Amsterdam Stock Index Plunges: Over 4% Drop To Year-Low

Table of Contents

Global Economic Uncertainty Fuels AEX Decline

The current global economic climate plays a significant role in the AEX's decline. Several interconnected factors contribute to this instability, impacting investor confidence and driving down stock prices.

-

Increased Inflation Impacting Consumer Spending: Soaring inflation rates across the globe are eroding consumer purchasing power. This reduced spending directly impacts companies' revenues, leading to decreased profitability and lower stock valuations. For example, Eurozone inflation recently hit [insert current Eurozone inflation rate]%, significantly impacting consumer confidence and spending.

-

Central Bank Interest Rate Hikes Slowing Economic Growth: To combat inflation, central banks worldwide, including the European Central Bank (ECB), are aggressively raising interest rates. While this aims to curb inflation, higher interest rates also increase borrowing costs for businesses, slowing economic growth and impacting investment. The recent ECB interest rate hike of [insert recent ECB interest rate hike percentage] demonstrates this proactive approach to tackling inflation, albeit with potential negative economic consequences.

-

Geopolitical Tensions Creating Market Volatility: Ongoing geopolitical instability, such as the war in Ukraine, adds further uncertainty to the global economic outlook. This uncertainty creates volatility in the markets, as investors seek safer havens for their investments, leading to sell-offs in riskier assets like stocks. The continuing conflict and its impact on energy prices are a key driver of this volatility.

Poor Performance of Key Sectors Drags Down AEX

The AEX decline isn't solely due to macroeconomic factors; the underperformance of several key sectors significantly contributed to the overall drop.

-

Energy Sector Downturn Due to Fluctuating Oil Prices: The energy sector, a significant component of the AEX, has experienced a downturn due to fluctuating oil prices. Volatility in the global energy market, driven by geopolitical events and supply chain disruptions, impacts the profitability of energy companies listed on the AEX, such as [mention a relevant Dutch energy company].

-

Tech Sector Weakness Mirroring Global Tech Stock Performance: The tech sector, mirroring the global trend, has experienced weakness. Concerns over high valuations and slowing growth in the tech industry have led to significant sell-offs in tech stocks listed on the AEX, including [mention a relevant Dutch tech company].

-

Financial Sector Concerns Related to Rising Interest Rates: Rising interest rates pose challenges for the financial sector. Higher borrowing costs impact banks' profitability and increase the risk of loan defaults, impacting the performance of financial institutions listed on the AEX, such as [mention a relevant Dutch financial institution].

Investor Sentiment and Market Volatility

The sharp decline in the AEX is also heavily influenced by shifts in investor sentiment and increased market volatility.

-

Increased Risk Aversion Among Investors: Investors are exhibiting increased risk aversion, moving away from riskier assets like stocks and seeking safer investments like government bonds. This shift in sentiment contributes to the selling pressure on the AEX.

-

Selling Pressure Leading to Increased Market Volatility: The increased selling pressure leads to increased market volatility, as prices fluctuate sharply. This volatility further erodes investor confidence, leading to a vicious cycle of selling and price declines.

-

Impact of Negative News Headlines and Analyst Reports: Negative news headlines and pessimistic analyst reports exacerbate the negative sentiment, fueling further selling pressure and contributing to the AEX's decline. Market sentiment is heavily influenced by media coverage and expert opinions.

Potential Implications and Future Outlook for the AEX

The significant drop in the AEX has several potential short-term and long-term implications.

-

Impact on Dutch Businesses and the National Economy: The AEX decline will likely impact Dutch businesses and the national economy. Reduced investor confidence and lower stock prices can lead to decreased investment and slower economic growth.

-

Opportunities for Value Investing in the Wake of the Decline: The sharp drop also presents opportunities for value investors. Some undervalued stocks might offer attractive entry points for long-term investors willing to take on some risk.

-

Predictions for the AEX's Performance in the Coming Months: Predicting the AEX's future performance is challenging. However, many financial analysts [cite sources if available] suggest a cautious outlook in the short term, with potential for recovery depending on global economic developments and investor sentiment.

Conclusion: Navigating the Amsterdam Stock Index Plunge

The significant drop in the Amsterdam Stock Index (AEX) is a result of a confluence of factors: global economic uncertainty, weak sector performance, and negative investor sentiment. The over 4% plunge highlights the volatility of the market and the impact of macroeconomic conditions on individual stock performance. While the outlook remains cautious in the short term, potential opportunities exist for savvy investors. Stay informed about the evolving situation surrounding the Amsterdam Stock Index and consult with a financial advisor before making any investment decisions. Understanding the factors impacting the AEX is crucial for navigating this volatile period.

Featured Posts

-

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And Their Significance

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And Their Significance

May 24, 2025 -

High Speed Police Chase Astonishing Refueling Moment At 90mph

May 24, 2025

High Speed Police Chase Astonishing Refueling Moment At 90mph

May 24, 2025 -

Sergey Yurskiy Vecher Pamyati V Teatre Mossoveta

May 24, 2025

Sergey Yurskiy Vecher Pamyati V Teatre Mossoveta

May 24, 2025 -

Pameran Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 24, 2025

Pameran Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 24, 2025 -

Pochti 40 Par Pozhenilis Na Kharkovschine Svadebniy Bum V Odin Den

May 24, 2025

Pochti 40 Par Pozhenilis Na Kharkovschine Svadebniy Bum V Odin Den

May 24, 2025

Latest Posts

-

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025 -

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025 -

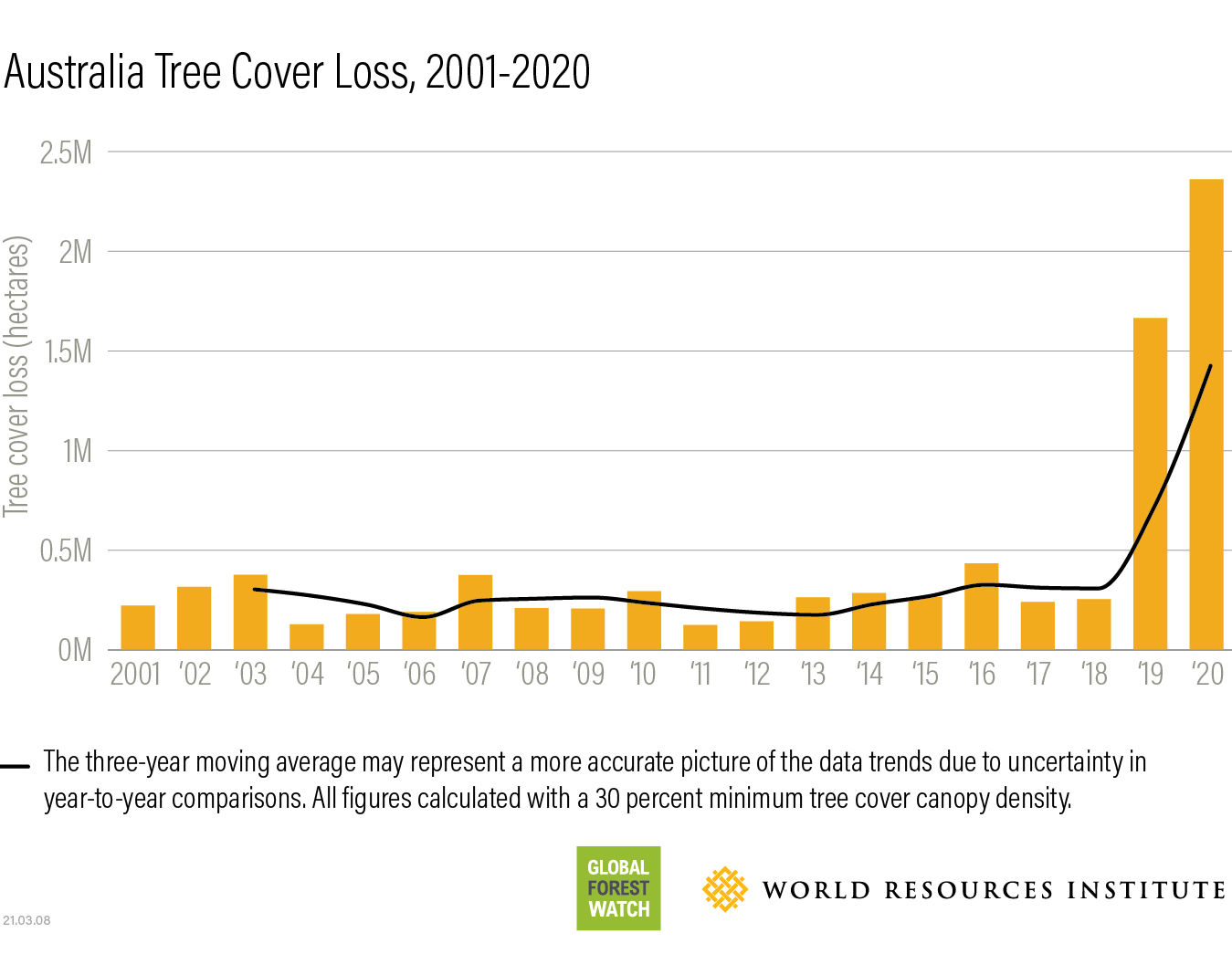

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025 -

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025 -

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025