Last-Minute Changes Alter Trump Tax Bill Before House Passage

Table of Contents

Key Provisions Altered in the 11th Hour

The last-minute amendments to the Trump tax bill introduced several key changes impacting various aspects of the proposed tax reform.

-

Changes to Corporate Tax Rates: Initial proposals suggested a 20% corporate tax rate. However, last-minute negotiations resulted in a revised rate of 21%, slightly higher than initially planned. This change, reportedly a result of bipartisan compromise, aimed to address concerns about potential revenue losses. Sources within the House Ways and Means Committee confirmed this adjustment.

-

Individual Deduction Modifications: Significant alterations were made to individual deductions. The standard deduction was increased, benefiting lower- and middle-income taxpayers, while certain itemized deductions, such as those for state and local taxes (SALT), were capped or eliminated. The rationale behind these changes remains a subject of debate, with some suggesting they were intended to offset revenue losses from corporate tax cuts, while others point to political pressures from various interest groups.

-

Impact on Different Income Groups: The changes disproportionately affected different income brackets. While the increased standard deduction provided relief for lower-income earners, the limitations on itemized deductions hit higher-income earners harder. Corporations, while still benefiting from lower taxes, saw a less dramatic reduction than initially proposed. Further analysis is needed to fully understand the long-term distributive effects.

Impact on the National Debt

The fiscal implications of these last-minute alterations are significant. While the initial bill projected a substantial increase in the national debt, these changes, particularly the slightly higher corporate tax rate, are estimated to slightly mitigate the projected deficit over the next decade, according to the Committee for a Responsible Federal Budget. However, the overall impact on the national debt remains a subject of ongoing debate among economists. Further independent analysis will be needed to accurately assess the long-term fiscal consequences.

Political Fallout and Congressional Reaction

The last-minute changes to the Trump tax bill generated intense political fallout and divided reactions within Congress.

-

Republican and Democratic Responses: Republicans largely defended the amendments, emphasizing their commitment to tax reform and the overall benefits of the legislation. Democrats, however, strongly criticized the bill, citing concerns about its impact on income inequality and the national debt. Statements from key figures like House Speaker Paul Ryan and Minority Leader Nancy Pelosi highlight this stark partisan divide.

-

Internal Republican Disagreements: Despite largely unified Republican support, some internal disagreements arose regarding the last-minute changes. Conservative factions expressed dissatisfaction over the slightly higher corporate tax rate and modifications to individual deductions, while more moderate Republicans defended the compromises as necessary to secure passage.

-

Impact on the Bill's Passage: While the last-minute changes created uncertainty, they ultimately did not derail the bill’s passage in the House. However, the close votes and internal party tensions underscore the fragility of the support for the revised legislation, highlighting the complexities of achieving bipartisan consensus on such a significant piece of legislation.

Lobbying and Influence

The influence of special interest groups on the last-minute amendments remains a matter of speculation. While specific lobbying efforts are difficult to definitively trace, the changes regarding deductions suggest potential pressure from various corporate and individual stakeholders. Further investigation is needed to determine the extent to which lobbying efforts shaped the final version of the bill.

The Amended Trump Tax Bill: A Closer Look at the Final Version

After the last-minute amendments, the Trump tax bill emerged with a significantly altered structure.

-

Key Features of the Final Version: The final version featured a 21% corporate tax rate, modified individual deductions, and adjustments to various other tax provisions. A detailed summary of these changes is available on the House Ways and Means Committee website.

-

Comparison with Earlier Drafts: Comparing the final version with earlier drafts reveals significant departures. The corporate tax rate, individual deductions, and other provisions underwent substantial revisions, illustrating the dynamic nature of the legislative process and the significant compromises reached during the final stages.

-

Potential Long-Term Economic Consequences: The long-term economic consequences of the amended tax bill are complex and uncertain. While proponents argue that it will stimulate economic growth, critics express concern about its potential impact on income inequality and the national debt. Predicting the precise economic effects requires detailed econometric modeling and careful consideration of numerous interrelated factors.

Expert Opinions

Economists and tax experts offer differing opinions on the revised bill’s impact. Some argue that the tax cuts will boost economic growth through increased investment and job creation. Others express concern about the potential for increased national debt and widening income inequality. These diverse perspectives emphasize the complexity of assessing the long-term economic effects of such sweeping tax legislation.

Understanding the Implications of Last-Minute Changes to the Trump Tax Bill

The last-minute changes to the Trump tax bill before its House passage represent a critical juncture in the legislative process. These alterations significantly altered key provisions, sparking political debate and raising questions about the bill's long-term economic impact. The changes demonstrate the complexities of tax reform and the powerful influence of lobbying and political negotiations.

Key Takeaways: The eleventh-hour revisions highlight the intense political dynamics surrounding major legislation. The final version differs significantly from earlier drafts, with implications for corporations, individuals, and the national debt. Understanding these last-minute changes is crucial to analyzing the overall impact of the Trump tax plan.

Call to Action: Stay updated on the evolving landscape of the Trump tax bill and its potential effects by following our coverage and learning more about the intricacies of this landmark legislation. Understanding these last-minute changes is critical to grasping the full impact of the Trump tax plan and its consequences for the American economy. Further analysis of the Trump tax bill's long-term effects is warranted.

Featured Posts

-

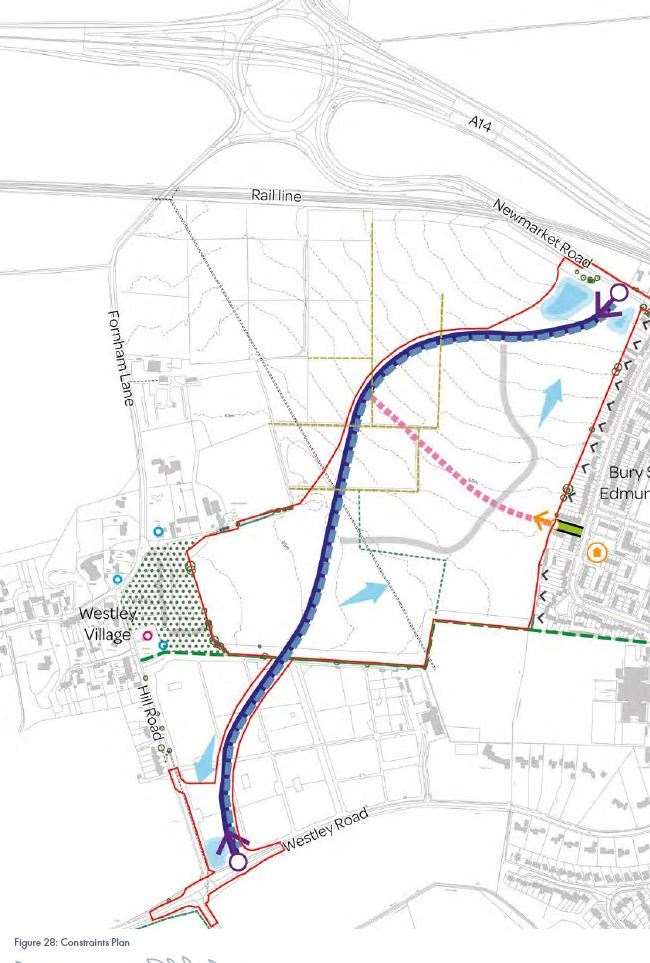

Bury And The M62 Relief Road A Plan That Never Was

May 24, 2025

Bury And The M62 Relief Road A Plan That Never Was

May 24, 2025 -

Pmi Surprise Boosts Dow Jones To Cautious Upswing

May 24, 2025

Pmi Surprise Boosts Dow Jones To Cautious Upswing

May 24, 2025 -

Desjardins Forecasts Three Further Bank Of Canada Rate Cuts

May 24, 2025

Desjardins Forecasts Three Further Bank Of Canada Rate Cuts

May 24, 2025 -

Severe Delays On M6 Motorway After Van Accident

May 24, 2025

Severe Delays On M6 Motorway After Van Accident

May 24, 2025 -

Apples Future A 254 Price Target And What It Means For Investors

May 24, 2025

Apples Future A 254 Price Target And What It Means For Investors

May 24, 2025

Latest Posts

-

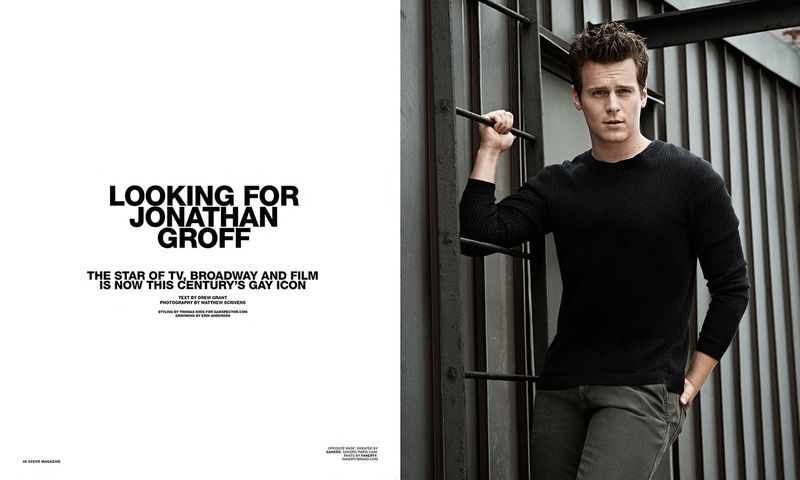

Jonathan Groff Discusses His Asexuality In New Instinct Magazine Interview

May 24, 2025

Jonathan Groff Discusses His Asexuality In New Instinct Magazine Interview

May 24, 2025 -

Jonathan Groffs Asexual Past An Instinct Magazine Interview

May 24, 2025

Jonathan Groffs Asexual Past An Instinct Magazine Interview

May 24, 2025 -

Broadway Buzz Jonathan Groffs Just In Time And The Raw Energy Of Bobby Darin

May 24, 2025

Broadway Buzz Jonathan Groffs Just In Time And The Raw Energy Of Bobby Darin

May 24, 2025 -

Just In Time Musical Review Groffs Performance And The 60s Vibe

May 24, 2025

Just In Time Musical Review Groffs Performance And The 60s Vibe

May 24, 2025 -

Jonathan Groffs Just In Time Performance Bobby Darin Primal Instincts And Broadway Buzz

May 24, 2025

Jonathan Groffs Just In Time Performance Bobby Darin Primal Instincts And Broadway Buzz

May 24, 2025