Amsterdam Exchange Plunges: 2% Drop After Trump's Tariff Announcement

Table of Contents

Immediate Market Reaction to Trump's Tariff Announcement

Trump's announcement of new tariffs, specifically targeting key Dutch export sectors, sent a ripple effect through the Amsterdam Exchange (AEX) almost instantaneously. The announcement, released mid-morning Amsterdam time, triggered a near-immediate sell-off, with the AEX shedding 2% of its value within the first hour of trading. This rapid reaction demonstrates the heightened sensitivity of global markets to protectionist trade policies. The speed and severity of the drop indicate the significant impact of the tariffs on investor confidence.

- Specific Stocks Affected: Technology and export-oriented companies bore the brunt of the losses. ASML Holding, a leading semiconductor equipment manufacturer, saw a particularly sharp decline, dropping by 3.5% in early trading. Similarly, several agricultural companies experienced significant losses, reflecting the direct impact of the tariffs on Dutch agricultural exports.

- Trading Volume Spikes: The trading volume on the AEX surged dramatically, indicating a heightened level of market activity as investors rushed to react to the news. This high trading volume underscores the level of uncertainty and anxiety among investors.

- Market Analyst Quote: "The market's reaction was swift and brutal," stated leading financial analyst, Jan Willem de Vries. "The tariffs represent a significant threat to Dutch businesses, and investors are clearly pricing in the potential negative consequences."

Impact on Key Sectors in the Amsterdam Exchange

The Amsterdam Exchange plunge didn't affect all sectors equally. Certain industries were hit harder than others, showcasing the nuanced impact of these tariffs.

- Technology: The technology sector, heavily reliant on global supply chains, experienced significant losses. Companies heavily involved in exporting technology products to the US were particularly vulnerable.

- Financials: While initially showing some resilience, the financial sector also felt the pressure as investor sentiment soured. Uncertainty surrounding the future economic climate led to a decrease in investment activity.

- Agriculture: The agricultural sector was directly and severely impacted. The Netherlands, a major exporter of agricultural products, is expected to feel significant losses due to increased trade barriers.

(Insert Chart/Graph here illustrating percentage drops in each sector)

- Detailed Breakdown: The technology sector fell by an average of 2.8%, with some individual companies experiencing declines exceeding 4%. The agricultural sector suffered an even steeper drop, averaging a 3.5% decline.

- Disproportionate Losses: Smaller, export-oriented companies with limited diversification experienced disproportionately large losses.

- Long-Term Implications: The long-term implications for these sectors remain uncertain, with potential job losses and reduced economic growth a significant concern.

Global Market Ripple Effects – Beyond the Amsterdam Exchange Plunge

The Amsterdam Exchange plunge wasn't an isolated incident; it reflects broader anxieties in the global marketplace. The decline in Amsterdam mirrored similar, though less pronounced, drops in other major exchanges.

- International Market Correlation: The London Stock Exchange, the Frankfurt Stock Exchange, and even the New York Stock Exchange experienced declines, although less severe than the Amsterdam Exchange. This interconnectedness highlights the global nature of financial markets.

- Related News: Currency fluctuations and anxieties around global oil prices further exacerbated the situation, adding to the overall market volatility.

- Further Volatility Potential: The potential for further market volatility remains high, with many analysts warning of increased uncertainty in the coming weeks and months. The situation remains fluid and further announcements from the US could trigger additional market reactions.

Investor Sentiment and Future Outlook – Amsterdam Exchange Recovery Potential

Following the sharp drop, investor sentiment is currently characterized by a mix of fear and cautious optimism.

-

Fear and Uncertainty: Many investors are concerned about the potential for further tariff announcements and the resulting long-term economic impact.

-

Potential for Recovery: Some analysts believe that the market may recover relatively quickly if the current tariff situation stabilizes and broader economic indicators remain positive.

-

Government Intervention: The Dutch government's response, as well as potential interventions from the European Central Bank, will play a significant role in determining the speed and extent of any recovery.

-

Expert Predictions: Financial experts offer divergent views. Some predict a swift recovery, while others warn of a prolonged period of market uncertainty.

-

Government Actions: The Dutch government is exploring options to mitigate the impact on businesses, though concrete measures are yet to be fully announced.

-

Investment Strategies: In light of this volatility, a diversified investment strategy is recommended. Seeking personalized advice from a financial professional is highly encouraged.

Conclusion: Navigating the Aftermath of the Amsterdam Exchange Plunge

The Amsterdam Exchange plunge, a direct consequence of Trump's tariff announcement, underscores the fragility of global markets in the face of protectionist policies. The severity of the 2% drop, particularly its impact on key sectors such as technology and agriculture, has sent shockwaves throughout the Dutch and global economies. While the potential for recovery exists, the outlook remains uncertain, highlighting the need for careful monitoring and potentially adjusted investment strategies. Stay informed about the evolving situation on the Amsterdam Exchange and consider consulting financial professionals for personalized investment advice in light of this significant Amsterdam Exchange Plunge and its continuing implications.

Featured Posts

-

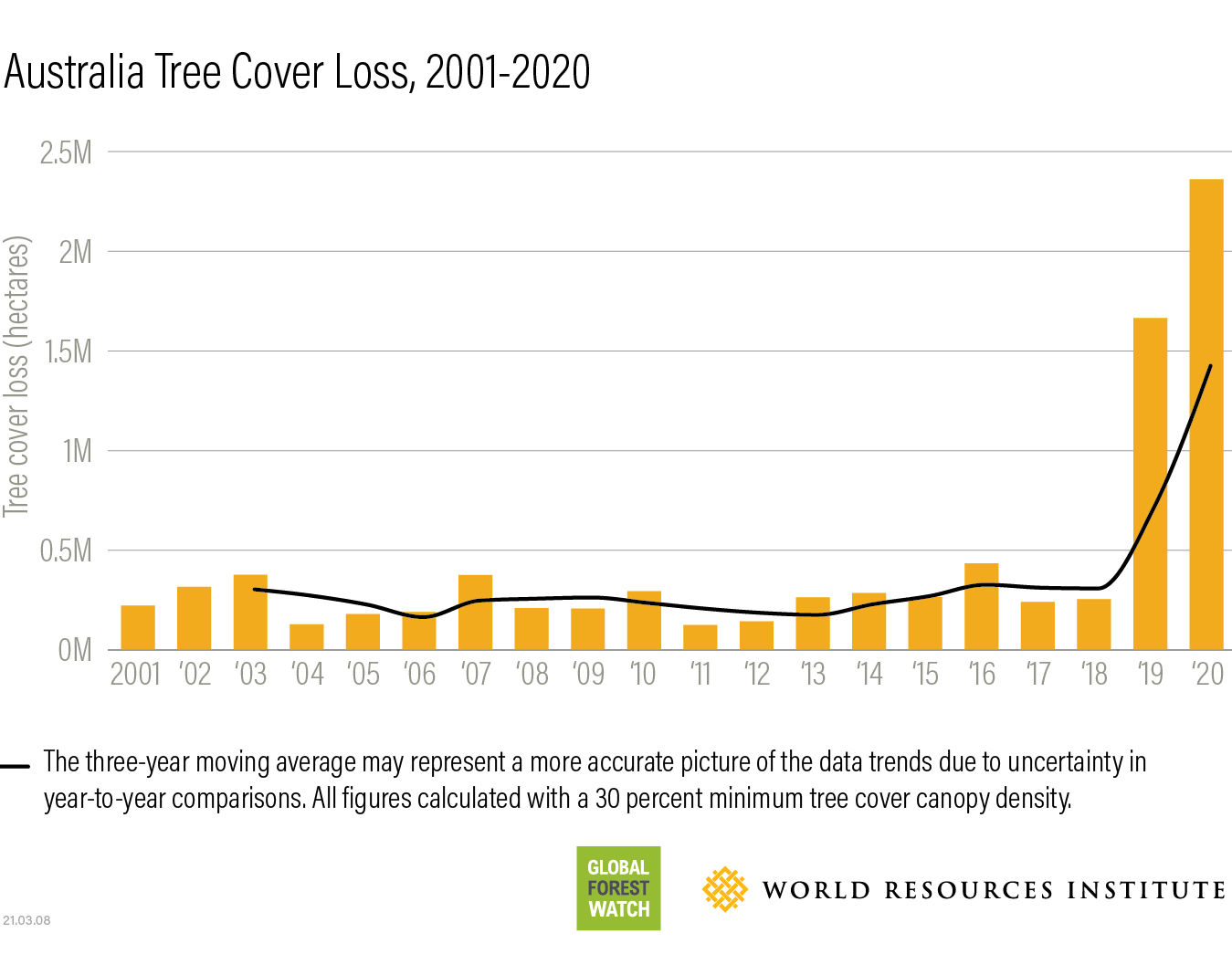

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025 -

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 24, 2025

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 24, 2025 -

Tathyr Atfaq Washntn Wbkyn Ela Mwshr Daks Qfzt Ila 24 Alf Nqtt

May 24, 2025

Tathyr Atfaq Washntn Wbkyn Ela Mwshr Daks Qfzt Ila 24 Alf Nqtt

May 24, 2025 -

Mia Farrow Demands Trumps Imprisonment Following Venezuelan Gang Member Deportations

May 24, 2025

Mia Farrow Demands Trumps Imprisonment Following Venezuelan Gang Member Deportations

May 24, 2025 -

Beursherstel Na Trumps Uitstel Aex Fondsen Boeken Winst

May 24, 2025

Beursherstel Na Trumps Uitstel Aex Fondsen Boeken Winst

May 24, 2025

Latest Posts

-

Ramaphosas White House Encounter Exploring Other Possible Responses

May 24, 2025

Ramaphosas White House Encounter Exploring Other Possible Responses

May 24, 2025 -

Live Stock Market Updates Bond Sell Off Dow Futures Reaction Bitcoin Rally

May 24, 2025

Live Stock Market Updates Bond Sell Off Dow Futures Reaction Bitcoin Rally

May 24, 2025 -

House Tax Bill Passes Impact On Stock Market Bonds And Bitcoin Today

May 24, 2025

House Tax Bill Passes Impact On Stock Market Bonds And Bitcoin Today

May 24, 2025 -

Stock Market Today Bonds Tumble Dow Futures Uncertain Bitcoin Surges Live Updates

May 24, 2025

Stock Market Today Bonds Tumble Dow Futures Uncertain Bitcoin Surges Live Updates

May 24, 2025 -

Universals 7 Billion Theme Park Will It Topple Disneys Reign

May 24, 2025

Universals 7 Billion Theme Park Will It Topple Disneys Reign

May 24, 2025