Amundi Dow Jones Industrial Average UCITS ETF: Daily NAV Updates And Their Significance

Table of Contents

Accessing Daily NAV Updates for the Amundi Dow Jones Industrial Average UCITS ETF

Staying informed about the daily performance of your investment is paramount. The Amundi Dow Jones Industrial Average UCITS ETF NAV is updated daily, reflecting the closing prices of the underlying assets. Here's how you can access this crucial information:

Official Sources for NAV Information

Reliable NAV data is essential. You should always prioritize official channels. Here are some places to find the Amundi Dow Jones Industrial Average UCITS ETF daily NAV:

- Amundi Website: The official Amundi website is the primary source for accurate and up-to-date information on all their ETFs, including the Amundi Dow Jones Industrial Average UCITS ETF. Look for dedicated ETF pages that usually provide historical NAV data and often display the latest closing NAV.

- Financial News Websites: Major financial news outlets (like Bloomberg, Yahoo Finance, Google Finance) usually provide real-time or delayed quotes for major ETFs, including the Amundi Dow Jones Industrial Average UCITS ETF. Search for the ETF's ticker symbol to find the NAV.

- Brokerage Platforms: If you hold the Amundi Dow Jones Industrial Average UCITS ETF through a brokerage account, your platform will display the daily NAV, usually with a slight delay. Check your account statement or portfolio summary for this information.

The typical update time for the NAV is at the close of the market for the underlying assets (typically, the New York Stock Exchange closing time).

Third-Party Data Providers

Several reputable third-party data providers offer comprehensive financial information, including ETF NAVs. While convenient, it's important to exercise caution.

- These providers often aggregate data from multiple sources. While generally reliable, there might be minor discrepancies compared to the official Amundi data. Always cross-reference information from multiple reputable sources.

- The advantages of using third-party providers include consolidated views of your portfolio performance and often access to advanced charting and analytical tools.

- Disadvantages include the potential for slight inaccuracies and the need to ensure the data provider's credibility and reliability.

The Significance of Daily NAV in Investment Decision-Making

Monitoring the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF offers significant benefits for informed investment decisions.

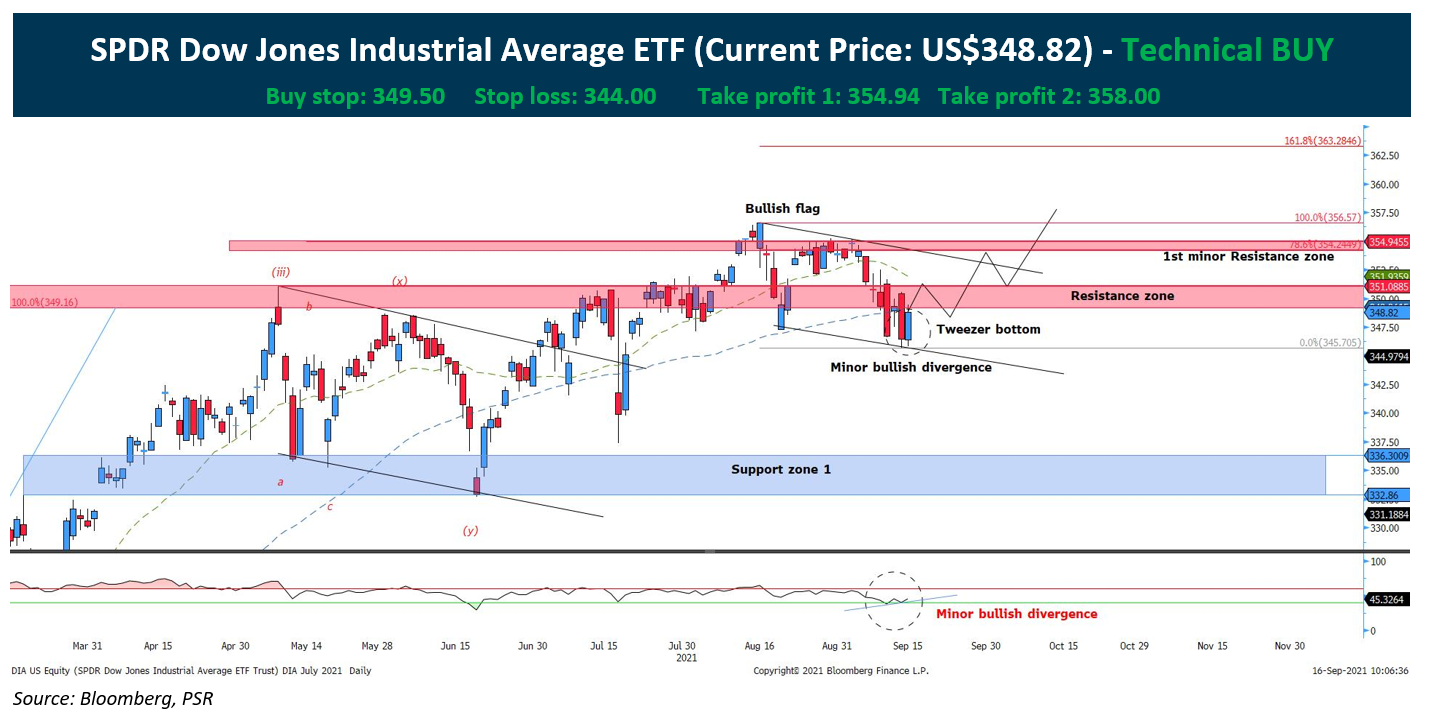

Tracking Performance and Returns

Daily NAV updates allow investors to track the performance of their investment closely. By comparing consecutive daily NAVs, you can calculate the daily return. While daily fluctuations can be volatile, consistent monitoring helps gauge the overall trend of your investment. Visualizing this trend with charts and graphs provides a clearer picture of your investment’s performance over time.

Informative Investment Strategies

The Amundi Dow Jones Industrial Average UCITS ETF NAV plays a crucial role in various investment strategies. For example, dollar-cost averaging relies on the NAV to determine the quantity of shares purchased at regular intervals, mitigating the risk of investing a lump sum at a market peak. However, remember that NAV is just one factor to consider, and other market indicators and your financial goals should inform your buying and selling decisions.

Risk Management and Portfolio Diversification

Daily NAV monitoring is vital for risk management. Sudden drops in NAV can signal potential risks. By closely observing these fluctuations, investors can adjust their portfolios accordingly, diversifying their investments to mitigate potential losses. Though short-term fluctuations are common, a long-term perspective based on consistent tracking is key to effective risk management.

Factors Influencing the Daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors contribute to the daily fluctuations in the Amundi Dow Jones Industrial Average UCITS ETF NAV:

Market Movements and Global Economic Conditions

The overall market sentiment significantly impacts the ETF's NAV. Global economic factors like interest rate changes, inflation rates, and geopolitical events can cause significant market movements, affecting the ETF's performance. Major news events can cause sharp short-term fluctuations.

Performance of the Underlying Assets (Dow Jones Industrial Average)

The Amundi Dow Jones Industrial Average UCITS ETF directly tracks the Dow Jones Industrial Average. Therefore, the performance of the index dictates the ETF's NAV. Individual stock performance within the Dow Jones Industrial Average also plays a significant role. Understanding the composition of the index and the performance of its constituent companies is vital for predicting potential NAV changes.

Currency Exchange Rates (if applicable)

For international investors, currency exchange rates can influence the NAV, especially if the ETF is denominated in a currency different from their own. Currency fluctuations can impact returns positively or negatively depending on the direction of the exchange rate movement.

Conclusion: Staying Informed with Amundi Dow Jones Industrial Average UCITS ETF Daily NAV Updates

Regularly monitoring the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for informed investment decision-making. Accessing NAV data from official sources like the Amundi website, financial news outlets, and brokerage platforms provides reliable insights. Understanding how market movements, the performance of the underlying Dow Jones Industrial Average, and currency exchange rates affect the NAV empowers you to adjust your investment strategy accordingly. By consistently monitoring the Amundi Dow Jones Industrial Average UCITS ETF daily NAV and employing a balanced approach, you can make informed choices to optimize your investment strategy and achieve your financial goals. Start monitoring the daily NAV today and take control of your investment in the Amundi Dow Jones Industrial Average UCITS ETF.

Featured Posts

-

Betrug An Der Uni Duisburg Essen 900 Euro Fuer Notenverbesserung

May 24, 2025

Betrug An Der Uni Duisburg Essen 900 Euro Fuer Notenverbesserung

May 24, 2025 -

Astonishing 90mph Refueling Police Helicopter Chase Ends In Dramatic Fuel Stop

May 24, 2025

Astonishing 90mph Refueling Police Helicopter Chase Ends In Dramatic Fuel Stop

May 24, 2025 -

Hromadne Prepustanie V Nemecku Ktore Firmy Rusia Pracovne Miesta

May 24, 2025

Hromadne Prepustanie V Nemecku Ktore Firmy Rusia Pracovne Miesta

May 24, 2025 -

Dow Jones Rallies Pmi Beat Fuels Continued Cautious Growth

May 24, 2025

Dow Jones Rallies Pmi Beat Fuels Continued Cautious Growth

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Nav Explained

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Nav Explained

May 24, 2025

Latest Posts

-

Dispute Over Dylan Farrows Accusations Sean Penns Perspective

May 24, 2025

Dispute Over Dylan Farrows Accusations Sean Penns Perspective

May 24, 2025 -

Dylan Farrow And Woody Allen Sean Penn Weighs In

May 24, 2025

Dylan Farrow And Woody Allen Sean Penn Weighs In

May 24, 2025 -

Sean Penns View On The Dylan Farrow Woody Allen Case

May 24, 2025

Sean Penns View On The Dylan Farrow Woody Allen Case

May 24, 2025 -

Dylan Farrows Woody Allen Accusations Sean Penns Skepticism

May 24, 2025

Dylan Farrows Woody Allen Accusations Sean Penns Skepticism

May 24, 2025 -

Sean Penn Casts Doubt On Dylan Farrows Sexual Assault Claims Against Woody Allen

May 24, 2025

Sean Penn Casts Doubt On Dylan Farrows Sexual Assault Claims Against Woody Allen

May 24, 2025