Frankfurt Stock Exchange: DAX Inches Closer To New Record High

Table of Contents

Factors Contributing to the DAX's Rise

Several key factors are contributing to the DAX's impressive climb on the Frankfurt Stock Exchange. Understanding these factors is crucial for investors seeking to navigate the current market conditions.

Robust German Economy

Germany's robust economy is a primary driver of the DAX's performance. Several key indicators point to sustained economic growth:

- Strong Export Performance: German exports, particularly in the automotive and manufacturing sectors, are booming, fueled by global demand and innovative products. This contributes significantly to the overall economic health and boosts the profits of DAX-listed companies.

- Low Unemployment and Consumer Spending: Low unemployment rates signify a healthy labor market, leading to increased consumer spending and confidence. This positive consumer sentiment translates directly into higher sales for businesses, further fueling economic growth.

- Positive GDP Growth Forecasts: Positive GDP growth forecasts for the coming quarters suggest continued economic expansion, creating a favorable environment for the DAX and the Frankfurt Stock Exchange. This stability attracts both domestic and international investment.

These factors collectively paint a picture of a thriving German economy, directly supporting the upward trajectory of the DAX.

Positive Global Economic Sentiment

The positive global economic sentiment also plays a significant role in the DAX's rise. This broader optimism is influencing investor decisions and driving capital into the German market.

- Easing Inflation Concerns: While inflation remains a concern globally, easing fears in major economies are boosting investor confidence. This reduced uncertainty encourages investment in riskier assets, such as stocks listed on the Frankfurt Stock Exchange.

- Strong Corporate Earnings: Strong corporate earnings reports globally are bolstering investor optimism. Positive results from multinational companies headquartered in Germany and those with significant operations in the country contribute directly to the DAX's growth.

- Increased Foreign Investment: Increased foreign investment in German companies signals confidence in the German economy and its future prospects. This influx of capital further propels the DAX upward on the Frankfurt Stock Exchange.

Strong Corporate Performance within the DAX

The exceptional performance of many DAX-listed companies is another crucial contributor to the index's recent surge. Companies are demonstrating robust growth through various strategies.

- Successful Product Launches and Expansion: DAX companies are experiencing success with innovative product launches and strategic expansions into new markets. This reflects strong innovation and adaptability within the German corporate landscape.

- Technological Advancements: Innovative technological advancements are contributing to increased profitability for several DAX companies, leading to improved stock performance and bolstering investor confidence.

- Strategic Mergers and Acquisitions: Strategic mergers and acquisitions are driving growth and efficiency for some DAX companies. This consolidation strengthens their market position and contributes to overall index performance.

Analyzing the DAX's Potential for Further Growth

While the outlook for the DAX is currently positive, several factors could influence its future trajectory. A balanced perspective requires acknowledging both potential upsides and downsides.

Geopolitical Risks and Uncertainties

Geopolitical risks and uncertainties pose potential challenges to the DAX's continued growth. These factors introduce volatility and uncertainty into the market.

- Impact of the War in Ukraine: The ongoing war in Ukraine continues to create uncertainty in the global economy, potentially impacting German businesses and investor sentiment. This geopolitical risk can influence the Frankfurt Stock Exchange's performance.

- Energy Price Volatility: Energy price volatility remains a significant concern, potentially impacting the profitability of German businesses and influencing the DAX's performance.

- Global Supply Chain Disruptions: Global supply chain disruptions can negatively impact the production and sales of DAX-listed companies, creating headwinds for the index's growth.

Inflation and Interest Rate Hikes

Inflation and interest rate hikes represent significant macroeconomic factors that could impact the DAX's performance.

- ECB Monetary Policy: The European Central Bank's (ECB) monetary policy and its interest rate decisions will significantly influence investor sentiment and the DAX's trajectory on the Frankfurt Stock Exchange.

- Impact of Rising Interest Rates: Rising interest rates could dampen investor enthusiasm, potentially leading to a slowdown in the DAX's growth.

- Inflation's Effect on Consumer Spending: High inflation can reduce consumer spending and business investment, negatively affecting the overall economic climate and impacting the DAX.

Technical Analysis of the DAX

Technical analysis of the DAX chart provides valuable insights into potential future movements.

- Chart Patterns and Resistance Levels: Analyzing current chart patterns and identifying potential resistance levels can help predict short-term fluctuations in the DAX.

- Technical Indicators: Technical indicators, such as moving averages and relative strength index (RSI), provide further insights into the underlying momentum and potential for future upward or downward movement.

- Support Levels: Identifying potential support levels can help determine potential price floors that could prevent a significant downturn in the DAX.

Conclusion

The DAX's impressive ascent on the Frankfurt Stock Exchange is fueled by a combination of robust domestic economic performance, positive global sentiment, and strong corporate earnings. While geopolitical risks and macroeconomic factors pose challenges, the overall outlook remains relatively positive. However, investors should carefully monitor these evolving factors and diversify their portfolios accordingly. To stay informed about the latest developments and trends affecting the Frankfurt Stock Exchange and the DAX, keep checking for regular updates on market analysis and expert commentary. Understanding the nuances of the DAX and its implications for the broader German and European economy is crucial for making well-informed investment decisions.

Featured Posts

-

Essen Uniklinikum Beruehrende Ereignisse In Der Naehe

May 24, 2025

Essen Uniklinikum Beruehrende Ereignisse In Der Naehe

May 24, 2025 -

Duisburg Essen Skandal Um Notenmanipulation Aufgedeckt

May 24, 2025

Duisburg Essen Skandal Um Notenmanipulation Aufgedeckt

May 24, 2025 -

Planning Your Memorial Day 2025 Trip Smart Flight Booking Tips

May 24, 2025

Planning Your Memorial Day 2025 Trip Smart Flight Booking Tips

May 24, 2025 -

Kerings Financial Report Sales Fall Guccis Demna Collection Coming In September

May 24, 2025

Kerings Financial Report Sales Fall Guccis Demna Collection Coming In September

May 24, 2025 -

Aktien Frankfurt Eroeffnung Dax Rueckgang Am 21 Maerz 2025

May 24, 2025

Aktien Frankfurt Eroeffnung Dax Rueckgang Am 21 Maerz 2025

May 24, 2025

Latest Posts

-

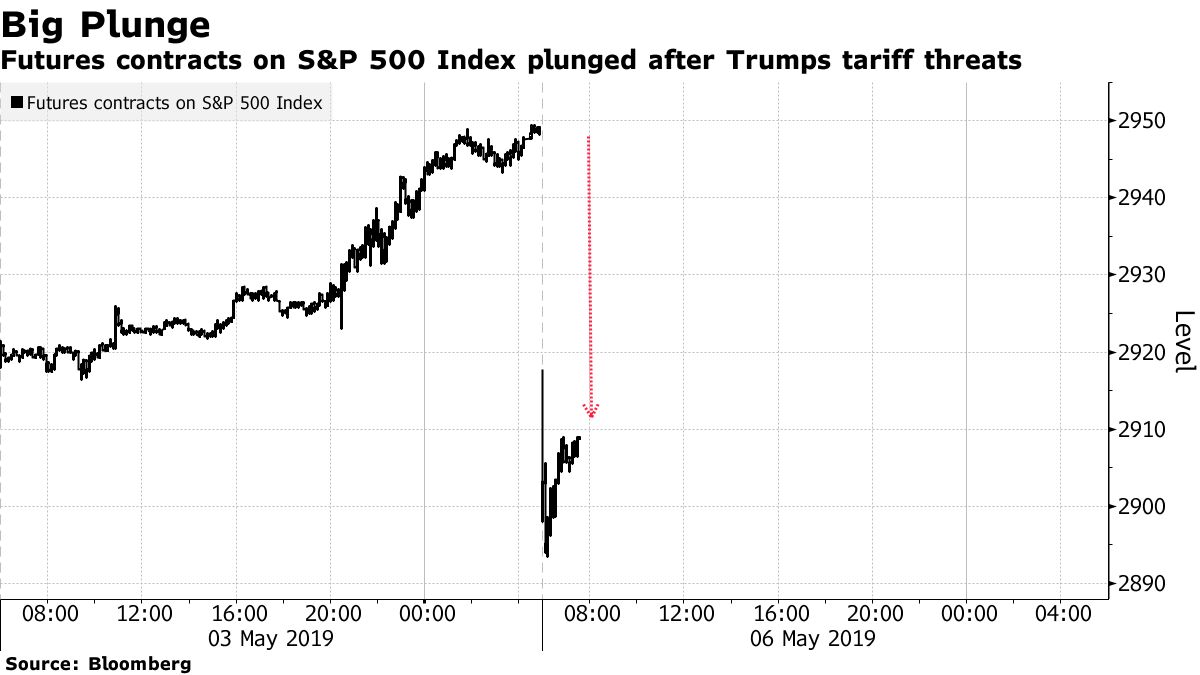

Amsterdam Exchange Plunges 2 Drop After Trumps Tariff Announcement

May 24, 2025

Amsterdam Exchange Plunges 2 Drop After Trumps Tariff Announcement

May 24, 2025 -

2 Fall On Amsterdam Stock Exchange Following Trumps Latest Tariffs

May 24, 2025

2 Fall On Amsterdam Stock Exchange Following Trumps Latest Tariffs

May 24, 2025 -

Trumps Tariff Hike Sends Amsterdam Stock Exchange Down 2

May 24, 2025

Trumps Tariff Hike Sends Amsterdam Stock Exchange Down 2

May 24, 2025 -

Demna Gvasalia Reshaping The Identity Of Gucci

May 24, 2025

Demna Gvasalia Reshaping The Identity Of Gucci

May 24, 2025 -

Amsterdam Stock Exchange Drops 2 After Trumps Tariff Increase

May 24, 2025

Amsterdam Stock Exchange Drops 2 After Trumps Tariff Increase

May 24, 2025