Amsterdam Exchange: Index Down Over 4%, Reaching 1-Year Low

Table of Contents

Causes of the Amsterdam Exchange's Sharp Decline

Several interconnected factors have contributed to the sharp decline in the Amsterdam Exchange index. These can be broadly categorized into global economic headwinds, the underperformance of key sectors, and escalating geopolitical factors.

Global Economic Headwinds

The global economic landscape is currently fraught with challenges. Rising inflation, aggressive interest rate hikes by central banks worldwide, and growing fears of a global recession are creating significant market volatility and impacting investor sentiment negatively. This uncertainty is directly reflected in the performance of the Amsterdam Exchange.

- Weakening Euro: The weakening Euro against major currencies like the US dollar is significantly impacting export-oriented companies listed on the Amsterdam Exchange, reducing their profitability and competitiveness in international markets.

- Reduced Consumer Spending: Inflationary pressures are squeezing household budgets, leading to reduced consumer spending. This directly impacts retail and consumer goods sectors, causing decreased demand and lower stock prices.

- Energy Price Uncertainty: Fluctuations and uncertainty surrounding energy prices are creating significant challenges for industrial production. This translates into lower profits and increased market volatility for energy-intensive companies.

- Inflation Impact: Persistently high inflation erodes purchasing power and reduces investor confidence, leading to a flight from riskier assets and a decline in overall market valuations. The impact of inflation is keenly felt across various sectors listed on the Amsterdam Exchange.

Performance of Key Sectors

Analyzing the performance of individual sectors reveals a mixed picture, with some faring worse than others. A detailed sector-by-sector stock market analysis is crucial to understand the specific drivers of the overall index decline.

| Sector | Performance (%) | Reasons for Decline |

|---|---|---|

| Technology | -6% | Interest rate hikes, reduced venture capital funding |

| Energy | -3% | Volatility in global energy prices, regulatory uncertainty |

| Financials | -2% | Concerns about rising interest rates and loan defaults |

| Consumer Goods | -5% | Reduced consumer spending due to inflation |

Geopolitical Factors

The ongoing war in Ukraine and persistent trade tensions between major global powers have created significant geopolitical risk and uncertainty, impacting investor sentiment and fueling market instability. This uncertainty is a key contributing factor to the downturn.

- War in Ukraine: The conflict has disrupted supply chains, increased energy prices, and created widespread economic uncertainty, impacting investor confidence globally and in the Amsterdam Exchange.

- Trade Tensions: Ongoing trade disputes between major economies create uncertainty and hinder international trade, negatively impacting the performance of companies involved in global trade.

Impact on Investors and the Dutch Economy

The sharp decline in the Amsterdam Exchange has significant implications for both investors and the Dutch economy.

Investor Losses and Portfolio Adjustments

Investors holding assets listed on the Amsterdam Exchange have experienced considerable investment losses. Many are reacting by selling assets to limit further losses, leading to a further downward spiral. This highlights the need for effective portfolio diversification and robust risk management strategies.

- Diversification: A well-diversified portfolio can help mitigate losses during market downturns.

- Risk Management: Effective risk management strategies, such as stop-loss orders, can limit potential losses.

Economic Consequences for the Netherlands

The decline in the Amsterdam Exchange has broader implications for the Dutch economy. A weakened stock market can lead to decreased investment, slower economic growth, and a decline in consumer confidence.

- Employment: Reduced economic activity could lead to job losses in various sectors.

- Economic Growth: The decline in the Amsterdam Exchange will likely translate to lower GDP growth in the Netherlands.

- Consumer Confidence: Negative news about the stock market can impact consumer confidence, leading to reduced spending.

Future Outlook for the Amsterdam Exchange

The future outlook for the Amsterdam Exchange remains uncertain. However, analyzing analyst predictions and understanding prevailing market sentiment provides some insight into potential future price movements.

Analyst Predictions and Market Sentiment

Financial analysts offer mixed predictions, with some suggesting a potential recovery in the near future, while others foresee prolonged volatility. Market sentiment currently reflects considerable uncertainty, with many investors adopting a cautious approach. For example, several analysts quoted in recent reports highlight concerns over persistent inflation and a potential recession as key headwinds.

Potential Recovery Strategies

Navigating this market volatility requires a proactive investment strategy. Investors should focus on diversification, risk management, and adopting a long-term perspective.

- Diversification: Invest across different asset classes and sectors to mitigate risk.

- Risk Management: Implement strategies to protect against further losses, like stop-loss orders.

- Long-Term Investment: Focus on long-term investment goals and avoid making impulsive decisions based on short-term market fluctuations.

Conclusion: Navigating the Amsterdam Exchange Downturn

The significant decline in the Amsterdam Exchange index is a result of a confluence of factors, including global economic headwinds, weak sector performance, and geopolitical uncertainties. This has led to investor losses and broader economic consequences for the Netherlands. While the future outlook remains uncertain, a cautious approach with a focus on diversification and risk management is crucial. Stay updated on the latest developments on the Amsterdam Exchange and consult with a financial advisor to develop a robust investment strategy for navigating the volatility of the Amsterdam Exchange. Informed decision-making is key to mitigating risk and capitalizing on potential recovery opportunities.

Featured Posts

-

M6 Southbound Crash Causes 60 Minute Delays For Drivers

May 24, 2025

M6 Southbound Crash Causes 60 Minute Delays For Drivers

May 24, 2025 -

M56 Road Closure Live Traffic Updates And Diversion Routes

May 24, 2025

M56 Road Closure Live Traffic Updates And Diversion Routes

May 24, 2025 -

March 26 2025 Nyt Mini Crossword Solutions And Clues

May 24, 2025

March 26 2025 Nyt Mini Crossword Solutions And Clues

May 24, 2025 -

Indian Wells 2024 Draper Secures Historic Masters 1000 Victory

May 24, 2025

Indian Wells 2024 Draper Secures Historic Masters 1000 Victory

May 24, 2025 -

Three Day Losing Streak Amsterdam Stock Exchange In Freefall

May 24, 2025

Three Day Losing Streak Amsterdam Stock Exchange In Freefall

May 24, 2025

Latest Posts

-

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025 -

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025 -

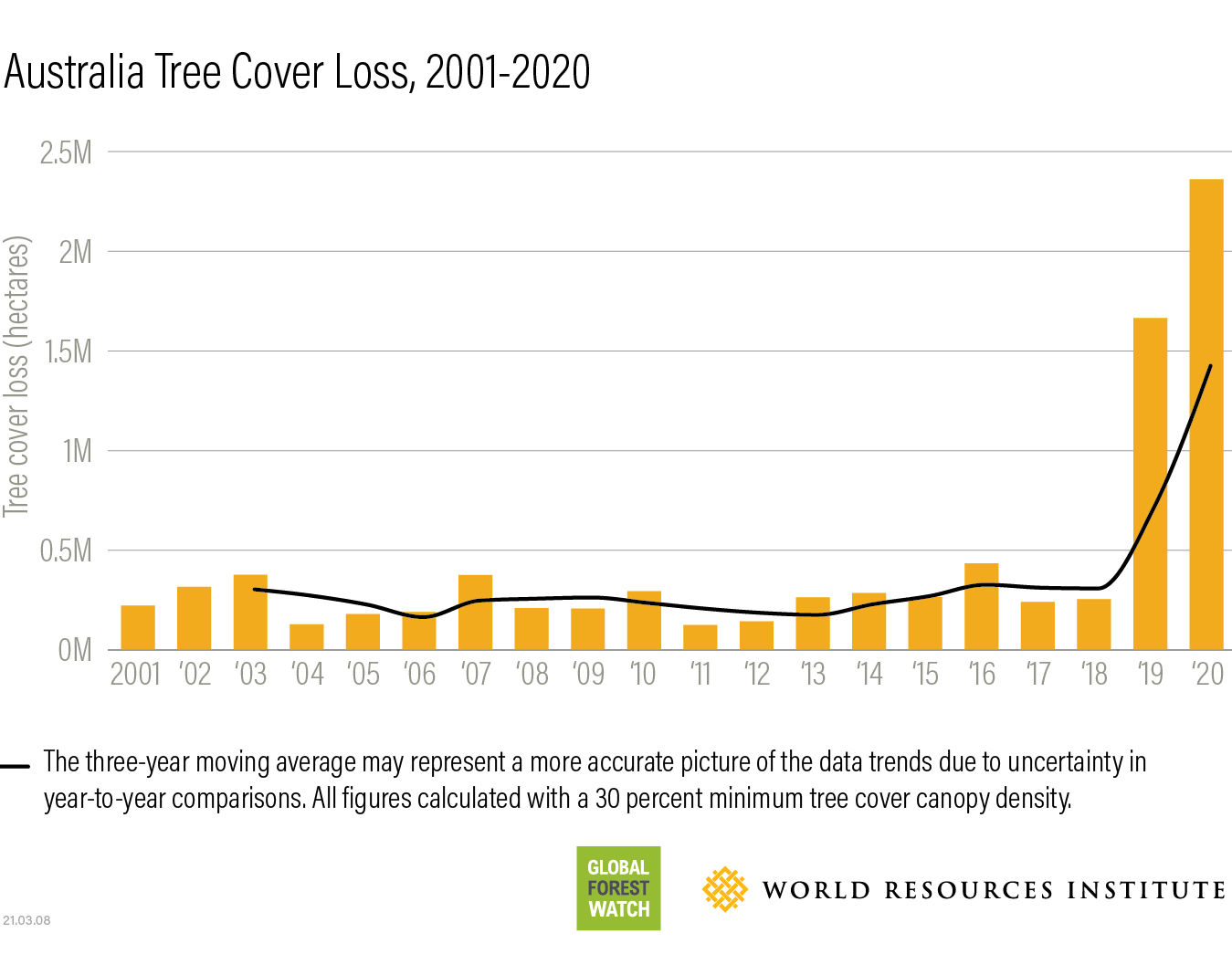

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025 -

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025 -

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025