Apple Stock: Below Key Support Ahead Of Fiscal Q2 Report

Table of Contents

Technical Analysis: Breaking Key Support Levels

Technical analysis provides valuable insights into the current state of Apple stock. The recent breach of a key support level, around $[Insert Specific Price Level Here], signals a bearish trend. This level had previously held strong for [Duration], acting as a reliable support for the Apple stock price. This break, coupled with other technical indicators, suggests a potential continuation of the downward movement.

-

Significance of the Broken Support: The breach of this support level is significant because it suggests that the buying pressure previously supporting the stock price has weakened considerably. Historically, this level has marked significant price reversals, making its breach a strong bearish signal.

-

Negative Chart Patterns: The breakdown is further reinforced by [mention specific chart patterns observed, e.g., a bearish engulfing candle, a head and shoulders pattern]. These patterns, visible on the daily and weekly charts, increase the probability of further price declines.

-

Trading Volume: High trading volume accompanying the breakdown confirms the strength of the selling pressure. This indicates that the move is not simply a temporary fluctuation but a potentially significant shift in market sentiment regarding Apple stock. The increased volume suggests a significant number of investors are actively selling their Apple stock holdings.

Macroeconomic Factors Impacting Apple Stock

The recent decline in Apple stock isn't solely attributable to technical factors. Several macroeconomic headwinds are also exerting downward pressure.

-

Inflation and Consumer Spending: High inflation is eroding consumer purchasing power, potentially impacting demand for discretionary items like iPhones and other Apple products. Consumers may postpone purchases or opt for cheaper alternatives, affecting Apple's sales and revenue growth.

-

Rising Interest Rates: Rising interest rates increase borrowing costs for businesses and reduce investor appetite for riskier assets like stocks. This can lead to a decrease in stock valuations, including Apple's. Higher interest rates also make bonds more attractive compared to stocks, potentially diverting investment away from the stock market in general.

-

Recession Fears: Growing concerns about a potential recession further dampen investor sentiment. During economic downturns, consumer spending on electronics typically falls, impacting Apple's revenue and consequently its stock price.

-

Supply Chain Issues: While less prominent currently, lingering supply chain issues can still impact Apple's production capacity and timely delivery of products. Any disruption to the supply chain could negatively affect sales and revenue projections.

Impact of the Strong US Dollar

The strength of the US dollar against other major currencies is another significant factor impacting Apple's stock price. A substantial portion of Apple's revenue comes from international sales. When the dollar strengthens, these international sales translate into fewer US dollars, thus impacting the reported revenue figures. This effect can disproportionately affect earnings growth compared to expectations.

Anticipation of Fiscal Q2 Earnings Report

The upcoming fiscal Q2 earnings report is a critical event for Apple investors. Analyst expectations vary, with some predicting strong performance in certain segments while others express concerns regarding overall growth.

-

iPhone Sales: iPhone sales, historically a cornerstone of Apple's revenue, will be a closely watched metric. Any significant slowdown in iPhone sales could negatively impact overall financial results and investor sentiment.

-

Services Revenue: Apple's Services segment, comprising revenue from app store sales, iCloud, Apple Music, etc., continues to show robust growth. However, even this high-growth segment is susceptible to broader economic pressures.

-

Guidance: The guidance provided by Apple management for the upcoming quarters will be heavily scrutinized. Any indication of reduced expectations for future growth could lead to further downward pressure on Apple's stock price. Investors will be keen to see if Apple’s guidance aligns with Wall Street's expectations.

Investor Sentiment and Market Reaction

The current investor sentiment surrounding Apple stock is cautious, reflecting both the technical weakness and the macroeconomic headwinds. The market's reaction to the Q2 earnings report will largely depend on whether Apple meets or exceeds expectations.

-

Risk Management: In this uncertain environment, investors should employ robust risk management strategies. Diversification, position sizing, and stop-loss orders are crucial tools to mitigate potential losses.

-

Hedging Strategies: Investors concerned about further declines in Apple stock could consider hedging strategies to protect their investments. Options trading can offer a way to manage risk while still maintaining exposure to Apple stock.

Conclusion:

Apple stock is currently facing a confluence of challenges: it's trading below a key support level, macroeconomic headwinds are impacting consumer spending and investor sentiment, and the upcoming Q2 earnings report holds significant uncertainty. The current position of Apple stock below key support ahead of the Q2 report warrants close monitoring. Stay informed about the upcoming earnings announcement and consider adjusting your investment strategy in light of the potential risks and opportunities surrounding Apple stock (AAPL). Conduct thorough research and consider consulting a financial advisor before making any investment decisions related to Apple stock or other similar equities. Remember that this analysis is for informational purposes and doesn't constitute financial advice.

Featured Posts

-

Ecb Faiz Indirimi Ardindan Avrupa Borsalarinda Karisiklik

May 24, 2025

Ecb Faiz Indirimi Ardindan Avrupa Borsalarinda Karisiklik

May 24, 2025 -

Apple Stock Below Key Support Ahead Of Fiscal Q2 Report

May 24, 2025

Apple Stock Below Key Support Ahead Of Fiscal Q2 Report

May 24, 2025 -

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Nasledie Nashego Pokoleniya Uspekhi I Vyzovy Buduschego

May 24, 2025

Nasledie Nashego Pokoleniya Uspekhi I Vyzovy Buduschego

May 24, 2025 -

Chainalysis Acquisition Of Alterya A Strategic Move In Ai Powered Blockchain Security

May 24, 2025

Chainalysis Acquisition Of Alterya A Strategic Move In Ai Powered Blockchain Security

May 24, 2025

Latest Posts

-

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025 -

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025 -

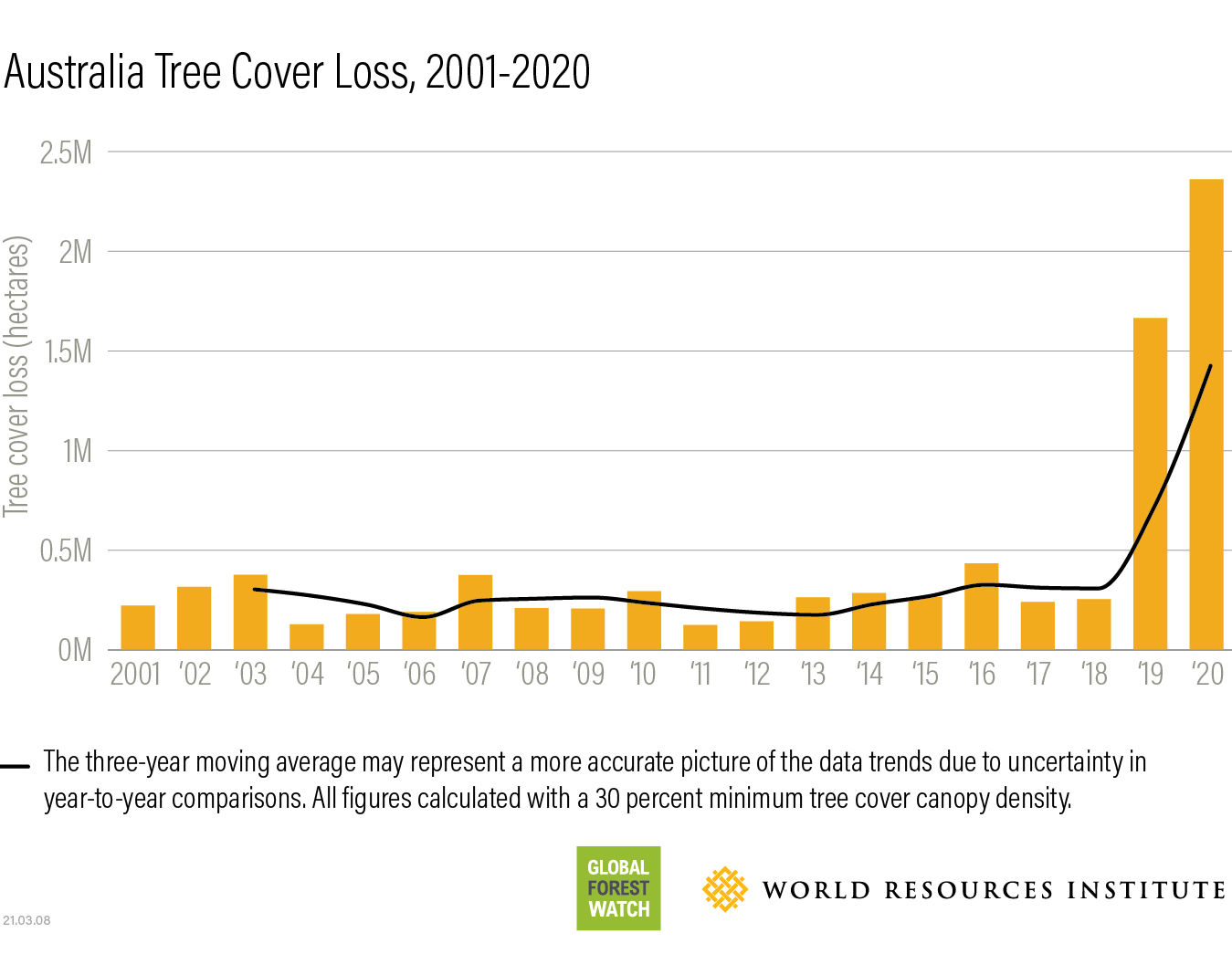

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025 -

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025 -

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025