Apple Stock (AAPL) Price Targets: Key Levels And Technical Analysis

Table of Contents

Understanding Current Market Sentiment for AAPL

Analyzing the current market sentiment surrounding AAPL is paramount to predicting its price movements. This involves examining recent news, events, and the overall investor attitude.

Recent News and Events Impacting Apple Stock:

Apple's stock price is highly sensitive to various factors. Recent news and events significantly influence investor confidence and, consequently, the stock's price.

- New Product Launches: The release of the iPhone 15 series, along with new Apple Watches and AirPods, generally impacts investor sentiment positively, reflecting on future revenue projections. Positive reviews and strong initial sales figures often translate to increased share prices. Conversely, any negative reception could exert downward pressure.

- Financial Reports: Apple's quarterly earnings reports, including earnings per share (EPS) and revenue growth figures, are closely scrutinized by investors. Beating analyst expectations usually leads to positive price movements, while disappointing results can trigger significant sell-offs. For example, a decrease in iPhone sales or unexpected supply chain issues could negatively affect the AAPL stock forecast.

- Macroeconomic Factors: Global economic conditions, such as interest rate hikes or recessionary fears, can also impact Apple's stock price. These broader macroeconomic forces can influence consumer spending and, ultimately, Apple's sales.

Analyzing Investor Sentiment:

Gauging investor sentiment provides valuable insights into the market's perception of AAPL's prospects.

- Analyst Ratings: A majority of analysts currently hold a "buy" or "overweight" rating on AAPL, suggesting positive long-term expectations. However, it's crucial to consider the diversity of opinions and the rationale behind each rating.

- Social Media Sentiment: Monitoring social media platforms can offer a real-time gauge of public opinion on Apple. A predominantly positive sentiment often correlates with rising prices, while a negative trend might suggest potential downward pressure.

- Market Trends: The overall market trend plays a significant role. A bullish market typically supports higher AAPL stock prices, while a bearish market can lead to declines even for strong performers like Apple.

Key Support and Resistance Levels for AAPL

Identifying key support and resistance levels is crucial in technical analysis for predicting potential price movements.

Identifying Support Levels:

Support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further declines.

- Chart Illustration: [Insert chart showing AAPL stock price with key support levels clearly marked, e.g., $150, $140]. These levels often correspond to previous price lows or significant psychological barriers.

- Bounce-Back Scenarios: If the AAPL stock price approaches a support level, investors often anticipate a bounce back as buyers step in, potentially leading to a short-term price increase.

Identifying Resistance Levels:

Resistance levels represent price points where selling pressure is likely to dominate, hindering further price increases.

- Chart Illustration: [Insert chart showing AAPL stock price with key resistance levels clearly marked, e.g., $180, $190]. These levels often represent previous price highs or significant psychological barriers.

- Implications of Failure to Break Through: If the price fails to break through a resistance level, it may signal a temporary halt in the upward trend, potentially leading to a price correction or consolidation.

Moving Averages and Trendlines:

Moving averages (e.g., 50-day, 200-day) and trendlines provide additional insights into price trends.

- Chart Illustration: [Insert chart displaying AAPL stock price with 50-day and 200-day moving averages and a clear trendline].

- Predicting Future Movements: The interaction between the price, moving averages, and trendlines can offer clues about potential future price directions. For example, a price crossing above the 200-day moving average is often considered a bullish signal.

Apple Stock Price Target Predictions from Analysts

Consolidating analyst forecasts provides a valuable perspective on the potential price range for AAPL.

Consolidating Analyst Forecasts:

Numerous financial analysts offer price targets for Apple stock. The following table summarizes their predictions:

| Analyst | Price Target (USD) | Rationale |

|---|---|---|

| Analyst A | 175 | Strong iPhone sales and new product launches |

| Analyst B | 200 | Expectation of increased market share |

| Analyst C | 160 | Concerns about macroeconomic headwinds |

| Average | 178.33 |

Disclaimer: Stock price predictions are inherently uncertain and should not be considered financial advice.

Comparing Analyst Predictions with Technical Analysis:

Comparing analyst forecasts with the technical analysis performed earlier helps to refine the outlook for AAPL.

- Convergence and Divergence: A convergence between analyst predictions and technical analysis strengthens the confidence in the forecast. Divergence requires further investigation to understand the underlying reasons.

- Discrepancies and Explanations: Discrepancies might stem from differing assumptions about future growth, market conditions, or the impact of specific events.

Conclusion

This analysis of Apple Stock (AAPL) price targets, combining technical analysis with analyst forecasts, provides a comprehensive view of the potential price range. Key support levels around $150 and $140, and resistance levels around $180 and $190, have been identified. Analyst predictions suggest a price range between $160 and $200, with an average target around $178.33. However, it's crucial to remember that these are predictions, and the actual price may deviate.

Call to Action: Before making any investment decisions, conduct thorough research and consider your own risk tolerance and investment strategy. This analysis should serve as one input among many in your decision-making process. Further reading on Apple stock (AAPL) price targets and technical analysis can enhance your understanding and help you refine your investment strategy accordingly. Stay informed on the latest developments impacting Apple Stock (AAPL) price targets and refine your investment strategy accordingly.

Featured Posts

-

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Cyberattack To Cost Marks And Spencer 300 Million Full Impact Assessment

May 24, 2025

Cyberattack To Cost Marks And Spencer 300 Million Full Impact Assessment

May 24, 2025 -

Escape To The Country Top Locations For A Tranquil Life

May 24, 2025

Escape To The Country Top Locations For A Tranquil Life

May 24, 2025 -

Porsche 356 Riwayat Produksi Dan Warisan Pabrik Zuffenhausen Jerman

May 24, 2025

Porsche 356 Riwayat Produksi Dan Warisan Pabrik Zuffenhausen Jerman

May 24, 2025 -

Revised Agenda For Philips 2025 Annual General Meeting Of Shareholders

May 24, 2025

Revised Agenda For Philips 2025 Annual General Meeting Of Shareholders

May 24, 2025

Latest Posts

-

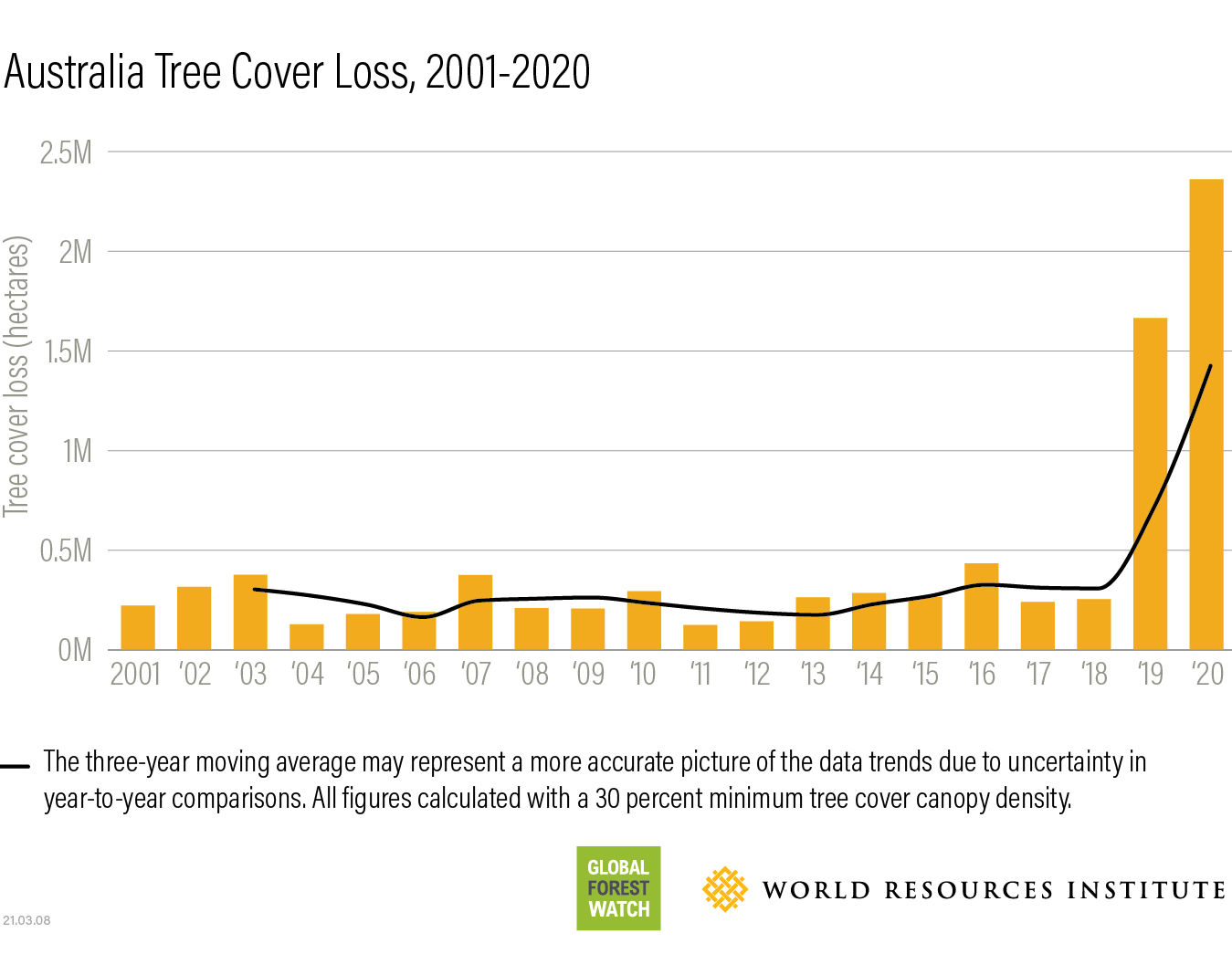

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025 -

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025 -

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025 -

Global Forest Loss Reaches Record High Wildfires Fuel The Destruction

May 24, 2025

Global Forest Loss Reaches Record High Wildfires Fuel The Destruction

May 24, 2025 -

The China Factor Analyzing The Struggles Of Bmw Porsche And Other Auto Brands

May 24, 2025

The China Factor Analyzing The Struggles Of Bmw Porsche And Other Auto Brands

May 24, 2025