Amundi MSCI All Country World UCITS ETF USD Acc: A Guide To Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the net worth of an ETF's underlying assets. It's calculated by subtracting the ETF's liabilities (expenses, fees) from the total market value of its assets. For ETF investors, understanding the NAV is paramount because it reflects the intrinsic value of the ETF's holdings. This is different from the market price, which can fluctuate throughout the trading day due to supply and demand.

- NAV reflects the intrinsic value: The NAV provides a true picture of the underlying assets' worth.

- Market price fluctuates: The market price of an ETF can differ from its NAV due to trading activity.

- Informed decisions: Understanding the difference between NAV and market price is essential for making sound investment choices.

- Daily calculation: NAV is typically calculated at the close of each trading day.

Calculating the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc

Calculating the NAV for a globally diversified ETF like the Amundi MSCI All Country World UCITS ETF USD Acc is more complex than for a single-country or sector-focused ETF. It involves several factors:

- Currency exchange rates: Because the ETF invests across numerous countries, fluctuations in currency exchange rates directly impact the NAV. A strengthening US dollar, for instance, might lower the NAV if a significant portion of the underlying assets are denominated in other currencies.

- Asset class values: The ETF's holdings encompass various asset classes (stocks, bonds, etc.). Daily changes in the market values of these assets affect the overall NAV calculation. A downturn in a specific sector will be reflected in the NAV.

- Management fees: The ETF's management fees are deducted from the total asset value before the final NAV is calculated. This reduces the overall NAV.

- Regular updates: You can find regular updates on the Amundi MSCI All Country World UCITS ETF USD Acc NAV on the Amundi website and through major financial data providers like Bloomberg and Yahoo Finance.

NAV and Investment Decisions for the Amundi MSCI All Country World UCITS ETF USD Acc

The Amundi MSCI All Country World UCITS ETF USD Acc NAV is a powerful tool for making informed investment decisions.

- Performance evaluation: Tracking NAV changes helps investors understand the ETF's growth and performance over time. A rising NAV generally indicates positive performance.

- Identifying opportunities: Comparing the ETF's NAV to its market price can reveal potential buying or selling opportunities. A significant difference might suggest a premium or discount, allowing you to capitalize on pricing inefficiencies.

- Investment strategy assessment: Consistent monitoring of the NAV helps assess the effectiveness of the ETF's investment strategy. A consistently underperforming NAV compared to benchmarks might signal a need for review.

- Long-term perspective: Long-term NAV analysis provides valuable insights into the ETF's performance and its ability to achieve its investment objectives.

Where to Find the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc

Reliable sources for the daily Amundi MSCI All Country World UCITS ETF USD Acc NAV include:

- Amundi's official website: Check the ETF's dedicated page on Amundi's website.

- Major financial news websites: Sites like Bloomberg, Yahoo Finance, and Google Finance often provide real-time or end-of-day NAV data.

- Brokerage platforms: Most brokerage accounts display the NAV of your holdings.

- Dedicated ETF data providers: Specialized financial data providers offer comprehensive ETF data, including NAV information.

Conclusion

Understanding the Amundi MSCI All Country World UCITS ETF USD Acc NAV is crucial for effective investment management. By understanding how NAV is calculated, how it relates to market price, and where to find this crucial data, you can make informed decisions about buying, selling, or holding this ETF. Mastering Amundi MSCI All Country World UCITS ETF USD Acc NAV is key to successful investing. Stay informed about your Amundi MSCI All Country World UCITS ETF USD Acc NAV and make the most of your investment strategy.

Featured Posts

-

Bbc Radio 1 Big Weekend 2025 Sefton Park A Ticket Buyers Guide

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Sefton Park A Ticket Buyers Guide

May 24, 2025 -

Kyle And Teddis Explosive Dog Walker Argument

May 24, 2025

Kyle And Teddis Explosive Dog Walker Argument

May 24, 2025 -

Porsche 956 Nin Tavani Neden Asili Sergi Tasariminin Sirri

May 24, 2025

Porsche 956 Nin Tavani Neden Asili Sergi Tasariminin Sirri

May 24, 2025 -

West Hams Pursuit Of Kyle Walker Peters A Transfer Update

May 24, 2025

West Hams Pursuit Of Kyle Walker Peters A Transfer Update

May 24, 2025 -

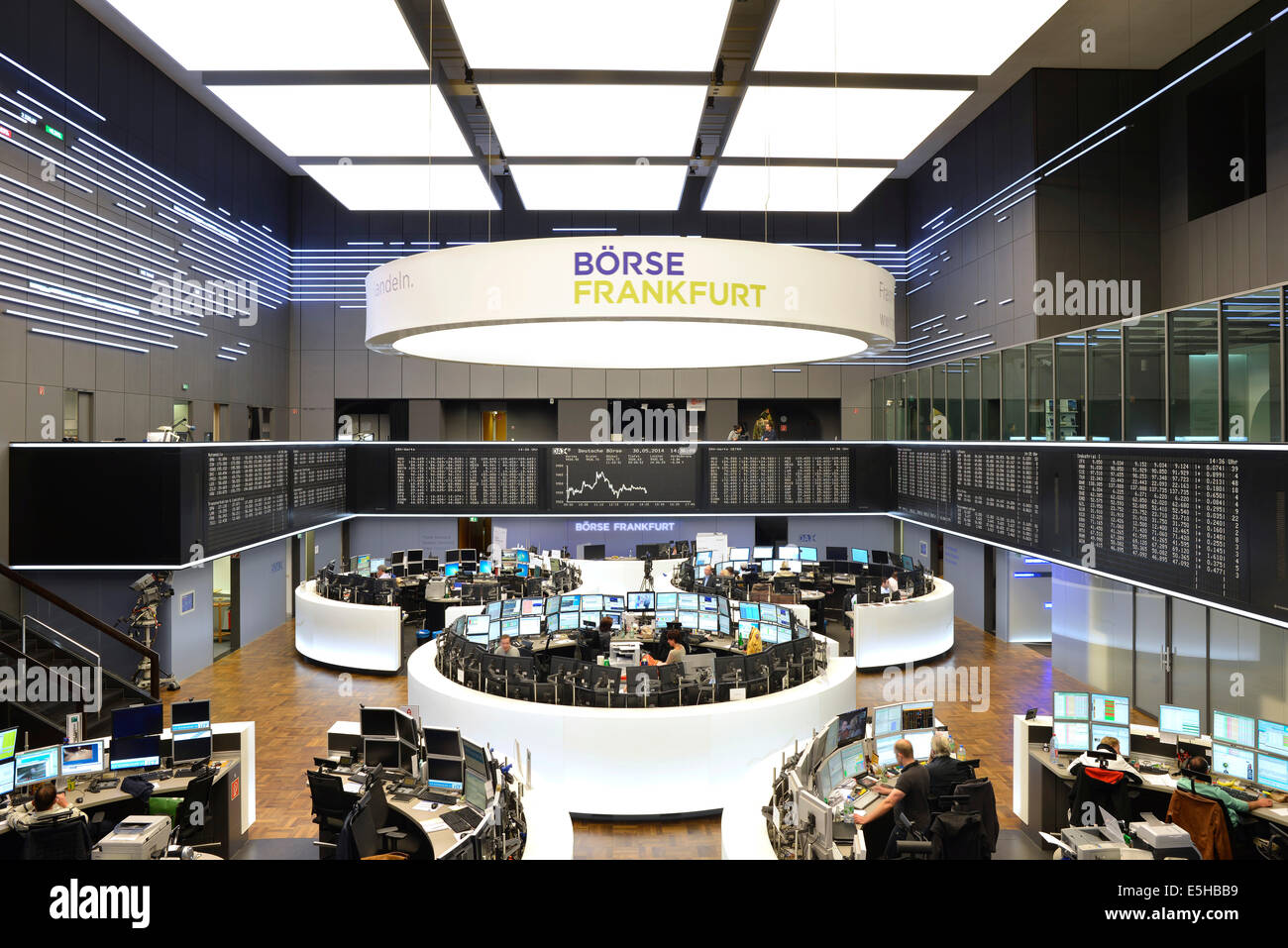

Frankfurt Stock Market Update Dax Trading Below 24 000

May 24, 2025

Frankfurt Stock Market Update Dax Trading Below 24 000

May 24, 2025

Latest Posts

-

M56 Road Closure Live Traffic Updates And Diversion Routes

May 24, 2025

M56 Road Closure Live Traffic Updates And Diversion Routes

May 24, 2025 -

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025 -

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025 -

Annie Kilner Addresses Allegations Public Statement And Social Media

May 24, 2025

Annie Kilner Addresses Allegations Public Statement And Social Media

May 24, 2025 -

Allegations Of Poisoning Emerge Annie Kilner Speaks Out

May 24, 2025

Allegations Of Poisoning Emerge Annie Kilner Speaks Out

May 24, 2025