncertainty. Continue monitoring the AEX Index for further updates and detailed analysis to make informed investment decisions.

Featured Posts

-

Best Of Bangladesh In Europe 2nd Edition Highlights Collaboration For Future Growth

May 25, 2025

Best Of Bangladesh In Europe 2nd Edition Highlights Collaboration For Future Growth

May 25, 2025 -

R And B Music Spotlight Leon Thomas And Flos Latest Songs

May 25, 2025

R And B Music Spotlight Leon Thomas And Flos Latest Songs

May 25, 2025 -

Outrage At Hamilton Ferrari Chiefs Strong Reaction To Comments

May 25, 2025

Outrage At Hamilton Ferrari Chiefs Strong Reaction To Comments

May 25, 2025 -

Amundi Msci All Country World Ucits Etf Usd Acc A Guide To Net Asset Value

May 25, 2025

Amundi Msci All Country World Ucits Etf Usd Acc A Guide To Net Asset Value

May 25, 2025 -

Refleksiya Fedora Lavrova Imperator Pavel I I Privlekatelnost Trillerov Dlya Zritelya

May 25, 2025

Refleksiya Fedora Lavrova Imperator Pavel I I Privlekatelnost Trillerov Dlya Zritelya

May 25, 2025

Latest Posts

-

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025