Net Asset Value (NAV) Explained: Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Table of Contents

Calculating the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF

The Net Asset Value (NAV) of an ETF like the Amundi Dow Jones Industrial Average UCITS ETF represents the net value of its underlying assets per share. Calculating the NAV is a straightforward process, though the underlying calculations are handled by the fund manager. It essentially boils down to subtracting the fund's liabilities from its assets and then dividing by the number of outstanding shares.

- Assets: This includes the market value of all the stocks comprising the Dow Jones Industrial Average that the ETF holds, along with any cash reserves, bonds, or other assets.

- Liabilities: Liabilities encompass expenses such as management fees, administrative costs, and any outstanding debts.

- Formula: (Total Assets - Total Liabilities) / Number of Outstanding Shares = NAV

The NAV for ETFs like the Amundi Dow Jones Industrial Average UCITS ETF is typically calculated daily, providing investors with a daily snapshot of the fund's net asset value per share. This daily NAV calculation ensures that the price reflects the current value of the underlying holdings. Understanding this NAV calculation is crucial to grasping how the value of your investment changes over time.

Factors Affecting the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors can influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF. These factors affect the value of the underlying assets and therefore impact the overall NAV calculation:

- Market Fluctuations of the Dow Jones Industrial Average: The primary driver of NAV changes is the performance of the Dow Jones Industrial Average itself. If the index rises, the value of the ETF's holdings increases, leading to a higher NAV. Conversely, a decline in the index will result in a lower NAV. This highlights the inherent volatility associated with market-linked investments.

- Dividend Payments from Constituent Companies: When companies within the Dow Jones Industrial Average pay dividends, the ETF receives these payments. These dividends increase the total assets of the fund and, consequently, the NAV. However, this effect is often immediately offset by the distribution of dividends to the ETF's shareholders.

- Expense Ratios and Their Effect on NAV: The ETF's expense ratio (the annual cost of managing the fund) reduces the overall assets and thus the NAV. A higher expense ratio will gradually erode the NAV over time. This is a crucial factor to consider when comparing different ETFs.

- Currency Exchange Rates: Since the Amundi Dow Jones Industrial Average UCITS ETF is a UCITS (Undertakings for Collective Investment in Transferable Securities) ETF, it might be affected by currency exchange rate fluctuations, particularly if the fund's holdings include foreign assets.

NAV vs. Market Price: Understanding the Difference in the Context of the Amundi Dow Jones Industrial Average UCITS ETF

While the NAV represents the intrinsic value of the ETF's holdings, the market price is the price at which the ETF trades on the exchange. These two figures are not always identical. The market price is determined by supply and demand, meaning that it can fluctuate based on investor sentiment and trading volume, even within a single day.

- Market Price: Driven by supply and demand; can deviate from NAV due to trading dynamics.

- NAV: Represents the true underlying value of the ETF's assets per share.

- Premium or Discount to NAV: The market price might trade at a premium (higher than NAV) or discount (lower than NAV) to the NAV. This discrepancy is often short-lived, but it's important to be aware of it.

Using NAV Information to Make Informed Investment Decisions with the Amundi Dow Jones Industrial Average UCITS ETF

Understanding NAV is crucial for making informed investment choices. By monitoring the NAV, investors can:

- Track Long-Term Performance: Consistent monitoring of NAV provides a clear picture of the ETF's performance over time, enabling you to assess its growth against the benchmark Dow Jones Industrial Average.

- Compare Against Benchmark Indices: Comparing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF to the Dow Jones Industrial Average itself allows for performance evaluation against the index it tracks.

- Make Informed Buy-Low/Sell-High Decisions: Although timing the market is tricky, understanding the relationship between NAV and market price can potentially assist in identifying potential buying or selling opportunities.

Conclusion: Mastering Net Asset Value (NAV) for Your Amundi Dow Jones Industrial Average UCITS ETF Investments

Understanding Net Asset Value (NAV) is fundamental for success in ETF investing. This article has outlined how NAV is calculated for the Amundi Dow Jones Industrial Average UCITS ETF (Distributing), the factors that influence it, and how it differs from the market price. By consistently monitoring NAV and understanding its implications, you can make more informed decisions regarding your investments in this popular ETF and others. Gain a deeper understanding of Net Asset Value and make informed investment choices with the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) today!

Featured Posts

-

Sterke Prestaties Relx Ai Biedt Weerstand Tegen Economische Neergang

May 24, 2025

Sterke Prestaties Relx Ai Biedt Weerstand Tegen Economische Neergang

May 24, 2025 -

Experience The World From England Airpark And Alexandria International Airport The Ae Xplore Campaign

May 24, 2025

Experience The World From England Airpark And Alexandria International Airport The Ae Xplore Campaign

May 24, 2025 -

Gucci Supply Chain Shakeup Departure Of Chief Industrial Officer Massimo Vian

May 24, 2025

Gucci Supply Chain Shakeup Departure Of Chief Industrial Officer Massimo Vian

May 24, 2025 -

Your Dream Country Escape Awaits A Step By Step Planning Guide

May 24, 2025

Your Dream Country Escape Awaits A Step By Step Planning Guide

May 24, 2025 -

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 24, 2025

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 24, 2025

Latest Posts

-

Florida Film Festival 2024 Celebrity Sightings Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival 2024 Celebrity Sightings Mia Farrow And Christina Ricci

May 24, 2025 -

Buffetts Apple Bet A Deep Dive Into Tariff Related Risks And Rewards

May 24, 2025

Buffetts Apple Bet A Deep Dive Into Tariff Related Risks And Rewards

May 24, 2025 -

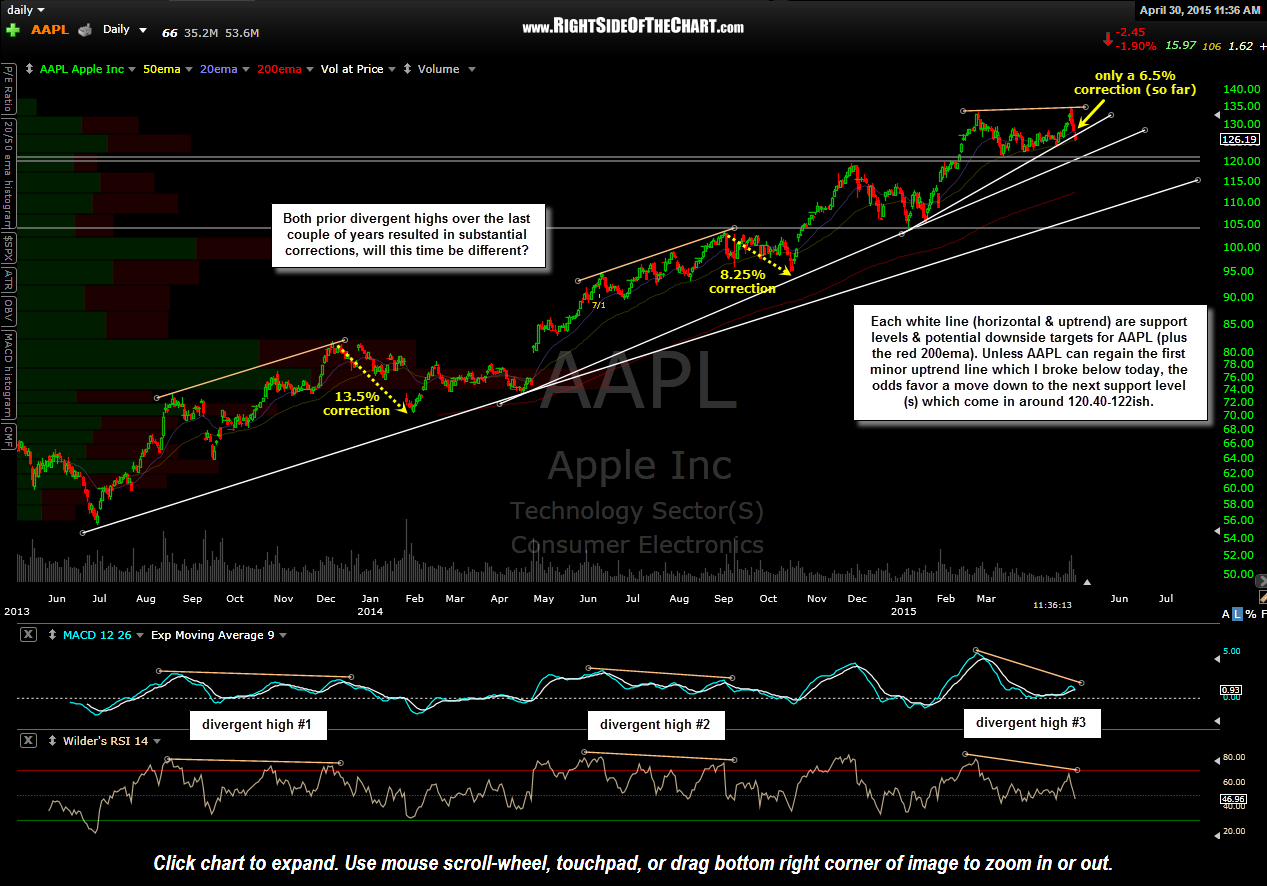

Apple Stock Below Key Support Ahead Of Fiscal Q2 Report

May 24, 2025

Apple Stock Below Key Support Ahead Of Fiscal Q2 Report

May 24, 2025 -

Forecasting Apple Stock Aapl Price Movements Key Levels To Consider

May 24, 2025

Forecasting Apple Stock Aapl Price Movements Key Levels To Consider

May 24, 2025 -

Apple Stock Under Pressure Ahead Of Q2 Results

May 24, 2025

Apple Stock Under Pressure Ahead Of Q2 Results

May 24, 2025