Despite Apple Price Target Cut, Wedbush Remains Bullish: Should You?

Table of Contents

Wedbush's Rationale for Maintaining a Bullish Outlook

Despite the downward revisions of the Apple price target by other analysts, Wedbush Securities maintains a positive outlook on Apple's stock. Their bullish stance rests on several key pillars:

-

Strong iPhone sales and anticipated growth: Wedbush points to consistently strong iPhone sales, even amidst global economic uncertainty. They anticipate continued growth driven by new product releases, upgrades from older models, and strong demand in key markets. This sustained performance forms a crucial foundation for their Apple stock forecast. Their reports suggest a continued dominance in the premium smartphone segment, fueling their positive Apple revenue growth projections.

-

Potential for significant growth in services revenue (Apple Music, iCloud, etc.): Apple's services sector is a significant growth engine, and Wedbush highlights its potential for substantial expansion. Apple Music, iCloud, Apple TV+, and other subscription services are generating increasing revenue streams, demonstrating a diversified revenue model less reliant on solely hardware sales. Their Apple services revenue projections are significantly higher than those of some competing analysts.

-

Innovation in other product lines (Apple Watch, AirPods, etc.) and future product releases: Beyond the iPhone, Apple's ecosystem continues to expand. The success of the Apple Watch, AirPods, and other wearables showcases the company's ability to innovate and capture new market segments. The anticipation of future product releases, rumored to include advancements in augmented reality and other cutting-edge technologies, further bolsters Wedbush's positive Apple stock price prediction.

-

Strong brand loyalty and a large, loyal customer base: Apple boasts an incredibly loyal customer base, creating a strong foundation for recurring revenue and future product adoption. This brand loyalty translates into consistent demand, contributing to the long-term growth potential highlighted by Wedbush in their Apple stock forecast. This robust customer base is a key differentiator and a significant factor in their positive Apple revenue growth projections.

Analyzing the Price Target Cuts from Other Analysts

While Wedbush remains optimistic, several other analysts have lowered their Apple price target. Their concerns often center around:

-

Concerns about the global economic slowdown: A weakening global economy can impact consumer spending, potentially affecting demand for Apple products, particularly higher-priced items. This macroeconomic factor influences the Apple stock price prediction of many cautious analysts.

-

Potential competition in the smartphone market: The smartphone market is fiercely competitive. Intense competition from Android manufacturers could put pressure on Apple's market share and profitability, impacting the Apple stock valuation.

-

Supply chain issues or other macroeconomic factors: Ongoing supply chain disruptions or other unforeseen macroeconomic factors can influence production costs, product availability, and ultimately impact the Apple stock price prediction.

These concerns, reflected in the varied Apple analyst ratings, contribute to the divergence in price target forecasts. Some analysts predict a more moderate Apple stock price prediction than Wedbush's more optimistic forecast.

Evaluating Your Own Investment Strategy in Light of Conflicting Opinions

The conflicting opinions surrounding the Apple price target highlight the importance of individual investor analysis. Before making any investment decisions, consider:

-

Your personal investment goals (short-term vs. long-term): Are you investing for retirement, a down payment, or short-term gains? Your time horizon significantly impacts your risk tolerance and investment strategy.

-

Assess your risk tolerance – are you comfortable with potential volatility?: Apple's stock price can fluctuate significantly. Understanding your risk tolerance is crucial to making informed investment decisions.

-

Diversify your portfolio to mitigate risk: Don't put all your eggs in one basket. Diversifying your portfolio across different asset classes reduces your overall risk.

-

Research Apple's financials and future prospects independently: Analyze Apple's financial statements, understand key metrics like the P/E ratio, and consider the broader market sentiment towards Apple. Understanding the Apple financial statements is essential for informed investment decisions.

Alternative Investments to Consider

While Apple offers significant growth potential, exploring alternative investments can help diversify your portfolio. Consider researching other technology companies with strong growth prospects or investing in broader market ETFs. This approach can reduce your reliance on any single stock’s performance, including the Apple price target.

Conclusion

The current situation surrounding the Apple price target presents a mixed outlook. While Wedbush maintains a bullish stance based on strong iPhone sales, services revenue growth, and continued innovation, other analysts express concerns regarding economic slowdowns and competition. The disparity in opinions emphasizes the critical need for thorough due diligence. Ultimately, the decision to invest in Apple rests on your own analysis of the Apple price target, your risk tolerance, and your overall investment strategy. Remember to always conduct your own thorough research before making any investment decisions related to the Apple price target.

Featured Posts

-

Escape To The Country Balancing Rural Life With Modern Amenities

May 24, 2025

Escape To The Country Balancing Rural Life With Modern Amenities

May 24, 2025 -

Nyt Mini Crossword Clues And Answers March 16 2025

May 24, 2025

Nyt Mini Crossword Clues And Answers March 16 2025

May 24, 2025 -

Crystal Palace Eyeing Kyle Walker Peters On A Free

May 24, 2025

Crystal Palace Eyeing Kyle Walker Peters On A Free

May 24, 2025 -

Kyle Walker And Mystery Women Understanding The Recent Events

May 24, 2025

Kyle Walker And Mystery Women Understanding The Recent Events

May 24, 2025 -

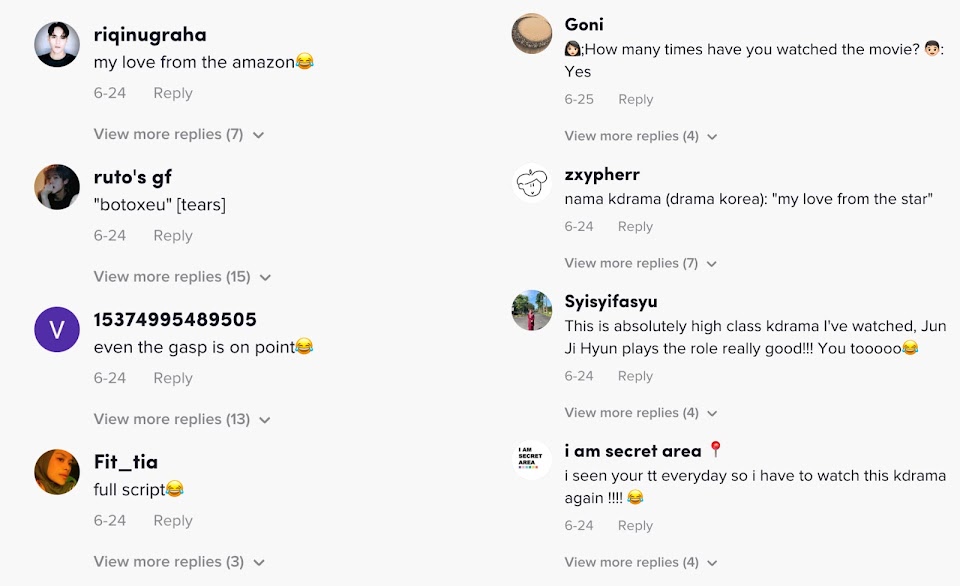

From Tik Tok To Dancing With The Stars Alix Earles Influencer Marketing Strategy

May 24, 2025

From Tik Tok To Dancing With The Stars Alix Earles Influencer Marketing Strategy

May 24, 2025

Latest Posts

-

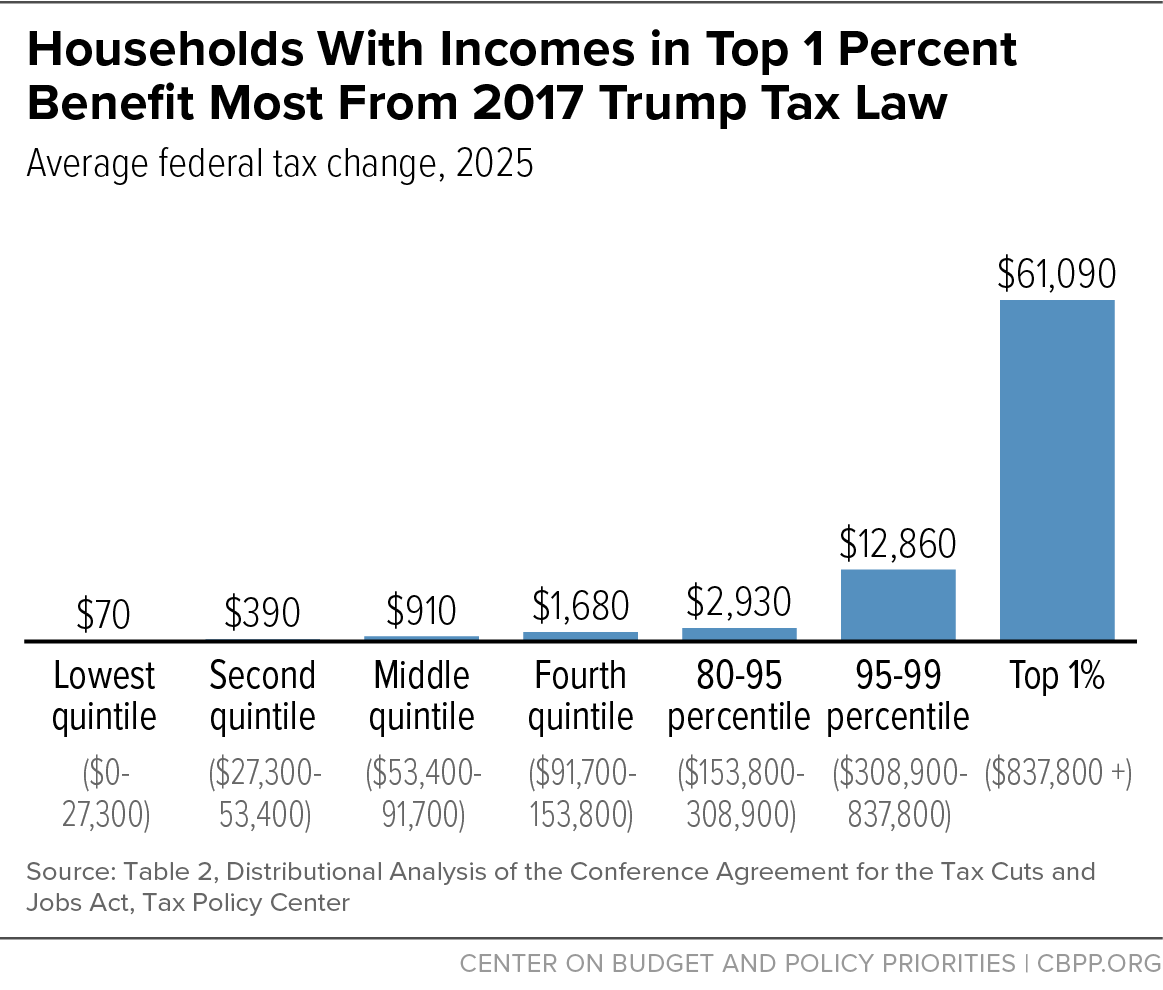

Analysis The House Passed Trump Tax Bill And What It Means

May 24, 2025

Analysis The House Passed Trump Tax Bill And What It Means

May 24, 2025 -

Orbital Space Crystals A New Frontier In Pharmaceutical Development

May 24, 2025

Orbital Space Crystals A New Frontier In Pharmaceutical Development

May 24, 2025 -

Last Minute Changes Alter Trump Tax Bill Before House Passage

May 24, 2025

Last Minute Changes Alter Trump Tax Bill Before House Passage

May 24, 2025 -

From Parishioner To Viral Sensation A Tik Tokers Story With Pope Leo

May 24, 2025

From Parishioner To Viral Sensation A Tik Tokers Story With Pope Leo

May 24, 2025 -

Air Traffic Controllers Link Newark Airport Issues To Trump Administration Policy

May 24, 2025

Air Traffic Controllers Link Newark Airport Issues To Trump Administration Policy

May 24, 2025