Interpreting The Net Asset Value Of Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV)?

NAV represents the net value of an ETF's underlying assets, calculated by subtracting liabilities from the total asset value and dividing by the number of outstanding shares. It essentially shows the intrinsic value of each share. The ETF's share price closely tracks its NAV, though minor discrepancies can occur due to market forces.

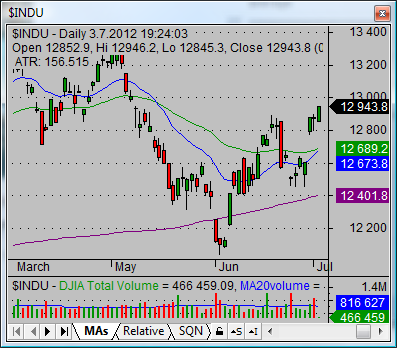

The Amundi Dow Jones Industrial Average UCITS ETF is designed to track the performance of the Dow Jones Industrial Average, a benchmark index of 30 large, publicly-owned companies in the United States. This makes it an attractive option for investors seeking broad exposure to the US blue-chip market. The target investor is generally someone seeking diversified exposure to large-cap US equities and looking for a relatively low-cost investment option.

This article aims to provide investors with a comprehensive understanding of how to interpret the NAV of the Amundi Dow Jones Industrial Average UCITS ETF.

Factors Affecting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF. Understanding these factors is crucial for interpreting NAV movements accurately.

-

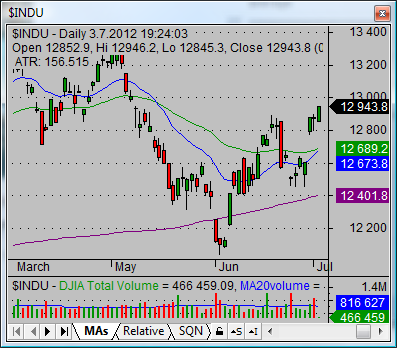

Performance of the Dow Jones Industrial Average: The primary driver of the ETF's NAV is the performance of the underlying Dow Jones Industrial Average. An increase in the index's value generally leads to a rise in the ETF's NAV, while a decline in the index results in a decrease in the NAV. This direct correlation makes it easy to understand the NAV's movement in relation to broader market trends.

-

Currency Fluctuations: For investors outside the United States, currency fluctuations between the US dollar (USD) and their local currency can significantly impact the NAV. If the USD strengthens against the investor's currency, the NAV (when converted to the investor's currency) will appear lower, even if the underlying assets have not changed in USD value. Conversely, a weakening USD will increase the NAV in the investor's local currency.

-

Management Fees and Expenses: The ETF incurs expenses, including management fees, which are deducted from the assets under management. These expenses reduce the overall value available for distribution to shareholders, slightly impacting the NAV over time.

Bullet Points:

- Daily changes in the Dow Jones Industrial Average directly impact the NAV.

- Exchange rate fluctuations (USD to the investor's currency) affect the NAV for international investors.

- Accrual of management fees gradually reduces the NAV.

- Dividend distributions from the underlying companies affect the NAV; a dividend payout will generally cause a slight decrease in NAV on the ex-dividend date, as the cash is distributed.

Where to Find the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Accessing real-time and historical NAV data for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Several reliable sources provide this information:

-

Amundi's Official Website: The ETF provider's website is the primary source for accurate and up-to-date NAV information. You'll typically find this data within the ETF's fact sheet or dedicated page.

-

Financial News Websites and Data Providers: Major financial news websites and data providers (like Bloomberg, Refinitiv, Google Finance, Yahoo Finance etc.) usually offer real-time and historical NAV data for various ETFs, including the Amundi Dow Jones Industrial Average UCITS ETF.

-

Your Brokerage Account: Your brokerage account platform will display the NAV of your holdings, including the Amundi Dow Jones Industrial Average UCITS ETF, providing a convenient way to monitor your investment's performance.

Bullet Points:

- Amundi's official website provides the most authoritative NAV data.

- Major financial data providers offer real-time and historical NAV information.

- Your brokerage account displays the NAV of your ETF holdings.

Interpreting NAV Changes and Their Implications for Investors

Interpreting NAV changes is crucial for understanding your investment's performance.

-

Positive NAV Change: A positive change signifies growth in the underlying assets, reflecting positive performance of the Dow Jones Industrial Average.

-

Negative NAV Change: A negative change indicates a decline in the underlying assets' value, likely mirroring a downturn in the Dow Jones Industrial Average.

-

NAV vs. Share Price: While the NAV and share price should closely track each other, slight discrepancies may occur due to trading volume and market supply/demand. This difference is known as tracking error. For sophisticated investors, significant deviations might present arbitrage opportunities, but this requires advanced trading strategies.

-

Long-Term Perspective: It's crucial to consider NAV changes within a long-term context, as short-term fluctuations are normal for any investment.

Bullet Points:

- Positive NAV change reflects growth in the underlying assets.

- Negative NAV change suggests a decline in the underlying assets' value.

- Discrepancies between NAV and share price can be due to market dynamics; large discrepancies may represent potential arbitrage opportunities for experienced traders.

- Focus on long-term trends when evaluating NAV fluctuations.

Using NAV to Make Informed Investment Decisions with the Amundi Dow Jones Industrial Average UCITS ETF

Understanding the NAV allows for more informed investment decisions.

-

Performance Monitoring: Regularly reviewing the NAV helps track your investment's performance over time.

-

Buy/Sell Decisions: The NAV is only one factor to consider when deciding to buy or sell. Risk tolerance, investment goals, and overall market conditions should be part of a comprehensive investment strategy.

-

Comparative Analysis: Comparing the Amundi Dow Jones Industrial Average UCITS ETF's NAV to other similar ETFs, like other Dow Jones Industrial Average trackers, helps assess relative performance and fees.

Bullet Points:

- Regularly review the NAV to track portfolio performance.

- Consider rebalancing strategies based on NAV movements and overall portfolio allocation.

- Compare the NAV with other index-tracking ETFs to assess relative performance.

- Consult with a financial advisor for personalized investment advice.

Conclusion: Mastering the Net Asset Value of Your Amundi Dow Jones Industrial Average UCITS ETF Investment

Understanding and interpreting the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is essential for successful investing. By understanding the factors influencing NAV, knowing where to find accurate data, and interpreting changes correctly, investors can monitor performance, make informed buy/sell decisions, and compare this ETF against others in the market. Actively monitoring the NAV and using it in conjunction with broader market analysis is vital. To further enhance your understanding of interpreting Amundi ETF NAVs, consider conducting additional research or consulting with a financial advisor specializing in ETF investing and Amundi Dow Jones Industrial Average UCITS ETF NAV analysis.

Featured Posts

-

Kyle And Teddis Explosive Dog Walker Argument

May 24, 2025

Kyle And Teddis Explosive Dog Walker Argument

May 24, 2025 -

Buffetts Apple Bet A Deep Dive Into Tariff Related Risks And Rewards

May 24, 2025

Buffetts Apple Bet A Deep Dive Into Tariff Related Risks And Rewards

May 24, 2025 -

Live Pedestrian Hit By Vehicle On Princess Road Emergency Services Respond

May 24, 2025

Live Pedestrian Hit By Vehicle On Princess Road Emergency Services Respond

May 24, 2025 -

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 24, 2025

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 24, 2025 -

Ferrari Nappasi 13 Vuotiaan Lupauksen Nimi Muistiin

May 24, 2025

Ferrari Nappasi 13 Vuotiaan Lupauksen Nimi Muistiin

May 24, 2025

Latest Posts

-

Apple Stock Q2 Earnings Preview Key Levels And Potential Movement

May 24, 2025

Apple Stock Q2 Earnings Preview Key Levels And Potential Movement

May 24, 2025 -

Apple Price Target Lowered But Is Wedbush Right To Remain Bullish

May 24, 2025

Apple Price Target Lowered But Is Wedbush Right To Remain Bullish

May 24, 2025 -

Mia Farrow Michael Caine And A Shocking Film Set Visit The Untold Story

May 24, 2025

Mia Farrow Michael Caine And A Shocking Film Set Visit The Untold Story

May 24, 2025 -

Apple Stock Aapl Price Targets Key Levels And Technical Analysis

May 24, 2025

Apple Stock Aapl Price Targets Key Levels And Technical Analysis

May 24, 2025 -

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025