Amundi MSCI All Country World UCITS ETF USD Acc: A Guide To Net Asset Value

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the underlying value of an ETF's holdings. In simple terms, it's the total value of all the assets the ETF owns (like stocks, bonds, and other securities) minus its liabilities (such as expenses and fees), divided by the number of outstanding shares. This calculation provides a snapshot of the ETF's intrinsic worth per share.

Understanding the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is vital for several reasons:

- Determining True Worth: The NAV gives you a clear picture of the ETF's actual value, independent of market fluctuations in its trading price.

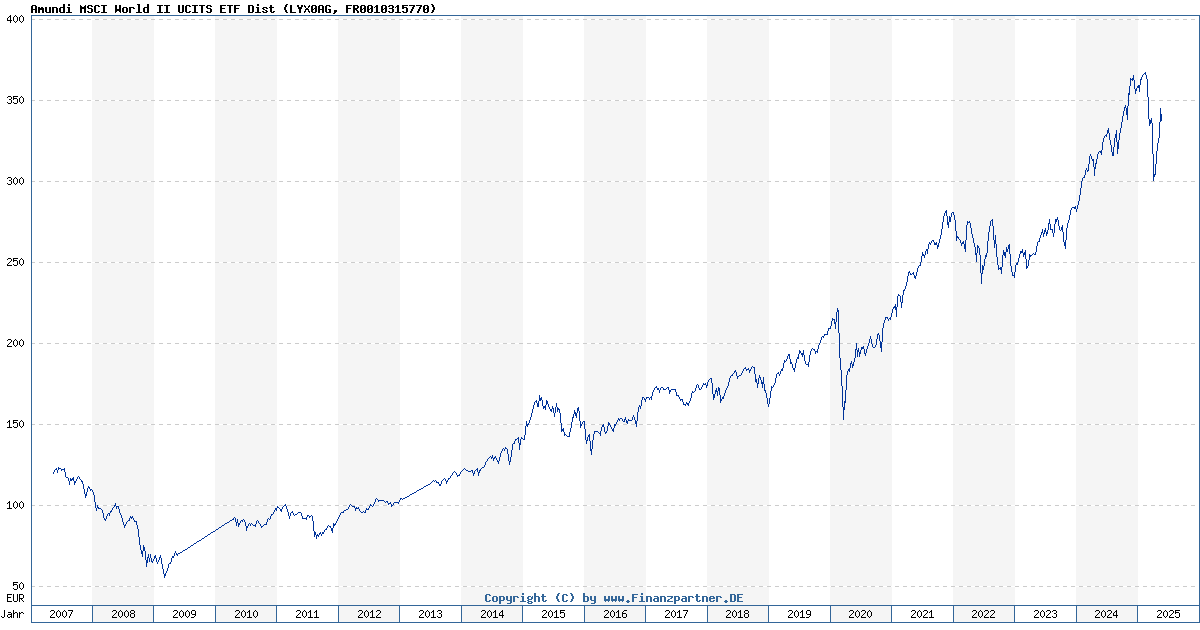

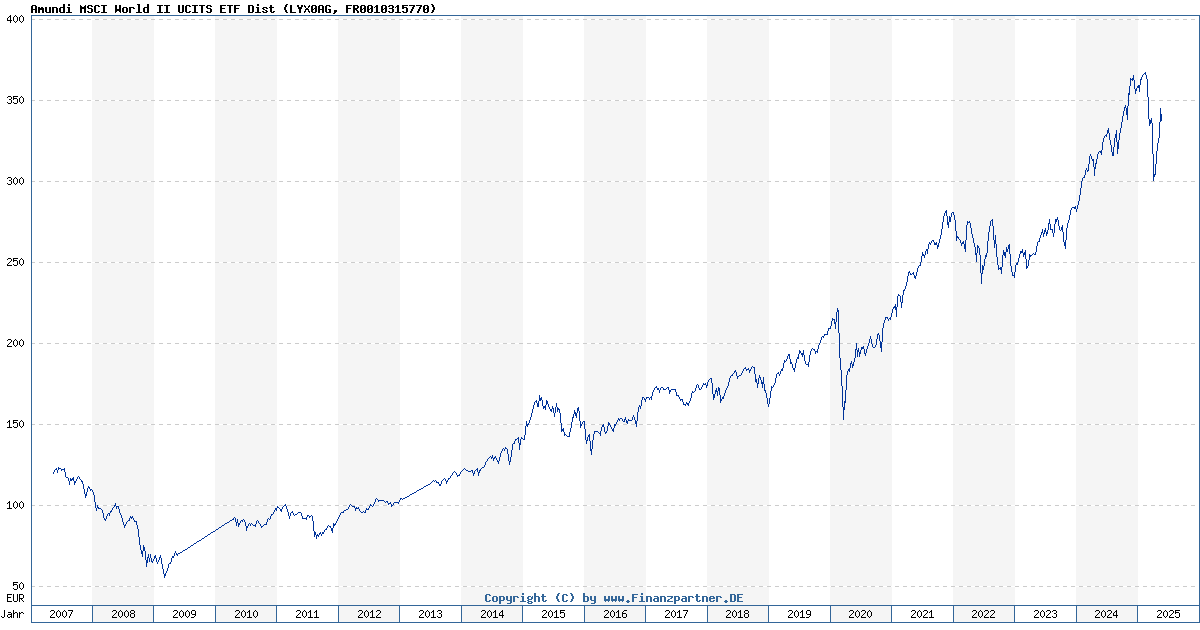

- Tracking Performance: By monitoring the NAV over time, you can accurately track the ETF's performance and assess its growth or decline.

- Understanding Investment Returns: Changes in the NAV directly reflect your investment returns, allowing you to evaluate the success of your investment in the Amundi MSCI All Country World UCITS ETF USD Acc.

- Comparing to Similar ETFs: NAV allows for direct comparison with other ETFs to identify potential opportunities and optimize your portfolio allocation.

The basic calculation is straightforward: (Total Asset Value – Liabilities) / Number of Shares. However, for a globally diversified ETF like the Amundi MSCI All Country World UCITS ETF USD Acc, the process is significantly more complex, as we'll explore further.

Calculating the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc

Calculating the Amundi MSCI All Country World UCITS ETF USD Acc NAV involves a multifaceted process, taking into account numerous factors. The fund manager, Amundi, employs sophisticated methods to determine the daily NAV.

-

Data Sources: The NAV calculation relies on various data sources, including real-time market prices of the underlying assets (stocks, bonds, etc.) across global markets, and current currency exchange rates. The accurate valuation of these diverse assets is key to an accurate NAV figure.

-

Frequency: The NAV is typically calculated and published on a daily basis, reflecting the closing market prices of the underlying assets.

-

Complexity: Due to the ETF's extensive holdings across numerous countries and asset classes, calculating the NAV is a complex undertaking. Amundi utilizes specialized software and methodologies to handle this intricate process, ensuring accuracy and efficiency.

-

Impact of Currency Fluctuations on the USD Acc Share Class: Because this is a USD-denominated share class (USD Acc), fluctuations in exchange rates between the USD and other currencies significantly impact the NAV. A strengthening dollar will generally increase the NAV, while a weakening dollar will decrease it.

-

How Dividends and Corporate Actions Affect the NAV: Dividend payments from the underlying holdings and corporate actions (such as stock splits or mergers) directly affect the NAV. These events are factored into the calculation, ensuring the NAV reflects the true value of the ETF's assets.

NAV vs. Market Price

While the NAV represents the intrinsic value of the Amundi MSCI All Country World UCITS ETF USD Acc, the market price is the price at which the ETF trades on the exchange. These two figures can differ due to market supply and demand.

- Differences: The market price can trade at a premium (higher than the NAV) or a discount (lower than the NAV) to the NAV. This difference arises from factors such as investor sentiment, trading volume, and market speculation.

- Premium/Discount: A premium indicates higher demand for the ETF than its intrinsic value suggests, while a discount suggests lower demand. These premiums or discounts tend to be short-lived for well-traded ETFs.

- Implications: While short-term deviations are common, significant and persistent differences between market price and NAV could signal underlying market inefficiencies or unique investor dynamics concerning the Amundi MSCI All Country World UCITS ETF USD Acc.

Accessing the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Investors can readily access the official Amundi MSCI All Country World UCITS ETF USD Acc NAV through several channels:

- Official Sources: Amundi's official website is the primary source for the most accurate and up-to-date NAV information. Many financial news websites and data providers also publish this data.

- Brokerage Platforms: Most reputable brokerage platforms display the current NAV alongside the market price of the ETF, providing investors with a convenient way to monitor the NAV.

- Data Delays: It's important to note that there might be slight delays in the reporting of the NAV, usually less than 24 hours, as the calculation requires gathering data from various sources.

Using NAV for Investment Decisions

While the NAV is a crucial metric, it shouldn't be the sole factor influencing your buy/sell decisions.

- Performance Tracking: Regularly monitoring the NAV over time allows you to track the long-term performance of your investment in the Amundi MSCI All Country World UCITS ETF USD Acc and compare it to your overall investment goals.

- Buy/Sell Decisions: While NAV is informative, other factors like market trends, your personal risk tolerance, and financial goals should also be carefully considered before making buy or sell decisions.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is crucial for making informed investment decisions. This guide has clarified the meaning of Amundi MSCI All Country World UCITS ETF USD Acc NAV, its calculation, and how it differs from the market price. By consistently tracking the NAV and considering it alongside other market factors, investors can better manage their investments and achieve their financial objectives. Remember to regularly consult official sources for the most current Amundi MSCI All Country World UCITS ETF USD Acc NAV data. Learn more about optimizing your investment strategy by visiting [link to relevant resource].

Featured Posts

-

New Ferrari Flagship Showroom Opens In Bangkok

May 25, 2025

New Ferrari Flagship Showroom Opens In Bangkok

May 25, 2025 -

Princess Road Accident Emergency Services Respond To Pedestrian Hit By Vehicle

May 25, 2025

Princess Road Accident Emergency Services Respond To Pedestrian Hit By Vehicle

May 25, 2025 -

Artfae Daks Alalmany Tjawz Dhrwt Mars Kawl Mwshr Awrwby

May 25, 2025

Artfae Daks Alalmany Tjawz Dhrwt Mars Kawl Mwshr Awrwby

May 25, 2025 -

Your Guide To Bbc Radio 1 Big Weekend 2025 Tickets Full Artist Lineup

May 25, 2025

Your Guide To Bbc Radio 1 Big Weekend 2025 Tickets Full Artist Lineup

May 25, 2025 -

The Milan Party Kyle Walkers Actions After Wife Annie Kilners Return

May 25, 2025

The Milan Party Kyle Walkers Actions After Wife Annie Kilners Return

May 25, 2025

Latest Posts

-

Gaga And Polansky Couple Makes Hand In Hand Appearance At Snl Afterparty

May 25, 2025

Gaga And Polansky Couple Makes Hand In Hand Appearance At Snl Afterparty

May 25, 2025 -

Proposed Changes To Juvenile Sentencing In France

May 25, 2025

Proposed Changes To Juvenile Sentencing In France

May 25, 2025 -

Frances Justice System Reforming Sentencing Of Minors

May 25, 2025

Frances Justice System Reforming Sentencing Of Minors

May 25, 2025 -

French Ex Prime Minister Critiques Macrons Policies

May 25, 2025

French Ex Prime Minister Critiques Macrons Policies

May 25, 2025 -

Facing Retribution The High Cost Of Challenging The Status Quo

May 25, 2025

Facing Retribution The High Cost Of Challenging The Status Quo

May 25, 2025