Amundi MSCI World II UCITS ETF USD Hedged Dist: Net Asset Value (NAV) Explained

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

The Net Asset Value (NAV) represents the value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. In simpler terms, it's the net worth of the ETF per share. Understanding NAV calculation is key to grasping the ETF's true value.

The formula for calculating NAV is straightforward:

(Total Assets - Total Liabilities) / Number of Outstanding Shares = NAV

- Total Assets: This includes the market value of all the securities held within the ETF, such as stocks, bonds, and other assets.

- Total Liabilities: This encompasses the ETF's expenses, including management fees and any outstanding debts.

- Number of Outstanding Shares: This represents the total number of ETF shares currently held by investors.

It's crucial to remember that the NAV fluctuates constantly due to changes in the market value of the underlying assets. A rising market generally leads to a higher NAV, while a falling market results in a lower NAV. This dynamic nature of NAV is a fundamental aspect of ETF valuation and asset valuation in general.

Understanding the Daily NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist

The Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is typically published daily by the ETF provider, Amundi. You can usually find this information on Amundi's official website, major financial news sources, and through your brokerage account. This daily update is crucial because it reflects the most current value of the ETF based on the closing prices of its underlying assets.

- Frequency: The NAV is usually calculated and published at the end of each trading day.

- Importance: Monitoring the daily NAV allows you to track the performance of your investment and make informed decisions about buying, selling, or holding the ETF. Understanding daily NAV changes is essential for effective investment strategies.

- Where to find it: Check Amundi's website, reputable financial news sites (like Bloomberg or Yahoo Finance), or your brokerage platform.

Factors Affecting the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist

Several factors can impact the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist. Understanding these factors helps you interpret NAV fluctuations and anticipate potential changes.

- Currency Fluctuations: The "USD Hedged" aspect means the ETF employs strategies to mitigate the impact of currency fluctuations between the underlying assets' currencies and the US dollar. While this hedging reduces exposure to currency risk, it doesn't eliminate it entirely and can still slightly affect the NAV.

- MSCI World Index Performance: The ETF tracks the MSCI World Index, which represents a broad range of global equities. The performance of this index directly impacts the value of the underlying assets and therefore the ETF's NAV. Strong index performance boosts the NAV, and vice versa.

- Dividends and Distributions: When the underlying companies within the index pay dividends, the ETF receives these payments, which are then usually distributed to ETF shareholders. These distributions can slightly affect the NAV, depending on the timing and amount.

- Management Fees and Expenses: The ETF has an expense ratio (management fees and other operating costs). These costs are deducted from the assets, which slightly reduces the NAV over time. A higher expense ratio can lead to a lower NAV compared to a similar ETF with a lower expense ratio.

Using NAV to Make Informed Investment Decisions

The NAV is a powerful tool for making informed investment decisions. By analyzing NAV changes in conjunction with other market indicators, you can develop a robust investment strategy.

- Interpreting NAV Changes: Consistent upward trends in the NAV typically suggest positive performance, while downward trends indicate potential losses. However, always consider the overall market conditions.

- NAV vs. Market Price: The NAV is the intrinsic value of the ETF, while the market price is the actual price at which it trades. These may differ slightly due to market supply and demand. Significant discrepancies could present buying or selling opportunities.

- Buy Low, Sell High: While not a guaranteed strategy, understanding NAV fluctuations helps in identifying potential buying opportunities when the NAV is relatively low compared to the market price, and selling opportunities when it's relatively high.

For example, if the NAV is consistently lower than the market price, it might signal an undervalued ETF, while the opposite could indicate an overvalued one. However, always conduct thorough research and consider other market factors before making any investment decisions.

Conclusion: Mastering the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist is crucial for making informed investment decisions. By comprehending how NAV is calculated, what factors influence it, and how to interpret its changes, you can effectively monitor your investment's performance and adjust your strategy accordingly. Regularly monitoring the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV, combined with a thorough understanding of the underlying assets and market conditions, allows you to optimize your investment strategy and potentially maximize returns. For a deeper understanding of ETFs and NAV calculations, explore resources like the Amundi website and reputable financial education platforms. Start monitoring the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV today and make informed investment choices!

Featured Posts

-

Avrupa Borsalari Guenluek Degisimler Ve Analiz

May 24, 2025

Avrupa Borsalari Guenluek Degisimler Ve Analiz

May 24, 2025 -

German Markets Strong Performance A Wall Street Comeback Scenario

May 24, 2025

German Markets Strong Performance A Wall Street Comeback Scenario

May 24, 2025 -

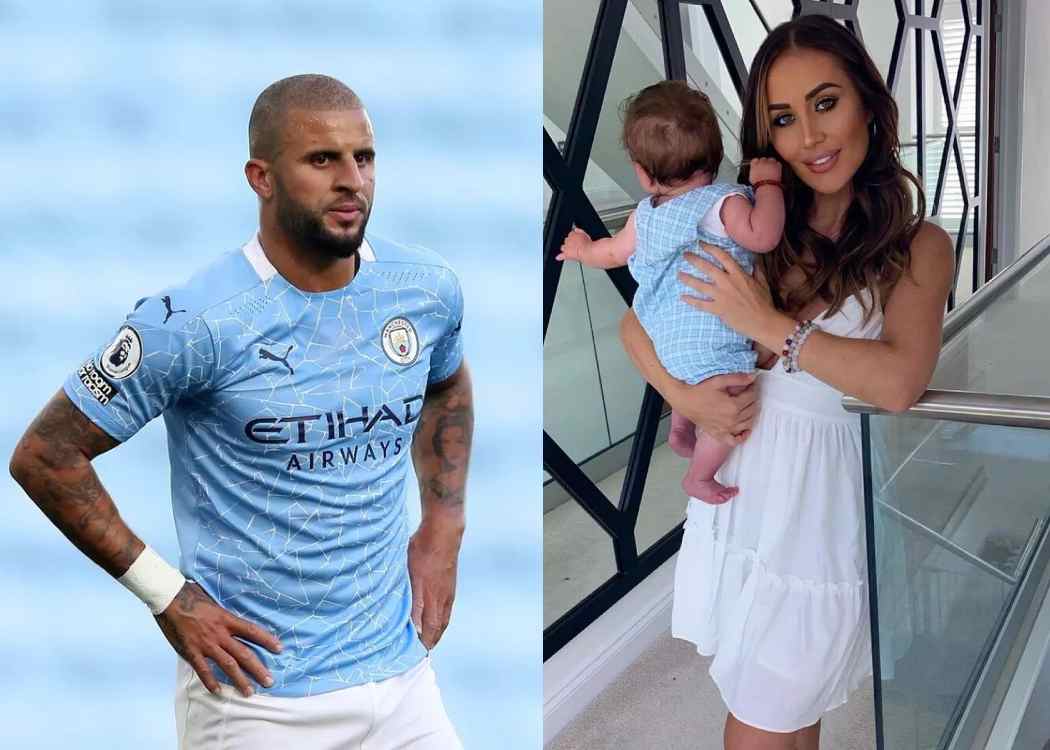

Kyle Walkers Milan Party Details Emerge Following Wifes Uk Flight

May 24, 2025

Kyle Walkers Milan Party Details Emerge Following Wifes Uk Flight

May 24, 2025 -

The Kyle Walker Annie Kilner Situation New Developments In Milan

May 24, 2025

The Kyle Walker Annie Kilner Situation New Developments In Milan

May 24, 2025 -

Learn From Nicki Chapman A 700 000 Escape To The Country Property Investment

May 24, 2025

Learn From Nicki Chapman A 700 000 Escape To The Country Property Investment

May 24, 2025

Latest Posts

-

Allegations Of Poisoning Emerge Annie Kilner Speaks Out

May 24, 2025

Allegations Of Poisoning Emerge Annie Kilner Speaks Out

May 24, 2025 -

The Kyle Walker Annie Kilner Story A Timeline Of Events

May 24, 2025

The Kyle Walker Annie Kilner Story A Timeline Of Events

May 24, 2025 -

Kyle Walker New Details Emerge Following Party Pictures And Annie Kilners Trip Home

May 24, 2025

Kyle Walker New Details Emerge Following Party Pictures And Annie Kilners Trip Home

May 24, 2025 -

Annie Kilners Public Statements After Kyle Walker Incident

May 24, 2025

Annie Kilners Public Statements After Kyle Walker Incident

May 24, 2025 -

The Kyle Walker Controversy Party Pictures And Relationship Implications

May 24, 2025

The Kyle Walker Controversy Party Pictures And Relationship Implications

May 24, 2025