Amsterdam Stock Exchange Opens Down 7%: Trade War Intensifies

Table of Contents

The Impact of the Intensifying Trade War on the AEX

The intensifying trade war has had a profound and multifaceted impact on the Dutch economy, directly affecting the AEX. The Netherlands, with its highly export-oriented economy, is particularly vulnerable to trade tensions. The direct and indirect effects are significant:

-

Increased Uncertainty Among Investors: The ongoing trade disputes create a climate of uncertainty, making investors hesitant to commit capital. This hesitation leads to sell-offs, driving down stock prices.

-

Disruption of Global Supply Chains: The Netherlands is a crucial hub in global supply chains. Trade tariffs and restrictions disrupt these chains, impacting businesses reliant on international trade and leading to reduced production and profitability.

-

Reduced Consumer and Business Confidence: Uncertainty about future trade policies dampens consumer and business spending, reducing demand and negatively impacting company revenues.

-

Potential for Reduced Exports and Increased Import Costs: Tariffs and trade barriers directly impact Dutch exports, reducing their competitiveness in global markets. Simultaneously, increased import costs inflate prices for businesses and consumers.

Specific sectors heavily impacted include technology, due to its reliance on global supply chains, and export-oriented industries like agriculture and manufacturing. Companies like ASML Holding, a major player in the semiconductor industry, are acutely feeling the pressure of global trade uncertainties. The ripple effect on smaller, related companies throughout the Dutch economy is also substantial. This uncertainty weighs heavily on the overall Dutch economy and consequently the AEX.

Global Market Reactions and Contagion Effects

The escalating trade war isn't solely impacting the AEX; it's a global phenomenon. The decline in the Amsterdam Stock Exchange reflects a broader trend of market nervousness. The concept of market contagion is crucial here – a decline in one market can trigger similar declines in others due to interconnectedness and investor sentiment.

-

Correlation Between AEX and Other Major Indices: The AEX's performance is closely correlated with other major European and global indices like the DAX (Germany), FTSE (UK), and the Dow Jones (US). A decline in the AEX often foreshadows or mirrors similar trends in these other markets.

-

Analysis of Investor Sentiment in Other Major Markets: Investor sentiment globally is cautious, reflecting concerns about the long-term economic consequences of the trade war. This widespread pessimism contributes to the downward pressure on stock markets worldwide.

-

Related News Affecting Global Stock Markets: Recent news regarding further escalation of trade tensions, such as new tariff announcements or retaliatory measures, invariably triggers negative reactions in global stock markets.

Analysis of Key AEX Performers and Sectors

A closer look at individual companies and sectors within the AEX reveals a varied response to the current market turmoil.

-

Percentage Changes in Key Company Stocks: Companies heavily reliant on international trade have experienced steeper declines than those with a more domestically focused business model.

-

Analysis of Sector-Specific Factors Influencing Performance: The energy sector, for example, is sensitive to global economic growth. A slowdown caused by trade tensions would directly impact this sector. Similarly, the financial sector faces increased uncertainty and potential losses from volatile markets.

-

Expert Opinions on the Future Performance of These Sectors: Financial analysts are closely monitoring the situation, offering diverse opinions on the future performance of different AEX sectors, depending on how the trade war evolves. Some suggest a period of prolonged volatility, while others anticipate a recovery once trade tensions ease.

Potential Future Scenarios and Investor Strategies

Predicting the future is challenging, but several scenarios are plausible depending on the trajectory of the trade war.

-

Diversification of Investment Portfolios: Investors should consider diversifying their portfolios across different asset classes and geographies to mitigate risk.

-

Risk Management Techniques: Implementing robust risk management strategies, including stop-loss orders, is crucial to limit potential losses during market volatility.

-

Monitoring Global Economic Indicators: Keeping a close eye on global economic indicators, such as inflation rates, GDP growth, and consumer confidence, is essential for informed decision-making.

-

Long-Term vs. Short-Term Investment Strategies: The current uncertainty might favor a long-term investment strategy over short-term trading, focusing on companies with strong fundamentals and growth potential.

Conclusion: Navigating the Uncertainties of the Amsterdam Stock Exchange

The 7% drop in the AEX is a stark reminder of the significant impact of the intensifying trade war on the Amsterdam Stock Exchange and the global economy. The interplay of increased investor uncertainty, disrupted supply chains, and reduced consumer confidence has created a challenging environment for investors. Informed decision-making is paramount. Stay informed about the Amsterdam Stock Exchange, global trade developments, and key economic indicators to develop effective investment strategies that can navigate this uncertain period. Regularly check back for updates on the evolving situation and its impact on the AEX.

Featured Posts

-

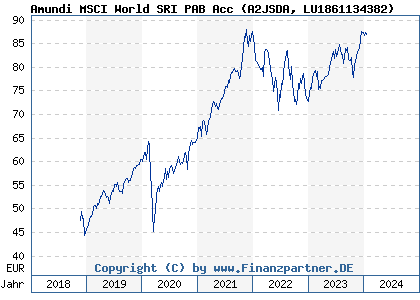

Amundi Msci World Ex Us Ucits Etf Acc Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci World Ex Us Ucits Etf Acc Understanding Net Asset Value Nav

May 24, 2025 -

The Importance Of Net Asset Value Nav For Amundi Dow Jones Industrial Average Ucits Etf Investors

May 24, 2025

The Importance Of Net Asset Value Nav For Amundi Dow Jones Industrial Average Ucits Etf Investors

May 24, 2025 -

Woody Allen Sexual Abuse Accusations Reignited Sean Penns Backing Sparks Debate

May 24, 2025

Woody Allen Sexual Abuse Accusations Reignited Sean Penns Backing Sparks Debate

May 24, 2025 -

Young Hawaiian Artists Shine Memorial Day Lei Poster Contest

May 24, 2025

Young Hawaiian Artists Shine Memorial Day Lei Poster Contest

May 24, 2025 -

Philips 2025 Annual General Meeting Updated Agenda

May 24, 2025

Philips 2025 Annual General Meeting Updated Agenda

May 24, 2025

Latest Posts

-

Live Stock Market Updates Bond Sell Off Dow Futures Reaction Bitcoin Rally

May 24, 2025

Live Stock Market Updates Bond Sell Off Dow Futures Reaction Bitcoin Rally

May 24, 2025 -

House Tax Bill Passes Impact On Stock Market Bonds And Bitcoin Today

May 24, 2025

House Tax Bill Passes Impact On Stock Market Bonds And Bitcoin Today

May 24, 2025 -

Stock Market Today Bonds Tumble Dow Futures Uncertain Bitcoin Surges Live Updates

May 24, 2025

Stock Market Today Bonds Tumble Dow Futures Uncertain Bitcoin Surges Live Updates

May 24, 2025 -

Universals 7 Billion Theme Park Will It Topple Disneys Reign

May 24, 2025

Universals 7 Billion Theme Park Will It Topple Disneys Reign

May 24, 2025 -

The Exclusive Collaboration Between Sam Altman And Jony Ive A New Device

May 24, 2025

The Exclusive Collaboration Between Sam Altman And Jony Ive A New Device

May 24, 2025