Learn From Nicki Chapman: A £700,000 Escape To The Country Property Investment

Table of Contents

Nicki Chapman's Property Investment Strategy: A Closer Look

Nicki Chapman’s approach to property investment, as evidenced by her recent purchase, highlights a strategic blend of research, careful evaluation, and an understanding of long-term potential. Her strategy doesn't appear to be based on impulsive purchases but rather a calculated investment in properties offering significant returns.

-

Finding the Right Properties: Her success stems from identifying properties with both immediate value and significant future potential. This includes a keen eye for location, understanding the local market, and recognizing properties ripe for renovation or boasting strong rental income potential. She likely prioritizes properties offering a blend of immediate livability and potential for appreciation.

-

Due Diligence and Research: Before committing to any purchase, Nicki undoubtedly undertakes thorough due diligence. This involves comprehensive market research, understanding local planning regulations, and potentially even commissioning detailed property surveys to identify any potential issues. This minimizes risk and ensures her investment is sound.

-

Unique Aspects of her Strategy: While precise details of her strategy aren't publicly available, it’s likely she prioritizes long-term rental income or the potential for significant capital appreciation after renovation. This long-term perspective is crucial for successful property investment.

-

Key Elements of her Approach:

- Thorough market research to identify undervalued properties in desirable locations.

- Careful calculation of renovation costs and potential return on investment (ROI).

- Strategic location selection based on proximity to amenities, transport links, and schools.

- Diversification within her property portfolio, potentially spreading risk across different locations and property types.

Key Factors Contributing to a Successful Country Property Investment

Investing in country properties can be incredibly rewarding, but it requires a strategic approach. Several key factors contribute to a successful investment, mirroring the likely principles Nicki Chapman employs.

-

Location, Location, Location: The proximity to amenities, transport links (including good broadband access!), and reputable schools significantly impacts property value and rental demand. Investing in a remote property without easy access to essential services may limit its appeal and rental potential.

-

Property Type and Condition: The type of property (cottage, farmhouse, barn conversion) and its condition (requiring renovation or move-in ready) directly influence both initial investment cost and potential rental income. Properties needing renovation can offer higher returns but also carry greater risk.

-

Financing and Mortgage Options: Securing competitive mortgage rates and having a clear understanding of deposit requirements is vital. Interest rates fluctuate, so securing a favorable mortgage is a crucial element of a successful investment strategy.

-

Essential Considerations:

- Identifying high-demand areas with strong rental yields and capital appreciation potential.

- Understanding local planning regulations and potential for future development or expansion.

- Securing competitive mortgage rates and suitable financing options tailored to your investment strategy.

- Creating a realistic budget that includes contingencies for unexpected repairs or delays.

Minimizing Risks in Rural Property Investment

Rural property investment, while potentially lucrative, comes with inherent risks. Understanding these risks and implementing mitigating strategies is paramount.

-

Challenges of Rural Locations: Remoteness, limited amenities, and a slower market turnover compared to urban areas present unique challenges. Properties may take longer to sell, and finding reliable tenants can be more difficult.

-

Risk Mitigation Strategies: Thorough due diligence is crucial. This includes engaging a reputable surveyor for comprehensive property inspections, consulting legal and financial professionals, and conducting thorough market research to understand local trends and potential risks.

-

Key Risk Management Techniques:

- Employing a reputable surveyor for detailed property inspections to identify potential structural or maintenance issues.

- Consulting with solicitors and financial advisors experienced in rural property investment.

- Understanding the local market trends, including seasonal fluctuations in demand and potential economic impacts on the area.

- Building a contingency fund to cover unexpected expenses, such as major repairs or extended vacancy periods.

Learning from Nicki Chapman: Practical Tips for Aspiring Investors

Nicki Chapman’s success underscores the importance of a well-defined strategy, thorough research, and a realistic understanding of the market.

-

Key Takeaways from Nicki’s Approach: Her investment highlights the value of long-term thinking, thorough due diligence, and identifying properties with both immediate value and significant growth potential.

-

Actionable Advice for Aspiring Investors: Start with thorough research focusing on areas with high rental demand and strong capital appreciation potential. Network with experienced property professionals and investors to gain valuable insights. Be patient and persistent; finding the right investment property takes time.

-

Resources and Further Reading: Explore resources like government websites for planning regulations, property portals for market data, and financial websites for mortgage information.

-

Practical Steps to Success:

- Start with thorough research and due diligence.

- Network with property professionals and investors to gather advice and insights.

- Be patient and persistent in your search for the right investment opportunity.

- Continuously educate yourself on market trends, investment strategies, and relevant legislation.

Conclusion

Nicki Chapman's £700,000 country property investment serves as a compelling example of the potential rewards in the rural property market. By employing a strategic approach, thorough due diligence, and effective risk management, you too can build a successful property portfolio. Her journey underscores the importance of comprehensive research, detailed location analysis, and a firm grasp of your financial capabilities.

Call to Action: Inspired by Nicki Chapman's success? Take the first step towards your own lucrative Escape to the Country property investment. Begin your research today and discover the potential of building a rewarding property portfolio. Start your journey to securing your own slice of the countryside and building a successful investment property portfolio.

Featured Posts

-

The Kyle Walker Situation Party Pictures And Relationship Fallout

May 24, 2025

The Kyle Walker Situation Party Pictures And Relationship Fallout

May 24, 2025 -

The Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 24, 2025

The Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 24, 2025 -

Duisburg Essen Skandal Um Notenmanipulation Aufgedeckt

May 24, 2025

Duisburg Essen Skandal Um Notenmanipulation Aufgedeckt

May 24, 2025 -

Net Asset Value Nav Explained Amundi Msci World Ex United States Ucits Etf Acc

May 24, 2025

Net Asset Value Nav Explained Amundi Msci World Ex United States Ucits Etf Acc

May 24, 2025 -

Evrovidenie Chto Stalo S Pobeditelyami Za Poslednie 10 Let

May 24, 2025

Evrovidenie Chto Stalo S Pobeditelyami Za Poslednie 10 Let

May 24, 2025

Latest Posts

-

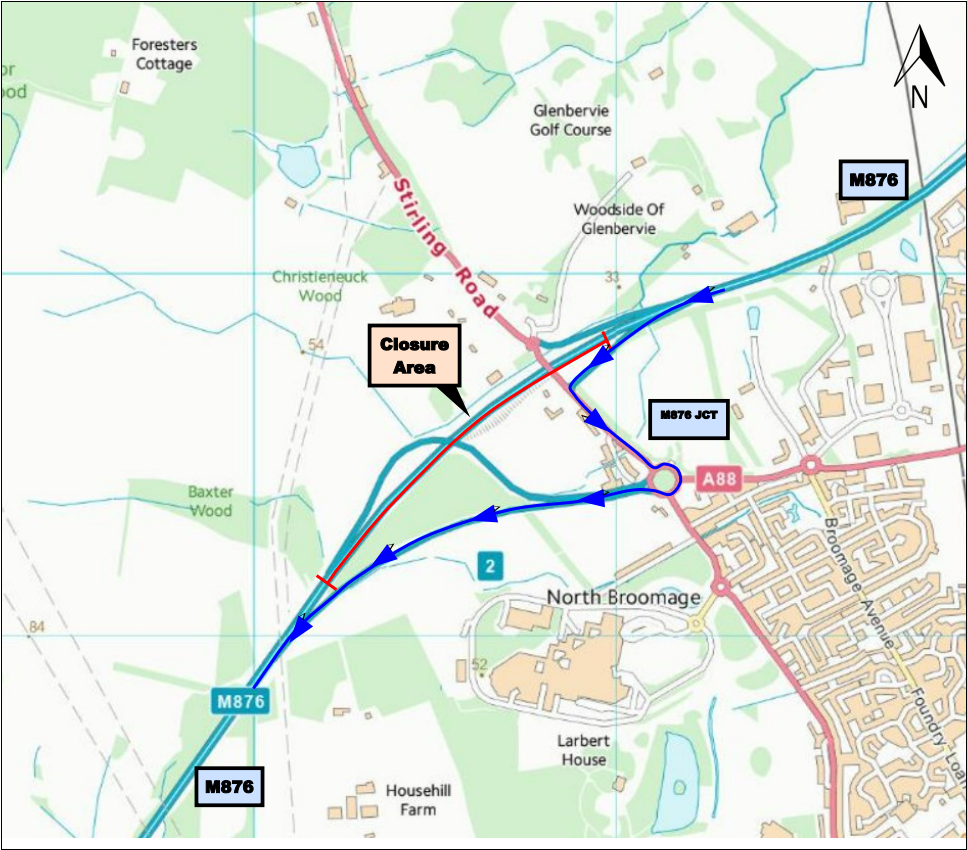

M62 Manchester To Warrington Westbound Resurfacing Works And Road Closure Details

May 24, 2025

M62 Manchester To Warrington Westbound Resurfacing Works And Road Closure Details

May 24, 2025 -

Planned M62 Westbound Closure For Resurfacing Impact On Drivers From Manchester To Warrington

May 24, 2025

Planned M62 Westbound Closure For Resurfacing Impact On Drivers From Manchester To Warrington

May 24, 2025 -

M56 Traffic Delays Live Updates Following Serious Collision

May 24, 2025

M56 Traffic Delays Live Updates Following Serious Collision

May 24, 2025 -

M62 Westbound Closure Manchester To Warrington Resurfacing Works

May 24, 2025

M62 Westbound Closure Manchester To Warrington Resurfacing Works

May 24, 2025 -

M56 Motorway Closure Serious Crash Causes Major Delays Live Updates

May 24, 2025

M56 Motorway Closure Serious Crash Causes Major Delays Live Updates

May 24, 2025