Amundi MSCI World II UCITS ETF USD Hedged Dist: A Guide To Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and How Does it Work?

H2.1: Defining NAV

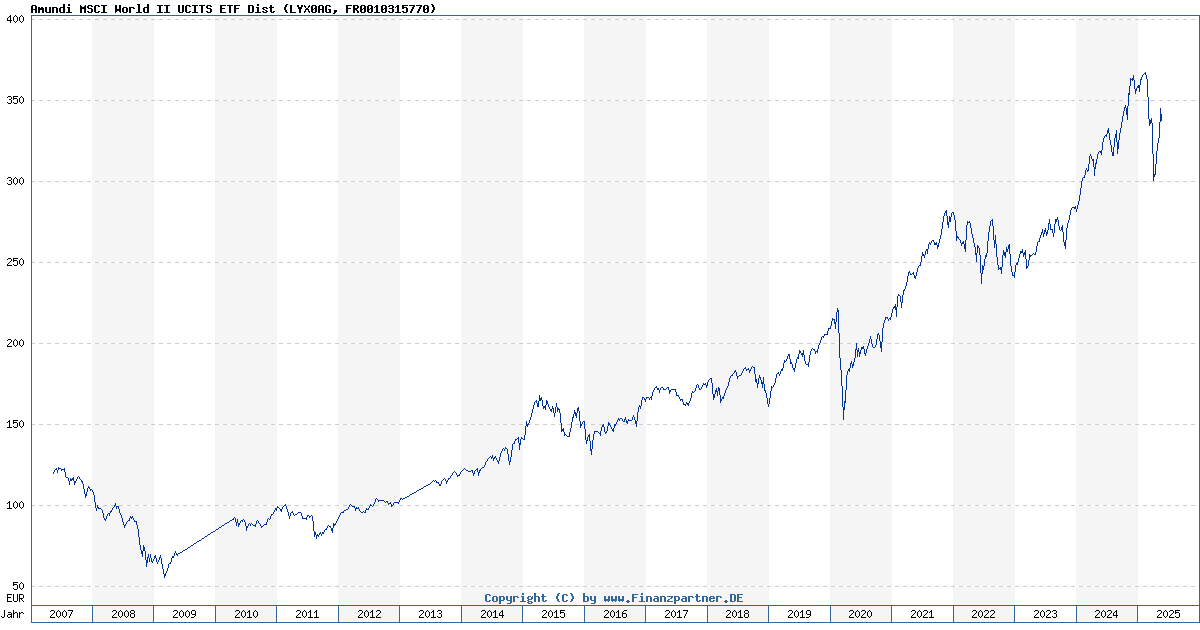

Net Asset Value (NAV) represents the net worth of an ETF's underlying assets. It's calculated daily by subtracting the fund's liabilities (expenses, debts) from the total market value of its assets (stocks, bonds, etc.). For the Amundi MSCI World II UCITS ETF USD Hedged Dist, this calculation considers a globally diversified portfolio of equities, with the added complexity of USD hedging.

- Components of NAV: Assets (market value of all holdings) - Liabilities (expenses, management fees, etc.) = NAV.

- Daily Calculation: The NAV is calculated at the end of each trading day, reflecting the closing prices of the underlying assets. This daily calculation ensures the ETF's price reflects its true value.

- NAV vs. Market Price: While closely related, the NAV and market price of an ETF can differ slightly. Market price fluctuates throughout the trading day based on supply and demand, while the NAV is a snapshot of the fund's net asset value at the end of the day.

H2.2: NAV's Importance for Investors

Understanding NAV is crucial for several reasons:

- Performance Assessment: NAV helps investors track the fund's performance over time. Increases in NAV generally indicate positive performance.

- Reflecting Underlying Asset Performance: Changes in the NAV directly reflect the performance of the underlying assets held within the ETF. A rising NAV suggests the underlying assets are appreciating in value.

- ETF Comparison: Investors can use NAV to compare the performance of similar ETFs, facilitating informed investment decisions.

- Buy and Sell Transactions: NAV plays a role in determining the price at which you buy or sell shares of the ETF, especially in larger transactions.

H2.3: Factors Affecting NAV

Several factors influence the NAV of an ETF:

- Currency Fluctuations: The "USD Hedged" aspect of the Amundi MSCI World II UCITS ETF is crucial. This hedging strategy aims to minimize the impact of currency fluctuations between the base currency of the underlying assets and the USD. However, the effectiveness of the hedge can impact the NAV.

- Market Movements: Changes in the overall market significantly affect the NAV, as the value of the underlying assets rises or falls.

- Dividend Distributions: When the ETF distributes dividends, the NAV will typically decrease by the amount of the dividend payment.

Understanding NAV in the Context of Amundi MSCI World II UCITS ETF USD Hedged Dist

H3.1: Specific Considerations for this ETF

The "USD Hedged" feature of the Amundi MSCI World II UCITS ETF significantly impacts NAV calculation:

- Currency Hedging: The hedging strategy aims to reduce the risk associated with currency fluctuations. This means that even if the underlying assets perform well in their base currencies, the NAV might not reflect the full gains if the hedging strategy isn't perfectly effective.

- Hedging Effectiveness: The success of the hedging strategy affects the NAV. A highly effective hedge will minimize the impact of currency swings, offering greater NAV stability. Less effective hedging could lead to greater NAV volatility.

H3.2: Where to Find the NAV

You can find the daily NAV for the Amundi MSCI World II UCITS ETF USD Hedged Dist from several sources:

- Amundi's Official Website: The fund's official website will usually provide daily NAV data.

- Financial News Sources: Many reputable financial news websites and portals publish ETF NAV data.

- Brokerage Platforms: Your brokerage account will typically display the NAV alongside other relevant information for your ETF holdings.

H3.3: Interpreting NAV Data for Informed Investment Decisions

While NAV is crucial, consider it alongside other factors:

- Other Performance Indicators: Use NAV in conjunction with other performance indicators, such as the total return, expense ratio, and the fund’s specific investment strategy.

- Long-Term Trends: Focus on long-term NAV trends rather than short-term fluctuations. Analyzing the overall direction of the NAV over several months or years provides a more accurate picture of the fund’s performance.

- Expense Ratio and Management Fees: Consider the expense ratio and management fees, as these will impact the overall return and, therefore, the NAV.

Conclusion: Making Informed Investment Decisions Using Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Understanding the Net Asset Value (NAV) is paramount for making informed investment choices with the Amundi MSCI World II UCITS ETF USD Hedged Dist. By consistently monitoring the NAV, considering its relationship to the underlying assets and the effectiveness of the USD hedging, and using it alongside other performance metrics, you can better assess the fund's performance and align your investment strategy with your financial goals. Regularly reviewing the NAV allows you to track your investment's progress effectively. Learn more about using NAV to optimize your investment in the Amundi MSCI World II UCITS ETF USD Hedged Dist and make informed decisions today!

Featured Posts

-

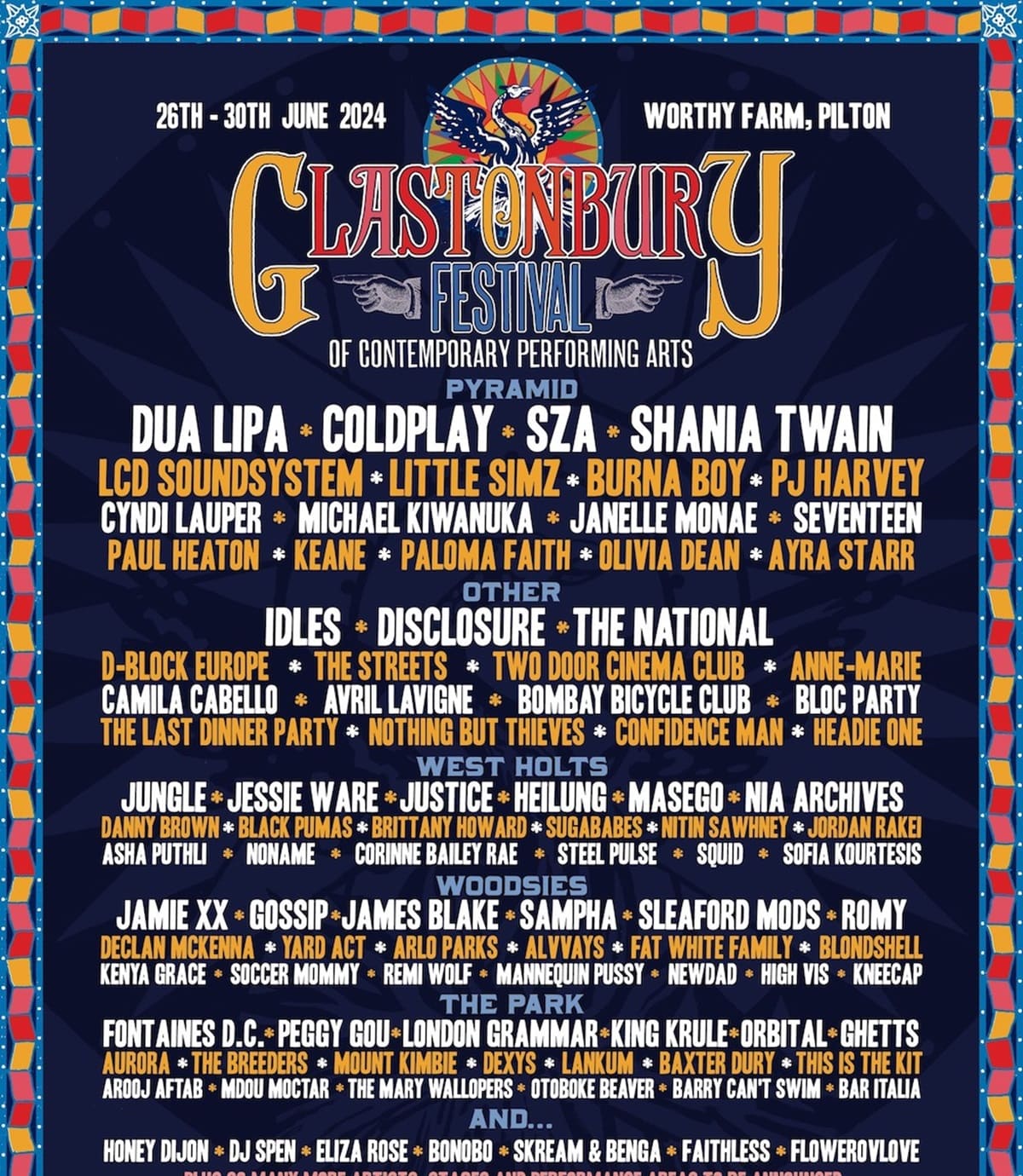

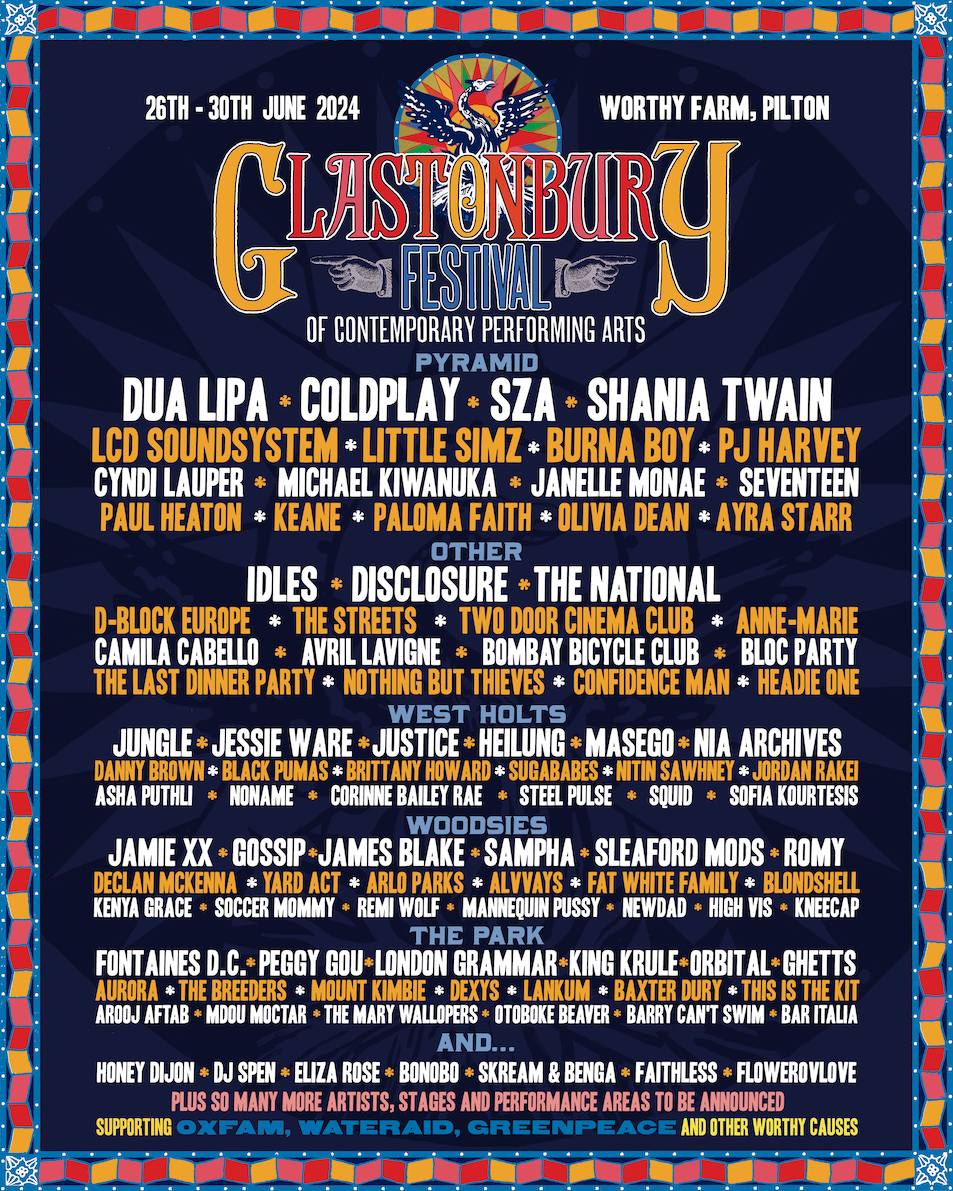

Is Glastonbury 2025s Lineup The Strongest Ever Featuring Charli Xcx Neil Young And Must See Acts

May 25, 2025

Is Glastonbury 2025s Lineup The Strongest Ever Featuring Charli Xcx Neil Young And Must See Acts

May 25, 2025 -

Auto 80 Millio Forintos Extrak Ezen A Porsche 911 Esen

May 25, 2025

Auto 80 Millio Forintos Extrak Ezen A Porsche 911 Esen

May 25, 2025 -

Ferrari Day In Bangkok Launch Of New Flagship Showroom

May 25, 2025

Ferrari Day In Bangkok Launch Of New Flagship Showroom

May 25, 2025 -

Amundi Msci All Country World Ucits Etf Usd Acc A Guide To Net Asset Value

May 25, 2025

Amundi Msci All Country World Ucits Etf Usd Acc A Guide To Net Asset Value

May 25, 2025 -

Escape To The Country Homes Activities And More

May 25, 2025

Escape To The Country Homes Activities And More

May 25, 2025

Latest Posts

-

Get Your Bbc Radio 1 Big Weekend Tickets The Ultimate Guide

May 25, 2025

Get Your Bbc Radio 1 Big Weekend Tickets The Ultimate Guide

May 25, 2025 -

Securing Your Bbc Radio 1 Big Weekend Tickets Tips And Strategies

May 25, 2025

Securing Your Bbc Radio 1 Big Weekend Tickets Tips And Strategies

May 25, 2025 -

Bbc Radio 1 Big Weekend A Ticket Buyers Guide

May 25, 2025

Bbc Radio 1 Big Weekend A Ticket Buyers Guide

May 25, 2025 -

Glastonbury Festival 2025 Complete Lineup And Ticket Purchase Guide Following Leak

May 25, 2025

Glastonbury Festival 2025 Complete Lineup And Ticket Purchase Guide Following Leak

May 25, 2025 -

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 25, 2025

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 25, 2025