Understanding The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV)?

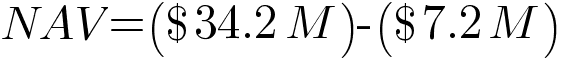

Net Asset Value (NAV) represents the theoretical value of an ETF's underlying assets per share. Unlike a stock traded throughout the day with fluctuating prices, an ETF's NAV is calculated daily, usually at the close of the market. This calculation reflects the total market value of all the assets held within the ETF, minus any liabilities, divided by the total number of outstanding shares. This provides a snapshot of the ETF's intrinsic value. The NAV differs from the ETF's market price; the market price can fluctuate throughout the trading day based on supply and demand, while the NAV remains relatively stable until the next calculation. Factors such as market movements of the underlying assets (in this case, the 30 companies comprising the Dow Jones Industrial Average) significantly influence daily NAV fluctuations.

- NAV represents the theoretical value of an ETF's holdings per share.

- Calculated daily, usually at the end of the trading day.

- Reflects the total value of the ETF's assets minus liabilities, divided by the number of outstanding shares.

- Provides a snapshot of the intrinsic value of the ETF.

How is the Amundi Dow Jones Industrial Average UCITS ETF NAV Calculated?

The Amundi Dow Jones Industrial Average UCITS ETF NAV is calculated daily, mirroring the closing prices of the 30 constituent companies of the Dow Jones Industrial Average (DJIA). The fund manager, Amundi, undertakes this calculation, ensuring accuracy and transparency. The process involves summing the market value of each holding, considering any currency conversions if the underlying assets are in currencies other than the ETF's base currency. Any dividends received by the ETF during the day are also included in the calculation, increasing the total asset value. The final NAV is then determined by dividing this total asset value by the number of outstanding ETF shares. This NAV is regularly published on the Amundi website and through major financial data providers, providing investors with readily accessible information.

- Daily calculation based on closing prices of the 30 Dow Jones Industrial Average components.

- Currency conversion considerations (if applicable).

- Inclusion of any dividends received by the ETF.

- Regularly published on the Amundi website and financial data providers.

The Importance of NAV for Amundi Dow Jones Industrial Average UCITS ETF Investors

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is crucial for investors to track performance effectively. By comparing the NAV over time, investors can accurately assess the ETF's growth and returns. This information plays a vital role in buy and sell decisions, providing a clear understanding of potential gains or losses. The relationship between the NAV and the market price of the ETF is also important. Sometimes a small premium or discount exists, offering potential arbitrage opportunities (discussed below).

- Benchmark for evaluating ETF performance over time.

- Helps determine the actual return on investment.

- Provides transparency regarding the ETF’s holdings' value.

- Understanding discrepancies between NAV and market price can inform trading strategies.

Arbitrage Opportunities and NAV

Discrepancies between the Amundi Dow Jones Industrial Average UCITS ETF NAV and its market price can create short-term arbitrage opportunities for sophisticated investors. These opportunities arise when the market price deviates significantly from the NAV. However, it's crucial to understand that arbitrage is complex and involves risks. Authorized participants, typically large institutional investors, play a key role in exploiting these discrepancies, often bringing the market price back in line with the NAV. For the average investor, focusing on long-term growth and understanding the underlying asset values, as reflected in the NAV, is a more prudent approach than attempting complex arbitrage strategies.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for informed investment decisions. By grasping how the Amundi Dow Jones Industrial Average UCITS ETF NAV is calculated and its significance in tracking performance and identifying potential (though risky) arbitrage opportunities, investors can better manage their portfolio. Regularly checking the published NAV and staying updated on market fluctuations will empower you to make more strategic decisions regarding your Amundi Dow Jones Industrial Average UCITS ETF investments. Learn more about Amundi Dow Jones Industrial Average UCITS ETF NAV and other key metrics today!

Featured Posts

-

Is News Corp An Undervalued And Underappreciated Asset

May 24, 2025

Is News Corp An Undervalued And Underappreciated Asset

May 24, 2025 -

Thlyl Adae Daks 30 Tjawz Aldhrwt Alsabqt Wfrs Alastthmar

May 24, 2025

Thlyl Adae Daks 30 Tjawz Aldhrwt Alsabqt Wfrs Alastthmar

May 24, 2025 -

Former French Pm Disagrees With Macrons Decisions

May 24, 2025

Former French Pm Disagrees With Macrons Decisions

May 24, 2025 -

Escape To The Country Financing Your Rural Dream Home

May 24, 2025

Escape To The Country Financing Your Rural Dream Home

May 24, 2025 -

Jordan Bardella Leading The French Opposition Into The Next Election

May 24, 2025

Jordan Bardella Leading The French Opposition Into The Next Election

May 24, 2025

Latest Posts

-

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025 -

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025 -

Apple Stock Price Drops On 900 Million Tariff Announcement

May 24, 2025

Apple Stock Price Drops On 900 Million Tariff Announcement

May 24, 2025 -

Apple Stock Suffers Setback Amidst 900 Million Tariff Projection

May 24, 2025

Apple Stock Suffers Setback Amidst 900 Million Tariff Projection

May 24, 2025 -

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025