Finding Your Dream Home In The Countryside: Budget-Friendly Options Under £1 Million

Table of Contents

Strategic Location Choices for Budget-Conscious Buyers

Finding affordable countryside properties requires a strategic approach to location. Focusing on less-competitive areas can unlock significant savings without compromising on charm and lifestyle.

Exploring Less Popular Regions

More sought-after areas like Cotswolds or parts of Surrey often command premium prices. However, exploring less popular regions can yield incredible value. Consider areas of Wales, particularly parts of West Wales or mid-Wales, which offer stunning scenery and lower property prices compared to their more popular counterparts. Similarly, certain regions of Northern England, such as the Yorkshire Dales or Northumberland, present excellent opportunities for budget-conscious buyers.

- Lower property prices: These regions generally offer significantly lower property prices per square foot.

- Future appreciation potential: As these areas gain popularity, property values may appreciate over time.

- Access to amenities: While not as densely packed as city centers, many villages offer essential amenities like shops, pubs, and schools.

- Proximity to transport links: Although travel times may be longer, improved road and rail networks are often available, making commuting more manageable.

Considering Villages vs. Isolated Properties

The choice between village life and an isolated property significantly impacts lifestyle and budget.

-

Village Life Benefits:

- Strong sense of community: Enjoy a close-knit community with regular social events and friendly neighbors.

- Access to amenities: Proximity to local shops, pubs, schools, and other essential services.

- Enhanced safety and security: A more populated area generally offers increased security.

-

Isolated Property Benefits:

- Uninterrupted privacy and tranquility: Enjoy the peace and quiet of your own private space.

- Larger plots of land: Benefit from extensive gardens, potentially with room for development or outdoor pursuits.

- Breathtaking views: Isolated properties often offer unparalleled scenic views.

-

Costs: Isolated properties may require more maintenance and incur higher utility bills due to greater distances from essential services. Commuting from isolated locations can also be time-consuming and expensive.

The Importance of Commute Considerations

If you work in a city, commuting time and cost must be carefully considered.

- Impact on lifestyle: Long commutes can drastically reduce leisure time and impact overall quality of life.

- Potential for remote working: Consider whether your job allows for remote work, reducing or eliminating commute needs.

- Cost of daily travel: Factor in fuel costs, train fares, or toll charges into your budget.

Types of Properties Offering Great Value Under £1 Million

Finding your dream countryside home under £1 million requires considering different property types that offer great value.

Renovation Projects

Purchasing a fixer-upper can significantly increase your purchasing power. A property requiring renovation may be cheaper upfront, allowing you to acquire a larger property or more land within your budget.

- Cost of renovation: Accurately estimate renovation costs, including labor, materials, and professional fees.

- Potential savings: Carefully compare the cost of renovation versus buying a ready-to-move-in property of comparable size and location.

- Essential checks: Engage a qualified surveyor to identify any structural issues and obtain necessary planning permissions before purchasing.

Smaller Properties with Character

Charming cottages or smaller properties often offer unique character and charm, providing a cozy and affordable entry point to rural living.

- Focus on charm and features: Prioritize features like period details, fireplaces, and original features over sheer size.

- Potential for extensions: Explore the possibility of extending the property in the future to increase living space.

- Lower running costs: Smaller properties generally have lower utility bills and maintenance costs compared to larger ones.

Properties with Land

Even a smaller house situated on a generous plot of land can offer significant advantages.

- Benefits of having land: Enjoy ample outdoor space for gardening, recreation, or potential future development.

- Potential for future expansion: The land provides room for extensions or outbuildings.

- Increased property value: Properties with land generally appreciate in value more readily than those without.

Smart Financial Strategies for Buying Your Countryside Home

Securing your dream countryside home requires careful financial planning and strategic decision-making.

Securing a Mortgage

Securing a suitable mortgage is crucial. Rural properties may present unique challenges for lenders, so early preparation is key.

- Types of mortgages: Research different mortgage types, including fixed-rate, variable-rate, and interest-only mortgages.

- Comparing interest rates: Shop around and compare offers from various lenders to secure the best interest rate.

- Importance of a good credit score: A high credit score improves your chances of securing a favorable mortgage deal.

- Lender considerations: Understand the factors lenders consider when assessing rural property applications, such as location, property condition, and potential rental income.

Saving for a Deposit

A substantial deposit is often required for a mortgage. Diligent saving is essential.

- Savings plans: Explore different savings plans and strategies to maximize your savings.

- Deposit requirements: Understand the deposit requirements of different lenders and aim to exceed the minimum.

- Help to Buy scheme: If eligible, consider utilizing government-backed schemes like Help to Buy to reduce the deposit needed.

- Shared ownership schemes: Explore shared ownership options to reduce the initial purchase cost.

Budgeting for Ongoing Costs

Beyond the purchase price, factor in all ongoing costs associated with owning a countryside home.

- Typical running costs: Estimate yearly costs for property taxes (Council Tax), utilities (water, electricity, gas), maintenance, and insurance.

- Unexpected maintenance expenses: Set aside a contingency fund for unexpected repairs and improvements.

- Commuting costs: Include the cost of commuting in your budget if you work in a city.

Conclusion

Finding your dream home in the countryside under £1 million is achievable with careful planning and strategic decision-making. By focusing on less popular locations, exploring different property types, and implementing smart financial strategies, you can significantly increase your chances of securing your idyllic rural retreat. Don't delay your countryside dreams – start your search for a budget-friendly home today! Begin your journey to finding your perfect countryside home under £1 million by researching the areas discussed and contacting local estate agents. Remember to carefully consider your budget, commute, and desired property features. Start your search now and find the perfect countryside escape!

Featured Posts

-

Escape To The Country Top Destinations For A Country Lifestyle

May 24, 2025

Escape To The Country Top Destinations For A Country Lifestyle

May 24, 2025 -

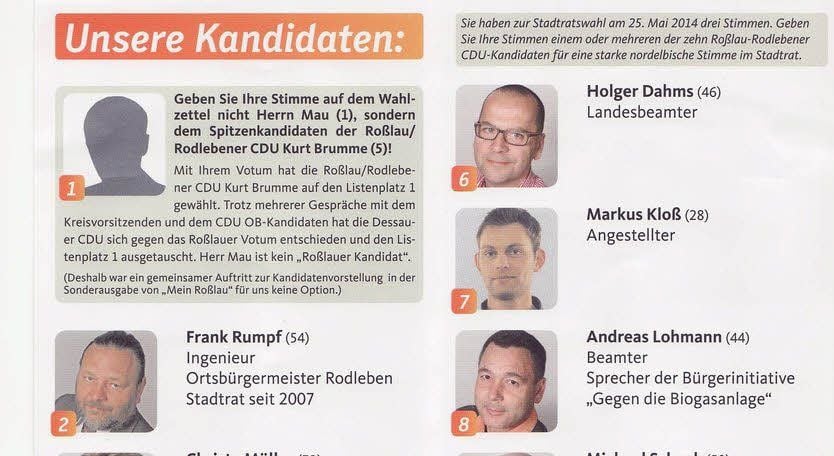

Die Essener Leistungstraeger Golz Und Brumme Karriere Und Erfolge

May 24, 2025

Die Essener Leistungstraeger Golz Und Brumme Karriere Und Erfolge

May 24, 2025 -

Dax Rises Again Frankfurt Equities Market Update

May 24, 2025

Dax Rises Again Frankfurt Equities Market Update

May 24, 2025 -

Porsche Now Labubu Porsche

May 24, 2025

Porsche Now Labubu Porsche

May 24, 2025 -

Glastonbury 2024 Unofficial Lineup Leak Points To Us Band

May 24, 2025

Glastonbury 2024 Unofficial Lineup Leak Points To Us Band

May 24, 2025

Latest Posts

-

Amundi Dow Jones Industrial Average Ucits Etf Nav A Comprehensive Guide

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Nav A Comprehensive Guide

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Distributing A Guide To Net Asset Value

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Distributing A Guide To Net Asset Value

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav And What It Means For Investors

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav And What It Means For Investors

May 24, 2025 -

The Underappreciated Potential Of News Corps Business Units

May 24, 2025

The Underappreciated Potential Of News Corps Business Units

May 24, 2025 -

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025