Amundi MSCI All Country World UCITS ETF USD Acc: Understanding Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and how does it relate to the Amundi MSCI All Country World UCITS ETF USD Acc?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. For the Amundi MSCI All Country World UCITS ETF USD Acc, the NAV reflects the total value of all the underlying stocks it holds, adjusted for expenses and currency conversions. It's essentially the price you would receive if you were to liquidate the ETF's holdings at their current market prices.

Calculating the NAV for this specific ETF involves several steps:

- Determining the market value of each underlying asset: The ETF tracks the MSCI All Country World Index, so the value of its holdings reflects the performance of this broad global market index.

- Converting values to USD: As the ETF is denominated in USD, the values of assets held in other currencies are converted to USD using current exchange rates. Fluctuations in these rates directly impact the NAV.

- Deducting expenses: Management fees, administrative costs, and other expenses are subtracted from the total asset value to arrive at the net asset value.

Key components influencing the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc include:

- Market value of underlying assets (stocks from various countries and sectors)

- Currency exchange rates (USD against various currencies)

- Management fees and expense ratios

- Other operating expenses

It's important to understand the difference between NAV and the market price of the ETF. While they are usually very close, they can differ slightly due to factors like supply and demand in the ETF market itself.

Factors Affecting the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc

Several factors influence the daily NAV fluctuations of the Amundi MSCI All Country World UCITS ETF USD Acc:

- Global Market Movements: The performance of global stock markets directly impacts the value of the underlying assets. A positive day on global markets generally translates to a higher NAV, and vice versa.

- Currency Fluctuations: Since the ETF is USD-denominated, fluctuations in exchange rates between the USD and other currencies affect the value of international holdings, influencing the NAV. A stronger USD can lead to a lower NAV for assets held in other currencies.

- Dividend Distributions: When underlying companies pay dividends, the ETF receives these payments, which typically increase the NAV. However, the impact is temporary, as the NAV will subsequently reflect the reinvestment of dividends or their distribution to shareholders.

- Management Fees and Expense Ratios: These fees are deducted from the ETF’s assets, impacting the NAV. Higher fees generally lead to lower NAV growth.

In summary, the main factors impacting NAV changes are:

- Global stock market performance

- Currency exchange rate movements

- Dividend payouts from underlying companies

- Management fees and other expenses

How to Use NAV Information to Make Informed Investment Decisions

To track the daily NAV of the Amundi MSCI All Country World UCITS ETF USD Acc, you can refer to several sources, including:

- The Amundi website

- Major financial news websites and data providers (e.g., Bloomberg, Yahoo Finance)

- Your brokerage account statement

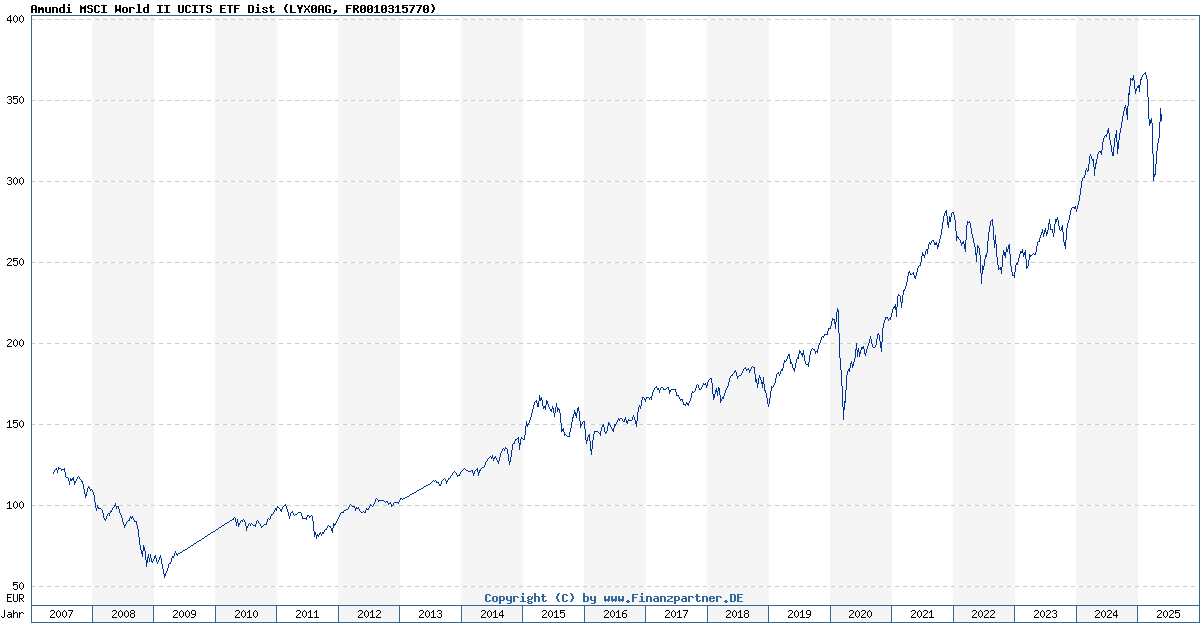

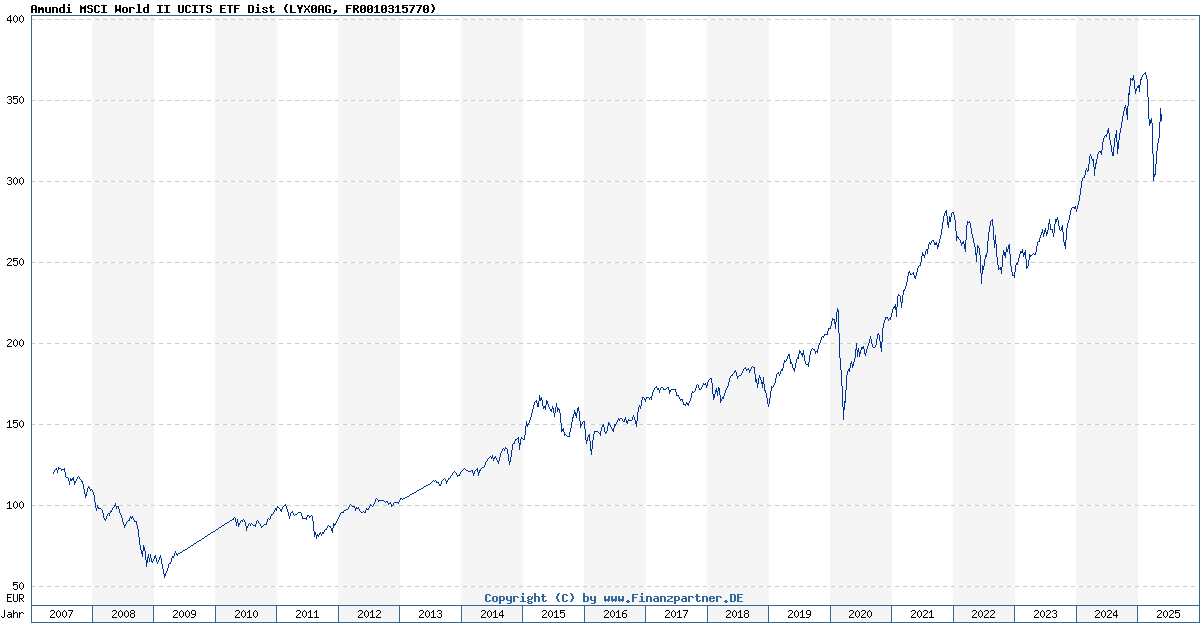

By tracking the NAV over time, you can monitor the ETF's performance and assess its growth. Comparing the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc with other similar ETFs allows you to make informed investment choices based on performance and expense ratios. Remember to use NAV data in conjunction with other investment metrics and your overall investment goals.

Using the NAV, you can calculate your returns: (Current NAV - Purchase NAV) / Purchase NAV * 100% = Return %. However, remember that brokerage fees and taxes also affect your overall returns. Always consider all factors before making investment decisions.

Understanding the Amundi MSCI All Country World UCITS ETF USD Acc's Investment Strategy and its Impact on NAV

The Amundi MSCI All Country World UCITS ETF USD Acc employs a passive investment strategy, aiming to replicate the performance of the MSCI All Country World Index. This index tracks a large and diverse range of global equities, weighted by market capitalization.

This global diversification strategy influences the NAV in several ways:

- Reduced volatility compared to single-country or sector funds: While the NAV will still fluctuate with market movements, global diversification can mitigate the impact of negative events in individual markets or sectors.

- Exposure to various economic cycles and growth trends: This can lead to potentially higher long-term returns but also means the NAV is subject to a variety of market influences.

The advantages of this strategy are clear: broad exposure, low costs, and relative simplicity. However, a disadvantage is that in periods of underperformance across many global markets, the NAV may show considerable declines.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is essential for investors seeking global diversification. By monitoring the NAV and understanding the factors that influence it, including global market trends, currency fluctuations, and expense ratios, you can make more informed investment decisions. Regularly checking the NAV allows you to track performance, compare it against other ETFs, and assess the overall health of your investment in this global ETF. Ready to understand your investment better? Learn more about the Amundi MSCI All Country World UCITS ETF USD Acc's NAV and make informed decisions today!

Featured Posts

-

Escape To The Country How Nicki Chapman Made 700 000 From Property

May 24, 2025

Escape To The Country How Nicki Chapman Made 700 000 From Property

May 24, 2025 -

Escape To The Countryside Homes Activities And More

May 24, 2025

Escape To The Countryside Homes Activities And More

May 24, 2025 -

Understanding The Net Asset Value Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Understanding The Net Asset Value Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025 -

Avrupa Borsalari Guenluek Degisimler Ve Analiz

May 24, 2025

Avrupa Borsalari Guenluek Degisimler Ve Analiz

May 24, 2025 -

Frankfurt Stock Exchange Dax Inches Closer To New Record High

May 24, 2025

Frankfurt Stock Exchange Dax Inches Closer To New Record High

May 24, 2025

Latest Posts

-

M56 Road Closure Live Traffic Updates And Diversion Routes

May 24, 2025

M56 Road Closure Live Traffic Updates And Diversion Routes

May 24, 2025 -

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025 -

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025 -

Annie Kilner Addresses Allegations Public Statement And Social Media

May 24, 2025

Annie Kilner Addresses Allegations Public Statement And Social Media

May 24, 2025 -

Allegations Of Poisoning Emerge Annie Kilner Speaks Out

May 24, 2025

Allegations Of Poisoning Emerge Annie Kilner Speaks Out

May 24, 2025