Net Asset Value (NAV) Explained: Amundi MSCI World Ex-United States UCITS ETF Acc

Table of Contents

How NAV is Calculated for the Amundi MSCI World ex-United States UCITS ETF Acc

The Net Asset Value (NAV) of the Amundi MSCI World ex-United States UCITS ETF Acc represents the net asset value per share. It's a crucial indicator of the ETF's underlying value. The calculation process is fairly straightforward, although the fund manager handles the complexities of valuing diverse assets. Here's a breakdown of the Amundi ETF NAV calculation:

-

Market Value of All Assets: This is the sum of the current market prices of all the securities held within the ETF. This includes stocks, bonds, and other assets, weighted by their respective holdings within the portfolio. The fund manager uses real-time market data to ensure accuracy.

-

Less: Liabilities: This deduction encompasses all the ETF's outstanding liabilities, such as management fees, administrative expenses, and any other payable obligations.

-

Less: Expenses: Further deductions include the daily operational costs of running the ETF, including transaction fees and other operational expenses.

-

Equals: Net Asset Value (NAV): The final figure represents the total net asset value of the ETF. This figure is then divided by the total number of outstanding shares to determine the NAV per share. This is the Amundi ETF NAV you see reported.

The fund manager plays a critical role in determining the NAV, employing sophisticated valuation models and utilizing up-to-the-minute market data for accurate calculation.

Factors Affecting the NAV of the Amundi MSCI World ex-United States UCITS ETF Acc

Several factors influence the daily NAV of the Amundi MSCI World ex-United States UCITS ETF Acc. Understanding these factors is crucial for informed investment decisions:

-

Market Performance of Underlying Assets (Stocks): The primary driver of NAV fluctuations is the performance of the stocks held within the ETF. A strong performance in the underlying markets leads to an increase in the ETF's NAV, while poor performance results in a decrease. Understanding market trends is key to anticipating NAV changes.

-

Currency Fluctuations: As the ETF invests in companies outside the United States, fluctuations in exchange rates can impact the NAV. Strengthening of the relevant currencies against the base currency will positively affect the NAV, while weakening has the opposite effect. This is particularly important for international ETFs like the Amundi MSCI World ex-United States UCITS ETF Acc.

-

Dividend Payouts: When underlying companies distribute dividends, these are passed on to ETF investors. While the dividend itself increases investor wealth, the NAV will typically decrease slightly following the ex-dividend date. This reflects the distribution of assets.

-

Changes in ETF Holdings: The fund manager might rebalance the ETF's portfolio, buying or selling assets to maintain its investment strategy. These transactions can affect the NAV, reflecting the changes in asset composition.

Importance of NAV for Amundi MSCI World ex-United States UCITS ETF Acc Investors

For investors in the Amundi MSCI World ex-United States UCITS ETF Acc, understanding NAV is paramount for several reasons:

-

Tracking Investment Returns: The NAV serves as the primary benchmark for tracking your investment performance. Comparing the NAV at the time of purchase with the current NAV provides a clear picture of your returns, excluding trading costs.

-

Price Discovery Mechanism: While the actual trading price of the ETF may deviate slightly from the NAV due to supply and demand, the NAV provides a fair valuation of the ETF's underlying assets. It's the price you would realistically receive if you were to redeem your shares.

-

Valuation Tool: The NAV allows investors to assess the intrinsic value of their investment. Comparing the NAV to the market price helps you identify potential buying or selling opportunities. A significant divergence might indicate arbitrage opportunities or market inefficiencies.

-

Informed Investment Choices: By regularly monitoring the NAV and understanding the factors that affect it, you can make more informed investment decisions. This includes timing your buy and sell orders strategically to maximize your returns.

Where to Find the NAV of the Amundi MSCI World ex-United States UCITS ETF Acc

The daily NAV of the Amundi MSCI World ex-United States UCITS ETF Acc is readily accessible through several channels:

-

Amundi's Website: The official Amundi website usually provides the most up-to-date NAV information.

-

Financial News Sources: Reputable financial news websites and data providers will typically publish the NAV for this and other ETFs.

-

Brokerage Platforms: Your brokerage account will display the current NAV of all your holdings, including the Amundi MSCI World ex-United States UCITS ETF Acc.

The NAV is typically updated daily, usually at the close of the relevant market. However, be aware that there might be minor delays in reporting, depending on the data source.

Conclusion: Mastering Net Asset Value (NAV) for Your Amundi MSCI World ex-United States UCITS ETF Acc Investment

Understanding Net Asset Value (NAV) is crucial for informed investment in the Amundi MSCI World ex-United States UCITS ETF Acc. We've explored how NAV is calculated, the factors impacting it, and its importance in tracking performance and making investment decisions. Remember to regularly monitor your ETF's NAV, considering market fluctuations, currency exchange rates, and dividend payouts. Stay informed about your NAV and make data-driven investment decisions!

Featured Posts

-

Biffy Clyro Blossoms And Jorja Smith Confirmed For Bbc Radio 1 Big Weekend

May 24, 2025

Biffy Clyro Blossoms And Jorja Smith Confirmed For Bbc Radio 1 Big Weekend

May 24, 2025 -

Alshrtt Alalmanyt Wmdahmat Almshjeyn Alkhlfyt Walasbab

May 24, 2025

Alshrtt Alalmanyt Wmdahmat Almshjeyn Alkhlfyt Walasbab

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Net Asset Value Nav Explained

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Net Asset Value Nav Explained

May 24, 2025 -

Finding Your Dream Home In The Countryside Budget Friendly Options Under 1 Million

May 24, 2025

Finding Your Dream Home In The Countryside Budget Friendly Options Under 1 Million

May 24, 2025 -

Porsche 956 Muezede Tavan Sergisi Neden

May 24, 2025

Porsche 956 Muezede Tavan Sergisi Neden

May 24, 2025

Latest Posts

-

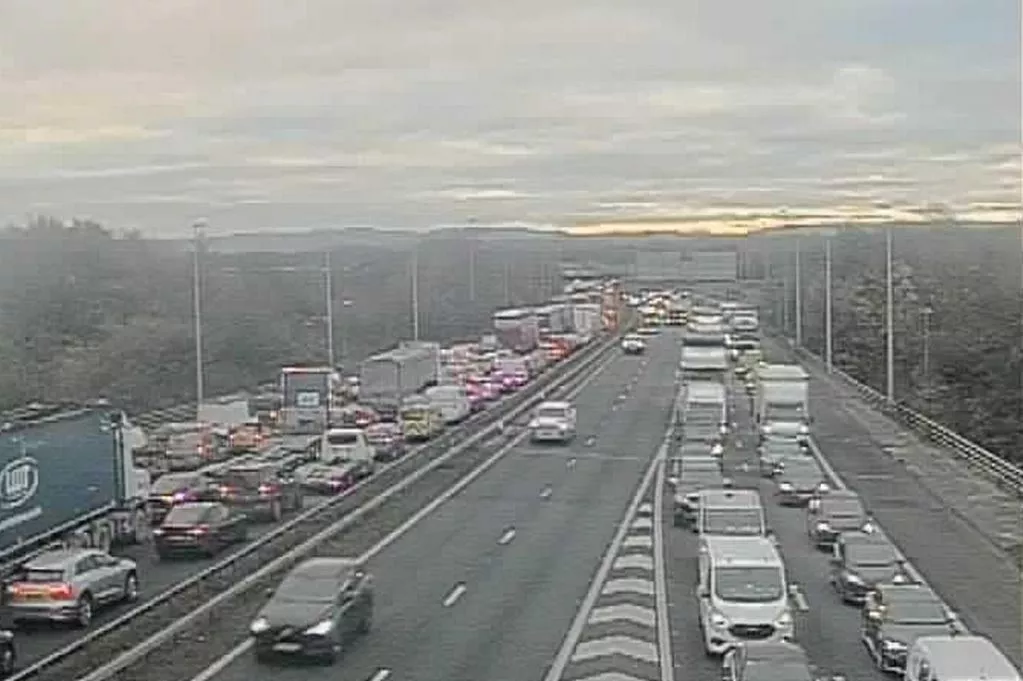

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025 -

M62 Westbound Roadworks Resurfacing Project Between Manchester And Warrington

May 24, 2025

M62 Westbound Roadworks Resurfacing Project Between Manchester And Warrington

May 24, 2025 -

Bury And The M62 Relief Road A Look At What Could Have Been

May 24, 2025

Bury And The M62 Relief Road A Look At What Could Have Been

May 24, 2025 -

M56 Motorway Crash Car Overturns Paramedics Treat Casualty

May 24, 2025

M56 Motorway Crash Car Overturns Paramedics Treat Casualty

May 24, 2025 -

Emergency Services Respond To Major Crash Patient Taken To Hospital

May 24, 2025

Emergency Services Respond To Major Crash Patient Taken To Hospital

May 24, 2025