News Corp's Hidden Value: Why It's Undervalued And Underappreciated

Table of Contents

News Corp, a global media and information services company, often flies under the radar, despite its vast portfolio of influential assets. Many investors overlook its significant potential, leading to an undervaluation in the market. This article delves into the reasons why News Corp is currently undervalued and why it deserves a closer look from discerning investors. We'll explore its diverse holdings, growth potential, and the factors contributing to its current market perception. Understanding why News Corp is undervalued is key to recognizing its true investment potential.

A Diversified Portfolio Beyond the Headlines

News Corp's value extends far beyond its prominent news brands. Its diversified portfolio positions it for success in a rapidly evolving media landscape. The company's strength lies in its ability to leverage established brands while strategically investing in emerging markets.

Dominant News and Information Businesses

News Corp boasts a collection of world-renowned news publications, including the Wall Street Journal, The Times of London, and The Sun. These brands command significant readership and influence, translating to substantial advertising revenue and growing digital subscription bases.

- Wall Street Journal: Maintains a dominant position in the financial news market, boasting millions of subscribers and a strong digital presence. Its reputation for in-depth reporting and financial analysis allows it to command premium subscription fees and advertising rates.

- The Times (UK): A leading UK national newspaper with a loyal readership and a robust online presence, contributing significantly to News Corp's revenue streams. Its digital subscription model is proving highly successful.

- The Sun (UK): A highly popular tabloid newspaper with a large and engaged readership, providing a strong base of advertising revenue. Its online version maintains a considerable following.

These brands aren't just sources of news; they are powerful platforms for reaching targeted audiences, making them attractive to advertisers seeking premium placements. Their legacy and established trust translate into higher advertising rates compared to newer, less established digital-only platforms.

Growth in Digital Real Estate

News Corp's investment in digital real estate, most notably realtor.com in the US, represents a significant growth area. This sector benefits from consistent demand and the ongoing shift towards online property searches.

- Realtor.com: A leading online real estate portal in the US, connecting buyers and sellers and generating substantial revenue through advertising and lead generation services. Its market position is strong and poised for further growth as the real estate market continues to evolve.

- Market Trends: The increasing reliance on online platforms for real estate transactions fuels the growth of News Corp's digital real estate holdings. The company's strategic investments in technology and user experience are key to maintaining its competitive advantage.

News Corp's success in this sector demonstrates its ability to adapt to changing market trends and capitalize on emerging opportunities beyond its traditional news media businesses.

The Power of Book Publishing

HarperCollins, a leading global book publisher under the News Corp umbrella, contributes significantly to the company's overall profitability. The book publishing industry, while facing challenges, remains resilient, benefiting from the enduring appeal of physical and digital books.

- HarperCollins' Success: HarperCollins publishes best-selling authors across various genres, maintaining a strong presence in the literary market. Its ability to identify and develop successful titles ensures continued revenue streams.

- Market Resilience: The book publishing market demonstrates ongoing resilience, particularly in genres like fiction, non-fiction, and children's literature. News Corp's established brands and distribution networks position HarperCollins favorably within this market.

The enduring popularity of books and the strength of HarperCollins' brand contribute to News Corp's overall financial health and demonstrate the diversification of its revenue streams.

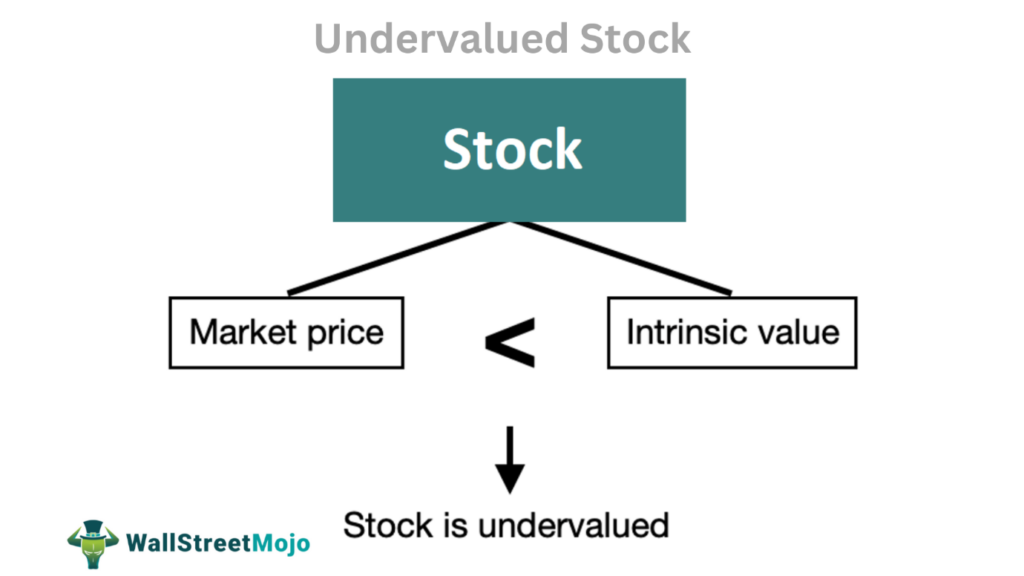

Undervaluation Factors and Market Misconceptions

The current market undervaluation of News Corp stems from several factors, many of which are based on misconceptions about the company and the broader media landscape.

Legacy Media Narrative

A persistent narrative surrounding traditional media portrays it as a declining industry, unfairly impacting News Corp's valuation. This overlooks the company's successful transition into digital platforms and its diversification beyond traditional print media.

- Challenging the Narrative: News Corp's digital subscription growth and successful online advertising strategies directly contradict this negative perception. Focusing solely on print circulation ignores the substantial revenue generated from digital platforms.

- Data-Driven Counterarguments: Presenting data on digital subscriber growth, online advertising revenue, and the overall profitability of its diversified holdings effectively challenges the narrative of decline.

This misconception fails to acknowledge the company's agility and ability to adapt to the changing media landscape.

Short-Term Focus of the Market

The market's short-term focus often overlooks News Corp's long-term strategic investments and their potential for future returns. The company's steady growth, while perhaps not always immediately reflected in short-term stock performance, shows a solid trajectory for the long term.

- Long-Term Growth Potential: News Corp's strategic acquisitions and investments in digital platforms are designed for long-term growth and sustainability.

- Future Profitability: These investments will yield increasing returns in the coming years, and the market is currently not fully appreciating this future growth potential.

Investors focused solely on short-term gains may miss the significant long-term value offered by News Corp.

Lack of Investor Awareness

A lack of awareness regarding News Corp's diverse holdings and its overall strategic direction contributes to its undervaluation. The company's relatively low profile compared to other media giants may also play a role.

- Improving Investor Awareness: Increased transparency about the company's financial performance, strategic plans, and growth opportunities can improve investor perception and ultimately its valuation. Enhanced investor relations efforts are key.

- Highlighting Diversification: Emphasizing the strength and diversification of News Corp's holdings, showcasing the synergy between its various business units, can highlight its value to potential investors.

Greater visibility and a clearer understanding of News Corp's strategic direction are crucial to attracting investors and achieving a more accurate market valuation.

Future Growth Potential and Investment Thesis

News Corp's future growth prospects are compelling, based on its ongoing digital transformation, strategic acquisitions, and strong cash flow.

Digital Transformation and Innovation

News Corp is actively adapting to the digital landscape, developing new revenue streams and enhancing existing platforms. Its commitment to innovation positions it for continued growth in the digital media space.

- Successful Digital Initiatives: Highlight specific examples of successful digital initiatives, such as increased digital subscription rates or innovative advertising models.

- Future Potential: Explore areas such as personalized content, targeted advertising utilizing data analytics, and the expansion of subscription models to unlock further revenue potential.

The company's continued focus on digital transformation will be a major driver of future growth.

Strategic Acquisitions and Partnerships

Future acquisitions and strategic partnerships will likely further diversify News Corp's portfolio and enhance its growth trajectory.

- Potential Acquisition Targets: Identify potential areas for acquisition that would complement existing businesses and expand into new markets.

- Strategic Partnerships: Discuss the potential for mutually beneficial partnerships to enhance market reach and leverage new technologies.

This proactive approach to strategic growth indicates a commitment to remaining competitive and expanding its market share.

Strong Cash Flow and Dividend Potential

News Corp generates substantial cash flow, offering strong dividend potential for investors. This makes it an attractive option for investors seeking a combination of capital appreciation and regular income.

- Dividend Payouts: Highlight the history of dividend payouts and the potential for future increases based on the company's strong financial performance.

- Attractiveness to Income Investors: Emphasize the appeal to investors seeking reliable dividend income streams.

The combination of capital appreciation potential and consistent dividend payments makes News Corp a compelling investment proposition.

Conclusion

News Corp's current market valuation fails to fully reflect its diverse portfolio of strong assets, its successful digital transformation, and its significant growth potential. While perceptions of legacy media might linger, a closer look reveals a company well-positioned for future success. The combination of established brands, strategic investments, and strong cash flow makes News Corp a compelling investment opportunity. Don't overlook the hidden value—consider adding News Corp to your portfolio and capitalize on the potential of this undervalued media giant. Further research into News Corp's undervalued assets is highly recommended for any investor seeking diversification and strong returns.

Featured Posts

-

Dazi Trump 20 Impatto Sul Settore Moda

May 24, 2025

Dazi Trump 20 Impatto Sul Settore Moda

May 24, 2025 -

Ferraris 10 Fastest Standard Production Models A Track Performance Comparison

May 24, 2025

Ferraris 10 Fastest Standard Production Models A Track Performance Comparison

May 24, 2025 -

Classifica Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo

May 24, 2025

Classifica Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo

May 24, 2025 -

Ferrari Challenge Racing Days Conquer South Florida

May 24, 2025

Ferrari Challenge Racing Days Conquer South Florida

May 24, 2025 -

Kerings Q1 Earnings Miss Targets Shares Fall 6

May 24, 2025

Kerings Q1 Earnings Miss Targets Shares Fall 6

May 24, 2025

Latest Posts

-

Apple Stock Aapl Important Price Levels And Future Predictions

May 24, 2025

Apple Stock Aapl Important Price Levels And Future Predictions

May 24, 2025 -

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025 -

Florida Film Festival Spotting Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival Spotting Mia Farrow And Christina Ricci

May 24, 2025 -

Apple Stock Dip Key Levels Breached Before Q2 Earnings

May 24, 2025

Apple Stock Dip Key Levels Breached Before Q2 Earnings

May 24, 2025 -

Despite Apple Price Target Cut Wedbush Remains Bullish Should You

May 24, 2025

Despite Apple Price Target Cut Wedbush Remains Bullish Should You

May 24, 2025