Amundi Dow Jones Industrial Average UCITS ETF (Distributing): A Guide To Net Asset Value

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the intrinsic value of a single share in an ETF. It's a crucial metric reflecting the underlying asset value of the fund. Think of it as the true worth of the ETF's holdings. The NAV is calculated daily, typically at the close of the market, using a straightforward formula:

NAV = (Total Assets - Total Liabilities) / Number of Outstanding Shares

- NAV represents the intrinsic value of each share. This means it reflects the net worth of the assets the ETF holds, after accounting for any liabilities.

- It's a key indicator of the ETF's performance. Changes in NAV directly reflect the overall performance of the underlying assets.

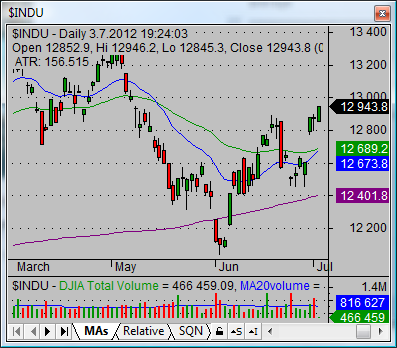

- Fluctuations in NAV reflect changes in the value of the underlying assets (Dow Jones Industrial Average components). If the Dow Jones Industrial Average rises, the NAV of the Amundi Dow Jones Industrial Average UCITS ETF will generally also rise.

NAV and the Amundi Dow Jones Industrial Average UCITS ETF (Distributing): A Closer Look

The Amundi Dow Jones Industrial Average UCITS ETF (Distributing) aims to replicate the performance of the Dow Jones Industrial Average. This investment strategy directly impacts its NAV. The ETF likely employs a full replication methodology, meaning it holds all 30 components of the index in roughly the same proportions as their weighting in the index. This close tracking ensures that the NAV closely mirrors the index's performance.

- The ETF aims to replicate the Dow Jones Industrial Average, so NAV movements closely mirror index performance. This makes the NAV a reliable indicator of how well the ETF is tracking its benchmark.

- Distributions (dividends from the underlying stocks) affect the NAV, typically reducing it on the ex-dividend date. When the ETF distributes dividends, the NAV will decrease because the fund's assets have reduced.

- Understanding the expense ratio and its subtle effect on NAV. The expense ratio, while small, represents the fund's operating costs. These costs are deducted from the fund's assets and therefore subtly affect the NAV over time.

How to Find the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Finding the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Several reliable sources provide this information:

- Amundi's official website is the primary source for accurate NAV data. Check their investor relations or ETF specific pages.

- Many financial websites and brokerage accounts will provide this information. Major financial news providers and your brokerage platform will usually display the current NAV.

- Pay attention to the date and time of the NAV calculation. Ensure you're comparing NAV figures calculated at the same time each day for consistency. Slight variations might exist between data providers due to timing differences.

Using NAV to Make Informed Investment Decisions

While the NAV is crucial, it's best used in conjunction with other metrics. Comparing the NAV to the ETF's market price is particularly insightful.

- A significant difference between NAV and market price might signal an arbitrage opportunity (but requires careful consideration). A large discrepancy might present a trading opportunity, but it's crucial to understand the associated risks.

- Consistent NAV growth indicates positive performance of the underlying index. Monitoring NAV trends over time reveals the long-term performance of the ETF.

- Combine NAV analysis with broader market research for informed decisions. Consider factors like overall market conditions, economic indicators, and the performance of competing ETFs before making investment decisions.

Conclusion

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is crucial for successful investing. By regularly monitoring the NAV and understanding its relationship to the ETF's market price and the performance of the Dow Jones Industrial Average, you can make better-informed decisions. Remember to consult the official Amundi website and other reliable financial sources for accurate and up-to-date NAV information. Start monitoring the Amundi Dow Jones Industrial Average UCITS ETF NAV today to optimize your investment strategy.

Featured Posts

-

8 Stock Market Gain On Euronext Amsterdam After Trumps Tariff Announcement

May 24, 2025

8 Stock Market Gain On Euronext Amsterdam After Trumps Tariff Announcement

May 24, 2025 -

Interpreting The Net Asset Value Of Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Interpreting The Net Asset Value Of Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Dazi Trump 20 Impatto Sul Settore Moda

May 24, 2025

Dazi Trump 20 Impatto Sul Settore Moda

May 24, 2025 -

Dog Walker Confrontation Kyle And Teddis Fiery Exchange

May 24, 2025

Dog Walker Confrontation Kyle And Teddis Fiery Exchange

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Net Asset Value Nav Explained

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Net Asset Value Nav Explained

May 24, 2025

Latest Posts

-

Apple Stock Price Drops On 900 Million Tariff Announcement

May 24, 2025

Apple Stock Price Drops On 900 Million Tariff Announcement

May 24, 2025 -

Apple Stock Suffers Setback Amidst 900 Million Tariff Projection

May 24, 2025

Apple Stock Suffers Setback Amidst 900 Million Tariff Projection

May 24, 2025 -

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025 -

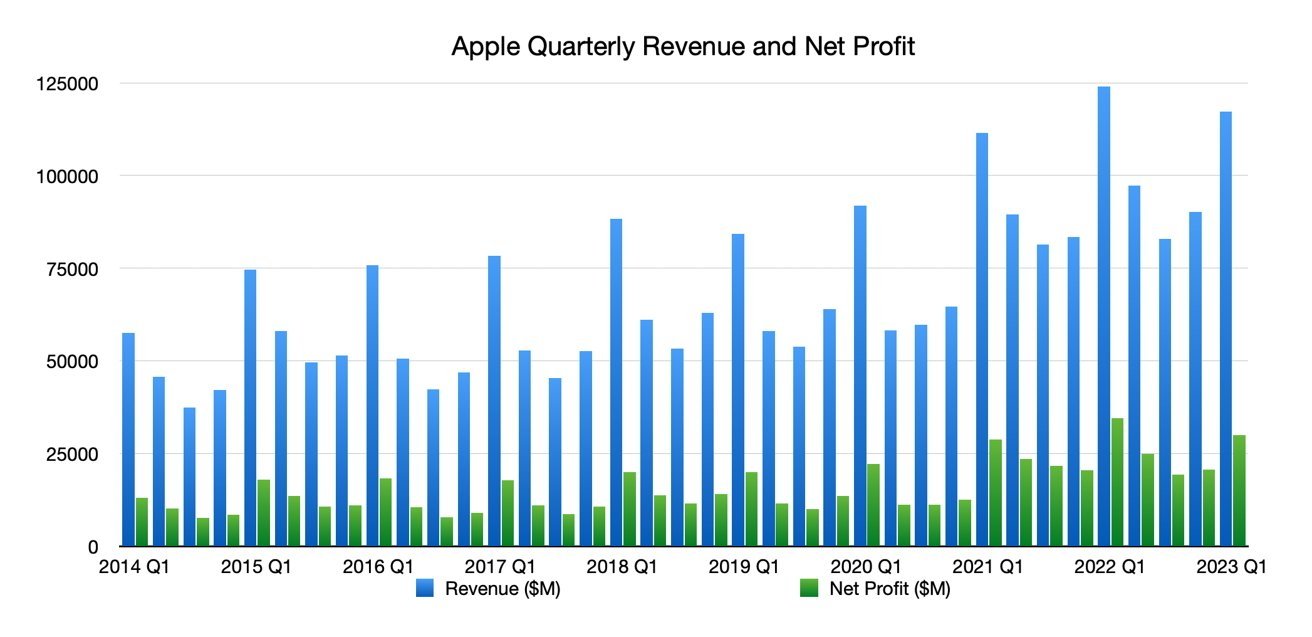

Investing In Apple Stock A Look At Q2 Financial Performance

May 24, 2025

Investing In Apple Stock A Look At Q2 Financial Performance

May 24, 2025 -

Apple Stock Analysis Q2 Results And Future Outlook

May 24, 2025

Apple Stock Analysis Q2 Results And Future Outlook

May 24, 2025