Apple Stock Slumps: $900 Million Tariff Impact

Table of Contents

The $900 Million Tariff Hit: A Detailed Breakdown

The $900 million figure represents a considerable portion of Apple's overall revenue, directly impacting its profitability and investor confidence. Let's break down this significant financial setback.

Which Apple Products are Affected?

Tariffs have increased the cost of several key Apple products, significantly impacting their profitability. The most affected items include:

- iPhones: Estimates suggest a percentage increase in the cost of iPhones, ranging from X% to Y%, depending on the model and manufacturing location. This directly affects import costs and potentially retail pricing. High import volumes of iPhones exacerbate the financial impact. [Link to relevant news article on iPhone tariff impact]

- iPads: Similar to iPhones, iPads have faced tariff increases, leading to higher production costs and potentially affecting sales figures, especially in key markets. The percentage increase in cost is estimated to be between Z% and W%. [Link to official Apple statement or relevant report]

- Apple Watches: The impact on Apple Watches is [mention percentage] which, while possibly smaller than on iPhones and iPads, still contributes to the overall $900 million loss. This reflects the ongoing tariff pressures on various Apple product lines.

Impact on Apple's Profitability and Revenue

The $900 million tariff impact is projected to significantly decrease Apple's revenue and profitability for this quarter. Analysts predict a revenue shortfall of [insert predicted amount] compared to previous quarters, representing a considerable blow to the company’s financial performance.

[Insert chart/graph visualizing the projected decrease in revenue and profitability].

Comparing this quarter's performance to previous quarters reveals a stark contrast. [Compare key financial metrics – e.g., net income, earnings per share – to highlight the decline]. Analysts attribute much of this decline to the increased tariff costs.

Geographic Impact: Where the Hit is Felt Most

The geographical impact of these tariffs is unevenly distributed. The United States, as a major importer of Apple products, is significantly affected. Similarly, European markets are feeling the pressure of increased prices. China, while a significant manufacturing hub for Apple, also faces repercussions due to the interconnectedness of the global supply chain.

- US Market: [Insert data on US sales figures, highlighting any decrease]. The impact on market share in the US is a critical concern for Apple.

- Europe: [Insert data on European sales figures]. Increased prices could lead to a loss of market share to competitors.

- China: [Insert data related to China, including manufacturing implications]. The complexity of Apple's global supply chain makes this region crucial for mitigating these impacts. Any significant shift in manufacturing strategy would have far-reaching implications.

Investor Reaction and Market Analysis

The news of the $900 million tariff impact sent shockwaves through the financial markets.

Stock Price Fluctuations and Volatility

Apple's stock price experienced immediate and significant fluctuations following the tariff announcement.

[Insert graph charting Apple's stock price changes in the relevant period].

Investor sentiment was largely negative, reflecting concerns about Apple's ability to offset the tariff costs and maintain its profitability. The broader stock market also reacted negatively, indicating a wider concern about the escalating trade war.

Analyst Ratings and Future Predictions

Financial analysts offer varying predictions regarding Apple’s stock recovery. Some predict a short-term correction followed by a gradual recovery, while others express more cautious optimism, anticipating a prolonged period of subdued growth.

[Include links to reputable financial news sources]. Many analysts are closely monitoring the evolving situation for any signals of Apple's ability to mitigate the impact of these tariffs. The impact on Apple's credit rating is currently [mention any information regarding credit rating changes].

Potential Strategies for Apple to Mitigate Tariff Impacts

Apple faces significant challenges in mitigating the effects of these tariffs.

Manufacturing Diversification and Reshoring

To reduce reliance on China, Apple may consider diversifying its manufacturing base. This could involve reshoring some production to the US or shifting operations to other countries with lower tariff barriers. However, this is a complex undertaking with significant financial and logistical implications.

Price Adjustments and Consumer Impact

Apple might consider raising prices to offset the tariff costs. However, increased prices could negatively impact consumer demand, particularly in price-sensitive markets. The competitive landscape plays a significant role; competitors might not increase their prices, putting Apple at a disadvantage. Apple might explore other strategies like optimizing production efficiency and supply chain management to maintain profitability without significant price hikes.

Conclusion

The $900 million tariff impact represents a substantial challenge for Apple. The resulting slump in Apple stock highlights the vulnerability of even the most successful companies to global trade tensions. The company's response to this situation, its strategies for mitigating the impact, and the consumer reaction will be crucial in determining its future trajectory. Follow the latest updates on Apple stock and tariff impacts to better understand the ongoing effects of this trade war on one of the world's most valuable companies. Analyze the evolving situation with Apple’s stock price and stay informed about the continuing effects of tariffs on Apple's financial performance. The situation remains fluid, and continued monitoring is essential.

Featured Posts

-

Emergency Services Respond To Major Crash Patient Taken To Hospital

May 24, 2025

Emergency Services Respond To Major Crash Patient Taken To Hospital

May 24, 2025 -

Almanya Alshrtt Tshn Hmlt Mdahmat Ela Mshjeyn

May 24, 2025

Almanya Alshrtt Tshn Hmlt Mdahmat Ela Mshjeyn

May 24, 2025 -

Planning Your Country Escape Top Tips For A Smooth Transition

May 24, 2025

Planning Your Country Escape Top Tips For A Smooth Transition

May 24, 2025 -

National Rallys Le Pen Demonstration A Disappointing Turnout

May 24, 2025

National Rallys Le Pen Demonstration A Disappointing Turnout

May 24, 2025 -

Le Brest Urban Trail Portrait Des Benevoles Artistes Et Partenaires

May 24, 2025

Le Brest Urban Trail Portrait Des Benevoles Artistes Et Partenaires

May 24, 2025

Latest Posts

-

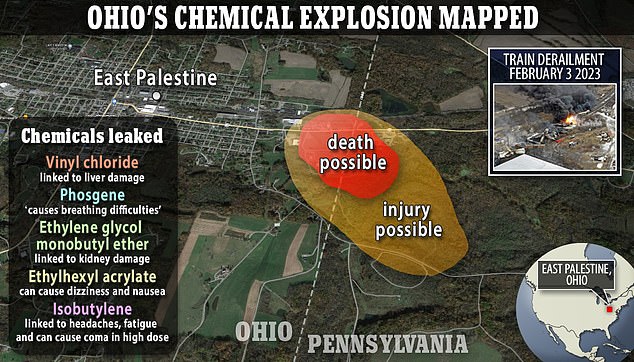

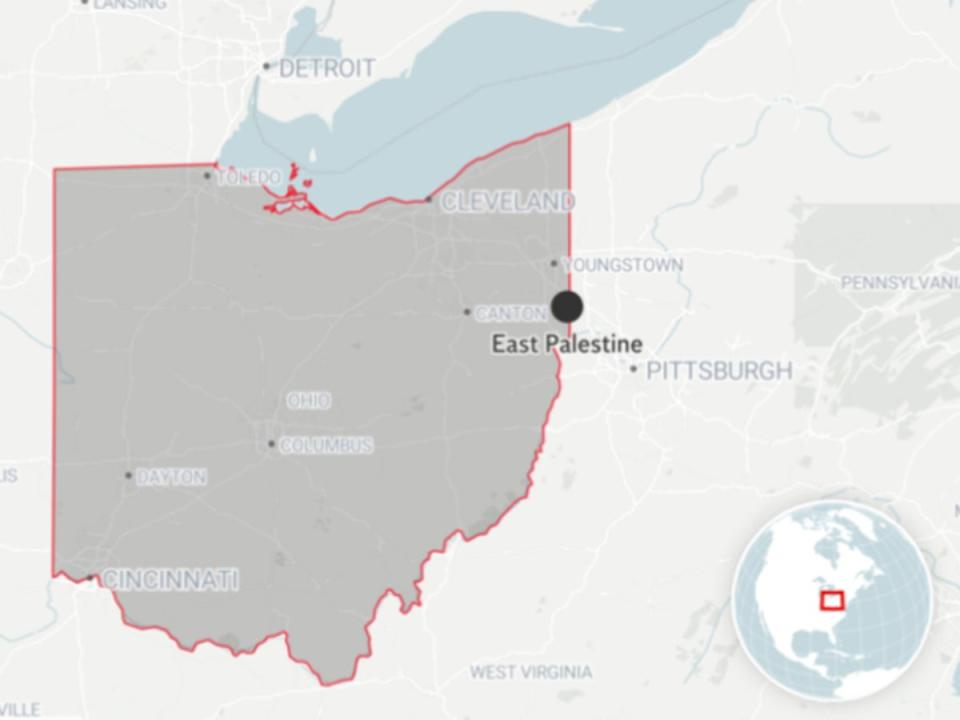

Ohio Train Derailment The Prolonged Impact Of Toxic Chemical Contamination On Buildings

May 24, 2025

Ohio Train Derailment The Prolonged Impact Of Toxic Chemical Contamination On Buildings

May 24, 2025 -

Car Dealerships Step Up Resistance To Mandatory Ev Sales

May 24, 2025

Car Dealerships Step Up Resistance To Mandatory Ev Sales

May 24, 2025 -

New Bipartisan Resolution Highlights Importance Of Canada Us Relations

May 24, 2025

New Bipartisan Resolution Highlights Importance Of Canada Us Relations

May 24, 2025 -

Toxic Chemical Residue From Ohio Train Derailment Building Contamination

May 24, 2025

Toxic Chemical Residue From Ohio Train Derailment Building Contamination

May 24, 2025 -

Us Senate Introduces Bipartisan Resolution Recognizing Canada Us Partnership

May 24, 2025

Us Senate Introduces Bipartisan Resolution Recognizing Canada Us Partnership

May 24, 2025