Is News Corp An Undervalued And Underappreciated Asset?

Table of Contents

News Corp's Diversified Portfolio: A Strength or Weakness?

News Corp's diversified media holdings present both advantages and challenges. The company's revenue streams are spread across multiple segments, mitigating the risk of over-reliance on any single sector. This diversification includes newspapers (like the Wall Street Journal and the New York Post), book publishing (HarperCollins), and digital real estate (Move Inc.). However, the performance of each segment varies significantly, impacting the overall picture.

-

Strengths:

- Market Leadership: News Corp holds strong market positions in several niches, particularly in business news and certain book publishing categories. This established brand recognition provides a significant competitive advantage.

- Synergies: The different segments offer opportunities for cross-promotion and content sharing, potentially boosting revenue and efficiency. For example, news stories from the Wall Street Journal could be promoted through HarperCollins' book marketing channels.

-

Weaknesses:

- Digital Transition Challenges: The newspaper segment faces significant headwinds due to the ongoing shift to digital media. Declining print advertising revenue remains a persistent concern.

- Online Competition: News Corp competes fiercely with numerous online platforms for both readers and advertisers, making it crucial to adapt and innovate quickly.

Financial Performance and Valuation Analysis of News Corp Stock

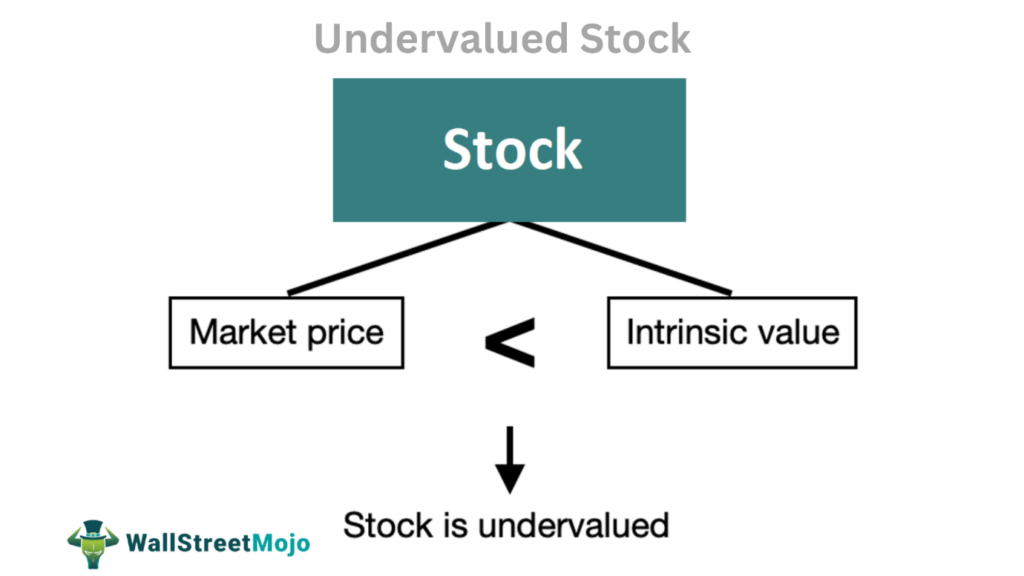

Analyzing News Corp's financial performance is crucial for assessing its valuation. Recent financial reports reveal a mixed bag, with some segments showing growth while others struggle. Key financial ratios must be examined to understand the true picture:

- Key Financial Ratios: Investors should carefully review News Corp's Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, debt levels, and cash flow generation to gauge its financial health. Comparing these metrics to industry benchmarks provides valuable context.

- Market Sentiment and Macroeconomic Conditions: The stock price isn't solely determined by internal factors. Broader market sentiment, macroeconomic conditions, and investor confidence all influence valuation.

- Potential Catalysts for Future Growth: News Corp’s potential for future growth hinges on its ability to execute its digital transformation strategy effectively, successfully navigate the competitive landscape, and potentially pursue strategic acquisitions.

Future Growth Prospects and Potential Risks for News Corp

News Corp's future prospects depend heavily on its ability to adapt to the evolving digital media landscape. This necessitates a proactive approach to growth, but also involves significant risks:

- Digital Transformation Strategies: Successfully transitioning to digital subscription models and leveraging online advertising revenue is paramount for long-term success. Diversification into new digital ventures could unlock growth opportunities.

- Competitive Landscape: News Corp faces intense competition from established tech giants and emerging digital media players. Maintaining a competitive edge requires innovation and strategic investments.

- Risks: Regulatory changes, technological disruptions, and geopolitical instability pose significant challenges. Declining print advertising revenue remains a key risk factor for the newspaper segment, while competition from streaming services impacts the entertainment sector.

Conclusion: Is News Corp a Hidden Gem or a Risky Investment?

Determining whether News Corp is truly undervalued requires a nuanced assessment. While its diversified portfolio offers some protection against sector-specific risks, the challenges in the digital transition and intense competition cannot be ignored. Its financial performance shows a mixed picture and future growth prospects remain uncertain. A careful analysis of the financial statements, sector performance, and competitive landscape is crucial. The significant risks associated with News Corp must be carefully considered against the potential for future growth.

Is News Corp an undervalued asset you should consider for your portfolio? Conduct your own thorough due diligence, including a detailed review of News Corp's financial statements and industry analysis, before making any investment decisions. Remember, this analysis is for informational purposes only and should not be considered financial advice.

Featured Posts

-

Avrupa Borsalari Guenluek Degisimler Ve Analiz

May 24, 2025

Avrupa Borsalari Guenluek Degisimler Ve Analiz

May 24, 2025 -

700 000 Property Profit Nicki Chapmans Escape To The Country Investment Strategy

May 24, 2025

700 000 Property Profit Nicki Chapmans Escape To The Country Investment Strategy

May 24, 2025 -

Escape To The Country Choosing The Right Location For You

May 24, 2025

Escape To The Country Choosing The Right Location For You

May 24, 2025 -

News Corps Hidden Value Why Its Undervalued And Underappreciated

May 24, 2025

News Corps Hidden Value Why Its Undervalued And Underappreciated

May 24, 2025 -

Svadby Na Kharkovschine Bolee 600 Brakov Za Mesyats

May 24, 2025

Svadby Na Kharkovschine Bolee 600 Brakov Za Mesyats

May 24, 2025

Latest Posts

-

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 24, 2025

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 24, 2025 -

Sean Penns Recent Appearance And Controversial Statements Explained

May 24, 2025

Sean Penns Recent Appearance And Controversial Statements Explained

May 24, 2025 -

The Sean Penn Woody Allen Relationship A Me Too Controversy

May 24, 2025

The Sean Penn Woody Allen Relationship A Me Too Controversy

May 24, 2025 -

Sean Penns Appearance Sparks Concern What Happened To The Hollywood Star

May 24, 2025

Sean Penns Appearance Sparks Concern What Happened To The Hollywood Star

May 24, 2025 -

Sean Penns Shocking Transformation Fans React To Bombshell Claims

May 24, 2025

Sean Penns Shocking Transformation Fans React To Bombshell Claims

May 24, 2025