Apple Stock (AAPL): Important Price Levels And Future Predictions

Table of Contents

Apple stock (AAPL) remains a dominant force in the tech sector and a popular choice for investors. Understanding key price levels and attempting to predict future performance is crucial for anyone considering investing in or trading AAPL. This article will delve into significant price points, analyze market trends, and offer insights into potential future predictions for Apple stock. We'll explore historical data, current market dynamics, and potential future scenarios to help you navigate the complexities of Apple stock investment.

Key Historical Price Levels and Their Significance

Analyzing past Apple stock price movements reveals crucial support and resistance levels that can inform future investment strategies. Understanding these levels provides valuable context for interpreting current market trends and making more informed decisions about AAPL.

Support Levels

Support levels represent price points where the Apple stock price has historically found buying pressure, preventing further declines. These levels are often marked by increased demand from investors who see the stock as undervalued at those prices.

- The $100 level: Served as strong support in Q4 2022, bouncing back after a period of market correction. This was partly due to positive investor sentiment surrounding the release of new iPhone models and strong holiday sales forecasts.

- The $130 level: Acted as support in mid-2023, following a period of economic uncertainty. The resilience at this level indicated sustained confidence in Apple's long-term growth prospects, despite macroeconomic headwinds.

- The $150 level: This level has historically provided strong support, acting as a floor in several previous market downturns. The consistent support at this level suggests a significant concentration of buy orders at this price point.

Factors contributing to these support levels often include positive earnings reports, announcements of innovative new products, and a general belief in Apple's brand strength and market dominance.

Resistance Levels

Resistance levels represent price points where the Apple stock price has historically encountered selling pressure, hindering further price increases. These levels signify points where profit-taking and a lack of buying pressure have capped the stock's upward momentum.

- The $170 level: This price acted as a significant resistance level in early 2023, preventing a sustained breakout despite positive quarterly results. This could have been influenced by concerns about rising interest rates and inflation.

- The $190 level: This level represented a strong resistance point throughout 2023, requiring a strong positive catalyst for the AAPL stock price to break through.

- The $200 level: This level has historically been a significant hurdle, representing a psychological barrier for investors. Breaking through this level usually signifies a strong bullish trend.

Successfully breaking through resistance levels often signals a shift in market sentiment, indicating increased confidence in the company's future performance and potentially triggering further upward momentum in the Apple stock price.

Analyzing Current Market Trends Affecting AAPL

Several factors significantly influence the current and future performance of Apple stock (AAPL). Understanding these trends is crucial for making informed investment decisions.

Impact of Product Launches

New product releases are significant catalysts for Apple stock price movements. The excitement and anticipation surrounding new iPhones, iPads, Macs, and services heavily impact investor sentiment.

- iPhone 15 launch: The anticipated launch of the iPhone 15 series is expected to generate significant short-term volatility in the AAPL stock price. Positive reviews and strong pre-orders could lead to a price increase, while negative reception might depress the stock.

- New services growth: The continued growth of Apple's services revenue stream (Apple Music, Apple TV+, iCloud, etc.) is expected to stabilize AAPL price and provide a floor for long-term growth.

- Mac and iPad updates: Continuous innovation in these product lines contributes to sustained growth and positive investor sentiment.

Global Economic Conditions and Their Influence

Macroeconomic factors exert significant influence on Apple's stock price. Global economic growth, inflation, and interest rates all play a role.

- Inflation and interest rates: Rising inflation and interest rates generally negatively impact tech stock valuations, including AAPL, as investors become more risk-averse and seek safer investments.

- Global economic growth: A slowing global economy can reduce consumer spending and consequently affect Apple's sales, leading to downward pressure on the AAPL stock price.

- Supply chain disruptions: Global supply chain issues can affect Apple's production and sales, impacting stock prices.

Competitor Analysis

The competitive landscape significantly impacts Apple's stock price. The actions and performance of competitors like Samsung and Microsoft influence investor sentiment and market share.

- Samsung's market share: Samsung's market share gains in the smartphone market could put pressure on Apple’s dominance, influencing AAPL’s price.

- Microsoft's cloud services: The competition from Microsoft’s cloud services could affect Apple's services revenue growth, impacting AAPL stock.

- Innovation in the tech sector: Constant innovation from competitors and new entrants presents both threats and opportunities for Apple, affecting stock valuation.

Predicting Future Apple Stock Price (with caveats)

Predicting the future price of any stock is inherently uncertain. However, based on the analysis of historical data and current trends, we can outline potential scenarios.

Bullish Predictions

Several factors could lead to higher Apple stock prices:

- Strong future product sales: Continued strong sales of iPhones, Macs, iPads, and wearables, combined with successful new product launches, could drive significant growth.

- Expansion into new markets: Expansion into new markets and further penetration in existing markets are positive drivers for Apple's growth.

- Growth in services revenue: Continued strong growth in the services sector will provide a stable and reliable revenue stream, mitigating reliance on device sales.

A bullish scenario could see AAPL reaching price targets above $220 within the next year (this is purely speculative).

Bearish Predictions

Several factors could contribute to lower Apple stock prices:

- Economic downturn: A significant global economic slowdown could decrease consumer spending, impacting Apple's sales and profit margins.

- Increased competition: Increased competition, particularly in the smartphone market, could lead to reduced market share and slower growth.

- Supply chain disruptions: Persistent supply chain problems could affect production and sales, leading to negative impacts on the AAPL stock price.

A bearish scenario could see AAPL dropping to levels below $150 (this is purely speculative).

Disclaimer

It is crucial to remember that these are potential scenarios and not financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results. Always conduct your own thorough research and consult a qualified financial advisor before making any investment decisions.

Conclusion

This article examined key historical price levels of Apple stock (AAPL), analyzed current market trends influencing its performance, and offered potential future predictions (with necessary disclaimers). Understanding these factors is vital for informed investment decisions. While predicting the future of Apple stock (AAPL) with certainty is impossible, thorough research and understanding of these key price levels and market trends can significantly improve your investment strategy. Continue your research on Apple stock (AAPL) and make informed decisions based on your risk tolerance and financial goals. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Will A Us Market Upswing Counteract The Daxs Positive Momentum

May 24, 2025

Will A Us Market Upswing Counteract The Daxs Positive Momentum

May 24, 2025 -

Sean Penns Support Of Woody Allen A Me Too Blind Spot

May 24, 2025

Sean Penns Support Of Woody Allen A Me Too Blind Spot

May 24, 2025 -

Forbes 2025 La Classifica Degli Uomini Piu Ricchi Del Mondo Cambia Ancora

May 24, 2025

Forbes 2025 La Classifica Degli Uomini Piu Ricchi Del Mondo Cambia Ancora

May 24, 2025 -

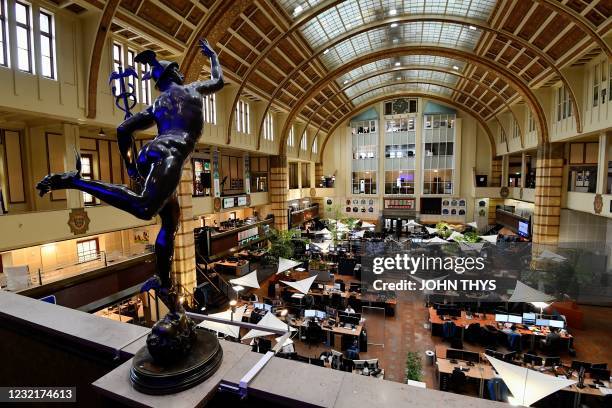

Trumps Tariff Relief 8 Stock Market Surge On Euronext Amsterdam

May 24, 2025

Trumps Tariff Relief 8 Stock Market Surge On Euronext Amsterdam

May 24, 2025 -

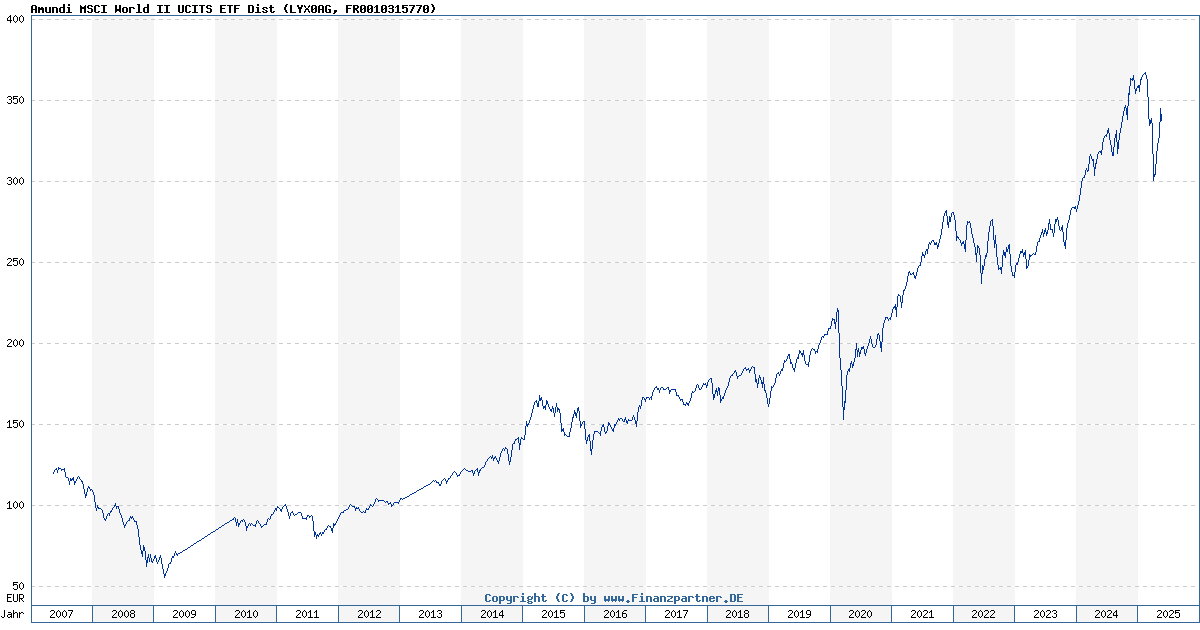

Amundi Msci All Country World Ucits Etf Usd Acc Daily Nav Updates And Analysis

May 24, 2025

Amundi Msci All Country World Ucits Etf Usd Acc Daily Nav Updates And Analysis

May 24, 2025

Latest Posts

-

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025 -

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025 -

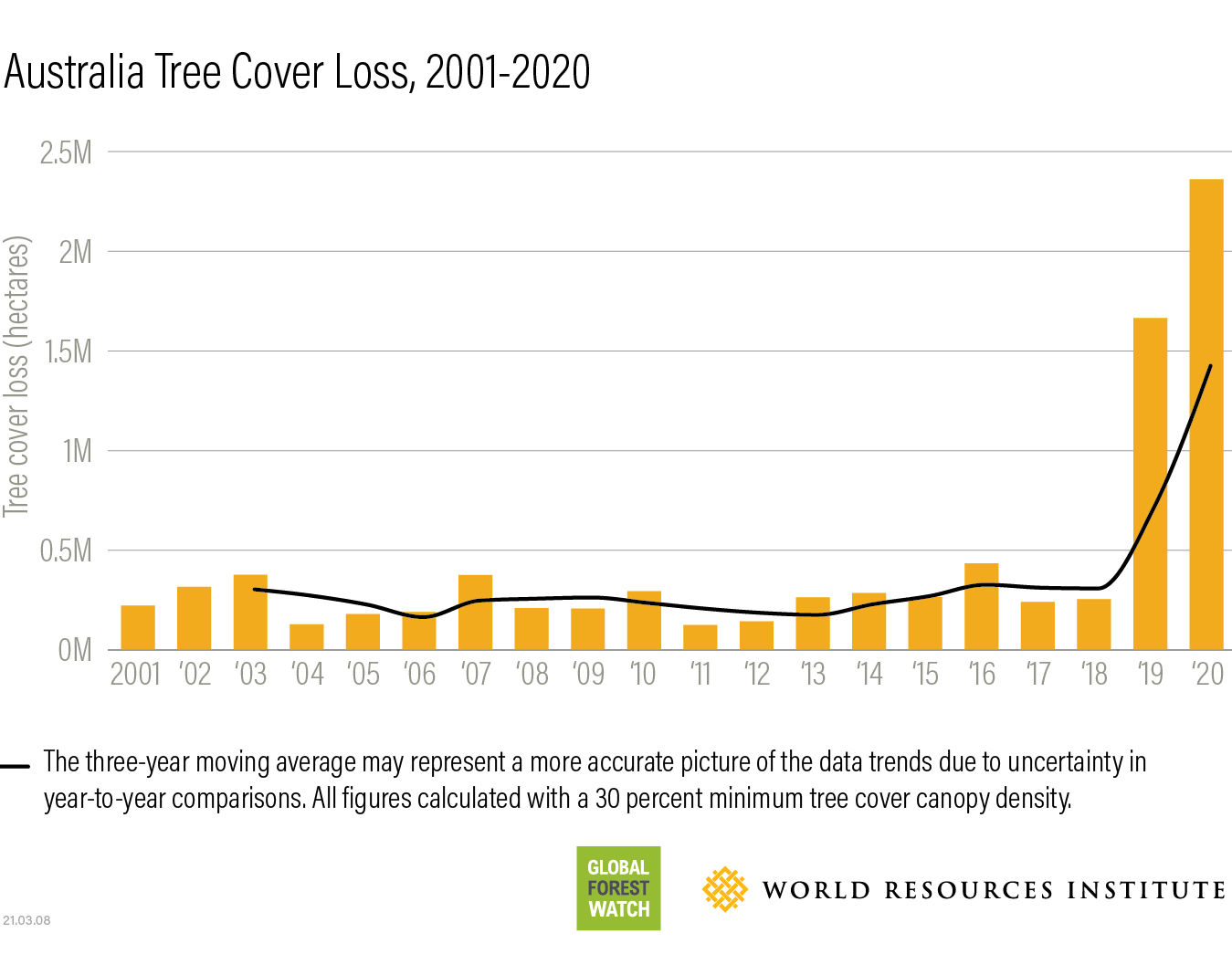

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025 -

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025 -

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025